- Jun 28, 2025

Bolivia's Top Export Product: Unwrought Gold

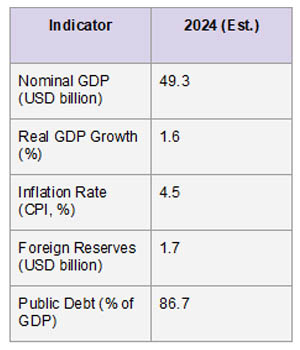

Economic instability has resulted from the nation's dependence on commodity exports, which has left it open to outside shocks. The export of minerals, especially gold, zinc, and silver, as well as natural gas, is the main source of Bolivia's resource-driven economy. It has experienced fundamental difficulties over the last ten years, such as diminishing gas production, diminished foreign reserves, and widening fiscal deficits. Despite sluggish GDP growth and low inflation when compared to regional peers, the country is struggling with growing debt levels and little diversification, according to a report by Import Globals on Bolivia Export Data.

Government subsidies continue to put pressure on public finances, and informal work is still very common. Bolivia's economic stability in the future depends on diversification into sustainable businesses, more extensive economic reforms, and improved management of its extractive industries.

The main export from Bolivia is Unwrought Gold

Unwrought gold has surpassed conventional exports like natural gas to become Bolivia's top export commodity, according to Bolivia Export Data From Import Globals.

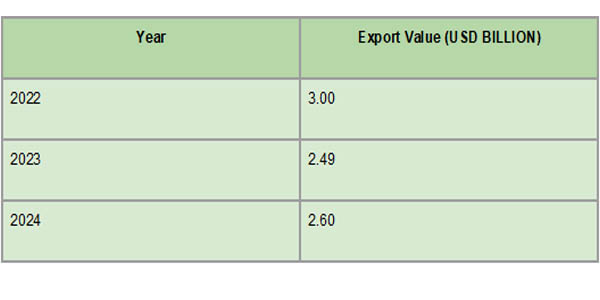

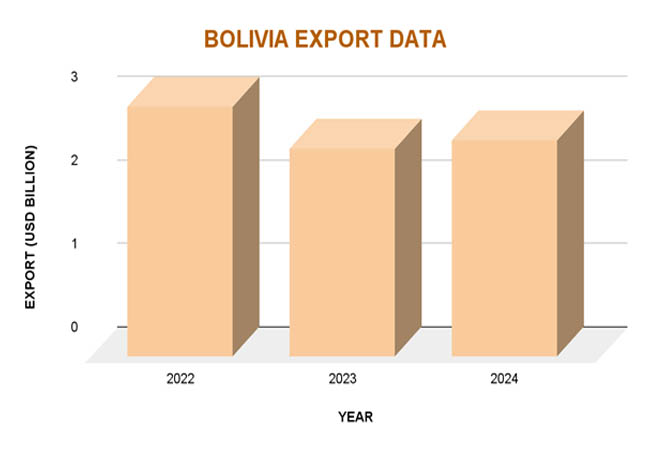

Bolivia's primary export is unwrought gold (HS code 710812), which has recently overtaken more conventional commodities like natural gas. Unwrought gold, which is mostly recovered through both industrial and artisanal small-scale mining (ASGM), is defined as non-monetary gold in its raw or semi-processed state. In the departments of La Paz, Pando, and Beni, where mining operations sustain thousands of livelihoods, particularly in rural and indigenous populations, it is primarily produced. According to Import Globals' Bolivia Import Data, Bolivia exported about $2.49 billion worth of gold, which made up almost 25% of its total export revenue. The metal's importance in Bolivia's export economy is still fueled by its widespread demand, particularly as a safe-haven asset during uncertain economic times.

Nonetheless, there are advantages and disadvantages to the gold industry. Although it creates jobs and vital foreign exchange, it also raises issues with labor exploitation, mercury pollution, and environmental degradation, particularly in the unorganized ASGM sector. Bolivia's economy is also susceptible to changes in the price of gold due to its reliance on it. India, the United Arab Emirates, and Switzerland are the top export destinations, according to Bolivia Import Trade Statistics, indicating robust global demand. Bolivia must formalize artisanal mining, strengthen regulatory frameworks, and reinvest export earnings in sustainable development, infrastructure, and education to secure long-term advantages from its gold resources.

Analysis of the Product

- HS Code: 710812 (non-monetary, unwrought gold).

- Composition: Mostly raw or semi-processed non-monetary gold.

- Extraction Regions: The La Paz and Pando departments are the most notable extraction regions, according to Import Globals' Bolivia Import Data.

- Production Methods: Consists of both artisanal small-scale mining (ASGM) and industrial mining.

Relevance

- Contribution to the Economy: Makes up over 23.9% of Bolivia's overall export earnings. Generating revenue is a vital source of foreign exchange, particularly in light of the drop in gas revenues.

- Employment: Helps sustain thousands of jobs, especially in mining and rural areas.

