- Oct 05, 2025

Comprehending the Worldwide Rice Trade: Patterns, Players, and the Path Ahead

Compared to many other grains, the worldwide rice market is rather small, with just around 10% of the world's crop being traded internationally.

As per Asia Import Data by Import Globals, despite this small share, the rice trade is important for importing countries' food security and a major source of foreign exchange profits for exporting countries, especially in Asia.

The World's Rice Production and Export Environment

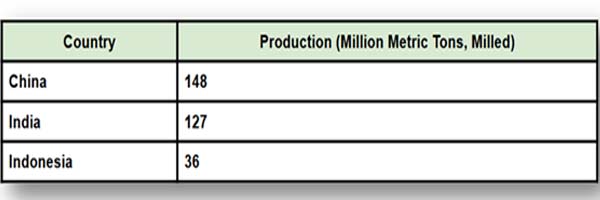

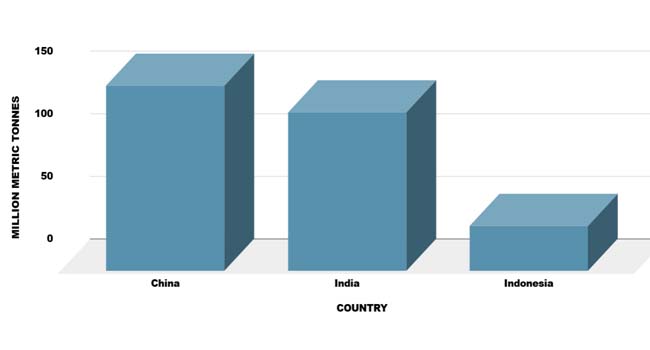

Approximately 520 million metric tons (milled basis) of rice were produced worldwide in 2023–2024, with Asia producing over 90% of the total, according to current Import Globals rice data. China, India, Indonesia, Bangladesh, Vietnam, and Thailand are among the major producers. However, as per Asia export data by Import Globals, because the top producers, such as China and Indonesia, consume the majority of what they grow domestically to feed vast populations, output does not directly transfer into export quantities.

Top 5 Rice Producing Countries

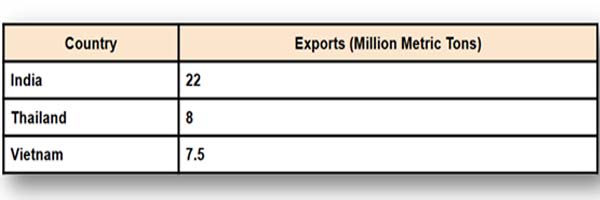

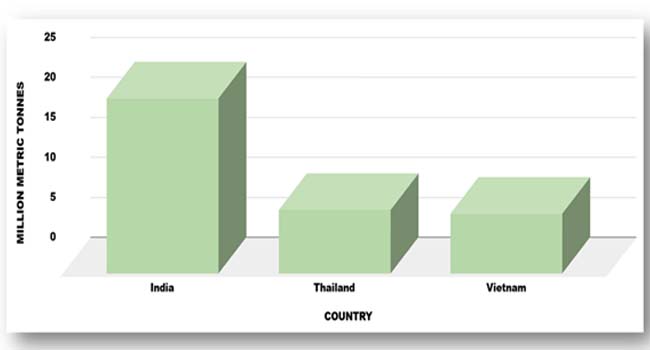

India is still the biggest exporter of rice in the world. Nearly 22 million metric tons of rice were shipped by India in the 2022–2023 marketing year, making up over 40% of all rice exports worldwide. As per Vietnam Import Export Trade Data by Import Globals, Vietnam and Thailand, which ship between 7 and 8 million metric tons a year, are the next biggest exporters after India. Other prominent participants in this sector include the United States and Pakistan. For instance, the United States sold over 2.5 million metric tons of rice last year, primarily to Latin America and Northeast Asia, whereas Pakistan sent roughly 4 million metric tons, predominantly of basmati and non-basmati types.

Top 5 Rice Exporters

Leading Importers and Demand Generators

Countries including Saudi Arabia, Iran, Nigeria, the Philippines, and China are the main importers. Due to dietary choices, population expansion, or land and water limits, indigenous supply is sometimes insufficient to fulfill domestic demand in these countries. As per China Import Data by Import Globals, China became the world's largest importer of rice in 2023, bringing in almost 5 million metric tons. To maintain food security for its expanding population and stable local prices, the Philippines, a significant producer in its own right, imported over 3.8 million metric tons. Imports have also increased in African nations, where rice has grown in importance in urban diets. For example, Nigeria imported almost 2 million metric tons despite several programs meant to increase domestic output.

Current Patterns and Trade Dynamics

Climate conditions, regulatory initiatives, and shifting consumer behaviors have all contributed to significant changes in the global rice trade in recent years. Periodically, supply routes have been interrupted and prices have fluctuated due to extreme weather catastrophes like floods in Pakistan and droughts in Southeast Asia. For instance, Pakistan's devastating floods in 2022 destroyed vast swaths of paddy farms, reducing exportable surpluses and raising prices internationally.

