- Oct 16, 2025

Global Battery Electric Vehicle (BEV) Trade

BEVs are quickly emerging as a crucial part of global trade, propelled by government incentives, consumer desire for greener mobility, and climate goals.

Previously seen as a niche market, as per China Export Import Global Trade Data by Import Globals, electric cars are now at the forefront of conversations about sustainability, innovation, and mobility. One of the most dynamic industries in the modern economy is the worldwide trade of BEVs, which is changing supply chains, investment flows, and industrial strategies.

Increase in BEV Exports and Production

Over the past ten years, nations that have made significant investments in green transportation and technology have seen a spike in BEV manufacturing. The United States, China, and the European Union continue to be the primary competitors, but more and more countries are getting involved. Thanks to its robust battery manufacturing environment and cost competitiveness, China, in particular, has become the world's largest exporter of electric vehicles. With its aggressive climate goals, Europe Import Export Global Data is also witnessing an increase in exports as automakers like Volkswagen, BMW, and Renault increase their production of electric vehicles.

Important BEV Trade Drivers

Global BEV trade is growing due to several factors:

- Government Policies & Subsidies: Europe Import Export Trade Analysis finds that to hasten the adoption of EVs, several nations have implemented tax cuts, incentives, and infrastructural expenditures.

- Sustainability Goals – Commitments to carbon neutrality are pushing both advanced and emerging economies to adopt BEVs.

- Technological Innovation: Solid-state and fast-charging battery technologies are among the advancements in battery technology that are increasing range and lowering costs.

- Customer Demand: Consumer desire for BEVs is increasing as a result of growing fuel prices and climate change awareness.

- Global Supply Chains: Europe Import Data indicates that the market for BEV parts and completed automobiles has become more worldwide as a result of the incorporation of vital minerals like lithium, cobalt, and nickel into EV supply chains.

Regional Perspectives

China

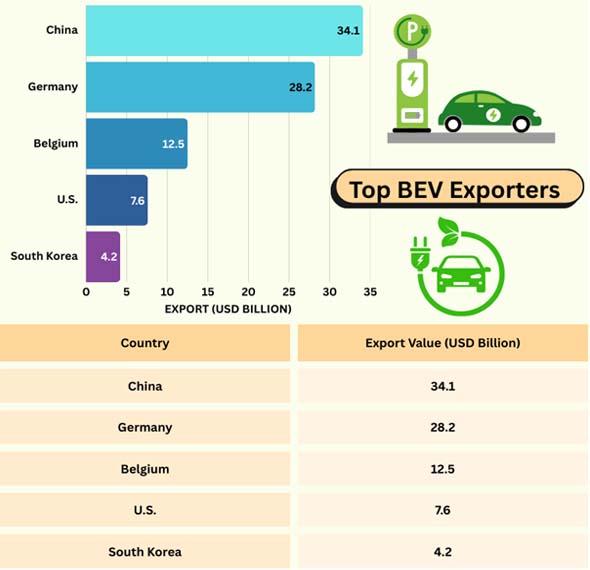

Thanks to firms like BYD, SAIC, and NIO, China continues to dominate the world in BEV exports. In 2024, as per China Export Data by Import Globals, China exported over 3.5 million electric vehicles due to extensive government assistance and economic manufacturing. As a reflection of its worldwide prominence, Europe and Southeast Asia are its top export markets.

Europe

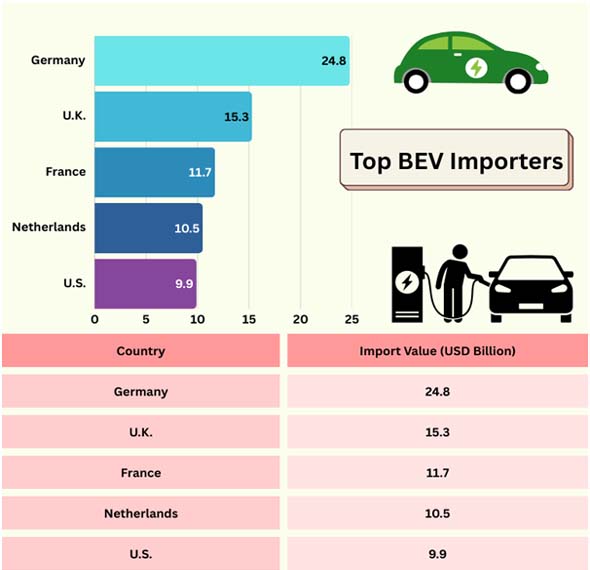

Based on Europe Import Export Trade Data by Import Globals, one of the biggest importers and exporters of BEVs is the European Union. Leading exporters are Germany, France, and Belgium, while major importers include the United Kingdom, France, and the Netherlands. The market is expanding because of EU climate legislation, such as the 2035 ban on fossil fuel vehicles.

United States

USA Import Data by Import Globals reveals that with Tesla in the forefront, the United States is increasing its exports of BEVs to Europe and Asia. Since domestic demand is still strong and production capacity is being steadily increased, the United States is still more of an importer than an exporter.

Asia-Pacific

As per Asia Import Trade Analysis, in addition to China, nations like Japan and South Korea are making significant investments in EV technology. Japan's persistent focus on hybrid vehicles is causing it to lag behind South Korea in BEV exports.

Challenges in the BEV Trade

The BEV market has many obstacles despite its quick expansion:

- Battery Supply Chains: As per China Export Data, one of the main concerns is the security of raw materials such as nickel, cobalt, and lithium.

- Charging Infrastructure: Adoption is hampered by the uneven global development of EV charging networks.

- Trade Barriers: Protectionist measures and tariffs may impede the free flow of BEVs.

- High Rivalry: As the number of companies grows, there is fierce rivalry in markets, prices, and innovation.

Prospects for the Future

The BEV commerce is expected to increase exponentially on a worldwide scale. In large economies, BEVs are predicted to make up around 60% of new automobile sales by 2030. USA Import Data by Import Globals suggests that the Global trade flows will change as a result of this change, with nations that rely on oil exports potentially losing influence and those that own vital minerals or cutting-edge battery technology perhaps gaining. Green mobility is expected to lead to new trade alliances, transforming BEVs into a geopolitical as well as a technological revolution.

Conclusion

Battery electric vehicles are a key component of the worldwide shift to sustainable mobility, not merely a fad. BEV commerce is becoming a distinguishing feature of the global economy as nations compete for a position in this rapidly expanding sector. The U.S. and other regions are catching up, but China and Europe are leading the way. In the upcoming decades, BEVs are expected to dominate the automotive trade sector with sustained investments, technical advancements, and international collaboration. Import Globals is a leading data provider of USA Import Export Trade Data. Subscribe to Import Globals to get more global trade details!

FAQs

Que. Which country is the largest exporter of BEVs?

Ans. China is currently the largest exporter of battery electric vehicles, accounting for around 35% of global BEV exports in 2024.

Que. Who are the biggest importers of BEVs?

Ans. Germany, the U.K., France, and the U.S. are among the leading importers of BEVs.

Que. What factors are driving BEV trade?

Ans. As per Germany Import Trade Statistics by Import Globals, Government incentives, technological innovations, sustainability goals, and rising consumer demand are key drivers of BEV trade.

Que. What is the future outlook for BEV trade?

Ans. BEV trade is projected to grow rapidly, with BEVs expected to account for over half of new car sales by 2030, reshaping global supply chains and trade patterns.

Que. Where can you obtain detailed Asia Import Shipment Data?

Ans. Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date data.