- Jan 19, 2026

Is Venezuela becoming a strategic energy partner for the U.S. Again?

It was close by sea, met the demands of Gulf Coast refineries, and could deliver heavy grades that many U.S. plants are built to treat. Then, sanctions, a drop in business, and a break in political ties basically ended that partnership.

The fundamental question in 2025–2026 is whether the trend has changed enough for Venezuela to be seen as a strategic energy partner again, or if what we're seeing is really a transitory, carefully controlled flow of barrels with specific rights.

The short answer is that Venezuela is becoming a useful tactical supplier again, and by early 2026, it looks like it may be a conditional strategic partner, but only with strict policy control, transaction structures, and compliance guardrails. The relationship is getting stronger, but it's not yet secure, wide-ranging, or predictable enough to be like the old days of "normal" energy partnerships.

What the term "Strategic Energy Partner" means in the U.S.

As per Venezuela Trade Data by Import Globals, a strategic partner is more than just a country that supplies oil to the U.S. from time to time. In actuality, it means that most of these facts are true:

- Reliability: steady volumes with a low chance of political meddling.

- Scale: There are enough barrels to be important for planning at refineries and maintaining the national supply strong.

- Policy alignment means working together to help the U.S. reach its bigger goals of security, good governance, and stability in the area.

- Infrastructure Fit: the right type of crude for U.S. refineries.

- A strong framework has rules that stay in place even when elections happen, headlines change, and enforcement changes.

- Venezuela only checks only part of these criteria in 2025. In early 2026, additional boxes start to fill in, but there's an asterisk next to them: the framework is still changing and is very political.

The 2025 Reality: A Comeback That Is Not Smooth

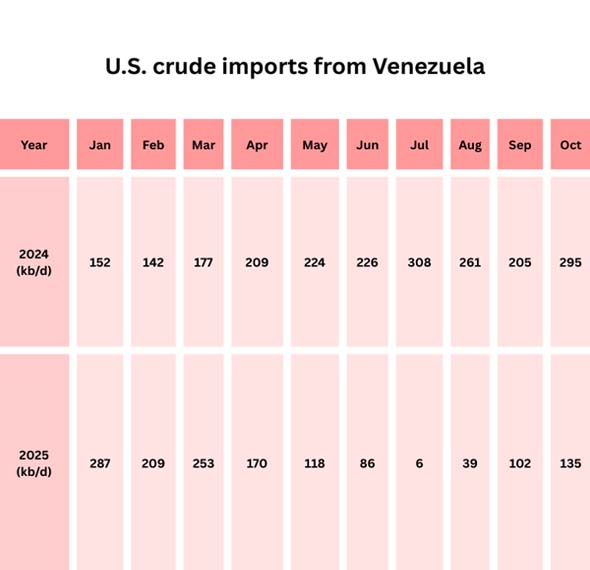

As per USA Import Data by Import Globals, Venezuela's contribution to U.S. imports in 2025 wasn't a straight line up. It started off well, but then it fell sharply in the middle of the year and then partially recovered.

That trend is important because strategic alliances depend on being able to forecast what will happen. A refinery requires more than just the correct crude; it also needs to know that the crude will come in every month.

Why the U.S. Keeps Taking Back Venezuelan Barrels into Refinery?

1) Refinery Compatibility: Heavy Crude is Still Important

Most Gulf Coast refineries are set up to handle heavier, sour crude. Venezuelan grades, especially heavier blends, can match those setups. Refiners can either lower their dependence on substitutes or raise their margins when Venezuelan barrels are available, depending on the price and product cracks.

2) An Edge in Geography

As per USA Export Data by Import Globals, Venezuela's closeness is a significant strategic advantage: it has shorter shipping routes than many other options, a faster supply response, and a more direct logistical network in the Atlantic Basin.

3) The Logic of Energy in the Hemisphere

When global markets are unstable, politicians generally choose regional resilience. The option value of a close heavy-crude supplier goes up when other routes get tighter, even if the U.S. imports are more diverse.

The Change in 2026: From "Imports" to "Managed Energy Diplomacy"

Early 2026 brings a new tone. Reporting shows deal-based flows where volumes, counterparties, and revenue processing are structured and monitored, instead of the U.S. just importing what markets offer.