India's decision to prohibit the export of non-basmati white rice in the middle of 2023 to control local inflation and stabilize prices was one noteworthy move. The Food and Agriculture Organization's Food Price Index shows that rice prices rose to a 15-year high as a result of this action, which had significant repercussions on international markets. Though the move came with increased prices and logistical challenges, nations that were largely dependent on Indian rice rushed to seek alternative supplies from Vietnam, Thailand, and Myanmar.

To be competitive, as per Vietnam Import Trade Analysis by Import Globals, Vietnam and Thailand have been growing their premium rice markets. For example, Vietnam is taking advantage of free trade agreements such as the EU-Vietnam Free Trade Agreement (EVFTA) to offer premium fragrant rice varieties to Europe and Asia-Pacific nations. Thailand, which is well-known for producing high-quality jasmine rice, is still dominant in high-value markets, but it is facing difficulties due to fierce competition and growing production costs.

Trade Accords and the Policy Environment

The rice market is significantly shaped by international agreements and trade policy. The ASEAN Free commerce Area, which includes a number of countries in Southeast Asia, lowers tariffs to promote commerce in rice among its members. Furthermore, as per Vietnam Export Data, rice exporters like Vietnam may now reach high-demand nations like Canada and Japan with advantageous tariffs thanks to the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP).

Rice is still a politically delicate product, though. To safeguard domestic supply, several nations impose import limits, export prohibitions, and stockpiling policies. Even while these interventions stabilize local markets, they frequently cause price surges and alter international trade flows. For example, as per Africa Import Export Data, historically, importing countries, especially those in Asia and Africa, have experienced instability as a result of India's sporadic export restrictions.

Price Patterns and Market Predictions

Over the previous ten years, rice prices have fluctuated significantly. As per India Export Import Global Trade Data, due to India's export restrictions and unfavorable weather conditions that affect crops in Southeast Asia, the benchmark Thai 5% broken white rice averaged about $600 per metric ton in early 2024, up from about $420 per metric ton the previous year, according to Import Globals.

According to the Import Globals, urbanization encroaching on paddy fields, water scarcity, and climate change might all pose ongoing problems for rice production worldwide. However, there is optimism for production stabilization due to advancements in technology, better irrigation, and the use of high-yield cultivars. As per Asia Import Data by Import Globals, demand is anticipated to increase moderately due to urbanization, shifting dietary patterns in countries, and population expansion in Asia and Africa.

Opportunities and Difficulties

The rice trade presents several difficulties, even if it guarantees food security for many countries. As per Asia Import Trade Statistics by Import Globals, the backbone of Asian production, smallholder farmers, frequently face challenges from shifting market pricing, restricted access to contemporary farming technologies, and climate-related hazards. Exporting nations must strike a balance between their internal food security and the demand for foreign cash, which occasionally leads to sudden changes in policy that cause market volatility.

The demand for premium and specialty rice types, such as organic, aromatic, and fortified rice, is rising, which presents an opportunity. In developed economies, consumers are becoming more prepared to pay extra for high-quality, sustainably farmed rice. Exporting nations now have the opportunity to advance up the value chain and diversify their product portfolios.

The future of the rice trade is likewise bright thanks to technology. As per Rice Import Shipment Data by Import Globals, to increase productivity, traceability, and farmer incomes, digital markets, blockchain for supply chain transparency, precision agriculture, and improved weather forecasting are all being progressively implemented. Investing in upgrading their rice industries is likely to increase a nation's competitiveness in the international market.

Conclusion

Millions of farmers and merchants rely on the global rice trade for their livelihoods, and it provides food security for billions of people in many nations. It is a complex system impacted by international trade agreements, customer preferences, governmental regulations, and weather patterns. The vulnerability of this sector and the requirement for robust and sustainable procedures are highlighted by recent events, such as India's export prohibition and production hazards associated with climate change.

The rice trade will continue to alter as the globe struggles with population increase, climate change, and changing eating preferences. To establish a stable, equitable, and sustainable global rice market that can feed future generations, stakeholders from farmers and exporters to legislators and consumers must collaborate. Import Globals is a leading data provider of Rice import export trade data. Subscribe to Import Globals to get more global trade details!

FAQs

Que. Which country exports the most rice globally?

Ans. India is the largest rice exporter, shipping around 22 million metric tons annually.

Que. Who are the major rice importers in the world?

Ans. China, the Philippines, Nigeria, Saudi Arabia, and Iran are among the largest rice importers.

Que. Why did rice prices rise sharply in 2023?

Ans. India’s export restrictions and adverse weather conditions in key producing countries drove prices to a 15-year high.

Que. Which countries export premium rice varieties?

Ans. Thailand and Vietnam are well-known for exporting premium fragrant and jasmine rice.

Que. How much of global rice production is traded?

Ans. Only about 10% of global rice production is traded internationally, making the market relatively thin compared to other grains.

Que. Where can you obtain detailed Rice Import Export Trade Analysis?

Ans. Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date data.