- Oct 02, 2025

How Intra-African Trade Is Fueling a New Export Story in Mozambique and the AfCFTA

Mozambique's exports to other African nations have surpassed a significant milestone, more than USD 1.5 billion over the last year, signaling significant traction in regional business as the African Continental Free Trade Area (AfCFTA) lowers obstacles and unifies regulations throughout the continent. Based on Mozambique Import Data by Import Globals, this increase complements the nation's larger export base of coal, natural gas, and aluminum while creating the groundwork for the expansion of value-added manufacturing and agrifood, which may gain from privileged access and simplified African customs.

The AfCFTA Background: The Significance of 2025 for Maputo

Mozambique Export Data by Import Globals indicates that by reducing tariffs and non-tariff trade obstacles and updating trade regulations throughout the continent, the AfCFTA aims to establish the biggest free-trade area in the world in terms of the number of participating nations. The full involvement of Mozambique starting in January 2025 puts local businesses in a position to benefit from streamlined customs processes, rules-of-origin regulations, and a pipeline of trade-finance programs supported by pan-African institutions. Mozambican exporters expect to benefit from improved market access, cross-border payment systems, and regional value chains as Afreximbank expands intra-African trade finance toward USD 40 billion by 2026 and continental trade recovers.

The Significant Amount: USD 1.5 Billion in African Exports

Mozambique exported more than USD 1.5 billion to African partners in the 12 months leading up to mid-August 2025. This is more than just a figure; it represents the actual demand from local markets for processed metals and energy-related goods from Mozambique, as well as expanding food and light manufacturing movements. As per Mozambique Import Export Trade Data by Import Globals, it also demonstrates the early commercial benefits of increased intra-African liquidity backed by regional banks and better market access under the AfCFTA.

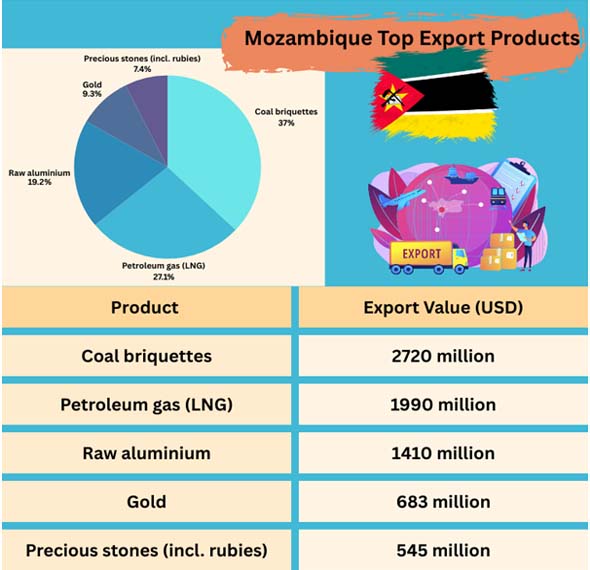

The Export Mix of Mozambique: Metals, Energy, and Other Items

Coal, LNG, and primary aluminum continue to be the mainstays of Mozambique's export profile, with gold and precious stones providing depth. Importantly, these categories have robust African end markets, either directly or through regional processing and logistical centers, and have historically dominated goods exports. As per Mozambique Import Custom Data by Import Globals, the product pillars that now cover the bills are highlighted by trade statistics, as Mozambique attempts to diversify into manufactured products and agro-processing.

Where the Goods Travel: Corridors and Partners

At the regional level, South Africa serves as a logistical and processing hub for intermediate and commodity items from Mozambique as well as a destination. China and India continue to be significant worldwide consumers, reflecting the need for metals and energy. Dashboards based on Mozambique Import Trade Analysis by Import Globals indicate the combination of Asian pull and African regional integration that characterizes Mozambique's trade geography, with South Africa, China, and India leading the list of destinations.

Momentum Within Africa: What's Fueling the USD 1.5 Billion?

There are three factors at play. First, businesses are being encouraged to formalize and expand intra-African commerce by tariff favors and more transparent rules of origin. Second, as per Africa Export Data by Import Globals, the frictions that once made cross-border transactions expensive or delayed are gradually being reduced by trade finance and payments infrastructure, such as Afreximbank facilities and the Pan-African Payment and Settlement System (PAPSS). Third, the economics of transporting manufactured goods and bulk commodities to nearby locations are enhanced by corridor effects and infrastructure, particularly the Maputo Corridor and port improvements. As per Mozambique Export Import Global Trade Data, these elements work together to explain why Mozambique's intra-African exports have surpassed USD 1.5 billion in a single year, mirroring the intra-African trade upswing observed throughout 2024.

Beyond Commodities: The Upcoming Group of Champions

The AfCFTA creates pathways for agrifood, fisheries, wood products, building materials, fertilizers, and basic manufacturing, but metals and hydrocarbons will continue to dominate the market. Mozambican SMEs may expand their production of processed cashews, sugar, drinks, seafood, and timber-based goods for African consumers as regional standards and verification improve and customs procedures converge. As per Mozambique Import Data by Import Globals, AfCFTA may increase incomes and diversify exports by reducing tariff and non-tariff frictions, according to macroevidence throughout Africa. Mozambique can profit from this by investing in high-quality infrastructure, testing and certification, and industrial parks close to transportation hubs.

What Mozambique May Be Holding Back

There are two real-world obstacles to overcome. Reliability in logistics, such as port congestion and last-mile road/rail capacity, might undermine the cost savings brought about by AfCFTA preferences. Additionally, smaller exporters continue to face disparities in firm-level preparation, ranging from trade documentation to rules-of-origin compliance. Based on Mozambique Import Trade Statistics by Import Globals, the following policy levers are now important: (1) targeted support for export-ready SMEs (training on compliance, help with packaging and standards); (2) infrastructure upgrades focused on corridors to shorten turnaround times; and (3) deeper integration with continental trade-finance lines to maintain predictable and affordable working capital. These initiatives are in line with the continent's trade-finance scale-up and the larger AfCFTA-era agenda.

Conclusion

Whether Mozambique converts today's momentum into long-term benefits will be determined by three indicators. First, diversification of products: do we anticipate an increase in the proportion of light manufacturing, fisheries, and processed agrifood in the intra-African export basket? Second, how broad is the market? Does Mozambique consistently increase sales outside of South Africa into SADC and East Africa? The third question is: Do more Mozambican SMEs use trade finance to grow orders and smooth cash cycles? With strong profitability and regional value-chain ties, Mozambique might change its commodity-heavy structure into a more balanced economic narrative driven by the AfCFTA. Import Globals is a leading data provider of Mozambique Import Export Trade Data. Subscribe to Import Globals to get more details on global trade!

FAQs

Que. Why are Mozambique’s intra-African exports growing now?

Ans. Because AfCFTA is lowering trade frictions and pan-African lenders are scaling trade finance, making it easier and cheaper to ship to regional buyers.

Que. Which products lead Mozambique’s exports today?

Ans. As per Mozambique Import Shipment Data, Coal, LNG, and raw aluminum top the list, with gold and precious stones also significant contributors.

Que. Who are Mozambique’s biggest buyers?

Ans. Globally, India, China, and South Africa are the top destinations; within Africa, South Africa is a major trade partner and logistics hub.

Que. What’s the single most important policy lever to sustain growth?

Ans. Improve logistics reliability and SME readiness (standards, documentation, rules-of-origin) while tapping AfCFTA-aligned trade-finance lines.

Que. Where can you obtain detailed Mozambique Import Export Trade Analysis?

Ans. Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date data.