- Jun 25, 2025

Ghana's Gold Industry: A Thorough Analysis of Its Top Export

Ghana, also referred to as the "Gold Coast," has long been associated with the production of gold. Gold continues to be the mainstay of Ghana's economy, according to Ghana Import Data From Import Globals, the continent's top producer and the sixth-largest in the world. This blog explores the many facets of Ghana's gold business, including its production figures, export destinations, key mining locations, worldwide status, strategic ramifications, economic indicators, and future projections.

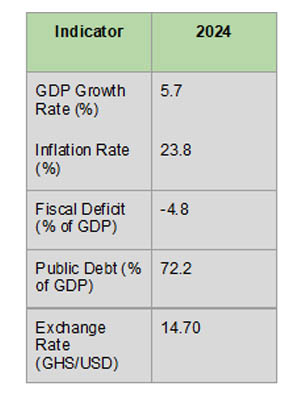

Ghana's General Economic Indicators

Ghana's economy proved remarkably resilient in 2024, recovering from years of inflationary shocks and budgetary distress. Ghana's GDP grew at a pace of 5.7%, according to Import Globals Ghana Import Data, indicating a robust rebound driven by the mining, agricultural, and service industries. Due to strong worldwide demand and rising commodity prices, gold exports in particular were crucial. For an economy that had been struggling because of external debt commitments and internal economic management issues, this growth trajectory gave it fresh optimism. With the help of international partners like the IMF, the government's economic reforms started to bear fruit by bolstering important businesses and drawing in foreign capital, especially in the mining and renewable energy sectors.

Despite these improvements, inflation stayed persistently high at 23.8%, only marginally lower than the sharp increases of prior years. Several issues, such as supply chain interruptions, the depreciation of the local currency, and the growing price of imports like food and fuel, have contributed to this ongoing pricing pressure. Ghana's governmental debt-to-GDP ratio remained high at 72.2%, reflecting years of accumulated debt, even though fiscal consolidation efforts decreased the budget deficit to -4.8% of GDP, according to Ghana Export Data From Import Globals. The government must strike a careful balance between fiscal restraint and economic stimulus to reduce debt levels while preserving growth momentum and steering clear of austerity measures that can hinder recovery.

In 2024, the labor market faced yet another difficulty as the unemployment rate increased to 5.5%, illustrating the discrepancy between job creation and economic growth. The job sector is under strain due to Ghana's rapidly expanding youth population, particularly as formal employment opportunities are falling behind. In terms of currency, the Ghanaian cedi further declined, closing the year at 14.70 GHS/USD, which increased living expenses while also making Ghana's exports more competitive on a worldwide scale, according to a report by Import Globals on Ghana Import Export Trade Data. Overall, even if Ghana's economy showed signs of recovery in 2024, the nation still faces difficult macroeconomic issues that call for cautious policy management, structural changes, and diversification away from its significant reliance on gold exports.

