- May 20, 2025

A Comprehensive Look at Africa's Energy Superpower: Angola's Crude Oil Exports in 2024

In the international energy market, Angola, one of Africa's biggest oil producers, nevertheless commands attention. Notwithstanding internal structural issues and worldwide price swings, Angola was able to sustain a robust crude oil export profile in 2024, underscoring the resource's strategic importance and resilience.

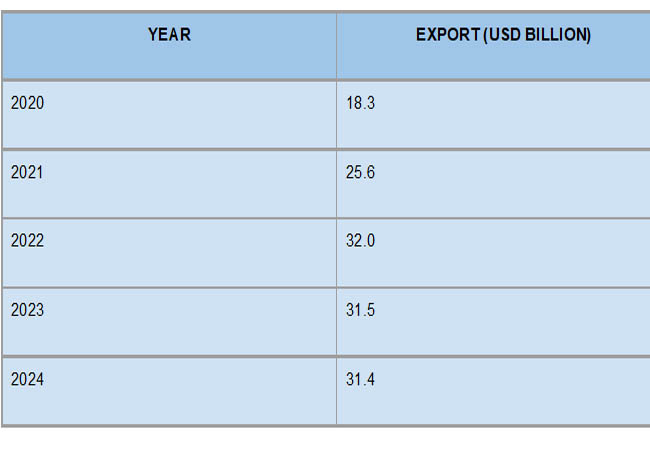

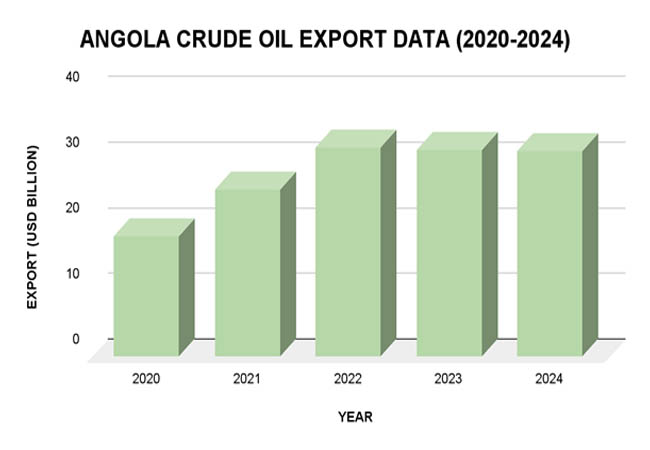

Angola’s Crude Oil Export Analysis

In 2024, crude oil continued to be Angola's most valuable export, accounting for around 85% of total exports and bringing in $31.4 billion. Angola exported 393.4 million barrels for the year at an average price of $79.70 a barrel, according to a report by Import Globals on Angola Exporter Data.

Despite a 1.8% rise in volume over 2023, revenue decreased by 0.11% as a result of unstable worldwide pricing. Angola's economy still relies heavily on oil, particularly now that changes in international markets have an impact on its long-term financial planning.

Values of Exports (2020–2024)

Consistent volumes and strategic reconfiguration have helped Angola maintain stability, even when revenue plateaued after 2022. According to the Import Globals Study on Angola Export Data, the precariousness of depending solely on one export product is highlighted by the fact that the minor decline in revenue in 2024 is mostly caused by changes in demand and worldwide pricing patterns.

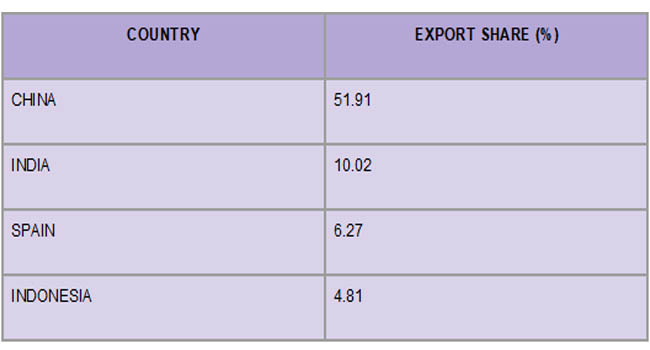

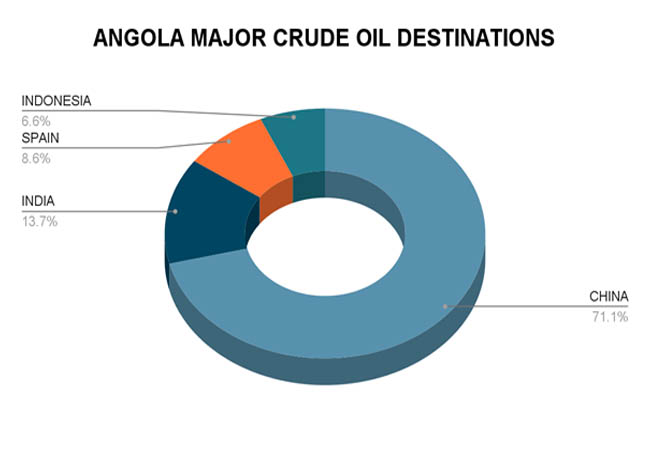

Angola’s Crude Oil Leading Export Destination Countries

According to Angola Export Data From Import Globals, China remained the country's top importer in 2024 as Angola's crude oil made its way to international markets. These collaborations highlight Angola's significance in the energy supply chains of Asia and Europe. Angola's oil-rich deposits, combined with China's growing energy needs, provide a good basis for long-term, prosperous export ties.

