- Sep 16, 2025

China’s Strategic Pivot: Soybean Imports From Argentina & Uruguay

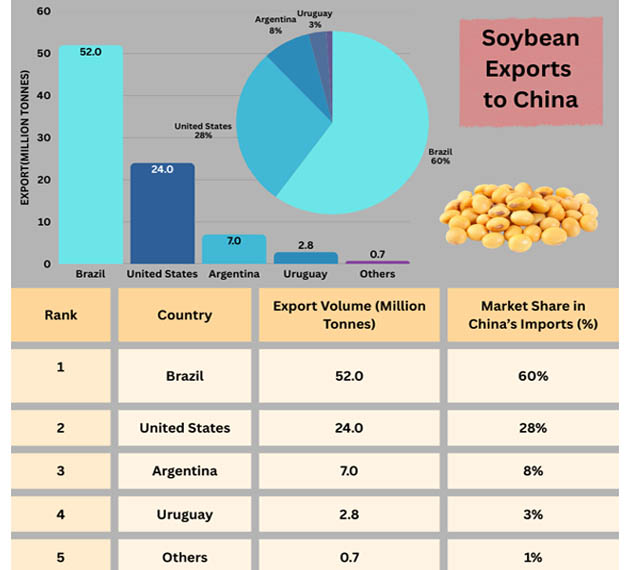

China uses around 60% of the world's soybeans, mostly for the manufacture of edible oil and animal feed.

China Import Data by Import Globals indicates that Brazil and the United States have historically been China's top suppliers. However, the dynamics of this agricultural market have changed as a result of trade conflicts and geopolitical concerns between the United States and China. Uruguay and Argentina have recently benefited greatly from this realignment, increasing their shipments of soybeans to China. This change affects regional competitiveness, long-term market strategy, and food security in addition to trade diversification.

Demand for Soybeans in China

Brazil Export Data by Import Globals signifies that imports of soybeans have been rising gradually as the country's middle class and meat consumption have grown. But because of the disruptions caused by the U.S.-China trade war, China was forced to look for other suppliers. Countries in South America, especially Uruguay and Argentina, have risen to the occasion.

Argentina’s Soybean Exports to China

Argentina is one of the top exporters of soybean oil and meal and the third-largest producer of soybeans worldwide. Argentina ships more raw soybeans straight to China, even though the majority of its soybeans are processed domestically. Argentina shipped almost 7 million tons of soybeans to China in 2024, a considerable increase over prior years. Additionally, Argentina has profited from currency devaluation, which has increased the competitiveness of its agricultural exports abroad. Argentina Import Export Trade Data by Import Globals states that in an effort to lessen their reliance on the Brazilian and American markets, Chinese buyers are increasingly looking to enter into long-term agreements with Argentine manufacturers. Argentina's critical role in altering the global soybean supply chain is shown by this pattern.

Uruguay’s Rising Soybean Trade

Despite being much smaller than Argentina, Uruguay has established itself as a trustworthy supplier of soybeans to China. Based on Uruguay Import Data by Import Globals, it produces 2.5 to 3 million tons of soybeans a year, mostly for export, with China being the biggest consumer.

More than 70% of Uruguay's almost 2.8 million tons of soybean exports in 2024 went to China. Political stability, close economic relations, and Uruguay's capacity to establish itself as a reliable supplier all help the country's agricultural industry. Given that Uruguay is seen as a low-risk trade partner, China's shift toward it indicates both volume demands and a diversification strategy.

U.S.-China Trade War Effects

American soybeans were subject to up to 25% tariffs as a result of the U.S.-China trade war, which decreased American competitiveness in the Chinese market. Even while there was some rebound following partial trade agreements, China has been compelled to diversify due to persistent concerns.

Before the trade war, as per the USA Import Trade Analysis by Import Globals, the United States provided China with more than 36 million tons of soybeans in 2017. This number had dramatically decreased by 2024, with South American suppliers filling the void. China now imports most of its soybeans from Brazil, Uruguay, and Argentina. Global soybean flows have undergone a long-term reconfiguration as a result of this evolution.

Economic Significance for Uruguay and Argentina

Argentina

- As per Argentina Export Data, Exports of soybeans provide a substantial contribution to foreign exchange profits.

- China's purchases aid in stabilizing Argentina's faltering economy, which is beset by debt and inflation.

- Argentina becomes a valuable geopolitical partner by expanding its agricultural connections with China.

Uruguay

- After cattle, Uruguay's second-largest export is soybeans.

- Export earnings from soybeans contribute to national trade balances and rural development.

- Uruguay Export Import Global Trade Data finds that Uruguay's reliance on China necessitates rigorous supply chain management and strong export standards.

Strategic Consequences

There are several ramifications to Argentina and Uruguay's increasing contribution to China's soybean imports:

Supply Diversification: China Import Data by Import Globals states that it lessens excessive reliance on Brazil and the United States.

The economic backbone of South America. Demand for soybeans is rising, which boosts the economies of Uruguay and Argentina.

Geopolitical Influence: As trade changes, China's sway over South America grows, opening the door for more extensive economic alliances.

Market Stability: China can reduce the danger of price shocks and supply disruptions by having several providers.

Prediction and Upcoming Patterns

It is anticipated that the global soybean trade will continue to be active in the future:

As per Argentina Import Trade Statistics, Argentina will continue to export significant quantities of soybean meal and oil, but if domestic crushing slows, it may raise its direct soybean exports. Uruguay is expected to increase its soybean farming area to meet China's increasing demand. To ensure food security, China is probably going to continue to have long-term purchasing deals with South American exporters. Based on China Import Shipment Data, although it is anticipated that the United States will regain some market share, South America will continue to compete with it.

Argentina and Uruguay have emerged as key actors in the dramatic change in the global soybean trade brought about by the U.S.-China trade conflict. Uruguay Import Export Trade Analysis by Import Globals, their higher exports to China demonstrate how smaller countries might benefit from new economic possibilities brought about by geopolitical concerns. Uruguay sees it as an opportunity to further establish itself as a dependable agricultural exporter, while Argentina sees it as an economic necessity. Argentina and Uruguay stand to gain market share in the global soybean industry as China continues to diversify its import sources.

Conclusion

Argentina and Uruguay have emerged as key actors in the dramatic change in the global soybean trade brought about by the U.S.-China trade conflict. Their higher exports to China demonstrate how smaller countries might benefit from new economic possibilities brought about by geopolitical concerns. Uruguay sees it as an opportunity to further establish itself as a dependable agricultural exporter, while Argentina sees it as an economic necessity. Argentina and Uruguay stand to gain market share in the global soybean industry as China continues to diversify its import sources. Import Globals is a leading data provider of Argentina Import Export Trade Data. Subscribe to Import Globals to get more global trade details!

FAQs

Que. Why has China increased soybean imports from Argentina and Uruguay?

Ans. China is diversifying away from the U.S. due to trade tensions and relying more on South American suppliers.

Que. How many soybeans does Uruguay export to China annually?

Ans. Uruguay exports around 2.5–2.8 million tonnes annually, with over 70% going to China.

Que. What benefits does Argentina gain from soybean exports to China?

Ans. Argentina earns crucial foreign exchange, stabilizes its economy, and strengthens geopolitical ties with China.

Que. Will the U.S. regain its soybean market share in China?

Ans. While the U.S. may recover some share, competition from Argentina, Uruguay, and Brazil will remain strong in the long run.

Que. Where can you obtain detailed Uruguay Import Export Global Data?

Ans. Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date data.