- Jan 20, 2026

How Liechtenstein Exports High-Precision Manufacturing Globally

Liechtenstein is tiny by geography and population, yet it consistently “shows up” in global supply chains because of one thing: high-precision manufacturing. Instead of competing on scale, Liechtenstein competes on accuracy, reliability, and specialization—the kind of engineering that large OEMs and professional users will not switch lightly once a product is proven.

This export model is not accidental. As per Liechtenstein Import Data by Import Globals, it’s the result of a long-running strategy that blends advanced industrial know-how, a strong base of internationally active firms, and a policy environment that makes it easy for manufacturers to serve customers across borders. The outcome is a trade profile where high-value manufactured goods dominate, and where Liechtenstein’s exports travel far beyond its immediate neighborhood—even if the country sits in the middle of Europe.

What “high-precision manufacturing” means in Liechtenstein

Liechtenstein’s manufacturing strength is best understood as a portfolio of niches rather than one single mega-industry. According to Liechtenstein Export Data by Import Globals, the “precision” idea runs across multiple segments:

Metal fabrication and engineered components that must meet tight tolerances Machinery and tools designed for professional and industrial environments. Electrical and electronic systems where performance and reliability matter more than price Optical, measurement, and specialty equipment used in demanding industrial workflows.

As per Liechtenstein Import Export Trade Data by Import Globals, dental and medical-adjacent manufacturing ecosystems (highly regulated, quality-driven, and globally distributed)

International institutions summarise this clearly: Liechtenstein’s manufacturing is highly specialized, spanning areas such as machine and tool engineering, plant construction, precision instruments, and dental equipment.

The Export Backbone: Manufactured Goods Dominate

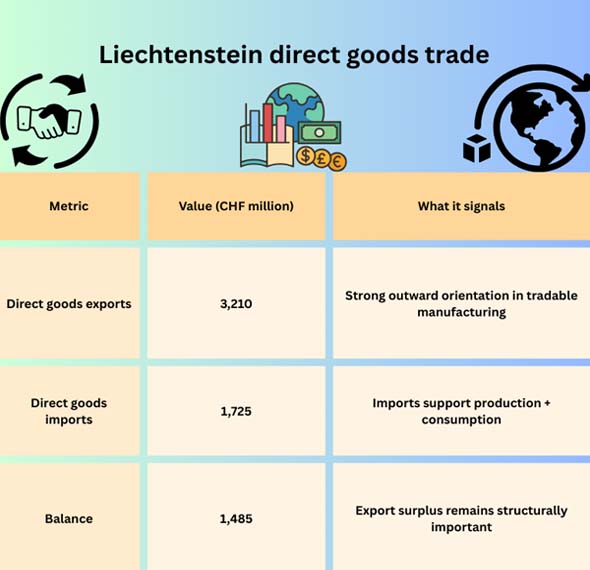

Liechtenstein’s direct goods exports (recorded without trade with Switzerland) show a very clear pattern: manufactured goods are essentially the whole story. In 2025, recorded direct exports were CHF 3,210 million, while recorded direct imports were CHF 1,725 million—a structure consistent with a high-value export economy.

Now look at what makes up the export basket. In 2025, as per Liechtenstein Import Custom Data by Import Globals, the largest product group by share was fabricated metal products, followed by machinery, then a second tier of categories that still carry meaningful weight: electrical equipment, electronics/optical goods, vehicles and parts, and “other goods not elsewhere specified.”

The geography advantage: Switzerland + Europe as a Launchpad

Liechtenstein’s trade statistics come with a crucial interpretation rule: the country is part of a customs and economic area with Switzerland, and it also enjoys access to the European single market through its European Economic Area (EEA) participation. As per Liechtenstein Import Trade Analysis by Import Globals, this combination matters because precision manufacturers don’t just need customers—they need smooth movement of components, compliance recognition, and reliable market access. Two structural Features Strengthen Liechtenstein’s Export Reach:

Customs integration with Switzerland

Switzerland acts on Liechtenstein’s behalf in customs-union matters, and Swiss trade agreements apply to Liechtenstein under the customs-union framework. In practice, this can widen the set of markets where Liechtenstein-based firms can operate under aligned rules and trade arrangements.

