- May 03, 2025

Chile's Leading Import: A Deep Dive into Mineral Fuels and Oils in 2024

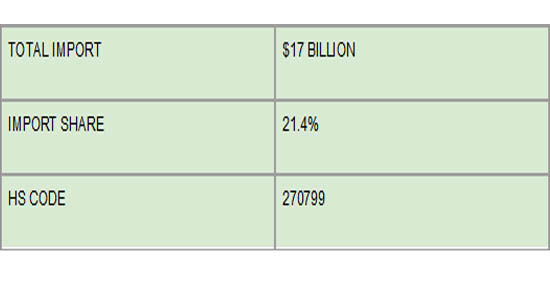

With natural fuels and oils accounting for the majority of the nation's imports, Chile has solidified its status as one of the most energy-dependent countries in Latin America as of 2024. As per the report by IMPORT GLOBALS on CHILE IMPORTER DATA, this product category has remained at the top of Chile's import profile, accounting for an impressive 21.4% of total imports, which reflects the country's reliance on imported energy.

Insights into Chile's Mineral Fuels and Oils Import Market

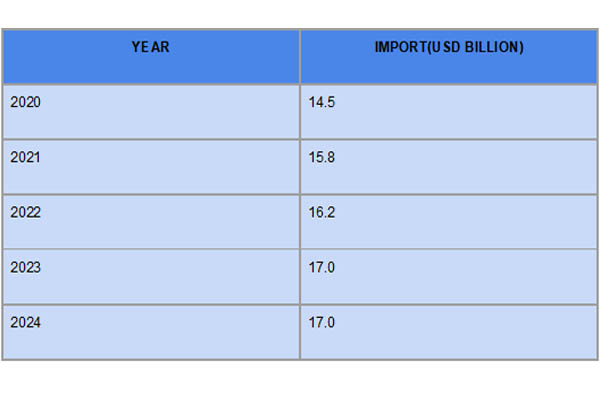

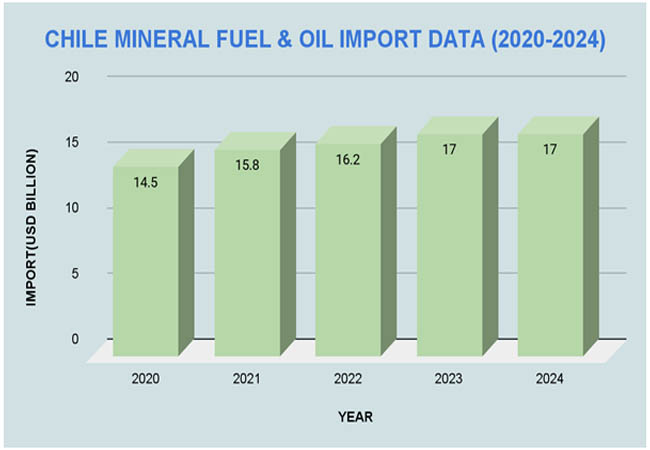

Mineral fuels and oils include a broad range of products: crude and refined petroleum, petroleum gases, bituminous mixtures, coal, and various petroleum derivatives. These fuels are indispensable in powering industries, transportation systems, and homes throughout Chile. As per research by Import Globals on Chile Import Trade Analysis, in 2024 alone, Chile imported mineral fuels and oils worth approximately USD 17 billion, a significant rise from the $14.5 billion recorded in 2020. The mineral fuels and oils include:

? Petroleum crude oils

? Both gaseous hydrocarbons and petroleum gases

? Coal and solid fuels derived from coal

? Bituminous blends

Of these, petroleum oils (not crude) and refined products made up over 48% of all mineral fuel imports, contributing close to $8.72 billion. Petroleum gases contributed an additional $2.72 billion, and crude petroleum came in second with $5.21 billion. These three groups together account for the majority of Chile's energy imports.

Chile’s Historical Import Trends (2020-2024)

According to Chile Import Shipment Data Provided by Import Globals, over the past few years, Chile's dependency on energy imports has steadily increased.

