- Sep 08, 2025

Bangladesh–U.S. Wheat Deal: A Strategic Response to Tariff Pressures

According to Bangladesh Import Export Trade Data by Import Globals, Bangladesh intends to do this to bolster its argument for preferential treatment concerning tariffs that directly jeopardize the nation's hard-won economic stability and millions of local jobs.

As per Bangladesh Import Data by Import Globals, the landmark deal, inked on July 20, 2025, commits Bangladesh to purchase 700,000 tonnes of U.S. wheat annually over the next five years. This long-term Memorandum of Understanding (MoU) is more than just a grain import contract; it represents a carefully calibrated step to cushion the country’s vital export sector against looming U.S. tariffs. The new wheat contract is part of a larger balancing act for Bangladesh, which mostly relies on its ready-made garments (RMG) sector to maintain its export-led development. Dhaka has decided to increase its imports to broaden its trade portfolio, strengthen bilateral ties, and show Washington that it is amicable as the US prepares to levy a high 35% tax on Bangladeshi commodities, especially clothing.

Bangladesh–U.S. Wheat Deal

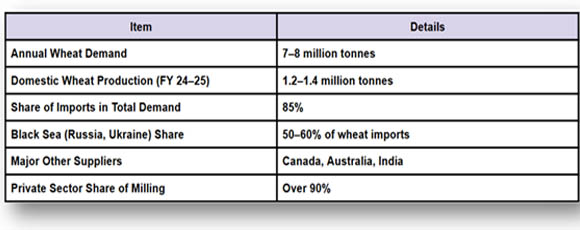

Recognizing Bangladesh's Dependency on Imports

South Asia's Bangladesh, a lower-middle-income nation, is one of the biggest importers of wheat worldwide. Every year, it uses around 7–8 million tons of wheat, the majority of which is imported from Canada, Russia, and Ukraine. Bangladesh has frequently experienced wheat supply shocks as a result of shifting global supply chains, logistical difficulties, and fluctuating weather patterns, particularly following the disruption of Black Sea shipments due to the Russia-Ukraine conflict.

In FY 2023–2024, Bangladesh imported almost 5.5 million tonnes of wheat, according to the Bangladesh export data by Import Globals. Historically, Russia and Ukraine together accounted for more than half of this wheat. However, the government is searching for reliable and secure alternative sources as a result of the escalating geopolitical tensions and the instability of shipping routes through the Black Sea. Bangladesh's sizable flour milling industry may leverage U.S. wheat's greater gluten content, superior blending capabilities, and consistent quality to enhance bread and pastry goods.

As per USA Import Custom Data by Import Globals, to strategically diversify its import basket and lessen its reliance on any one area, Bangladesh has committed to sourcing 700,000 tons per year from the United States, or around 12–14% of its annual need. At a time when grain prices throughout the world are still volatile, this also fits with the nation's goals for food security.

Bangladesh Wheat Market Snapshot

The Looming Risk of US Tariffs

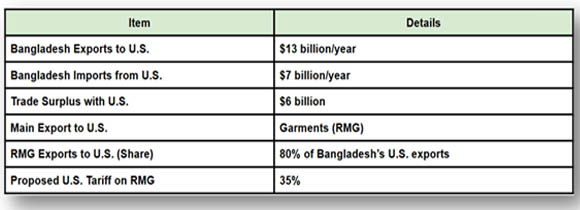

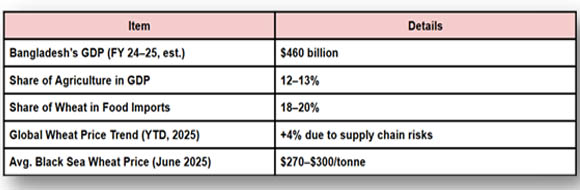

Bangladesh's food security is strengthened by the wheat import agreement, but its true driving force is the need to control a growing tariff issue. As per USA Import Trade Analysis by Import Globals, the US administration declared earlier this year that it will levy a reciprocal duty of 35% on several nations, including Bangladesh. More than 80% of Bangladesh's exports come from the flagship RMG sector, which is directly impacted by this policy change, which is presented as part of a larger rebalancing of U.S. trade relations.

Bangladesh–U.S. Trade Balance

With shipments totaling more than $10 billion annually, the United States is the biggest single-country market for Bangladeshi clothing, according to Import Globals. Bangladesh's competitive pricing advantage would be severely impacted by a 35% levy, which would cause orders to shift to competitors like Vietnam, Cambodia, and Mexico. A tariff shock might have serious social and economic repercussions because the garment industry employs over 4 million people, the majority of whom are women.

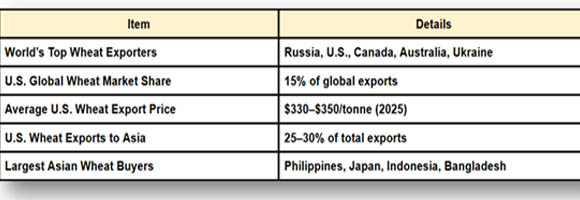

Wheat Trade Global Comparison

Policymakers in Dhaka understand that diplomatic lobbying alone won't be enough to persuade the United States to reverse or reduce these tariffs. Therefore, as per Bangladesh Export Data by Import Globals, the government is attempting to restore goodwill and balance the bilateral trade imbalance by increasing its imports from the United States, beginning with wheat. Bangladesh now has a significant trade surplus with the United States, importing only over $7 billion in products yearly and exporting over $13 billion. That imbalance is lessened by the wheat deal.