Single-market access via the EEA

For a manufacturing exporter, the European market is often the “base layer”—a dense cluster of customers, suppliers, and logistics corridors that supports scale and stability.

In short: As per Liechtenstein Exporter Data by Import Globals, Liechtenstein’s manufacturers operate from a location that is small on the map but plugged into two powerful market-access systems.

Why this Model Works: the Precision-Export Playbook

Liechtenstein’s global export success in high-precision manufacturing is typically built on a repeatable set of behaviors and capabilities:

1) Build in “hard-to-copy” niches

Precision industries reward deep specialization. As per Liechtenstein Importer Data by Import Globals, when a company becomes best-in-class at a narrow but critical component or system, it can sell globally because the market values proven performance over switching costs.

2) Engineer for the professional user, not the Lowest Price

Many Liechtenstein exporters succeed where downtime is expensive: construction, industrial production, optical/measurement environments, or regulated healthcare-adjacent manufacturing. As per Liechtenstein Import Trade Statistics by Import Globals, this tends to support premium pricing and stable global demand.

3) Keep close to the border of Quality

To create products with accuracy, you need to always follow tight tolerances, process control, and compliance. This builds brand confidence over time, leads to repeat orders, and meets the needs of clients from other countries.

4) Use subsidiaries and partner networks to grow on a Global Scale

Businesses go global early on because their domestic market is small. According to Liechtenstein Import Shipment Data by Import Globals, many firms headquartered in Liechtenstein build global distribution and service footprints so that customers in North America, Europe, and Asia can be served with the same reliability as local buyers.

Who buys Liechtenstein’s Precision Output? A Practical View

Even in headline trade reporting, you can see where Liechtenstein’s recorded surpluses concentrate. In 2025, as per Liechtenstein Import Export Trade Analysis by Import Globals, the recorded goods-trade surplus was driven especially by strong positive balances with large industrial markets.

A Note on Data: Why Trade Numbers can Look “Incomplete”

Because of the customs arrangement with Switzerland, Liechtenstein’s export statistics often do not itemise trade “with and via Switzerland,” which makes bilateral measurement difficult. Also, the recorded “direct exports” dataset (commonly used in Liechtenstein’s official goods trade reporting) explicitly excludes goods trade with Switzerland and may not capture every flow with non-EU/EEA states.

This doesn’t reduce the importance of Liechtenstein’s industrial exports—it simply means analysts should interpret the data carefully and focus on structure and direction, not just raw totals.

Conclusion: Liechtenstein Exports Precision by being Indispensable

As per Liechtenstein Export Import Global Trade Data by Import Globals, Liechtenstein’s export model is a masterclass in how a microstate can win globally: specialize deeply, maintain world-class quality, and plug into major market-access systems. The country’s exports are dominated by manufactured goods—especially fabricated metal products and machinery—supported by electrical, electronics/optical categories, and other high-value manufacturing segments.

The result is an economy where global customers don’t buy “from Liechtenstein” because it is large. They buy because Liechtenstein-based manufacturers have become difficult to replace. Import Globals is a leading data provider of Liechtenstein Import Export Trade Data.

FAQs

Que. What does Liechtenstein export the most?

Ans. Recorded direct exports show the biggest shares in fabricated metal products and machinery, followed by electrical equipment, electronics/optical products, vehicles/parts, and other specialized goods.

Que. Why are Liechtenstein’s trade statistics sometimes hard to compare?

Ans. Because Liechtenstein is part of the Swiss customs territory and its export statistics do not fully itemise trade with and via Switzerland; “direct exports” also exclude Switzerland and may not capture all non-EU/EEA flows.

Que. How does a small country export globally at scale?

Ans. By focusing on niche, high-value products, building global distribution/service networks, and becoming a trusted supplier in professional and industrial markets.

Que. Is Liechtenstein more about manufacturing or services?

Ans. It is known for both (industry and finance), but its goods-trade profile shows manufacturing-led exports—especially in precision-oriented categories like metal products and machinery.

Que. Where to get detailed Liechtenstein Import Export Global Data?

Ans. Visit www.importglobals.com.