- May 29, 2025

An in-depth Analysis of Bangladesh's Exports of Ready-made Garments (Rmg)

Bangladesh's Ready-Made Garments (RMG) industry is a pillar of the country's economy. It employs around 4 million people, the majority of whom are women, and generates more than 80% of total export revenues, according to Import Globals' Analysis on Bangladesh Export Data. Bangladesh has established a solid reputation as a worldwide center for sourcing clothing over the years because of its affordable prices, highly qualified labor force, and increasing adherence to international norms. What started as a nascent sector in the late 1970s has grown into one of South Asia's most potent catalysts for economic expansion.

By examining data patterns from 2020 to 2024, major export destinations, producing regions, price, difficulties, and future estimates, this blog explores the current state of Bangladesh's RMG exports.

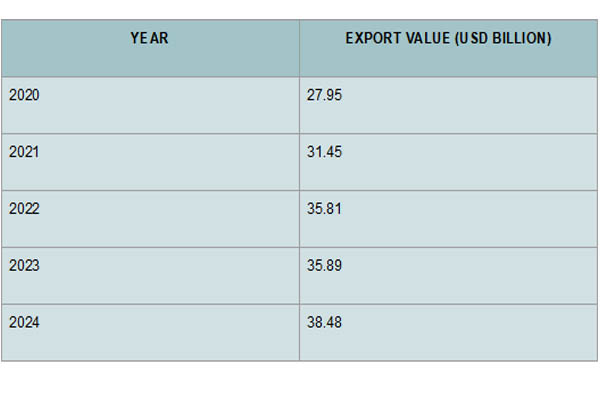

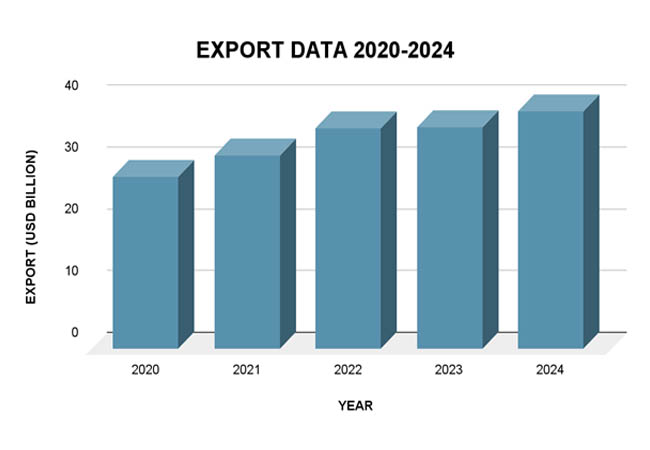

Performance of RMG Exports (2020–2024)

Bangladesh's RMG industry has demonstrated endurance in the face of shifting trade regulations and global economic upheavals. The industry recorded $38.48 billion in exports in 2024, according to Bangladesh Export Data From Import Globals. This indicates a moderate but consistent rise, especially via greater investment in sustainable manufacturing and diversification into new markets.

Notably, following a reconciliation procedure including the Export Promotion Bureau (EPB), Bangladesh Bank, and the National Board of Revenue (NBR), the export amount was changed from an initial estimate of nearly $47 billion to $35.89 billion in 2023.

