- Sep 30, 2025

Armenia’s Trade Landscape: Top 5 Import and Export Products Driving the Economy

Minerals, precious stones, food and drink, and high-value manufactured items are the main exports, whereas energy, automobiles, electronics, and a few luxury inputs for processing and re-exporting are the main imports.

Based on Armenia Export Import Global Trade Data, anyone creating projections, supply-chain plans, or market strategies around Armenia must have a thorough understanding of the top five for each side and the magnitude of these flows. Clean data tables (values and product codes) that are prepared to be dropped into a spreadsheet for charting are included below, together with a narrative summary of the factors that led to the statistics.

Armenia at a Glance

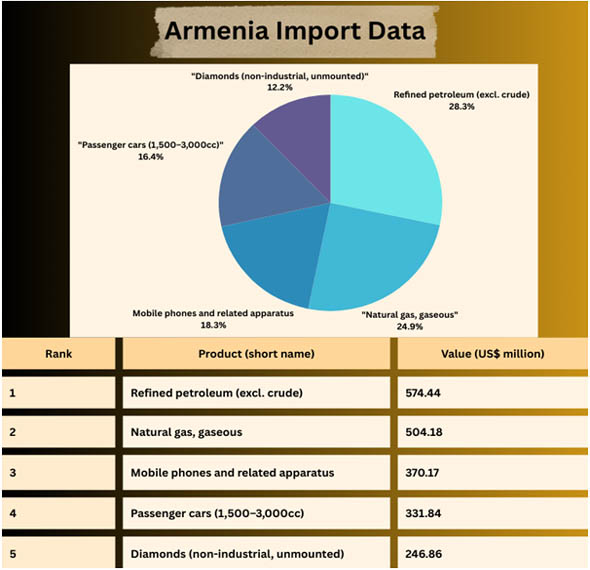

Armenia imports energy, is landlocked, and is heavily susceptible to commerce. This implies that due to limited local refining capability and fundamental energy supplies, natural gas and refined petroleum are nearly always among its top import lines. However, based on Armenia Import Data by Import Globals, the nation has gained a competitive edge in some export markets, including tobacco and branded drinks, precious metals and stones, copper ore from well-established mines, and, more recently, telecom equipment and electronics that frequently represent value-added distribution and transshipment. The end product is a portfolio that includes "traditional" mining and food and drink items with more contemporary, high-tech goods and reexports that are transported via Armenia's transportation networks.

Macroeconomically speaking, based on Armenia Export Data by Import Globals, even if growth rates slowed following the 2024 peak, Armenia's merchandise imports and exports have increased over the previous few years in tandem with a boom in trade turnover. The composition of that larger increase has remained mostly stable: exports are anchored by copper, diamonds/gold, branded consumer products, and telecom equipment, while imports are dominated by energy and automobiles. The top five lists below are helpful for planning because of this consistency, even when absolute values move in tandem with currency rates and commodity prices.

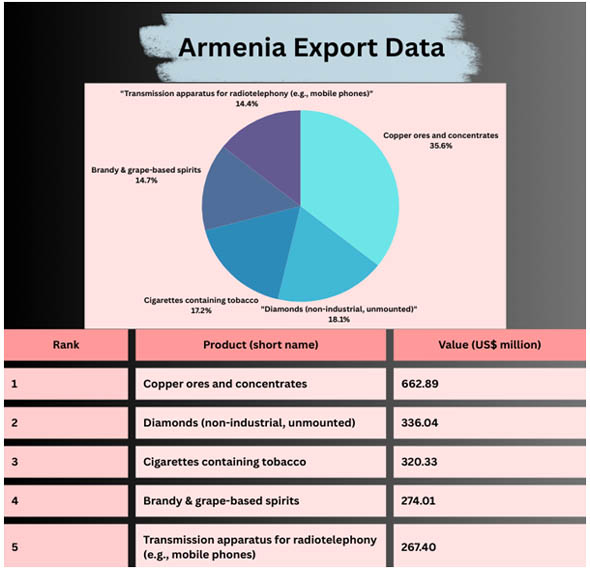

The Top 5 Export Items

Armenia's export portfolio includes branded consumer goods, raw resources, and a rapidly expanding electronics sector. Due to external demand and consistent mine output, copper ore continues to be a cornerstone earner. Gold and diamonds are significant both as re-exports and as locally processed products. As per Armenia Import Export Trade Data by Import Globals, the nation's longstanding expertise in food and drink production is demonstrated by tobacco products and Armenian brandies, which are grape-based drinks, while telecom equipment, particularly mobile phones and associated devices, has emerged as a significant and active export market.

