- Oct 13, 2025

Ethanol-Blended Gasoline: Redefining Energy Trade in a Low-Carbon World

From being a specialized climate tool, ethanol-blended gasoline is becoming a commonplace item. Countries may reduce tailpipe emissions, diversify their fuel supplies, and establish new cross-border energy and agricultural flows by combining bioethanol, which is mostly derived from sugarcane, maize, or other biomass, with regular gasoline.

As per Brazil Import Data by Import Globals, Ethanol is changing who purchases from whom, what is delivered, and how governments strike a balance between fuel, food, and climate goals as regulations increase and infrastructure grows. This blog examines the market data, new trade channels, and regulatory factors that are driving ethanol's growing worldwide significance.

The Importance of Ethanol Blends in Trade

Because it fulfills three purposes, ethanol is naturally "tradeable":

- Decarbonization at the Pump: Importers may fulfill transportation requirements without revamping engines or grids by using blends like E10, E15, and E20, which lower life-cycle greenhouse gas (GHG) emissions compared to plain gasoline.

- Diversification of Supply: As per USA Export Data by Import Globals, importing ethanol (or the grains used to make it) reduces dependency on pipeline gas or crude oil while providing exporters with a new market linked to agricultural production.

- Scalable with Current Logistics: Ethanol may capitalize on existing liquid-fuel supply chains by using blending terminals, storage, and certification, enabling quick adoption in areas with regulations.

Policy Momentum in key Markets

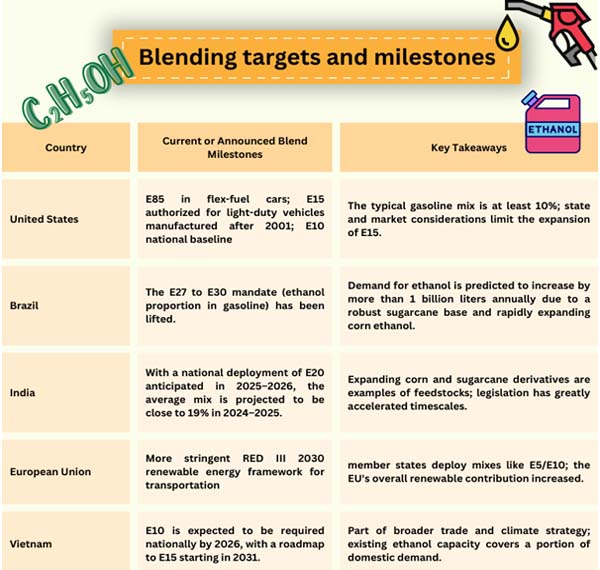

USA Import Export Trade Data by Import Globals, demand for ethanol is mostly driven by mandates, and the standard has lately increased in several major economies. With E15 authorized for cars manufactured after 2001, the U.S. essentially maintains a national E10 baseline; pioneering Brazil moved to increase its already high mix; India has hastened its transition to E20; the EU has strengthened regulations on transport decarbonization; and Vietnam is getting set to make a national transition to E10. These actions not only alter domestic fuel but also reroute international commerce in sugar, corn, and ethanol.

Who Buys and who Sells in Trade Flows

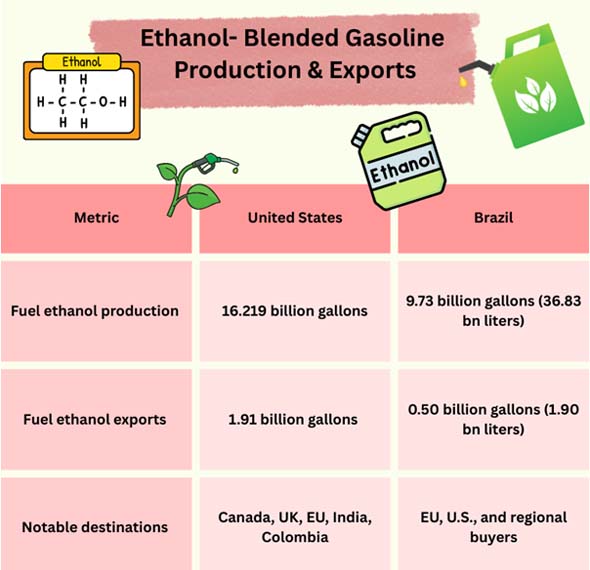

The United States and Brazil are the two nations that supply the majority of fuel ethanol. As more nations relied on imports to meet transportation goals, exports reached an all-time high in 2024, with the United States being the world's top producer (based on corn). Brazil Import Data by Import Globals, while maintaining a consistent export presence, Brazil, a historically dominant producer of sugarcane ethanol, has also increased maize ethanol and improved its local gasoline blend.

