- Feb 04, 2026

Geopolitical Shifts Behind US-Venezuela Trade Realignment in 2026

Trade between the U.S. and Venezuela has not been "normal" very often in the recent ten years. Trade is no longer seen as an economic bridge but as a geopolitical tool.

A Connection Established on Leverage, Not Friendship

This is what will change in 2026. In 2025, Washington used sanctions, licensing, and threats of tariffs to limit Venezuela's export options and influence who benefits from oil flows.

The collaboration is moving toward a more open strategic framework by the start of 2026. As per Venezuela Export Data by Import Globals, this means that who can get into the market will rely on what happens in politics, who controls the money, and keeping the U.S. enemies out of Venezuela's energy ecosystem or at least limiting their presence. This is why the word "realignment" is correct. It's not only about how many barrels get to U.S. refineries. It's about who gets to choose where barrels go, how payments are set up, and which outside powers are kept out of the Venezuelan supply chain.

2025 as the Setup: The "Permissioned" Oil Route and the Engineering of Sanctions

The permits system for oil-related activities in Venezuela was made stricter and redesigned in 2025. The U.S. framework was less like a blanket of openness and more like a valve: it was open just enough to change behavior, but it closed fast if political circumstances weren't satisfied.

The Two Most Important Tools Were:

Licensing as a Limit

Licenses became a mechanism to keep flows going, but only under certain conditions. They let some manufacturing and export activities happen while limiting how cash gets to Venezuelan government agencies. As per Venezuela Trade Export Data by Import Globals, this paradigm can support restricted trade without achieving complete economic normalcy.

The Trading Reality: U.S. crude oil imports changed a lot from 2020 to 2025.

Tariffs as a Second type of Pressure

Washington took a broader approach to deterrence that went beyond direct penalties and targeted third parties.

The Goal is Clear: make Venezuelan oil politically and commercially "costly" for other importers. This will give the U.S. more power over the destination mix and the negotiating table.

Why 2026 Looks Different: International Politics Took the Lead in the Deal

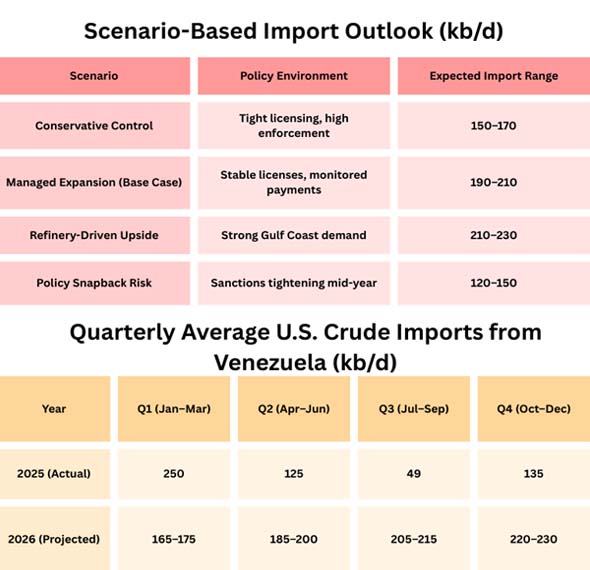

In 2025, U.S. crude oil imports from Venezuela were quite unstable. As per Venezuela Import Data by Import Globals, they started off high at the beginning of the year, then dropped sharply in the middle of the year before partially recovering. This trend shows how authorizations can be stopped and started, how compliance risk can change, how shipping and insurance can be limited, and how the shadow economy thrives when legal options become fewer.

The U.S.–Venezuela energy connection is becoming more clearly defined as a project for security and influence by early 2026. There are many levels to the logic:

1) Counter-adversary strategy: cut down on ways for China and Russia to have an effect

Venezuela's oil isn't just a product; it's a political tool that can be used to build alliances and networks of support. In 2026, one of the main goals of the U.S. government is to reduce the participation of foreign enemies and shadow networks in Venezuelan exports, especially when trading, shipping flags, or unclear middlemen make it hard to enforce. In practice, that means making interdiction stricter, putting more pressure on compliance, and prioritizing channels where payment and end-use routes are easier to regulate.