The Factors Influencing the Top Five Exports

The ranking of copper ore at number one is a result of both Armenia's capacity to transport steady quantities and the steady demand from smelters and refiners abroad. As per Armenia Import Custom Data by Import Globals, Armenia's position in cutting, polishing, trading, and re-exporting gold and diamonds, which are subject to rapid fluctuations in world pricing and policy regimes, is what gives it its ranking. Strong brands and local distribution networks are features of alcohol and cigarettes, two industries that often withstand turbulence in the macro environment. The increase in telecom equipment demonstrates Armenia's link to regional electronics supply chains, which may involve import-for-reexport transactions, including value-added logistics or configuration procedures.

Top 5 Imported Goods

Energy is the main import, and it is a fundamental aspect of Armenia's economy. Transportation, electricity, and heating are supported by pipeline natural gas and refined petroleum (diesel, gasoline, and other distillates). The country's role as a redistribution hub for completed goods and strong consumer demand is reflected in the following lanes, which are passenger automobiles and cell phones. As a crucial component of Armenia's stone trade and processing before being sent elsewhere, based on Armenia Import Trade Analysis by Import Globals, diamonds on the import side fit in well with the export scenario above.

The Factors Influencing the Top Five Imports

Energy is Fundamental: Armenia depends on imported natural gas for power production and heating, as well as imported refined goods for industry and road transportation. According to a report by Import Globals on Armenia Export Data, both domestic consumption and Armenia's place in regional commerce lanes, where many units are imported, sold domestically, and others are transshipped onward, are reflected in the high number of phones and passenger automobiles. A famous example of import-for-processing-and-re-export activity that contributes to gross commerce even when net value added is minimal is diamonds, which show on both sides of the ledger.

Analyzing the Data: risk, focus, and resilience

Approximately 34–36% of all merchandise exports are made up of the top five export lines as per Armenia Import Trade Statistics by Import Globals. This concentration is significant because a rise in copper prices boosts Armenia's export earnings, while a decline in the markets for gold and diamonds may cause export totals to decline even if volumes remain stable. As per Armenia Import Data, a similar trend can be seen in imports: almost 12% of the import bill is covered by the first two energy lines alone, leaving Armenia vulnerable to changes in pipeline and logistics costs as well as fluctuations in the price of gas and oil globally.

Three lessons are suggested by this profile for corporate planners. First, currency management and price hedging are important because commodity fluctuations are more pronounced in a relatively concentrated basket. The second competitive advantage is logistical agility based on Armenia Import Shipment Data: Armenia's dominance in phones, automobiles, and stones rests on reliable, effective cross-border transportation. Third, local mining and luxury goods margins may be further captured through industrial policy and value-added processing investment, transforming today's trade activity into tomorrow's manufacturing base.

Conclusion

Several changes might rearrange the pack. By increasing value added and decreasing dependency on ore shipments, refined copper products may rise into the top five exports if local downstream copper capacity (such as concentrate-to-cathode processes) grows. Changes to consumer financing, pollution regulations, or vehicle taxes may have an impact on the average value and makeup of automobile imports. Refined fuel and gas shares would progressively decline with any energy diversification, such as increased renewables, increased efficiency, or updated gas supply contracts. Lastly, changes in regulations about diamonds and precious metals, such as those governing provenance and the possibility of sanctions, have the potential to rapidly alter trading partners and volumes in those sectors.

Import Globals is a leading data provider of Armenia import export trade data. Subscribe to Import Globals to get more global trade details!

FAQs

Que: What is Armenia’s single biggest merchandise import?

Ans: Refined petroleum products lead the list, reflecting the economy’s structural dependence on imported fuels.

Que: Which export is most reliable year-to-year?

Ans: Copper ore has been consistently among the top earners, with volumes less volatile than precious stones, though prices still matter.

Que: Why do diamonds appear on both imports and exports?

Ans: Armenia imports rough or unmounted stones for processing and trade, then re-exports them; this inflates both sides of the ledger.

Que: How can firms hedge the biggest risks in this trade mix?

Ans: Combine commodity price hedging for energy and metals with diversified sourcing and logistics options, especially for high-value re-export categories.

Que: Where can you obtain a detailed Armenia Import Export Trade Analysis?

Ans: Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date data.