- Sep 17, 2025

Grain Exports to Southeast Asia Rise in the U.S.

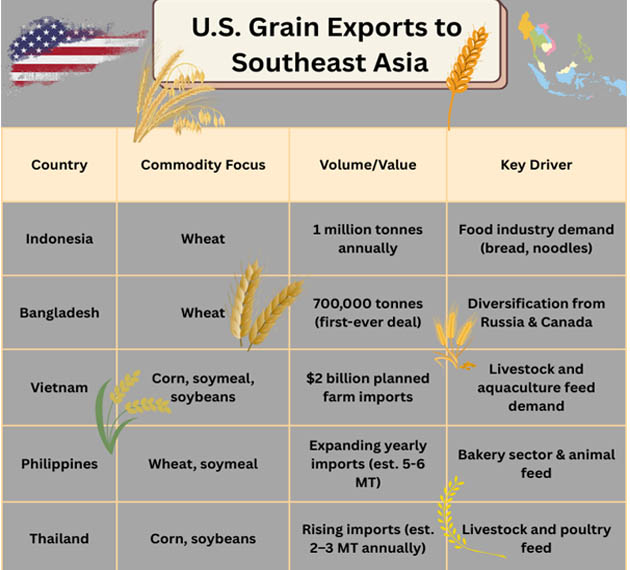

The Philippines, Thailand, Vietnam, Bangladesh, and Indonesia are increasing their imports of U.S. soybeans, corn, wheat, and soymeal.

Competitive pricing, advantageous trade regulations, and changing supply-demand dynamics in the area are the main drivers of this movement. Southeast Asia Import Data by Import Globals indicates that it is one of the agricultural commodities markets with the greatest rate of growth, thus American farmers and exporters are in a good position to take advantage of the expanding demand for industrial usage and food security.

Why Grain Imports Are Increasing in Southeast Asia

With a population of around 700 million and increasing urbanization, Southeast Asia is seeing a surge in demand for food, animal feed, and edible oil production. The USA Export Data by Import Globals says that the region is mostly dependent on imports for commodities like wheat and corn due to its small amount of arable land and erratic weather patterns. In an effort to lessen their reliance on conventional suppliers like Australia, Canada, and Ukraine, nations are also diversifying their supply chains.

The United States has emerged as a desirable option because of its robust logistics, plentiful harvests, and reliable quality. To provide American farmers a greater presence in the Asian grain market, USA Import Export Global Data finds that trade agreements and competitive pricing are also increasing U.S. exports.

Indonesia: A Consistent Purchaser of American Wheat

Because of its tropical environment, Indonesia Import Export Trade Data by Import Globals reveals that it does not grow wheat domestically, making it one of the world's biggest importers of the grain. To guarantee a steady supply for its flour milling sector, Indonesia has committed to buying one million tons of U.S. wheat yearly. A key component of Indonesia's burgeoning processed food, bread, and noodle industries, all of which are rising as a result of urbanization and shifting dietary habits, is wheat.

Due to droughts, as per USA Export Data, Australian wheat is in shorter supply, and prices are erratic; thus, the U.S. has been able to fill the gap. American wheat is preferred by Indonesian flour millers due to its high quality and uniformity, which is essential for making a variety of processed meals. This long-term commitment signals Indonesia’s confidence in the reliability of U.S. exports and demonstrates how food security concerns are shaping trade choices.

Bangladesh: An Emerging Market for American Wheat

The demand for bread, noodles, and baked products has led to a large increase in grain imports in Bangladesh, one of the countries in South Asia with the fastest rate of growth. A new era in bilateral agricultural commerce began when Bangladesh won its first-ever purchase of 700,000 tons of U.S. wheat in a historic agreement.

Bangladesh Import Data indicates that it has historically depended on supplies from Ukraine, Canada, and Russia. However, Dhaka looked to the United States for steady sourcing due to supply interruptions and fluctuating costs in these markets. Bangladesh's efforts to guarantee its 170 million citizens' long-term food security are reflected in the new agreement. Bangladesh's growing livestock and poultry sectors, which need a lot of soymeal and maize for feed, are also anticipated to help U.S. exporters. This move demonstrates how American grain exporters are expanding their clientele beyond conventional importers and effectively breaking into new Asian markets.

Vietnam: Growing Imports of Corn and Significant US Investment

One of the fastest-growing economies in Southeast Asia, Vietnam, has declared its intention to increase its imports of maize and spend close to $2 billion in American agricultural goods. Vietnam's two objectives, improving its supply of animal feed and expanding commercial ties with the United States, are reflected in this project.