2) Energy security and refinery math: heavy crude is important

Heavy sour crude is what many U.S. Gulf Coast refineries are set up to process. When they are legal and reasonably priced, Venezuela's Orinoco-grade barrels can be useful for business. Washington has reasons to keep a controlled corridor of heavy crude open, even though supply shocks can happen in many places.

3) The policy of sanctions turns into a "influence architecture."

In 2026, sanctions are not just a switch that turns on and off; they are a way to control who is involved in Venezuela's upstream, midstream, and export chains. You can utilize licenses, waivers, and restrictions to decide which businesses can run,

- Who can carry things,

- Where money is kept,

- And how fast a customer might increase the amount.

As per USA Import Data by Import Globals, this infrastructure also tells world markets that Venezuelan oil barrels may come back, but only through politically aligned routes.

Venezuela’s Internal Drivers: Survival Economics and Legitimacy

Venezuela's Incentives are Clear: its infrastructure has gotten worse, its production capacity is still limited by a lack of investment and system failure, and any sustained recovery needs money, equipment, and reliable export channels. As per Venezuela Trade Data by Import Globals, oil money is also important for politics. Even a small increase in exports can help the government deal with its financial problems, stabilize patronage arrangements, and buy time. But those benefits are lessened if you can't get cash directly or if the money is stuck in regulated accounts or is dependent on political actions.

The 2026 bargaining chip is "whoever has the money controls the politics."

One of the most important changes in early 2026 is that the focus will be on controlling revenue, not just allowing exports. If the money goes through strictly controlled channels, the U.S. (and its partners) can use it to decide between humanitarian priorities and elite capture.

- Reconstructive sequencing,

- And political conditions.

- For Venezuela, this may seem like a loss of sovereignty. As per USA Customs Data by Import Globals, Washington sees it as a means to make sure that oil revenue doesn't make corruption or hostile security networks worse. In either case, it turns trade into a way to govern.

- Politics over climate change is a factor, but it doesn't drive the situation.

Venezuelan crude oil is generally heavy and high in carbon, which makes it hard for any government that wants to be seen as a leader on climate change to do so. People are exploiting climate issues more commonly in politics and to make their arguments in 2026. Critics contend that more Venezuelan oil will maintain the supply of high-emissions energy consistent, but advocates say that energy stability and the country's geopolitical position are more important right now. Even though the realignment makes sense from a strategic point of view abroad, it is a dilemma for politics at home.

What to Watch for the Rest of 2026

Here are the signs to look for if you wish to witness the "realignment" happen:

- License Scope: Are permissions expanded to allow more sales, or are they maintained restricted to keep leverage?

- Payment Routing: Does the manner the money is sent affect who gets it in Venezuela?

- How fast are interdictions and compliance actions getting stronger? Are they making shadow channels smaller?

- Do big customers stop buying because they are scared of tariffs and the cost of following the rules?

- Investment Signals: Are U.S. and allied businesses willing to put their money on the line, or are they being careful because of the risk of politics?

Conclusion

In short, the 2026 realignment is less about bringing back a business relationship that existed before the sanctions and more about setting up a limited, conditional trade system. This system is supposed to change both Venezuela's international and domestic incentives at the same time. Import Globals is a leading data provider of USA Import Export Trade Data.

FAQs

Que. Is the change in the relationship between the U.S. and Venezuela largely about oil?

Ans. The major cause is oil, but the goal is bigger: to change alliances, make more money, and improve security in the region.

Que. Why did U.S. imports change so much in 2025?

Ans. The dangers of legal authorizations and compliance altered swiftly, and the commerce corridor remains conditional instead of totally normalized.

Que. What is Washington's most crucial geopolitical priority for 2026?

Ans. Reducing the power of foes and controlling how Venezuelan oil money flows in, while still leaving important supply routes open.

Que. What is the worst thing that could happen if this realignment happens?

Ans. Political instability and legal ambiguity can both make people less likely to invest and stop trade flows, even if there are barrels.

Que. Where to get detailed Venezuela Export Data?

Ans. Visit www.importglobals.com.