- Oct 29, 2025

The Global Bauxite Export Landscape: Leaders, Trends, and Insights (2025)

Bauxite is an important strategic resource on the world stage since it is needed to make aluminum.

Import Globals' China Import Data shows that in 2025, a small number of nations would control most of the production and exports. This will affect the supply chains of numerous industries, such as construction and the car industry. This blog talks about these top exporters, what's new, and how it all affects the economy.

Top Producers and Exporters

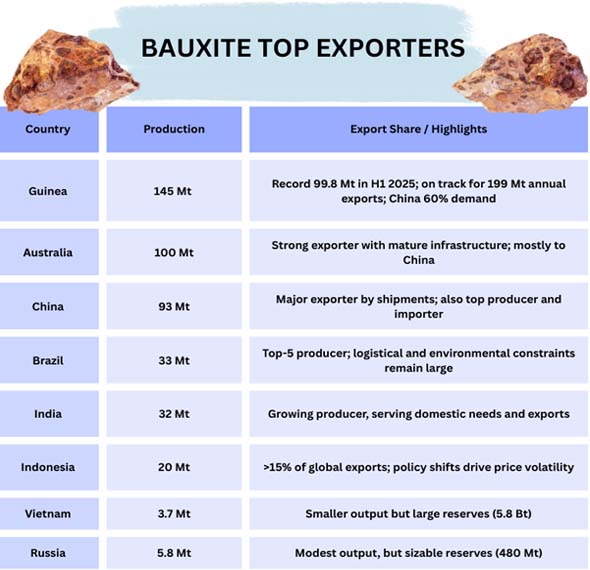

A small handful of countries with large production and export facilities control most of the world's bauxite supply chain. Guinea has been the top exporter, sending out around 99.8 million metric tons in the first half of 2025 alone, which is 36% more than the same period in 2024. According to Import Globals' Papua New Guinea Export Data, this result shows that Papua New Guinea is in a good position and is virtually equal to its full-year total for 2022. Chinese demand, which makes up over 60% of its exports, was the main reason for this rise. Even if some firms had to go offline because of rules, big exporters like SMB and Chalco were very important to the growth. This year, Guinea is scheduled to send out more than 199 million tons of goods.

Australia is still a heavyweight, but not by much. It is a constant top exporter, making approximately 100 million metric tons of goods every year. There are a lot of good things about this place: it has good reserves, a well-established mining infrastructure, and a good location near vital markets, especially China, which buys most of Australia's exports.

China is a major exporter of bauxite, with shipments coming from secondary markets. It produces more than 93 million metric tons of bauxite each year, which is nearly 40% of all export activity globally by shipment volume. Vietnam Import Export Trade Data says that the United States and Vietnam are second and third in terms of cargo counts.

Other countries also make a lot, such as Brazil (about 33 million), India (about 32 million), Indonesia (20 million), Vietnam, and Russia. Indonesia is responsible for more than 15% of the world's bauxite exports. The country's shifting export rules have a huge effect on markets and spot pricing.

Regional Views: Changing Market Forces and Drivers

Guinea: China's Lifeline and a Major Exporter

Guinea's recent rise in exports has secured its place as the world's leading exporter of bauxite. According to Import Globals' Papua New Guinea Import Data, this rise is due to improvements in infrastructure, such as better ports and rail links, and increased demand in China. Major producers were able to move cargoes or make more of them to meet demand, even if new mining restrictions made it harder for them to do so.

Australia: Reliable Supply, Great Quality

Australia's mining talents are the consequence of years of investment in automation, efficiency, and logistics. According to Australia Import Trade Analysis, the country sends around 100 million tons of high-grade ore a year, largely to Chinese enterprises with long-term contracts. Planned long-term expansions to mining capacity indicate a steady continuance.