Bolivia's top export is unwrought gold, which is classified under HS code 710812 and is primarily non-monetary. It is extracted through a combination of industrial mining operations and artisanal small-scale mining (ASGM), with the latter accounting for a significant portion of total output. According to Bolivia Import Shipment Data by Import Globals, artisanal operations are widespread in regions like La Paz and Pando and involve tens of thousands of miners. The unwrought gold is usually exported in raw form to international markets where it is refined further and used in industries like jewelry, electronics, and financial investment.

Gold is a strategically important export for Bolivia due to the great demand for it around the world, particularly in uncertain economic times. However, there are significant obstacles because a large portion of Bolivia's gold mining industry is unofficial. Problems, including illicit mining, mercury pollution, and deforestation, have been brought on by a lack of traceability, regulatory monitoring, and environmental safeguards. Furthermore, Bolivia loses out on increased export earnings that come with refining and manufacturing since it exports unwrought gold items rather than value-added ones, according to a report by Import Globals on Bolivia Import Export Trade Analysis. By strengthening the gold value chain through local processing, better regulation, and formalization, Bolivia's gold sector may become far more environmentally and economically sustainable.

Leading Export Destinations of Bolivian Gold

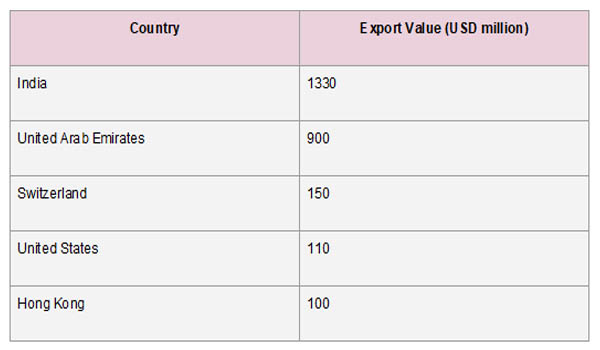

India regularly imports the greatest proportion of Bolivia's unwrought gold, making it the top export market for the country's gold. India bought almost $1.33 billion worth of gold from Bolivia, according to Bolivia Export Import Global Trade Data by Import Globals. This shows that India has a high demand for raw gold to sustain its sizable jewelry and investment industries. Due to its status as a significant hub for international gold trading, the United Arab Emirates imports over $900 million worth of gold, following closely behind. Along with the US and Hong Kong, Switzerland, a major player in the world's gold refining industry, continues to be a major destination for Bolivian gold. To satisfy the demands of the global consumer and industrial sectors, these nations mostly import Bolivian unwrought gold for refining and redistribution.

Bolivia's substantial integration into the global gold supply chain is highlighted by the dominance of these export markets, but it also emphasizes Bolivia's reliance on a small number of major clients. These countries refine and export gold to other areas, serving as both final consumers and middlemen. Despite the economic benefits of this trading relationship, Bolivia is exposed to the risk of price volatility, changes in trade regulations, and geopolitical conflicts in these nations. Bolivia might investigate expanding its gold export markets and negotiating better trade agreements to achieve long-term benefits and stability to improve trade resilience, according to Bolivia Import Export Global Data.

Global Exporters of Unwrought Gold

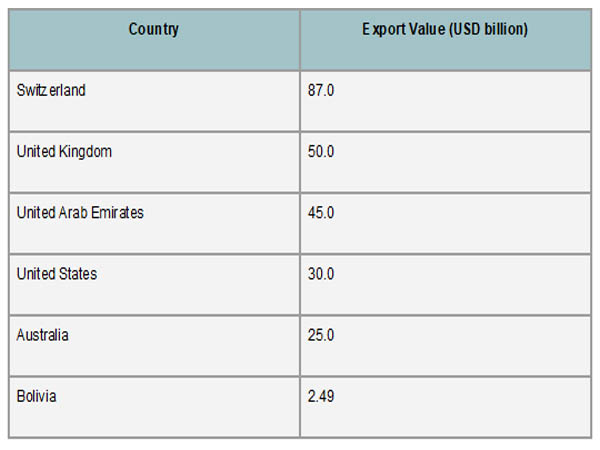

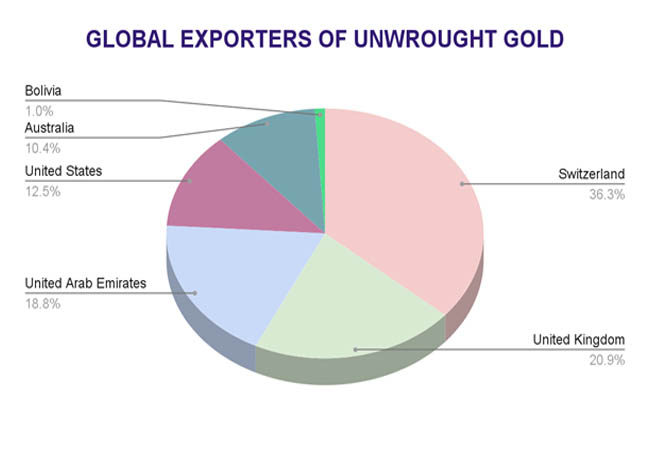

A small number of powerful companies control the majority of foreign exports and dominate the unwrought gold market worldwide. With exports of about $87 billion, Switzerland is the world's biggest exporter of unwrought gold. This is mostly because of its top-notch refining capabilities and its function as a major hub for the world's gold trade. Following closely behind with export values of almost $50 billion and $45 billion, respectively, are the United Kingdom and the United Arab Emirates, according to Import Globals' Bolivia Import Data. Large amounts of gold are imported, purified, and then re-exported from these nations, which serve as important transit hubs. With the help of their well-established gold industries and robust mining sectors, the United States and Australia also play important roles.

