- Sep 11, 2025

Brazil’s Auto Export Boom in 2025: How Argentina Became the Engine of Growth

In a matter of months, companies are working overtime, export projections have been drastically raised, and Argentina has become the primary market driving this increase.

Based on South America Import Data by Import Globals, Brazil's automobile sector is anticipated to experience a slight increase in exports in 2025 due to consistent demand throughout South America. Instead, what transpired surprised industry observers.

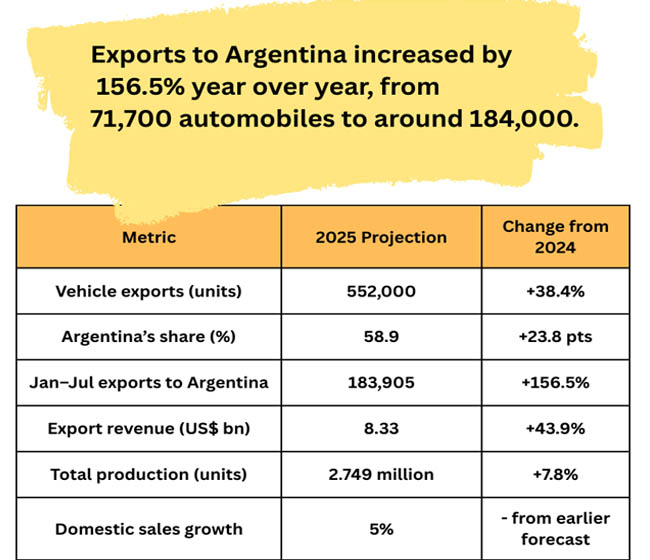

Nearly 59% of the cars, or more than half, are headed to Argentina. In fact, from January to July alone, Brazil moved approximately 184,000 automobiles across the border, more than quadruple the level observed in the same period of 2024.

An Unexpected Change in the Trade Winds

Argentina has always been a significant but not dominant player in the several Latin American markets to which Brazil sells automobiles. In 2024, as per Argentina Import Export Trade Data trends by Import Globals, a little more than one-third of Brazil's automobile exports came from Argentina. Its stake has increased by nearly 24 percentage points this year.

This change is explained by several causes. Following years of turbulence, Argentina's economy is now in a cautious rebuilding phase. Argentina Import Data by Import Globals suggested that the consumer demand has recovered more quickly than local manufacturing, particularly for small and mid-sized automobiles, and domestic manufacturers continue to experience supply chain problems. Because there are fewer restrictions on the movement of automobiles and components between Argentina and Brazil under the Mercosur trade bloc, Brazilian companies may quickly fill the void. Brazilian exports have also benefited from the currency exchange rate. Brazilian-made automobiles are more reasonably priced than certain foreign options, especially those from outside South America, because the Argentine peso is still under pressure.

Because of Mercosur trade agreements, similar logistical channels, and product compatibility, Argentina has long been Brazil's leading export destination for automobiles. However, this year's surge is very large.

Important motivators:

- Consumer expenditure in Argentina has recovered since the austerity, particularly for durable items.

- Argentine consumers can now afford Brazilian products thanks to currency fluctuations.

- Alignment of vehicle preferences: The same little and medium-sized automobiles that rule Brazil's manufacturing lines are preferred by the Argentinean market.

- Argentina's indigenous car industry has been struggling with a shortage of parts; therefore, the quickest method to satisfy demand is to import.

The Numbers Tell the Story

The most outstanding individual? From January to July 2025, exports to Argentina increased by 156.5% year over year, from 71,700 automobiles to around 184,000. A closer look at the data highlights both the opportunities and risks of the current trend.

Interest rates and domestic demand on the home front

Brazil's domestic car market is more limited, despite the country's booming exports. The benchmark interest rate set by the central bank, which is close to 15%, has increased the cost of auto loans and deterred many consumers from making large purchases. As a result, 2025 domestic sales growth is only expected to reach 5%, which is a little less than previous estimates.

In a sense, as per Brazil Import Trade Analysis by Import Globals, this lackluster domestic demand has made more manufacturing space available for exports. Due to decreasing showroom visitors at home, automakers have shifted their focus to international markets, where demand is now much higher.

The Overdrive Production Lines

Busier ports, increased output, and more jobs are all results of the export boom. Anfavea anticipates that, according to Brazil Export Data by Import Globals, it will produce 2.749 million vehicles this year, an increase of 7.8%. About 400 new jobs were generated in the car industry in July alone, representing a 4.4% increase in employment over the previous year.