Links between Agriculture and Energy: Trading in Corn and Sugar

The connection between gasoline and crops is rewired by ethanol. India Import Trade Analysis by Import Globals, demand for maize and sugarcane increases in response to requirements, which impacts fertilizer consumption, crop rotations, and pricing. For example, India's trading situation changed as a result of rising E20 and a policy shift toward ethanol made from maize. The quick expansion of maize ethanol in the Center-West region of Brazil gives sugarcane a second feedstock pillar, stabilizing supply and facilitating the E30 shift. Land-use decisions, export dynamics for rival crops, and feed pricing for cattle and poultry are all impacted by these changes in agriculture.

Benefits of Climate change and the Certification Process

Depending on the feedstock and technique, cellulosic ethanol can reduce GHG emissions by up to 90%, whereas maize ethanol usually reduces them by about 40% when compared to gasoline. Only if the savings are quantifiable, reportable, and verifiable can they be banked in trade. As per Europe Export Data by Import Globals, this is the reason why exporters invest in more efficient plants, lower-methane energy inputs, and better farming methods, while importers are tightening sustainability standards and carbon intensity (CI) grading. Long-term ethanol supply contracts are made easier to execute, and friction is decreased by convergent standards (EU RED, U.S. programs, and bilateral recognition).

Infrastructure and logistics: The Silent Differentiator

The capacity to trade ethanol depends on ports, tanks, rail, trucks, and blending facilities close to consumption hubs. Nations that announce increased mandates are also providing financing for: Terminals for blending and storage to manage seasonality and larger blend quantities. As per Europe Import Data by Import Globals, mechanisms for certification to monitor sustainability claims and CI ratings. Retail improvements (labeling, dispensers) for E15/E20 and, if applicable, flex-fuel E85. Import programs grow rapidly in situations when these components move in unison. Mandates may outstrip market preparedness in areas where they lag, which might hinder adoption or cause price increases.

Price Dynamics: Policy Buffers and Volatility

In addition to the gasoline blendstock, ethanol costs are influenced by feedstock and energy inputs (corn/sugar, natural gas, and electricity). By establishing a policy floor under demand, mandates reduce downside volatility and provide exporters the ability to invest and hedge. On the other hand, as per Asia Import Trade Statistics by Import Globals, abrupt changes in the maize or sugar markets, such as droughts, record harvests, or trade disruptions, can raise the price of ethanol and promote a return to lower mixes in the near term. Long-term policy signals, such as multi-year blending roadmaps, actually aid in trade and investment stabilization.

Emerging markets to keep an eye on

- Southeast Asia: With gradual regulations supported by trade agreements, neighbors may follow Vietnam's E10 blueprint, which serves as a predictor of regional import growth.

- South Asia: As feedstock becomes scarce, India's drive for a complete E20 rollout reorganizes regional flows for corn, sugar, and ethanol and may spur additional plant investment and imports.

- Europe: As members rely on E10/E5 mixes and import to maintain balance, stricter RED III transport requirements keep ethanol viable alongside advanced biofuels.

- Latin America: As per Brazil Import Data, Brazil's corn ethanol build-out maintains export capacity while its E30 anchors a sizable local market, which is frequently countercyclical to sugar markets.

The Path Ahead

Although, as per USA Export Import Global Trade Data, ethanol-blended gasoline won't take the role of electrification, it can reduce emissions in older car fleets instantly and effectively, especially in areas where EV uptake is slow. In the upcoming ten years, anticipate:

- Additional import initiatives linked to new or more stringent regulations (E10–E15–E20);

- More robust sustainability filters (traceability, CI score);

- Deeper ties to agriculture (trading in grain and sugar, DDGS flows from byproducts);

- Increased policy cooperation to promote long-term supply agreements and lessen certification friction.

Ethanol is now more than simply an agricultural policy concern for traders and politicians; it is an energy-trade tool that can be adjusted to balance fuel security, currency requirements, and climate targets, now, not only in 2050. Import Globals is a leading data provider of Brazil import export trade data. Subscribe to Import Globals to get more global trade details!

FAQs

Que. What blend levels are most common globally?

Ans. E10 is the most widespread baseline. Some markets are moving to E15/E20, while Brazil now targets E30 in gasoline. Flex-fuel vehicles can use E85 where available.

Que. Does ethanol really cut emissions?

Ans. Yes. On average, corn ethanol reduces life-cycle GHGs by 40% versus gasoline; advanced/cellulosic pathways can be much higher, depending on feedstock and process.

Que. Who leads ethanol exports today?

Ans. The United States is the largest exporter (record shipments in 2024). Brazil remains a top producer and exporter, with domestic demand also rising.

Que. Will ethanol compete with EVs?

Ans. They’re complementary in the transition. Ethanol reduces emissions from existing ICE fleets now, while EVs grow market share and cut tailpipe emissions over time.

Que. Where can you obtain a detailed Brazil Import Export Trade Analysis?

Ans. Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date data.