- Sep 10, 2025

A New Chapter in Transatlantic Trade: U.S.–EU Sign Historic $1.35 Trillion Deal

The recent U.S.-EU trade agreement represents a daring and calculated change in international commercial relations.

Over the following five years, as per Europe Import Data by Import Globals, the agreement is expected to invest more than $1.35 trillion in cross-border economic and energy cooperation. The EU has committed to investing $600 billion in different areas of the U.S. economy, while the U.S. will export $750 billion worth of energy to the EU.

Based on USA Export Data by Import Globals, the agreement raises energy and investment flows to all-time highs, but it has also generated controversy because of an asymmetrical tariff structure: the EU has eliminated levies on U.S. cars and industrial products, while the U.S. has increased tariffs on the majority of EU exports to 15%. This deal has the potential to change the dynamics of international commerce in addition to the U.S.-EU trade corridor.

Crucial Elements of the Agreement

1. $750 Billion in U.S. Energy Exports to Europe

Europe's increasing need for safe and varied energy sources is at the center of the deal. The agreement calls for the U.S. to provide the EU with $750 billion worth of energy goods, with a primary focus on:

- Liquefied Natural Gas (LNG)

- Crude oil

- Refined petroleum

- Renewable energy technologies

Based on USA Import Export Trade Data by Import Globals, geopolitical difficulties have caused Europe's reliance on Russian energy to decline dramatically; therefore, this agreement is strategically crucial for both political alignment and energy security.

2. $600 Billion in EU Investment into the U.S.

This amount of bilateral investment represents the biggest commitment made by the EU to a single non-EU nation. According to Europe Import Custom Data, the EU has pledged to contribute $600 billion to the American economy in exchange, focusing on important areas such as:

- Green infrastructure

- Electric vehicle manufacturing

- Semiconductor production

- Pharmaceutical research hubs

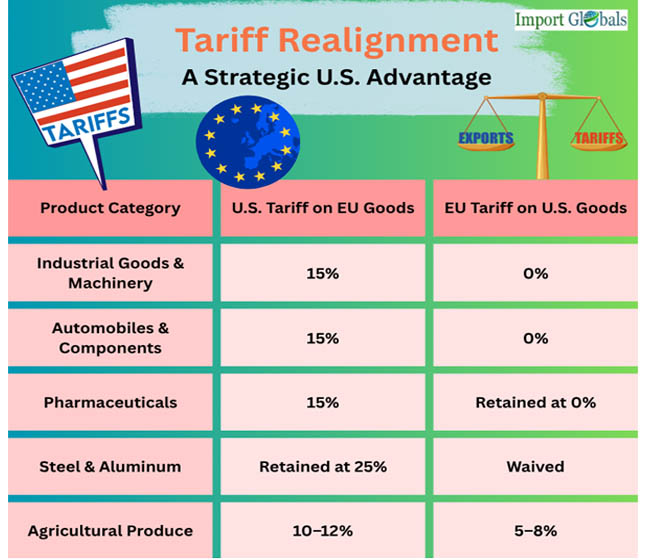

Tariff Realignment: A Strategic U.S. Advantage

As per Europe Import Trade Analysis by Import Globals, EU manufacturers and trade organizations are concerned about this imbalance, claiming that the agreement limits access to European markets and unfairly benefits U.S. goods. Even if the agreement benefits both parties in several ways, the tariff restructuring is receiving a lot of attention. The new tariff structure looks like this:

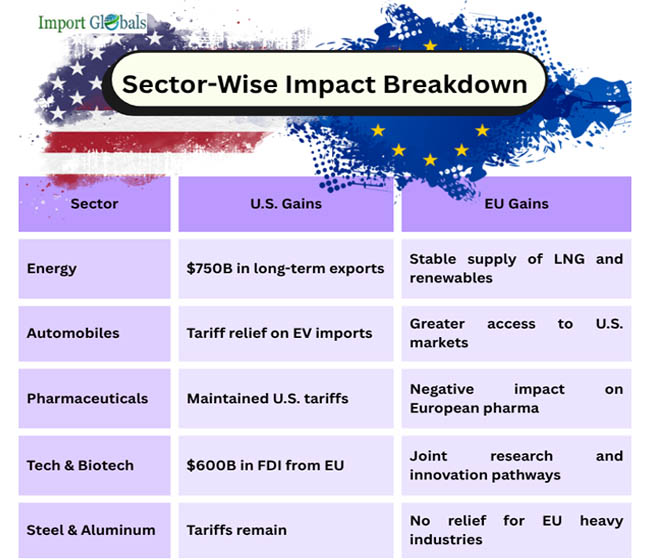

Analysis of Sector-Wise Impact

The Energy Sector

For American energy companies, the $750 billion energy component is revolutionary. In many European markets, it solidifies the United States' position as the continent's main supplier of fossil fuels and LNG, displacing Russia and the Middle East. Based on USA Export Data by Import Globals, over the following two years, U.S. energy exports by volume are also predicted to rise by 15–20% as a result of this.