Bolivia is not one of the top five exporters in the world, but its increasing contribution, estimated at $2.49 billion in 2023, makes it a significant player, particularly in the Latin American market. Bolivia's position in the refined gold market is limited since, in contrast to larger economies, the majority of its gold is exported in raw form without undergoing considerable domestic value addition. According to Import Globals' Bolivia Export Data, this disparity points to a structural weakness that Bolivia may close by making investments in regional refining facilities and enforcing more stringent regulations on its artisanal mining industry. By implementing cutting-edge procedures in regulation, traceability, and international trade involvement, Bolivia can learn from world leaders and boost the sustainability and value of its gold exports.

Strategic Consequences

- Economic Diversification: Bolivia's over-reliance on gold exports leaves it vulnerable to fluctuations in world prices.

- Regulatory Oversight: To address labor and environmental concerns, ASGM's popularity calls for better regulation.

- Revenue Management: According to Import Globals' Bolivia Import Export Trade Data, stabilizing the economy and funding sustainable development depend heavily on the efficient management of gold income.

Bolivia's significant reliance on exports of unwrought gold has many strategic ramifications for the country's economy and ecology. This reliance exposes the nation to unstable international gold prices and market swings, even while gold offers crucial foreign exchange and fiscal relief in the face of diminishing gas earnings. Furthermore, the prevalence of artisanal and informal mining presents concerns associated with uncontrolled mercury use, poor labor safeguards, and environmental deterioration, according to Import Globals' Bolivia Import Export Trade Data. Strategically, without formalization, oversight, and domestic value addition, Bolivia may struggle to maximize long-term benefits from its gold resources. To reduce these risks and guarantee sustained economic growth, it is imperative to diversify exports, fortify regulatory frameworks, and increase local refining capacity.

Projected Trend and Cost

- Global Demand: Because gold is a safe-haven asset, demand is expected to stay high.

- Price Forecasts: According to Import Globals Analysts on Bolivia Import Custom Data, the average price of gold in 2025 is expected to be between $1,900 and $2,000 per ounce.

- Bolivia's Prospects: Depending on international pricing and domestic production efficiency, Bolivia's gold export earnings may remain steady or slightly rise if production levels are maintained.

Despite global gold prices hitting near-record highs, Bolivia's gold export industry saw a sharp decline in 2024, with export values falling by almost 72% to about $687 million. The government's increasing domestic gold purchases and a drop in foreign demand are two of the reasons for this steep decline. Bolivia's state-owned trading company, Epcoro, has responded by announcing plans to buy up to 10 tonnes of gold in 2025, valued at over $1 billion, to strengthen the Central Bank's reserves, according to Bolivia Import Export Trade Analysis.

In conclusion

Bolivia's transition to gold as its main export represents a problem as well as an opportunity. Although it generates necessary income, the nation must mitigate the risks involved through diversification, regulatory changes, and sustainable practices to guarantee long-term economic stability, according to Bolivia Import Trade Analysis. Bolivia's economy faces both opportunities and challenges, as seen by its reliance on unwrought gold as its major export product. Gold is still a vital source of employment and foreign cash, but its potential for larger economic returns is constrained by the nation's reliance on raw exports as well as the legal and environmental issues associated with artisanal mining. To ensure sustainable growth going forward, Bolivia will need to be able to manage price volatility, diversify its export portfolio, and fortify regulatory structures. Bolivia can put itself in a position to gain more from its priceless gold resources by concentrating on formalizing its gold industry and enhancing value through processing and refining.

If you are looking for detailed and up-to-date Bolivia Export Data, You Can Contact Import Globals.

FAQs

Que. What is the main export from Bolivia?

Ans. The most important export from Bolivia is unwrought gold (HS code 710812).

Que. Which nations import the most gold from Bolivia?

Ans. Hong Kong, the United States, Switzerland, India, and the United Arab Emirates.

Que. What is the current state of the Bolivian economy?

Ans. Among the difficulties facing the economy have been falling natural gas production, dwindling foreign reserves, and rising inflation.

Que. What dangers come with depending too much on gold exports?

Ans. Bolivia's reliance on gold exposes it to changes in world prices as well as possible legal and environmental problems.

Que. Where to obtain detailed Bolivia Export Data?

Ans. Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date Bolivia Export Data.