- Oct 30, 2025

China’s Strategic Pivot: Soybean Imports From Argentina & Uruguay

World's biggest importer of Soybeans? It's China, after all! The increased needs have had an effect on the trade in soybeans throughout the world.

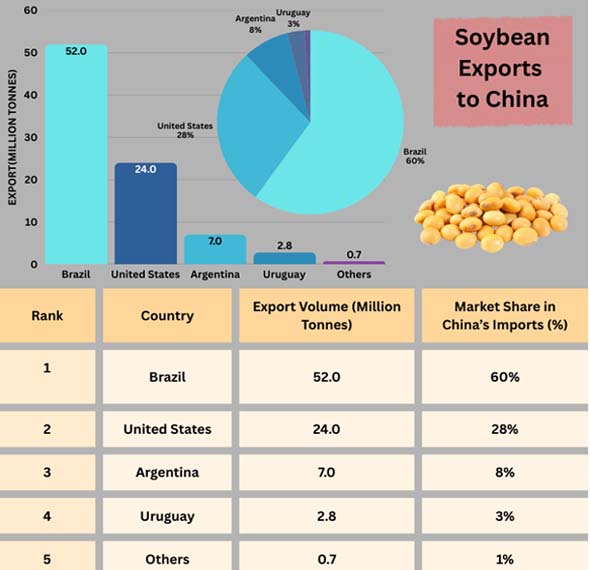

Import Globals' China Import Data shows that Brazil and the United States have always been its main exporters. A look at the current scenario shows that trade disagreements and political tensions between the US and China have impacted how the farm market works. Uruguay and Argentina have made a lot of money from this change in the past several years. They have increased the amount of soybeans they send to China. Because of this, this dynamic affects regional competitiveness, market strategy, food security, and trade diversification.

China's Need for Soybeans

China uses over 60% of the world's soybeans to make animal feed and edible oil. Import Globals' Brazil Export Data shows that soybean imports are steadily rising. This is happening at the same time that the country's middle class grows and meat consumption rises. The U.S.-China trade dispute caused problems for China, so it had to look for alternative suppliers. Uruguay and Argentina are two South American countries that have done a good amount of trade with each other.

China Imports from Argentina

Argentina is one of the top suppliers of soybean oil. It is also the third greatest producer of soybeans in the world. Most of Argentina's soybeans are processed in the country, but a lot of raw soybeans are exported straight to China. Recent numbers show a big increase over the past several years. In 2024, Argentina sent nearly 7 million tons of soybeans to China. Also, Argentina's currency has lost value, which has made its agricultural exports more competitive on the world market. As Import Globals says that Argentina Import Export Trade Data shows that Chinese buyers are trying to build long-term ties with Argentine manufacturers so they don't have to rely as much on Brazilian and American markets.

Uruguay's Global Soybean Export

Uruguay is a consistent supplier of soybeans to China, even though it is much smaller than Argentina. Import Globals' Uruguay Import Data shows that the country grows between 2.5 and 3 million tons of soybeans each year, with China being the main buyer. In 2024, Uruguay sent 2.8 million tons of soybeans to China, which was over 70% of all its exports. Uruguay's agricultural industry has grown because of stable politics, strong business ties, and the country's ability to market itself as a reliable provider. People think of Uruguay as a low-risk trade partner, so China's shift toward it means both more demand and a plan to diversify.

What the U.S.-China Trade War Will Do?

Because of the trade spat between the U.S. and China, American soybeans have tariffs of up to 25%. It has made it harder for Americans to compete in the Chinese market. China has had to diversify because of lingering anxieties, even if things got better after several trade deals.

Before the trade war, Import Globals' USA Import Trade Analysis says that the US sent more than 36 million tons of soybeans to China in 2017. This statistic shows that exports have dropped significantly by 2024. South American soybean exporters are filling the trade gap. Because of this, Brazil, Uruguay, and Argentina are the main places China gets its soybeans from. This has caused the long-term rearrangement of global soybean commerce.

How important is it for Uruguay and Argentina's Economies?

Argentina

According to Argentina Export Data, soybean exports are a big part of the country's foreign exchange revenues. Argentina's shaky economy has improved because China has bought things from it. It has a lot of difficulties with debt and rising prices. Argentina has become an important strategic ally for China because of increasing ties in agriculture.

Uruguay

Soybeans are Uruguay's second greatest export. The country's trade balance and rural development are both helped by the money gained from exporting soybeans. According to Uruguay Import Data, its reliance on China means that it has to have strict supply chain management and strong export rules.

Important Effects

There are several effects that Argentina and Uruguay's increased role in China's soybean imports will have. Import Globals' China Import Trade Statistics shows that this cuts down on too much reliance on Brazil and the US. Because there is a lot of demand for soybeans, the economies of Uruguay and Argentina are doing better. The growth of China's commerce with South America has an impact on geopolitics. It has helped more business relationships flourish. China can decrease the risk of pricing fluctuations and supply problems by working with a lot of different suppliers.

Trends that are expected to Happen in the Future

The worldwide trade in soybeans is likely to be strong in the future. Argentina Import Data figures show that the nation will continue to export large amounts of soybean meal and oil. However, a slowdown in domestic crushing might lead to an increase in direct soybean exports. To meet China's expanding demand, Uruguay is expected to increase the area it grows soybeans on. China is likely to have long-term contracts with South American exporters to make sure it has enough food. China's import cargo statistics show that South America will continue to compete, even if the United States is likely to gain some market share.

The U.S.-China trade war has led to a big change in the global soybean trade, and Argentina and Uruguay have come out on top. According to Import Globals' Uruguay’s Import Export Trade Analysis, business with other countries, the country's growing exports to China show how tiny countries may take advantage of new economic possibilities, especially those caused by geopolitical circumstances. Uruguay viewed it as a chance! Argentina sees improving its reputation as a reliable agricultural exporter as an economic necessity. China is getting soybeans from other places, which might help Argentina and Uruguay get a bigger portion of the global soybean market.

Final Evaluation

The trade war between the US and China has opened up business opportunities for Argentina and Uruguay. They have become important players in the big changes that are happening in the global soybean trade. How can smaller states take advantage of new economic opportunities that come up because of geopolitical conflicts? This is shown by the fact that these two countries are now exporting more to China. Uruguay can strengthen its reputation as a reliable agricultural exporter. Argentina sees it as a necessary step for the economy, since it will bring in more foreign currency. Argentina and Uruguay mostly want to get a big piece of the global soybean market. Import Globals is a leading data provider of China Import Export Trade Data. For more refined information on global trade, sign up for Import Globals today!

FAQs

Que. Why has China bought more soybeans from Argentina and Uruguay than from the United States?

Ans. Because of trade problems and tariffs.

Que. Every year, how many soybeans does Uruguay ship to China?

Ans. Uruguay sends out between 2.5 to 2.8 million tons of soybeans per year.

Que. What are the benefits for Argentina of selling soybeans to China?

Ans. Argentina gets foreign currency and strong political relations with China.

Que. Will the US ever get back its market share of the soybean market in China?

Ans. Seeing the current scenario, trade competition from Argentina, Uruguay, and Brazil will continue to be strong in the long run.

Que. Would you like a clear worldwide Uruguay Import Export Global Data?

Ans. Please go to www.importglobals.com or email info@importglobals.com for further information.