Chile Major Import Partners

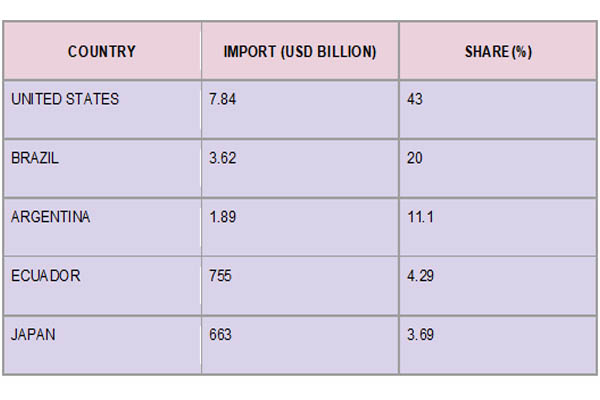

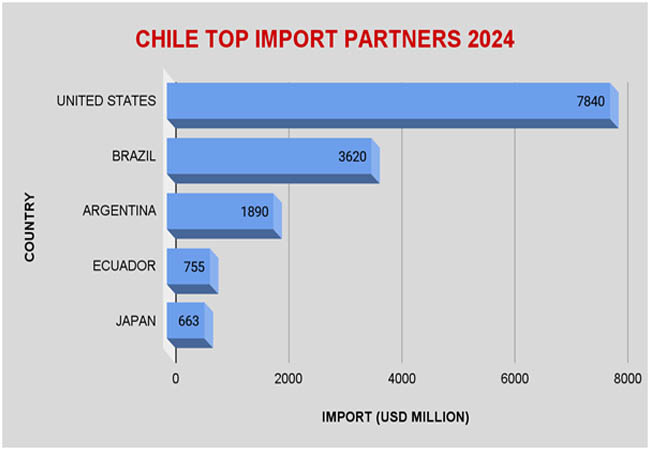

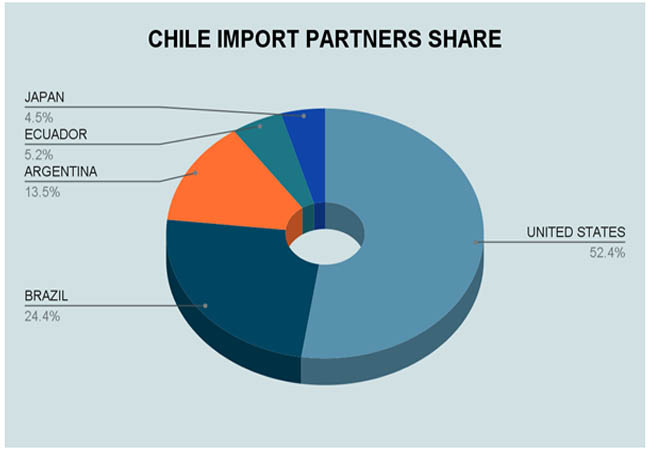

Chile's energy supply is mostly dependent on a small number of critical partners. As the largest exporter, the United States will provide Chile with mineral fuels and oils valued at USD 7.84 billion in 2023. In this area, it accounts for 43 percent of Chile's total imports. With a $3.62 billion contribution, Brazil comes in second at 20%. Japan ($663 million), Ecuador ($755 million), and Argentina ($1.89 billion) are other notable exporters.

Although Chile maintains economic relations with energy-heavy economies such as the United States and Japan, this geographic distribution of suppliers indicates Chile's preference for regional partners in Latin America. A report by Import Global on Chile Import Custom Data says that this dynamic is greatly influenced by trade agreements, transportation, and the availability of suppliers like Argentina and Brazil.