The effect is just as great for suppliers. Assembly plant orders have increased by double digits, according to parts manufacturers in São Paulo, Minas Gerais, and Paraná. Auto export volumes have increased by more than 20% in logistics centers like the Port of Santos, placing a strain on capacity while increasing shipping companies' profits.

Additional Markets Under Review

Softer performances elsewhere are concealed by Argentina's dominance:

Effects on the Workforce and Supply Chain

Brazil's car industry now has some breathing room thanks to the export boom. To lower the possibility of layoffs, factories in São Paulo, Minas Gerais, and Paraná have increased shifts. As said by Brazil Import Data:

- In July alone, more than 400 new positions were created.

- To fulfill export deadlines, OEMs have increased their orders by double digits, according to auto parts suppliers.

- Auto export-related port activity in Santos and Paranaguá has increased by 21% annually.

Historical Viewpoint: A Well-Known Boom with a Novel Twist

Brazil has already benefited from export windfalls. Shipments steadily increased in the early 2000s due to favorable exchange rates and robust demand from nearby countries like Chile and Venezuela. Trade agreements with Mexico and Colombia gave it further impetus in the middle of the decade.

Its concentration is what distinguishes the current surge. Currently, as per Argentina Import Trade Statistics by Import Globals, one nation receives over 60% of all automobile exports. Brazil's competitiveness in the Argentine market is demonstrated by this, but it also increases the sector's susceptibility to abrupt changes in Buenos Aires' economic or policy landscape.

An influx of competition from the east

Brazil is seeing a surge in exports, but the quick ascent of Chinese automakers is posing a new threat domestically. Brazil Import Shipment Data suggested that the country purchased almost 22,000 cars, primarily electric models, from China in the first half of 2025 alone. That figure may reach 200,000 by the end of the year, or about 8% of all light vehicle registrations.

In the electric car market, where Brazilian manufacturers still trail behind in terms of volume and technology, this surge is especially disruptive. Leaders in the industry are urging the government to address loopholes that allow semi-knocked-down kits to enter the country at reduced rates and to increase import taxes sooner than anticipated.

The Competitive Aspect: China's Quick Advancement

According to China Import Export Trade Analysis by Import Globals, Chinese automakers are quickly catching up in Brazil, despite the country's export boom. In 2025's first half, we witnessed:

- 22,000 Chinese cars were imported, with 200,000 expected by the end of the year.

- 70% of these imports are EVs, a market in which Brazilian automakers are less competitive.

- By year's end, it might account for 8% of Brazil's light vehicle registrations.

- To halt this trend, industry associations are calling for more rapid tariff increases and stringent regulations on imports of semi-knocked-down kits.

Trade and Policy Risks

Policymakers in Brazil are treading carefully. On the one hand, the export boom supports jobs and creates foreign cash, which is a welcome boost to the economy. However, if demand in a particular market, such as Argentina, declines, an excessive dependence on it may backfire.

Brazil Export Import Global Trade Data indicates that the government has reduced the duty-free time for imported car kits from 12 months to six months and implemented new import limitations in recent months to safeguard indigenous manufacturers. By taking these steps, local producers will be protected from unfair competition without inciting trade conflicts.

Conclusion

The ability of Brazil to strike a balance between its robust position in Argentina and a more varied export portfolio will determine the future of its car exports. Although Uruguay, Chile, and Colombia have room to develop, none of them can soon meet Argentina's present demand.

The current boom may turn into a sustained development phase if Argentina's demand for Brazilian automobiles continues until 2026 and if Brazil can expand into new markets while increasing its EV capabilities. However, Brazil's car sector may once again be reliant on a weak local market if demand from Buenos Aires declines. Import Globals is a leading data provider of Argentina Import Export Trade Data. Subscribe to Import Globals to get more global trade details!

FAQs

Que. Why is Argentina buying so many vehicles from Brazil in 2025?

Ans. As per Argentina Import Export Global Data by Import Globals, a mix of economic recovery, production shortages at home, favorable trade terms under Mercosur, and aligned consumer preferences has driven demand.

Que. What types of vehicles dominate Brazil’s exports to Argentina?

Ans. Mainly small and mid-sized passenger cars and light commercial vehicles that suit the Argentine consumer and rural transport needs.

Que. Could other markets replace Argentina if its demand drops?

Ans. While countries like Colombia and Chile are growing markets, their combined volume still falls far short of Argentina’s current import levels.

Que. How is competition from China affecting the situation?

Ans. It’s not hurting Brazil’s exports to Argentina directly, but in the domestic market, Chinese automakers, especially EV producers, are quickly gaining share, challenging local manufacturers.

Que. Where can you obtain detailed Argentina Import Data or Brazil Export data?

Ans. Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date data.