How the Agreement Operates

Bangladesh will get a guaranteed supply of premium wheat at competitive rates that have been pre-negotiated under the Memorandum of Understanding inked with the U.S. Department of Agriculture and U.S. Wheat Associates. Based on USA Import Data by Import Globals, this action may promote greater U.S. agricultural exports to South Asia, where the demand for processed foods and baked goods is being driven by the region's changing dietary preferences, urbanization, and population growth.

The vast private milling sector in Bangladesh, which consists of more than 250 mills that produce flour, semolina, and other bakery-grade goods, will be the main user of the wheat. The nation's food minister called the agreement a "win-win" that strengthens connections with a significant trading partner while guaranteeing consistent supply for customers. Reliable U.S. wheat exports, he stressed, will help stabilize domestic prices, which have been volatile because of shipping delays and the unpredictability of Black Sea wheat supply.

The wheat accord is a component of a broader strategy to diversify imports from a trade diplomacy perspective. Other agreements might follow, according to Bangladesh Import Trade Statistics by Import Globals, and could include U.S. pulses, soybeans, and even civil aviation equipment like Boeing planes. The goal of each of these actions is to reduce the trade surplus and give Dhaka more negotiating leverage in the upcoming tariff talks.

Political and Economic Indications

Beyond trade figures, Bangladesh's choice to sign the wheat MOU conveys significant messages. In the first place, it demonstrates how developing economies are prepared to adjust their purchasing tactics to gain negotiating advantage. Second, it highlights the growing interdependence of trade policy and global food security in a time of supply chain disruptions and tariff uncertainty.

Economic Signals & Related Metrics

As per USA Import Shipment Data by Import Globals, this agreement gives the US the chance to increase agricultural exports to Asia, which is a key goal of its foreign trade policy. Additionally, it enables Washington to keep its clout in an area where rivals like China and Russia have aggressively pushed in through investments in infrastructure and energy.

The wheat agreement, according to observers, may provide impetus for positive talks between Washington and Dhaka before the tariff implementation date of August 1. Trade officials have voiced hope that Bangladesh's generosity may pave the way for exclusions or reduced duty rates, even though there is currently no formal confirmation on whether the levy would be postponed.

Industry Responses and Upcoming Projects

In Bangladesh, business executives and analysts have greeted the wheat agreement with cautious optimism. Based on Bangladesh Import Export Trade Analysis by Import Globals, Bakeries and producers of processed foods will benefit from a more consistent supply of high-protein wheat, according to flour millers. Meanwhile, the apparel sector is keeping a careful eye on the deal's result in the hopes that it would help Washington soften its position on the proposed tariffs.

Additionally, authorities are getting ready for a fresh round of negotiations later this month in Washington, when they want to argue for tariff deferrals or waivers. To diversify export markets and reduce reliance on any one trading partner, Dhaka is concurrently investigating increased regional cooperation with China and India.

According to USA Export Import Global Trade Data by Import Globals, more than merely a contract for agricultural supplies, the U.S.-Bangladesh wheat import agreement is a calculated diplomatic ploy designed to protect Bangladesh's crucial apparel sector and preserve economic stability. Bangladesh is playing the long game in a volatile world trade arena by rebalancing its trade profile, bolstering its food security, and indicating a commitment to deeper connections with Washington.

The wheat deal might still be the diplomatic straw that gives Bangladesh the time and leverage it needs to preserve millions of jobs and maintain its export-driven growth story as the August 1 deadline for new U.S. tariffs draws near. Whether this calculated gamble pays off in the negotiating room and at the plant gates will be revealed in the upcoming weeks.

Conclusion

More than merely a contract for agricultural supplies, the U.S.-Bangladesh wheat import agreement is a calculated diplomatic ploy designed to protect Bangladesh's crucial apparel sector and preserve economic stability. Bangladesh is playing the long game in a volatile world trade arena by rebalancing its trade profile, bolstering its food security, and indicating a commitment to deeper connections with Washington. As per Bangladesh Import Export Global Data, the wheat deal might still be the diplomatic straw that gives Bangladesh the time and leverage it needs to preserve millions of jobs and maintain its export-driven growth story as the August 1 deadline for new U.S. tariffs draws near. Whether this calculated gamble pays off in the negotiating room and at the plant gates will be revealed in the upcoming weeks. Import Globals is a leading data provider of Vietnam import export trade data. Subscribe to Import Globals to get more details on global trade!

FAQs

Que. Why did Bangladesh sign a wheat deal with the U.S.?

Ans. Bangladesh signed the deal to diversify its wheat sources, ensure steady supplies, and offset potential losses from new U.S. tariffs on its garment exports.

Que. How much wheat will Bangladesh import under this deal?

Ans. Bangladesh will import 700,000 tonnes of U.S. wheat every year for five years.

Que. When will the new U.S. tariffs take effect?

Ans. The 35% tariff on Bangladeshi goods is scheduled to take effect on August 1, 2025.

Que. Who will use the imported U.S. wheat?

Ans. Mainly private flour mills and bakeries in Bangladesh, which will blend it with other wheat to improve product quality.

Que. Where can you obtain detailed USA Export Data?

Ans. Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date data.