Automobile Sector

When exporting to the United States, European manufacturers such as BMW, Volkswagen, and Mercedes-Benz are anticipated to enjoy 0% tariffs; nevertheless, they will be subject to a 15% charge on machinery and auto parts headed for the United States. On the other hand, as per USA Importer Data by Import Globals, American manufacturers like Tesla and GM have a major pricing advantage since they have greater access to the European market.

Production and Industrial Products

With the removal of all import taxes from the EU, exporters of equipment, semiconductors, and renewable technologies are now well-positioned to grow quickly in Europe. Meanwhile, the 15% tariff wall in the U.S. puts pressure on EU exporters' profit margins.

AI and Technology

Based on USA Import Trade Statistics by Import Globals, a sizable portion of the EU's $600 billion investment is going into semiconductor production facilities and AI research centers in important U.S. tech areas like Texas and Arizona. This seeks to increase local chip manufacturing, lessen reliance on Asian suppliers, and foster innovation in industries such as robotics, quantum computing, and AI healthcare. Stronger U.S.-EU cooperation in next-generation technology is anticipated as a result of the action.

FMCG and Agriculture

Important European agro-food exports, such as wine, cheese, olive oil, and packaged products, are now subject to higher U.S. taxes of up to 15%. Based on Europe Import Shipment Data, countries like France, Italy, and Spain, whose farmers and producers mostly depend on American customers, may be greatly impacted by this shift. It may cause export volumes to drop or compel European firms to increase their pricing, which would reduce their ability to compete in the market.

Historical Background: The Significance of This Transaction

The U.S.-EU trade relationship has been turbulent throughout the last ten years:

- 2018 saw retaliatory actions in response to steel and aluminum tariffs imposed by the Trump administration.

- Once regarded as a premier free-trade agreement, the Transatlantic Trade and Investment Partnership (TTIP) was abandoned.

- Based on Russia Import Export Trade Analysis, following the conflict between Russia and Ukraine, the EU has been looking for long-term, reliable energy options since 2022.

- With this 2025 agreement, the two biggest economies in the world will once again link their economies strategically and systematically.

International Responses and Criticism

EU Business Executives

Concern over the tariff mismatch has been voiced by several EU industry organizations. According to a joint statement by the German Manufacturing Union and the European Trade Association, "this deal exposes European industries to significant cost disadvantages."

US Tech & Energy Sectors

The IT and oil sectors in the US have praised the agreement. The deal was dubbed "a historic opportunity to serve Europe's energy needs while boosting U.S. jobs" by the American Petroleum Institute.

Analysis of Policy

According to China Export Import Global Trade Data, the agreement, which is intended to lessen China and Russia's influence in Western markets, is seen by international trade observers as a geopolitical alliance masquerading as an economic agreement.

Geopolitical and Strategic Consequences

- Europe's energy independence: A significant victory in the wake of Russia's energy policy reform.

- American supremacy in international trade: Strengthens America's expanding clout in industrial and energy exports.

- Investment reciprocity: Encourages international investment into the United States, particularly in the infrastructure and technology sectors.

- Tariff asymmetry: May lead to future renegotiations or WTO complaints.

Prospects and Prognoses for the Future

- In 2026 alone, U.S. energy exports to Europe are expected to increase by 18–22%.

- With the help of US tax breaks, EU investments are probably going to concentrate on climate-neutral infrastructure.

- If the current trend continues, trade experts estimate that overall bilateral commerce might surpass $2 trillion by 2030.

Conclusion

The tariff imbalance benefits U.S. exporters and might lead to further renegotiations, even if both sides expect to benefit from increased energy cooperation and capital flow. However, in the face of shifting global alignments, the accord represents a significant step toward strengthening transatlantic connections. Import Globals is a leading data provider of Europe import export trade data. Subscribe to Import Globals to get more global trade details!

FAQs

Que. Is the US-EU trade deal finalized?

Ans. Yes, the agreement was formally signed in July 2025, with phased implementation beginning in August 2025.

Que. Who benefits more from the deal?

Ans. The U.S. is considered the larger beneficiary in the short term due to energy sales and EU investment inflows.

Que. What goods are affected by new tariffs?

Ans. The U.S. raised tariffs on EU wines, dairy, textiles, and consumer electronics. EU eliminated tariffs on U.S. autos and industrial tools.

Que. How does this impact global trade?

Ans. It strengthens transatlantic ties and could lead to trade re-routing, affecting Chinese and Russian exports to both regions.

Que. Where can you obtain detailed USA Import Export Global Data?

Ans. Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date data.