- Dec 31, 2025

Czech Republic Automotive Exports and Supply-Chain Integration in Central Europe

The Czech Republic is one of Europe’s most export-oriented automotive powerhouses. It is not just a country that “makes cars”; it is a country that runs inside a regional production system—a tightly coordinated Central European supply chain anchored to German and broader EU demand.

As per Czech Republic Import Data by Import Globals, Czech vehicle plants assemble finished cars and buses, while thousands of suppliers produce engines, wiring, interiors, seats, electronics, and precision components that move across borders daily. In this model, exports are the outcome, not the strategy: the whole ecosystem is designed to serve foreign markets efficiently through just-in-time delivery, standardized quality systems, and deep integration with neighboring production hubs.

This integration has delivered scale. According to Czech Republic Export Data by Import Globals, the automotive sector is often described as a backbone of the Czech economy, and international institutions have highlighted its unusually large contribution compared to most European peers. The result is a country where the health of industrial output, employment, and trade is closely linked to automotive demand cycles—especially in Germany and the EU.

The Czech Automotive Machine: High Output, High Export Share

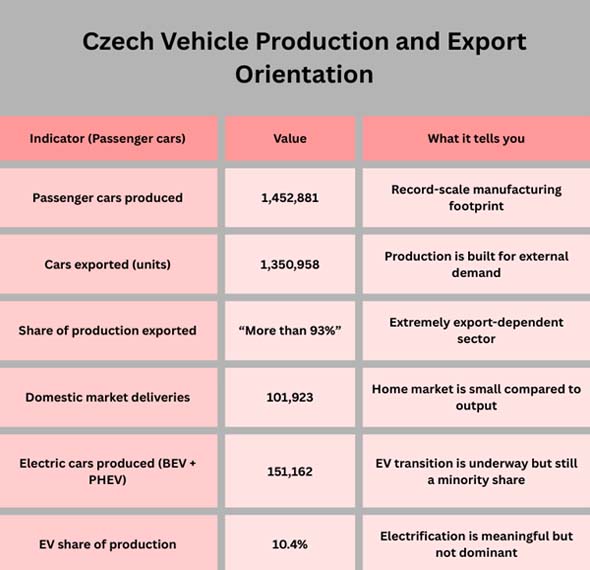

Czech vehicle production reached record levels recently, and the export share remains exceptionally high. As per Czech Republic Import Export Trade Data by Import Globals, most cars assembled in the Czech Republic are destined for foreign customers, which makes the sector a central driver of the country’s trade performance.

Export Value: Cars and Components as the Two Pillars

The Czech Republic’s automotive export strength has two major pillars:

Finished Vehicles (Especially Passenger Cars)

Parts and Accessories (Components Feeding EU Assembly Lines)

Based on Czech Republic Import Custom Data by Import Globals, this is important because “integration” shows up most clearly in parts trade. A single vehicle can cross borders multiple times in the form of components before it becomes a finished product. The Czech Republic is both an exporter of finished cars and a key supplier into neighboring production systems.

Where Czech Cars Go: The “Near-First” Geography of Demand

Czech automotive exports are highly concentrated in Europe, especially in nearby high-income markets. Proximity supports faster delivery, stable supply planning, and strong aftersales networks. As per Czech Republic Import Trade Analysis by Import Globals, even when Czech-made vehicles are sold globally, the first destination is often a European distribution or sales hub.

This pattern reflects the structure of European automotive demand: large, integrated markets; standardized regulations; and production networks optimized for EU trade. It also shows why shocks in European consumption—especially German industrial slowdowns—can quickly transmit to Czech output.

The Central European Supply Chain: How Integration Really Works

When people say “Central Europe is integrated,” the automotive industry is the best proof. Integration is not abstract; it is physical and operational:

Daily Cross-Border Component Flows: As per Czech Republic Exporter Data by Import Globals, parts move from Czech supplier parks to assembly plants in Germany, Slovakia, and Poland (and vice versa).

Platform Sharing Across Brands: standardized vehicle platforms allow suppliers to scale components across multiple models and plants.

Just-in-time/just-in-Sequence Llogistics: factories receive parts timed to the assembly line, minimizing inventory costs and maximizing speed.

Supplier Clustering: According to Czech Republic Importer Data by Import Globals, major suppliers locate within trucking distance of OEM plants to reduce cost and delivery risk.

A simple way to see integration is to look at Germany’s imports of certain automotive parts categories: Central European neighbors are top suppliers—because production is built as a regional system rather than isolated national industries.

Why the Czech Republic Became a Regional Automotive Hub

Several factors explain Czech competitiveness in Central European automotive networks:

1) EU single Market Access and Regulatory Alignment

Harmonized standards reduce friction in shipping components and finished vehicles. As per Czech Republic Import Trade Statistics by Import Globals, this is crucial for high-frequency, time-sensitive supply chains.

2) Dense Supplier Ecosystem and Workforce Capability

Supplier parks, engineering talent, and production know-how create a “learning loop,” where skills and process quality improve over time.

3) Geography and Logistics Economics

As per Czech Republic Import Shipment Data by Import Globals, central location near Germany, Austria, Slovakia, and Poland supports truck-based delivery schedules that are faster and cheaper than long-distance shipping.

4) OEM Presence + Supplier Clustering

Large assemblers attract suppliers; suppliers reduce costs for assemblers; and the cycle reinforces itself.

The Next Phase: Electrification and Supply-Chain Rewiring

The big strategic question is how Central Europe adapts as the automotive industry shifts toward electrification and software-driven value. EVs can change the supplier map:

Some mechanical parts demand decreases (fewer complex engine components).

As per Czech Republic Import Export Trade Analysis by Import Globals, new demand rises for batteries, power electronics, thermal management, and software.

Investment competition increases across the region for battery gigafactories and high-value EV components.

According to Czech Republic Export Import Global Trade Data by Import Globals, Czech production already includes EV output at meaningful scale, but the share shows there is still a long transition ahead. Countries that capture higher-value EV supply (batteries, electronics, and design/IP-heavy modules) will gain resilience; those concentrated in lower-value subcontracting may face margin pressure.

Conclusion

The Czech Republic’s automotive export success is inseparable from Central Europe’s supply-chain integration. Record production and high export shares show the Czech Republic’s role as both a major assembler and a crucial component supplier. The data also reveals a regional truth: Czech industry is intertwined with Germany and neighboring economies through constant cross-border parts flows.

That integration has delivered scale, jobs, and export power. The challenge now is to protect that position through the EV transition—moving up the value chain in electrification, deepening supplier capabilities, and ensuring the region stays competitive as the automotive industry becomes more software- and battery-centered. Import Globals is a leading data provider of Czech Republic Import Export Trade Data.

FAQs

Que. Why is the Czech Republic so export-dependent in autos?

Ans. Because the domestic market is small relative to production, and plants are designed to serve EU and global demand.

Que. What are the biggest Czech automotive export products?

Ans. Passenger cars are the biggest, followed by parts and accessories that are used in regional supply chains.

Que. Why is Germany so important for Czech car exports?

Ans. Germany buys a lot of Czech automobiles and is a big place where Czech parts are transferred to German factories to be put together.

Que. What does "supply-chain integration" mean in real life?

Ans. Daily flow of parts across borders, shared vehicle platforms, synchronized logistics, and groups of suppliers located close to OEM operations.

Que. Where to get detailed Czech Republic Import Export Global Data?

Ans. Visit www.importglobals.com.