- Jan 01, 2026

Automotive Exports and Their Role in Germany’s Trade Surplus

People often say that Germany's economy is based on exports, and one type of product that always stands out is motor cars and parts.

There is a clear leader in Germany's Export Engine

In 2024, motor vehicles and parts made up around 17% of all of Germany's exports, making it the country's biggest export segment. That alone tells you why the automotive industry matters—not only for jobs and innovation, but for the country’s external balance and overall competitiveness.

Germany’s trade surplus is shaped by many sectors (machinery, chemicals, measurement technology), yet autos remain the most visible “headline” contributor because they combine high unit value, global brand strength, and deep supplier networks. As per Germany Export Data by Import Globals, when auto exports accelerate, Germany’s surplus tends to be supported; when they slow (because of weak demand, new competition, or policy barriers), the surplus becomes more dependent on other categories.

The Trade-Surplus Link: What “Autos” do that other Sectors Can’t

A trade surplus exists when a country’s exports exceed its imports. Autos influence this balance in two distinct ways:

High-Value Exports: According to Germany Import Data by Import Globals, Germany’s cars and premium components command higher prices than many competing mass-market products, supporting export revenues even when volumes are under pressure.

Global Demand Reach: German companies sell to both mature markets (such as the EU, US, and UK) and growth markets all over the world. As per Germany Import Data by Import Globals, this diversification can help defend against shocks, but it also makes exports more subject to challenges from tariffs and politics.

Germany also buys vehicles and car parts from other countries. As per Germany Import Custom Data by Import Globals, modern automotive production is a network business: parts and modules flow across borders, and finished vehicles move both in and out. That means the best way to understand “autos and the surplus” is not only export size, but net contribution (exports minus imports).

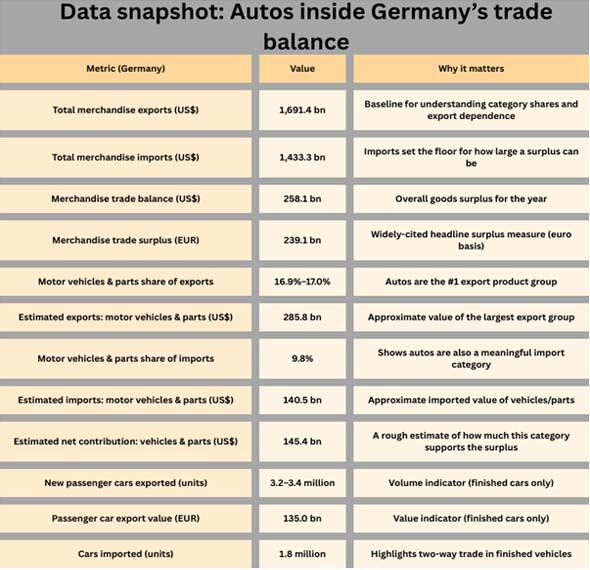

Reading the Numbers: What they Really Imply

A useful Way to Interpret the Table is This: the automotive export engine is so large that its estimated net surplus is a sizable fraction of Germany’s overall goods surplus. In other words, even if other categories perform well, autos often act as the “margin” that keeps the aggregate balance comfortably positive.

Also important: the passenger-car figures (units and € value) represent only finished new cars, while the broader “motor vehicles and parts” category includes components and systems that are essential to German industrial exports. As per Germany Import Trade Analysis by Import Globals, that broader bucket is what ties autos directly into the national trade surplus.

Why Germany’s auto Exports are Structurally Strong

Germany’s export success in vehicles and parts isn’t just branding; it is built on repeatable industrial advantages:

1) Engineering Depth and Premium Positioning - German manufacturers tend to compete in segments where customers pay for performance, safety, durability, and technology. Premium positioning helps protect margins when volumes soften.

2) A Dense Supplier Ecosystem - As per Germany Exporter Data by Import Globals, the value of German automotive exports is amplified by a mature supplier base—powertrains, electronics, sensors, materials, tooling, and specialized machinery—supporting both vehicle exports and high-value parts exports.