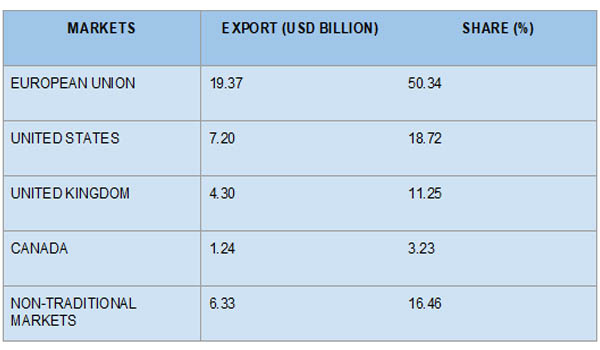

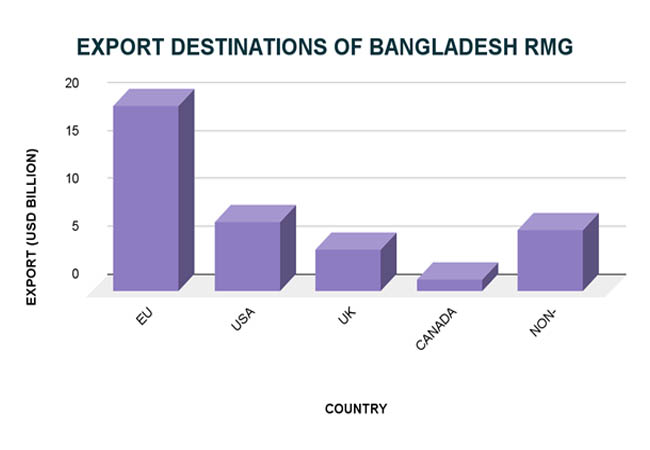

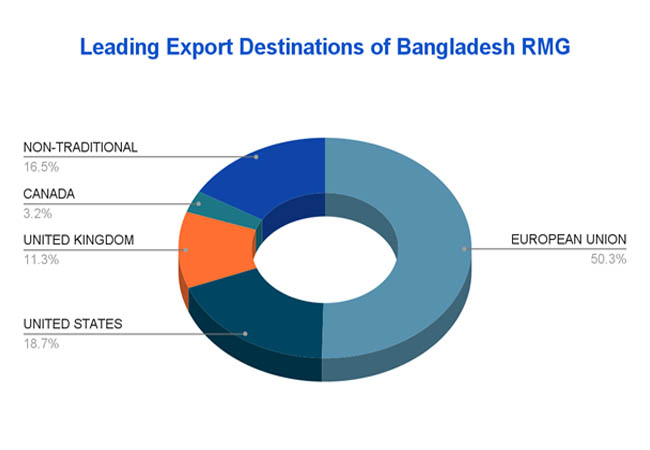

Leading Export Destinations of Bangladesh RMG

Bangladesh is the world's second-largest clothing exporter, behind China, with exports to over 160 nations. The EU continues to be Bangladesh's biggest clothing market, according to the Bangladesh Export Import Global Trade Data. The top importers are France, Spain, and Germany. Despite its volatility as a result of potential tariffs, the United States remains a significant market, contributing up to $7.2 billion in 2024. Bangladesh is better positioned to prosper in new areas due to this diversification, which lessens reliance on Western markets.

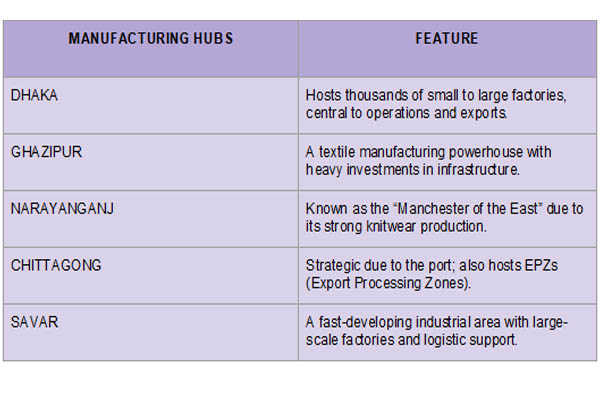

Major Manufacturers of RMG in Bangladesh

RMG production is concentrated in some locations, which serve as centers for the manufacture of textiles and clothing. These regions collectively employ over 4 million people, with women accounting for more than 60% of the workforce, according to research by IMPORT GLOBALS on Bangladesh Import Export Trade Data.

Forecasts and Trends in the RMG Sector

A study by Import Globals on Bangladesh Export Data, by 2026, Bangladesh hopes to leave the UN's Least Developed Country (LDC) list, which presents both possibilities and difficulties for the RMG industry.