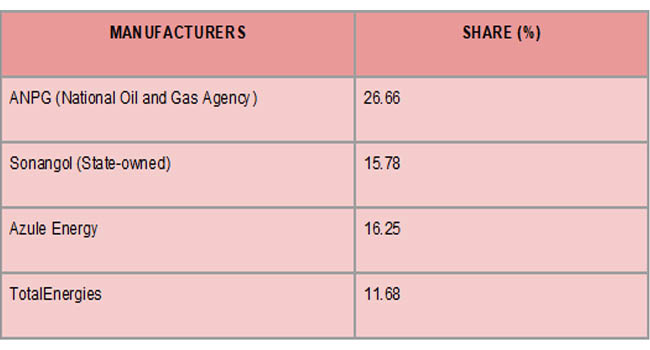

Top Manufacturers and Production Numbers

Angola maintained a production rate of 1.1 million barrels per day (bpd), per a study conducted by Import Globals on Angola Export Import Global Trade Data.

Angola's production strategy became more flexible once it left OPEC in 2023, which helped keep output stable through 2024. This policy change gave Angola the freedom to follow its course, particularly in the face of worldwide production reductions and demand swings. The major participants in Angola's oil industry were:

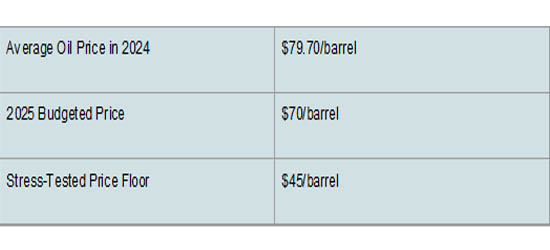

Trends in Pricing and Strategic Projection

According to the Import Globals on Angola Import Export Global Data in early 2025, Angola is cautiously predicting future income and preparing for worst-case scenarios due to price uncertainty. Even though the nation still depends heavily on oil exports, Angola must be ready for changes in income due to the volatility of world oil prices, particularly given its significant budgetary reliance on crude oil.

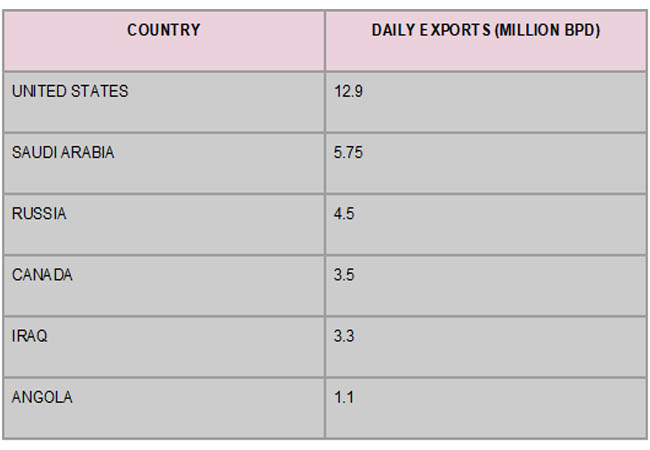

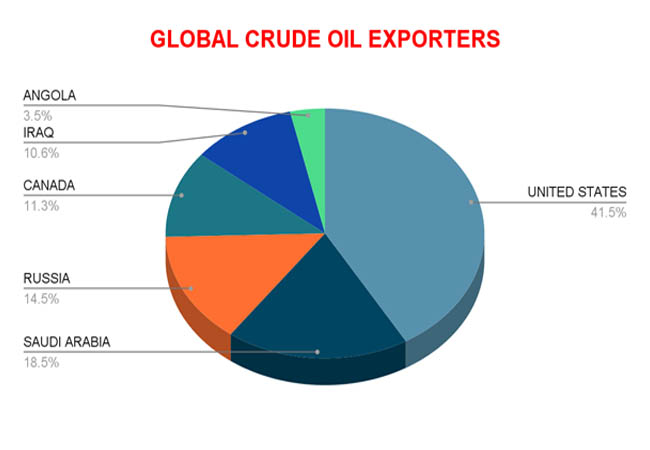

Global Exporters of Crude Oil

Global Exporters of Crude Oil

The Role of Crude Oil in Angola's Overall Economy

Nearly 90% of Angola's overall export earnings and more than 50% of the government budget in 2024 came from oil money, according to Angola Export Data from IMPORT GLOBALS. This degree of reliance highlights the oil industry's disproportionate impact on governmental spending, currency stability, and fiscal policy.