3) Platform Scale and Modular Production - Modern vehicle platforms allow firms to standardize architectures while differentiating features. That supports export variety without losing manufacturing efficiency.

4) “Industrial spillovers” - According to Germany Importer Data by Import Globals, automotive manufacturing sustains adjacent export strengths: machine tools, robotics, chemicals, and industrial software. Even when Germany exports a car, it is also exporting the industrial system behind it.

The Balancing Act: Germany exports cars, but also imports a lot of auto value

Germany’s Auto Trade is not a one-way Street. Imports Include: Components and modules sourced from global suppliers, vehicles produced elsewhere for the German market, parts that support cross-border “just-in-time” manufacturing.

According to Germany Import Trade Statistics by Import Globals, this matters because a country can export many cars and still see the surplus pressured if import content rises faster than export value. The encouraging part of the 2024 picture is that autos appear to maintain a strong net positive position—exports significantly above imports within the category—supporting the broader surplus.

The Biggest Risks to the Auto-Surplus Relationship

Even a structurally strong export sector can face shocks that quickly show up in trade data.

1) Demand Cycles in Major Markets - Autos are durable goods; purchases can be delayed when consumer confidence is weak or financing costs are high.

2) Competitive Pressure from New Global Players - As competitors climb the value chain—especially in EVs and software-defined vehicles—Germany’s pricing power can be challenged in some segments.

3) Energy and Input Costs - High production costs can squeeze margins and shift production decisions, affecting export competitiveness over time.

4) Trade Policy and Tariffs - Automotive trade is especially sensitive to tariff changes because vehicles are high-value items with complex supply chains. As per Germany Import Shipment Data by Import Globals, recent reporting has highlighted how tariffs can materially reduce German auto export volumes to key markets, compressing one of Germany’s most important export channels.

EV Transition: As per Germany Export Import Global Trade Data by Import Globals, reshaping export composition, not removing export strength.

The electric transition does not automatically weaken Germany’s export model—but it changes the “export basket.” EVs shift value from mechanical complexity toward:

battery and power electronics, software and electronics, charging ecosystem and grid-related components.

Germany’s competitiveness will depend on how well it captures value in these layers. Production data also show that electric-vehicle manufacturing has reached record levels in certain periods, indicating real industrial momentum—even while demand and policy incentives fluctuate.

Outlook: what to watch for in 2025–2026

Germany’s trade surplus will likely remain positive, but its dependence on industrial exports means the margin can move quickly. For autos specifically, watch four indicators:

Export volumes vs. export values. If values hold while volumes dip, premium pricing power is still supporting the surplus.

Import content of Vehicles and Parts- As per Germany Import Export Trade Analysis by Import Globals, rising import dependence can reduce net contribution even if exports stay large.

Market Concentration Risk- Any sharp disruption in a top destination can ripple through the trade balance.

Policy Risk- Tariffs and regulatory shifts can act like a sudden “tax” on exports, especially to markets that are large buyers of German vehicles.

The big Picture Remains: autos are not merely one sector among many. They are a primary stabilizer of Germany’s external balance—and one of the most sensitive “signal sectors” for how Germany’s export economy is performing. Import Globals is a leading data provider of Germany Import Export Trade Data.

FAQs

Que. Are cars really Germany’s biggest export driver?

Ans. Yes. Germany's biggest export group is motor vehicles and parts, thus cars are a big part of the story.

Que. Does sending a lot of automobiles to other countries inherently indicate you have a bigger trade surplus?

Ans. Not by itself. The surplus is based on net trade, which is the difference between exports and imports. Germany also buys cars and parts from other countries, therefore the most important thing is that the country sells more cars than it buys.

Que. Why do tariffs have such a huge influence on Germany's trade surplus so quickly?

Ans. Cars are expensive, and the amount of cars that are supplied can alter quickly when costs rise or rules change. This is especially true in big markets.

Que. Will Germany's ability to export be damaged by the changeover to electric cars?

Ans. It changes where value is created and what is sent out. Germany can continue strong as long as it obtains value from EV supply chains, high-tech parts, and software-driven auto systems.

Que. Where to get detailed Germany Import Export Global Data?

Ans. Visit www.importglobals.com.