Important Growth Factors for Sustainability Focus

Bangladesh is home to more LEED-certified green clothing manufacturing than any other country in the world, drawing in international companies.

Market Diversification: Results are being obtained via market penetration in Asia, the Middle East, and Latin America.

Enhanced Compliance: Particularly since the Rana Plaza tragedy in 2013, there has been an improvement in worker safety, environmental standards, and transparency.

Investments in Value Addition: Manufacturers are now producing technical clothing, luxury goods, and branding and design.

Challenges

Duties: To disrupt price and competition, the United States may levy duties on Bangladeshi imports of up to 37%.

Increasing Production Costs: Exporters' profit margins are being squeezed by rising costs and worldwide inflation.

Supply Chain Volatility: Reliance on imported raw materials from China and India, particularly cotton and synthetic fibers, can be hazardous.

Following the LDC transition, the loss of trade protections such as the Generalized System of Preferences (GSP) may have an effect on prices for Western purchasers, according to Bangladesh Export Import Global Trade Data by Import Globals.

Pricing

Bangladesh is renowned for having the world's most affordable clothing costs. However, pricing tactics are being impacted by shifting global dynamics:

Although there is a demand to raise the minimum wage, low labor costs provide a natural advantage. Utility and energy prices are increasing, particularly in light of the gas scarcity. Cost structures are impacted by buyer demands for greater customisation, smaller batch sizes, and quicker delivery. Bangladesh still provides value, but to maintain its competitive price, it has to make investments in automation and efficiency, according to research conducted By Import Globals on Bangladesh Export Data.

Strategic Consequences and the Future

Bangladesh has to future-proof its RMG industry by:

Transition to High-Value Products: Pay particular attention to performance apparel, technical fabrics, and branded goods.

Increase In-House Raw Material Capacity: To lessen reliance, create backward-linking industries.

Boost Digital Transformation: Adopt data analytics, supply chain digitalization, AI, and ERP.

Invest in the welfare of your employees by offering training, improved living conditions, and open salary structures.

Strengthen International Brand Partnerships: Cut out intermediaries and establish direct connections with international businesses.

Conclusion

Bangladesh's RMG industry is a representation of both national development and international aspirations, in addition to being a source of exports. Over the past several decades, the industry has seen a significant transformation, moving from the production of simple t-shirts to the production of luxury clothing. Bangladesh is well-positioned to fulfill future expectations as global garment demand rises and consumer awareness shifts toward sustainable sourcing, according to research by Import Globals on Bangladesh Export Import Global Trade Data.

However, the nation must shift to innovation, sustainability, and high-end value addition if it is to keep its competitive edge in a post-LDC, high-tariff world. Bangladesh may reinvent itself and regain its position as a worldwide leader in the garment industry in the upcoming ten years.

If you are looking for detailed and up-to-date Bangladesh Export Data, You Can Contact Import Globals.

FAQs

Que. What makes Bangladesh's RMG industry significant?

Ans. It employs 4 million people and accounts for more than 80% of the nation's export revenue, greatly advancing socioeconomic growth.

Que. Which are Bangladesh's main export destinations for clothing?

Ans. While Japan, Australia, and India are important non-traditional markets, the EU, USA, and UK remain the top conventional markets.

Que. What kinds of clothing is Bangladesh exporting?

Ans. Bangladesh exports technical textiles, sportswear, lingerie, denim, jackets, suits, knitwear, and woven clothing.

Que. What are the obstacles facing the RMG sector in Bangladesh?

Ans. Significant obstacles include raw material dependence, post-LDC trade adjustments, increased manufacturing costs, and tariff concerns, particularly from the US.

Que. Does Bangladesh make investments in the creation of sustainable clothing?

Ans. Indeed. Bangladesh is adopting environmentally friendly industrial methods and has the most LEED-certified green factories worldwide.

Que. Where to obtain detailed Bangladesh Export Data?

Ans. Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date Bangladesh Export Data.