China: A Producer, Exporter, and Consumer of Many Things

China has a unique approach to getting bauxite since it makes, sells, and uses nearly the same quantity of it. According to China Export Data, the country has 700 Mt of anticipated domestic reserves, but it still has to import goods to refine them. It may be flexible in international markets since it has a lot of influence over Guinea's production and exports.

New Exporters from Indonesia and other Countries

According to Import Globals' Indonesia Import Data, altering export policy has a huge effect on world prices. This is because it is tied to regional processing and environmental rules. In the meantime, countries like Ghana, Cameroon, and Sierra Leone are making more. Sierra Leone's exports are predicted to reach more than 5 million tons by 2025, and they might soon triple. Cameroon intends to attain 6 to 10 million tons per year by early 2026.

Other Important Countries: India and Brazil

Import Globals' Brazil Import Trade Statistics say that Brazil has logistical and environmental problems, even if it produces tens of millions of tons. India is still building up its mining capacity because it needs to add value to its downstream products and because there is a lot of demand for aluminum in the country.

Market Trends and Strategic Changes

More and more people want it powered by green technologies and infrastructure Aluminum is still important for things like building, transportation, and renewable energy. The rise in demand in Asia makes bauxite security even more important.

Infrastructure: Important for Export Growth

According to Import Globals' Australia Import Data, Australia's stable exports are due to decades of investment in infrastructure. Guinea's prosperity, on the other hand, is because its ports and railroads are getting better.

Policy and Nationalism affect Supply

Guinea's quest for local processing and Indonesia's export licensing are both examples of a larger trend toward resource nationalism. If exporters don't meet the new standards, they might not be able to sell their goods.

Markets depend on China because it is so Powerful

China buys around 60% of Guinea's exports and most of Australia's goods as well. It manages pricing and investment along the supply chain by building connections between countries.

According to the Cameroon Import Export Trade Analysis, new production centers provide a way to diversify. The growth in Cameroon, Ghana, and Sierra Leone shows that the capacity to export is slowly spreading to countries that aren't already leaders. This makes it easier for bauxite to travel throughout the world and makes it more competitive. The chance of prices going up and down, and supply issues. There have been big jumps in alumina prices on the futures market because of problems in Guinea with rules, logistics, or geopolitics. Prices throughout the world are steady because exporters keep flowing in.

Final Thoughts

Guinea, Australia, and China remain the main exporters of bauxite across the world in 2025. Guinea's record-breaking rise in exports is a huge change, whereas Australia is always a reliable source. China has an impact on how goods are created, how much is sold, and how much is utilized. At the same time, Indonesia, India, Brazil, Sierra Leone, and Cameroon are all gaining strength. Their economies are growing, and their markets are changing. You need to keep an eye on emerging export hubs while also managing demand, infrastructure, laws, and geopolitical alignment to keep the supply chain healthy. Import Globals is a leading data provider of Papua New Guinea Import Export Trade Data. To get to know more about global trade, sign up for Import Globals asap!

FAQs

Que. Who will export the most amount of bauxite in 2025?

Ans. Guinea is in the lead, with a projected yearly export volume of around 199 million metric tons. In the first half of the year, it exported 99.8 million metric tons.

Que. What nations make the most bauxite?

Ans. Australia (100 Mt), Guinea (145 Mt), and China (93 Mt) are the biggest producers. Brazil and India are next, each with about 30–33 Mt.

Que. What makes Guinea such an important part of the bauxite market?

Ans. Guinea has more than a fifth of the world's reserves. Chinese investment, better infrastructure, and a growing demand for aluminum are all helping its exports increase.

Que. Are new countries starting to export bauxite?

Ans. Yes. Sierra Leone and Cameroon are both increasing their exports. By 2025, Sierra Leone is anticipated to export more than 5 million tons, and by 2026, Cameroon hopes to sell between 6 and 10 million tons.

Que. Where can you find precise Papua New Guinea Import Export Global Trade Data?

Ans. For additional information on current statistics, go to www.importglobals.com or send an email to info@importglobals.com.