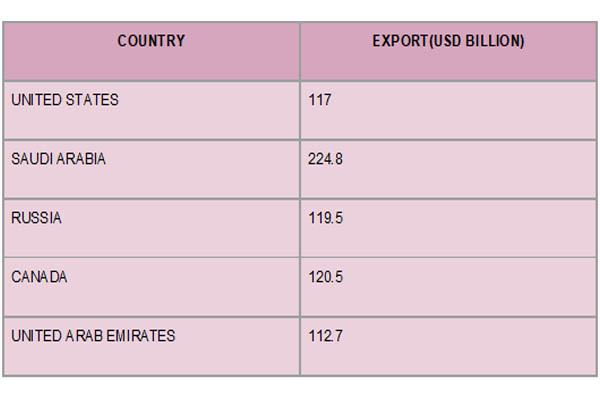

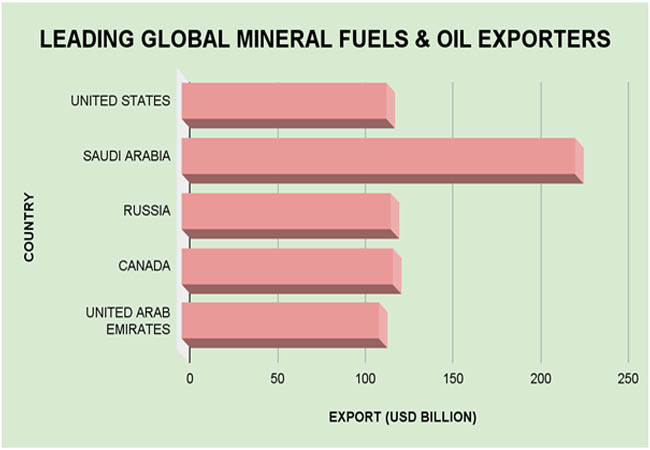

Leading Global Exporters of Mineral Fuels and Oils 2024

These nations' enormous oil reserves, sophisticated refining capabilities, and vital geopolitical roles allow them to dominate. Chile's efforts to align with dependable and stable suppliers are reflected in its partnerships with some of these countries, especially the United States.

Global Market Trends and Pricing of Mineral Fuels and Oils

There has been significant volatility in the price of mineral fuels and oils on the international market. A research by IMPORT GLOBALS on CHILE IMPORTER DATA finds that between 2020 and 2023, the price of a barrel of crude oil ranged from $40 to $80. Natural gas prices stayed between $2 and $6 per MMBtu (Million British thermal units), while refined petroleum prices ranged from $60 to $100 per barrel.

Global events such as the conflict between Russia and Ukraine, decisions made by OPEC+ on oil output, inflation, and the shift to renewable energy sources are the main causes of these price fluctuations. Chile is directly affected by these changes because it is a non-oil-producing nation with no capacity for refining.

Challenges

Chile's energy import strategy is beset by several difficulties. Global market price volatility, reliance on outside vendors, insufficient capacity for domestic refining, and risks to supply nations' geopolitics are the prime challenges.

A study on Chile Import Export Global Data by Import Globals witnessed that Chile is promoting greener energy projects, promoting the use of electric vehicles, and supporting domestic energy innovation to lessen these.

Forecast Trend Of Chile’s Imports

It is anticipated that Chile's imports of oils and mineral fuels will either stay the same or expand moderately in the future. Chile Import Trade Analysis says that infrastructure development, industrial growth, and the ongoing reliance on oil-based transportation will be important factors.

Nonetheless, Chile is also making investments in renewable energy sources like wind and solar, which could eventually lower the proportion of fossil fuels. Fossil fuels are still necessary as of 2024.

Conclusion

An important part of Chile's national economy is the importation of oils and mineral fuels. With more than $17 billion spent on these goods in 2024, the nation demonstrates both its strengths and weaknesses. The necessity of smart trade alliances, stable international prices, and the pressing need to diversify into renewable energy sources are all highlighted by the reliance on imported energy.

The information makes it abundantly evident that, despite its progress in the direction of renewable energy, Chile is still largely dependent on imported fossil fuels for the foreseeable future. These observations provide guidance and caution for the years to come for enterprises, environmentalists, and legislators alike.

If you are looking for detailed and up-to-date Chile Import Data, You Can Contact Import Globals.

FAQs

Que. Which product will be Chile's top import in 2024?

Ans. Mineral fuels and oils make up 21.4% of Chile's total imports in 2024, making them the biggest imported product category.

Que. In 2024, how much did Chile spend on importing oils and mineral fuels?

Ans. In 2024, Chile imported mineral fuels and oils at a cost of over USD 17 billion.

Que. In 2024, who are the leading exporters of oils and mineral fuels to Chile?

Ans. The United States, Brazil, Argentina, Ecuador, and Japan are the top five exporters to Chile.

Que. What are the prospects for energy imports in Chile?

Ans. In order to lessen its long-term reliance on imported fossil fuels, Chile is investing in renewable energy and working to diversify its energy sources.

Que. Where to obtain detailed CHILE IMPORT DATA from?

Ans. Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date Chile Import Data.