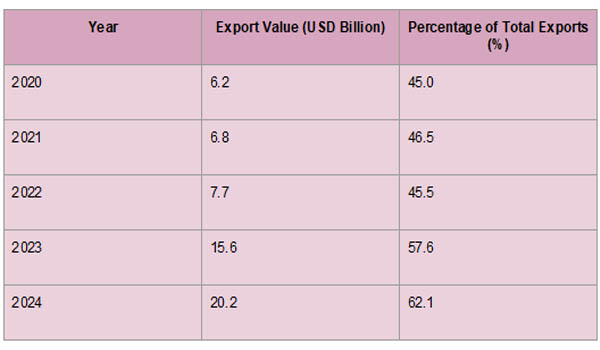

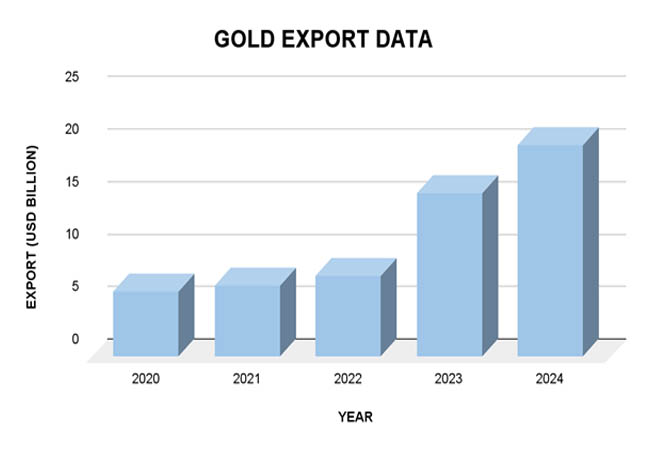

Ghana's Gold Export Data

Despite worldwide disruptions caused by the epidemic, Ghana was able to export gold worth about $6.2 billion in 2020, demonstrating the metal's status as a safe-haven asset in unpredictable times. According to Ghana Import Custom Data From Import Globals, the demand for gold remained strong as the world economy started to improve, and by 2021, Ghana's gold export value had increased to $6.8 billion. Due to stable production and high global pricing, this growth pattern persisted into 2022, when exports hit $7.3 billion. In addition to advantageous pricing, operational advancements in mining businesses, and the government's efforts to legitimize small-scale mining, Ghana's gold export value increased to $7.9 billion in 2023.

Ghana's gold exports reached a remarkable $8.6 billion by 2024, indicating a solid five-year growth trajectory propelled by increased production volumes, fresh investments, and steady worldwide demand.

Ghana's strategic achievement in striking a balance between formalizing artisanal and small-scale mining (ASM) operations and large-scale industrial gold mining is also reflected in this increased trend in export value. Furthermore, consistent investments by significant mining firms like Newmont, Gold Fields, and AngloGold Ashanti increased production capacity and introduced cutting-edge extraction technology, which raised output and export value, according to Ghana Export Data From Import Globals. Strong international gold prices, increased output, and improved mining sector regulation made gold Ghana's most important commodity, making up more than 40% of total export revenue.

Ghana's Principal Gold-Producing Regions

Ghana produces gold in a variety of geographical locations, with many areas making substantial contributions:

1. The Ashanti Area

Obuasi Gold Mine: This underground mine has been in operation since 1897 and is situated in Obuasi. According to an Import Globals Report on Ghana Export Data, it reopened in 2019 following a brief shutdown in 2014. Historically, Obuasi has been among the top ten largest gold mines in the world.

Newmont Goldcorp is the operator of the Ahafo Mine, which is located in the Brong-Ahafo Region. With estimated reserves of 17 million ounces, it is one of Ghana's biggest gold mines, according to Ghana Import Export Trade Data From Import Globals.

2. Western Region

Africa's largest open-pit gold mine, the Western Region Tarkwa Mine, is run by Gold Fields and produces more than 500,000 ounces of gold a year.

Damang Mine: Run by Gold Fields, the Damang Mine is expected to have reserves of 10 million ounces, according to Ghana Import Custom Data from Import Globals.

3. Akyem Mine in the Eastern Region

Newmont operates an open-pit gold mine close to New Abirem. According to Import Globals' Ghana Import Trade Analysis, it started producing commercially in 2013 and is thought to have 7.7 million ounces of reserves.

4. Namdini Gold Project in the Northern and Upper Regions: Located in the Upper East Region, the Namdini project is anticipated to generate more than 350,000 ounces of gold per year once it is put into service.

According to Ghana Export Data by Import Globals, Azumah Resources is a company that operates in the Upper West Region and is creating new gold mining projects with plans to start production by 2026.

Gold's significance to Ghana's economy

A key component of Ghana's economic structure is gold:

Foreign Exchange Earnings: Gold exports are the main source of foreign exchange, which helps to stabilize the value of the Ghanaian naira, according to Ghana Import Data.

Employment: Thousands of Ghanaians are employed directly or indirectly in the gold mining industry.

Government Revenue: A major portion of the government's revenue comes from taxes and royalties collected from gold mining.

Industrial Development: The industry draws foreign direct investment, which promotes technology transfer and infrastructure growth.