Important indications that were reported in early January 2026 include:

- A big oil sales deal worth billions of dollars, with the first wave of sales bringing in about $500 million.

- A specific volume goal was talked about in the tens of millions of barrels for export or sale to U.S. refiners and other buyers.

- Major U.S. companies, especially Chevron, anticipate to get more licenses so they may increase production and exports.

- As per USA Customs Data by Import Globals, more people want to get involved, including not just oil companies but also trading houses and refiners that want to receive licenses or waivers.

- This is important for the "strategic partner" argument because it shows that the U.S. sees Venezuelan oil as more than just a way to move products.

The Sanctions-and-Licenses Factor: The Key That Opens Everything

The "strategic partnership" is good for more than just where Venezuela is and how far away they are. It's also about how permits work. The data from July 2025 reveals that transfers to the U.S. could practically stop if companies, businesses need more approval.

When permissions go up, volumes may soon return. As per Venezuela Oil Exports by Import Globals, this means that the relationship works more like a valve than a pipe. The way it opens and closes depends on policy, compliance risk, and the status of diplomacy. This suggests that the U.S. may not see Venezuela as a good place to get basic materials for strategic planning. It might instead see it as a way to control the flow of heavy crude and its power in the area.

What Could Make Venezuela a Real Strategic Partner Again

1) Consistent volumes throughout several quarters

A single good quarter doesn't restore faith. Refineries and dealers want things to go the same way every time, especially for heavy grades that can change how they arrange their units.

2) Authorizations that are clearer and last longer

Short windows make it easier for thieves to take things. Longer, clearer frameworks make it easier to do infrastructure work, keep things running, and keep making things.

3) Venezuela's internal operational stability

Even with permission, how much they can produce and export depends on how well the fields are doing, how easy it is to get diluent, how well they can maintain the equipment, and how well PDVSA can do its job.

4) A connection that lasts through the news

If every political crisis stops trade, a strategic alliance is out of reach.

The "Strategic Partner" Faces the Most Risks Story

- Policy whiplash: As per Venezuela Oil Exports by Import Globals, abrupt tightening can mess up flows and keep people from investing.

- Financial and compliance plumbing problems: shipping, insurance, and payments must all still operate.

- Infrastructure is falling apart and not getting enough money: production may not grow as quickly as permissions allow.

- Political instability at home, both in Venezuela and in U.S. policy.

- These hazards don't mean that commerce should halt, but they do suggest that "strategic partner" should be used with care.

Conclusion

Will Venezuela once again become a vital energy partner for the U.S. in 2025–2026? It is going that way, but there are several crucial caveats. 2025 indicates that Venezuela can provide significant amounts when the conditions are right, but the pattern is too unstable to be called a "strategic partnership." Early 2026 shows a change toward structured, deal-driven flows and likely license growth, which makes Venezuela more strategically important. So the best way to put it is that Venezuela is becoming a strategically vital conditional supplier again, but this time as a partner in a regulated corridor instead of a totally normalized energy ally. If the 2026 framework holds up and the volumes stay steady from quarter to quarter the relationship might start to look more like a real strategic partnership again. Import Globals is a leading data provider of Venezuela Import Data.

FAQs

Que. What is it about Venezuelan oil that the U.S. wants?

Ans. This is because many Gulf Coast refineries can easily handle heavy crude, and Venezuelan grades fit those setups well.

Que. Did the US buy more things from Venezuela in 2025?

Ans. They went up a lot at the beginning of 2025, but then dipped significantly in the middle of the year before partially coming back up. This shows that they were not growing steadily.

Que. What will be different at the start of 2026?

Ans. Reports say that planning for sales and exports will be better structured, and big businesses may gain more approvals. This makes flows more predictable and based on rules.

Que. Is Venezuela taking the place of other suppliers like Canada or Mexico?

Ans. Not widely. It can compete at the margin, especially for heavy crude, but how big its role gets will depend on how consistent and stable it is.

Que. Where to get detailed Venezuela Export Data?

Ans. Visit www.importglobals.com.