However, Angola's finances have been strained by the unpredictability of oil prices, especially after Brent dropped below $60 in Q2 2024. The Finance Ministry has therefore chosen a cautious budgeting approach for 2025, estimating prices at an average of $70 per barrel while stress testing at as low as $45 per barrel.

Angola's Oil Sector Vision and Policy Transition

Angola's energy policy underwent a sea change when it left OPEC in late 2023. The country indicated a wish to retake control over its output decisions and maximize national interest by deviating from the cartel's production quotas, according to Angola Export Data Supplied to Import Globals. A mismatch between Angola's production capacity and OPEC's mandated limits, which frequently limited growth prospects, was one of the factors that prompted the move.

Through its National Agency for Petroleum, Gas, and Biofuels (ANPG), Angola implemented changes after OPEC to expedite licensing, promote offshore exploration, and draw in foreign participants. Diversifying operators and increasing the value extracted from marginal and maturing oil fields are the objectives.

According to a study by Import Globals on Angola Import Export Trade Data, it has set a goal of 1.1 million barrels per day and targeted production stabilization until 2027. It shows a practical approach following existing capabilities and infrastructure, even though it is not unduly ambitious.

Challenges in the Oil Industry in Angola

Even with consistent exports, Angola still confronts many challenges:

Declining Reserves: According to research on Angola export import global trade data done by IMPORT GLOBALS, output decreased from 1.9 million barrels per day in 2015 to 1.1 million barrels per day in 2024. There are initiatives in place to revitalize the industry and draw in new foreign direct investment. Nonetheless, both foreign and domestic investors continue to encounter difficulties due to the absence of stable governance. Angola's reserves are running short, and there hasn't been much progress in exploring new areas.

Aging Infrastructure: A large portion of the nation's oil infrastructure needs to be updated. Growth potential has been further constrained by a lack of investment in sophisticated extraction processes.

Investor Confidence: Long-term investment prospects are still impacted by previous governance problems and corruption scandals. Foreign direct investment (FDI) has decreased as a result of this mistrust in comparison to prior years.

Sustainability and the Energy Transition

Angola is at a turning point as the world moves toward cleaner energy sources. On the one hand, exports of crude oil continue to play a major role in its economy. However, the nation is aware of the long-term dangers associated with relying too much on fossil fuels.

Angola is investigating investments in biofuel production and natural gas infrastructure in order to achieve this goal. Some attempts are being made to include renewable energy sources in national planning, specifically in rural electrification, according to research by Import Globals on Angola Export Import Global Trade Data. But for the foreseeable future, Angola's export-based economy will continue to be based primarily on oil.

Prospects for Exploration and the Investment Climate

Investor interest in Angola's upstream industry is growing again, despite historical issues. Businesses from Asia, Europe, and the Middle East have expressed interest in several recent bidding rounds. Opportunities for new finds exist in the comparatively unexplored deepwater and ultra-deepwater basins.

Blocks 20, 21, and 18, as well as areas in the Lower Congo and Kwanza Basins, are specifically being marketed for foreign direct investment, according to Angola Export Data. Angola has started lowering administrative barriers and providing better contract terms and tax incentives to promote participation.

In an effort to retain more value domestically and develop technical ability inside the nation, local content policies are also being improved to promote collaborations between international businesses and Angolan service providers.

Conclusion

In 2024, Angola's crude oil industry portrays a country at a turning point, juggling its historical reliance on fossil resources with the need for economic diversification. According to a report by Import Globals on Angola Import Export Global Data, Angola is attempting to secure its position in the changing energy environment through strategic changes like leaving OPEC, focusing exports on Asia, and implementing state-sponsored reforms.

If you are looking for detailed and up-to-date Angola Export Data, You Can Contact Import Globals.

FAQs

Que. How much money did Angola make overall from the export of crude oil in 2024?

Ans. 393.4 million barrels were exported, bringing approximately $31.4 billion.

Que. Who are the main consumers of crude oil in Angola?

Ans. Spain, Indonesia, India (10.02%), and China (51.91%).

Que. What caused Angola to withdraw from OPEC in 2023?

Ans. Must become more flexible in determining its output targets and pursuing autonomous tactics.

Que. How much crude oil is produced every day in Angola?

Ans. In 2024, roughly 1.1 million barrels per day.

Que. What are the main obstacles to Angola's oil exports?

Ans. Declining reserves, deteriorating infrastructure, and problems with governance.

Que. Where to obtain detailed Angola Export Data?

Ans. Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date Angola Export Data.