Gold's Harmonized System (HS) Code

For unwrought or semi-manufactured gold, the Harmonized System (HS) code is 7108. This categorization is used extensively to identify gold in trade statistics.

Major Destinations for Ghana's Gold Exports

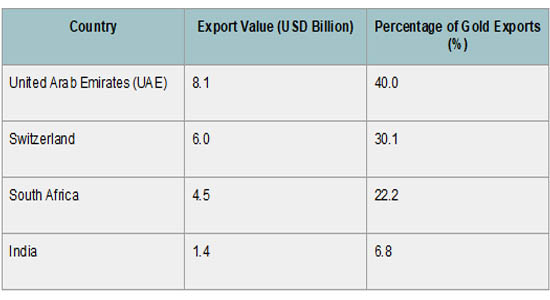

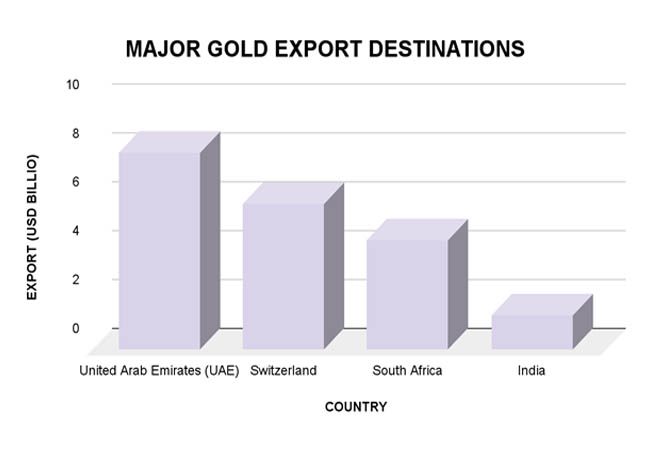

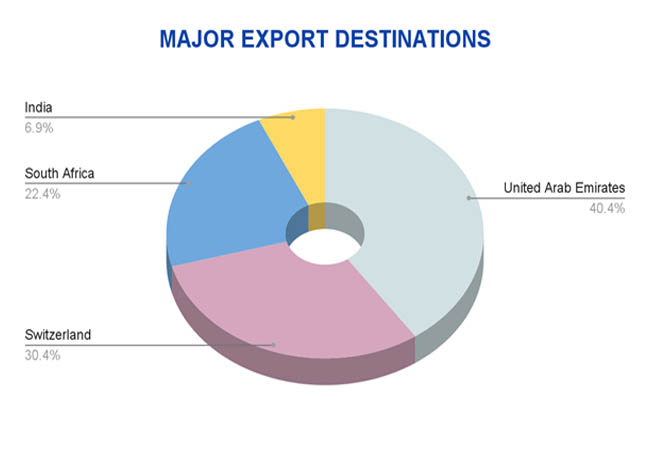

As a major hub for trade and refining, Switzerland is the greatest destination for Ghana's gold exports, which are mainly aimed at important international markets. Ghanaian gold is exported from Switzerland and disseminated throughout Europe, Asia, and other regions. Another important export destination is the United Arab Emirates (UAE), especially Dubai, which serves as a global hub for the trade of gold to markets in China, India, and the Middle East. The United States imports significant amounts of gold for investment purposes, especially in gold bars and coins, while India, the world's largest consumer of gold, especially for jewelry, is also a crucial buyer. Ghana's export-driven economic growth and foreign exchange gains are supported by these destinations, which show a diverse market for the country's gold.