As per Vietnam Import Trade Analysis by Import Globals, Vietnam's poultry and aquaculture sectors, which are flourishing as a result of growing local and international demand, depend heavily on corn. Vietnam used to import a large portion of its corn from South America, but the competitive price and logistical efficiency of the United States are changing the balance. Vietnam's $2 billion pledge also demonstrates its strategic goal of becoming Asia's center for food processing and exports. Vietnam can increase its competitiveness in the export of processed foods and animals while lowering the risk of supply chain interruptions by obtaining premium U.S. agricultural inputs.

Philippines: Growing Reliance on American Corn and Soybeans

The United States has a long history of agricultural commerce with the Philippines. Based on Philippines Import Data by Import Globals suggests that the need for food and animal feed is rising as the nation's population approaches 120 million. Both corn and soybeans, which are essential for the production of hogs, poultry, and aquaculture, are imported in large quantities into the Philippines.

Because domestic demand cannot be met by local manufacturing, the United States has become the favored provider. The high protein content of American soybeans and soymeal makes them ideal for animal feed. Imports of U.S. maize and soymeal are predicted to increase further as the Philippines' chicken sector grows quickly to satisfy growing domestic demand. In addition, U.S. exporters benefit from the Philippines’ long-standing trade relationship under various bilateral agreements, which ensure smoother market access compared to other competitors.

Thailand: Expanding Imports and Diversifying Supply

Thailand is a significant importer of grains, especially wheat and soymeal, and is well-known for its robust agricultural industry. Thailand exports rice all over the world, but it imports other grains that are necessary for its livestock and food processing sectors.

As companies look to diversify their supply chains away from Australia and Ukraine, the U.S. has gained traction in the Thai market. In particular, as per Thailand Import Trade Statistics, U.S. soymeal is growing more and more significant for Thailand's animal feed sector. Furthermore, the growth of Thailand's exports of food processing goods, such as processed meats and baked goods, has increased demand for goods made from wheat and soy. Thailand’s strategy to secure reliable U.S. supplies aligns with its broader economic goals of strengthening food exports and maintaining stability in its domestic agricultural markets.

The Surge's Strategic Implications

There are several significant ramifications to the increase in U.S. grain shipments to Southeast Asia:

- Enhancing U.S.-Asia Trade Ties: This increase strengthens strategic trade ties and increases the presence of American farmers in a high-growth area.

- Diminished Market Share for Rivals: As the U.S. solidifies its position, the Canada Import Data by Import Globals says that traditional exporters like Australia, Canada, and Ukraine may see a decline in market share.

- Food Security in Asia: By collaborating with the United States, Southeast Asian countries are guaranteeing a consistent supply of vital grains, lowering their susceptibility to geopolitical upheavals and climate shocks.

- Economic Opportunities for American Farmers: As long as demand remains strong, American farmers may anticipate steadier export earnings to help their local rural economies.

Conclusion

A larger change in international agricultural commerce is seen in the rise in U.S. grain shipments to Southeast Asia. The United States has established itself as a dependable provider in a vibrant and quickly expanding area as nations like Indonesia, Bangladesh, Vietnam, the Philippines, and Thailand increase their imports of wheat, corn, soymeal, and soybeans. This expansion is being driven by competitive price, consistent quality, and strategic alliances, which will open the door for closer economic relations between the United States and Asia in the years to come. Import Globals is a leading data provider of USA Import Export Trade Data. Subscribe to Import Globals to get more global trade details!

FAQs

Que. Why are Southeast Asian countries increasing grain imports from the U.S.?

Ans. Vietnam Export Import Global Trade Data says that due to rising populations, limited local production, and food security concerns, Southeast Asian nations are turning to U.S. grains for reliable supply and competitive pricing.

Que. Which country made its first-ever purchase of U.S. wheat?

Ans. Bangladesh made its first-ever purchase of 700,000 tonnes of U.S. wheat, marking a breakthrough in trade ties.

Que. What role does Vietnam play in U.S. grain exports?

Ans. Vietnam is expanding corn imports and investing around $2 billion in U.S. farm products, reflecting its long-term commitment to U.S. agricultural trade.

Que. How does this trend affect global competitors like Australia and Canada?

Ans. As U.S. grains gain market share, traditional suppliers such as Australia, Canada, and Ukraine may see reduced exports to Southeast Asia.

Que. Where can you obtain a detailed USA Import Export Trade Analysis?

Ans. Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date data.