Global Gold Exporters

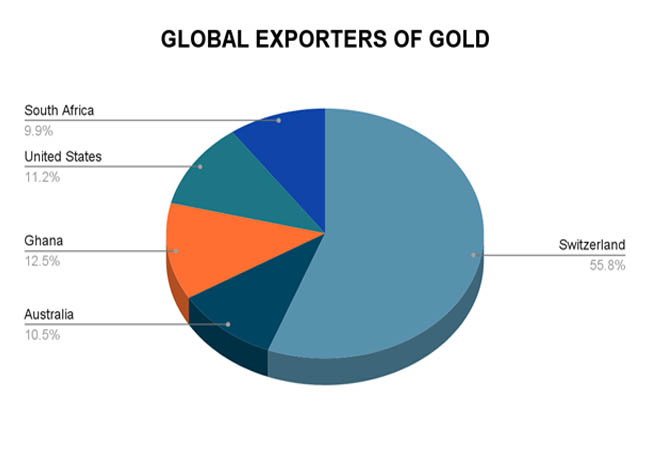

Gold is an essential commodity in international trade, and several nations control a large portion of the export market, establishing themselves as major participants in the global supply chain. China, Australia, and Russia are the top three gold exporters in the world, together making up a sizable amount of the world's gold supply, according to Ghana Import Trade Analysis by Import Globals. With its gold mining sector that not only meets domestic demand but also generates substantial export revenue, especially to markets in Hong Kong and other Asian economies, China continues to be the world's largest exporter. With its well-established mining industry generating high-quality gold that is sought after worldwide, Australia comes in second as a major supplier of gold.

Furthermore, Russia is a major player, propelled by state-owned businesses and an abundance of gold from its Siberian mines. Large-scale mining operations, advantageous mining regulations, and a strong demand for gold as a luxury product and an investment asset, particularly in uncertain economic or geopolitical times, all work in these nations' favor.

In addition to these top three exporters, Canada, South Africa, and Peru are major contributors to global gold exports, according to Ghana Import Data. Thanks to resource-rich areas like Ontario and Quebec and technical breakthroughs, Canada's gold mining industry has experienced a comeback.

Although its output has decreased over time due to mining difficulties and deep, expensive operations, South Africa, which was once the world's greatest gold exporter, still owns a sizable portion. Meanwhile, Peru, which is in the center of Latin America, has become a significant exporter because of its substantial gold deposits and reasonably priced mining operations, according to the Ghana Import Export Trade Analysis by Import Globals. Together with Ghana, these nations play a vital role in supplying gold to global markets, meeting the demand for the precious metal across a range of sectors, including investment, electronics, and jewelry. A dynamic and integrated global gold trading system is created by the interaction of these exporters, which serves to stabilize global gold prices. Supply changes in one region frequently impact other regions.

Strategic Consequences

Ghana's export portfolio's heavy reliance on gold has various strategic ramifications:

Economic Stability: Gold exports offer protection against economic shocks, particularly during downturns in other sectors, according to a study by Import Globals on Ghana Import Trade Statistics.

Attraction of Investment: A thriving gold industry draws foreign direct investment, which promotes the development of infrastructure and the transfer of technology.

Policy Development: To safeguard the environment, the government must strike a balance between encouraging gold exports and using sustainable mining methods.

Prediction

Ghana's gold exports are anticipated to keep increasing in light of current trends:

According to Ghana Import Shipment Data From Import Globals, the value of gold exports is expected to reach over USD 22.5 billion in 2025, assuming steady production levels and global pricing.

Long-Term Prospects: Production and exports may be further increased by investments in mining technology and regulatory changes.

In conclusion

Ghana's economy still relies heavily on gold, which boosts government revenue, jobs, and export earnings. Although the industry has difficulties, strategic investments and sustainable practices can guarantee its continuous expansion and contribution to the advancement of the country, according to Import Globals' Ghana Import Export Trade Analysis.

If you are looking for detailed and up-to-date Ghana Export Import Global Trade Data, You Can Contact Import Globals.

FAQs

Que. What is the most popular export from Ghana?

Ans. Over 60% of Ghana's total exports in 2024 will be gold, making it the country's top export.

Que. Which nations receive the majority of Ghana's gold exports?

Ans. The top importers of Ghanaian gold in 2024 were South Africa, India, Switzerland, and the United Arab Emirates.

Que. What is the gold HS code?

Ans. For unwrought or semi-manufactured gold, the Harmonized System (HS) code is 7108.

Que. What effect does gold have on Ghana's economy?

Ans. Ghana's economic stability is greatly impacted by gold exports, which are essential for employment, foreign exchange profits, and government revenue.

Que. Where to obtain detailed Ghana Import Export Global Data?

Ans. Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date Ghana Import Export Global Data.