- Oct 20, 2025

Imports of Electronics Into the Us: Reliance on Asian Supply Chains

Electronics are one of the biggest and most important categories that the US imports, ranging from laptops and smartphones to semiconductors and telecommunications equipment.

A complex supply chain that spans Asia is responsible for every gadget that is utilized in American factories or sold in American stores. USA Import Data by Import Globals states that it includes large-scale assembly and finished-goods exporters in China, contract manufacturers in Vietnam and Malaysia, and component suppliers in Taiwan and South Korea. Although this regional concentration has resulted in cost savings and efficiency, it also poses strategic risks in the form of concentrated procurement for essential components, supply disruptions, and geopolitical risk.

How large is the Import of Electronics?

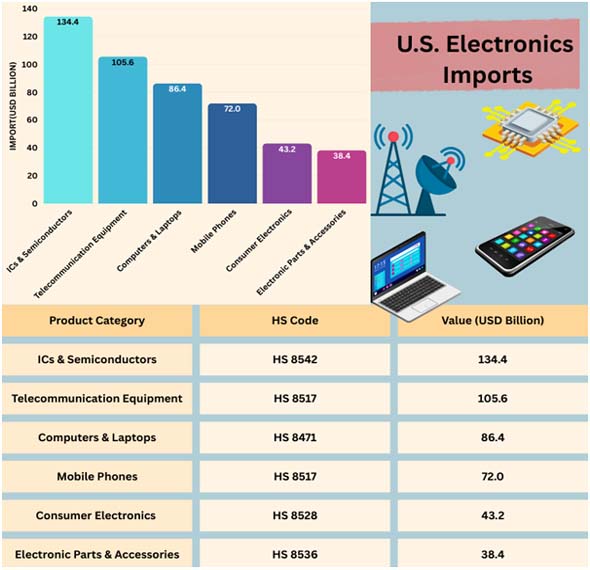

In terms of value, electronics are one of the biggest import categories into the United States. According to U.S. Import Export Trade Data, "electronic products" rank as a top industry, with yearly imports totaling hundreds of billions of dollars. Both completed items and intermediate parts that support American production and consumer demand are often imported from individual Asian vendors for sums ranging from tens to over a hundred billion dollars annually.

Why is the supply chain for electronics dominated by Asia?

Asia's disproportionate influence can be explained by several factors:

- Scale and Specialization: Taiwan Export Data by Import Globals finds that deep supplier networks were established by decades of investment, including contract electronics manufacturers throughout Southeast Asia, wafer fabs in Taiwan and South Korea, and component plants in Japan. Time-to-market and unit costs are decreased via these networks.

- Integrated Production Flows: It is uncommon for components to be completed in a single location. A chip may be created in the United States, manufactured in Taiwan, packaged in Thailand, put together in a phone in Vietnam, and then sent from China, all of which involve crossing international boundaries.

- Infrastructure and Investment: To support electronics production, USA Customs Data by Import Globals indicates that Asian ports, industrial zones, and skilled factory floors were constructed, providing high throughput and economical logistics.

- Policy Environment: long-term industrial policies and public-private coordination in Asian economies helped foster ecosystems that are hard to replicate quickly elsewhere.

This combination makes it attractive for U.S. firms to source and assemble electronics in Asia despite growing policy pressure to reshore or “friend-shore” certain segments.

Concentration Risks: Geopolitics and Supply Disruptions

There are obvious hazards associated with high concentration. Critical component supply can be disrupted by a natural catastrophe close to large factories or ports, a pandemic-related lockdown, a manufacturing closure in a specific region, or trade restrictions with a dominant supplier. This danger is particularly present in semiconductors, where a lack of capacity at a few wafer fabs can stop whole manufacturing lines for consumer electronics or automobiles. USA Import Trade Analysis by Import Globals suggests that the strategic implications of supply-chain concentration are raised by geopolitical tensions between the United States and China or cross-strait concerns affecting Taiwan. Global manufacturing networks may experience cost increases or shortages as a result of policy changes such as export restrictions, tariff adjustments, and export licensing for sophisticated chips.

Diversification, friend-shoring, and Reshoring Initiatives

The United States and commercial companies have adopted several mitigating techniques after realizing the vulnerabilities:

- Onshoring Key Capacity: Government incentives and grants are intended to increase the production of advanced packaging, semiconductor fabs, and certain components in the United States.

- Friend-Shoring: Mexico Import Data by import Globals says that to lessen reliance on a single geopolitical adversary, suppliers are urged to relocate to allied jurisdictions (such as Mexico or ASEAN allies).

- Businesses are investing in improved mapping, multi-sourcing, and strategic stocks for high-risk items to increase supply-chain visibility and stockpiling.

- Investing in regional hubs, such as increasing assembly in Vietnam and Malaysia or nearshoring to Mexico, can reduce lead times while maintaining competitive pricing.

Although these initiatives are making headway, they are limited by the time and money required to establish innovative factories or draw in deep-tier suppliers, as well as the persistent regional cost disparities.

Economic trade-offs between Security, Speed, and Cost

Supply chain changes are a balancing act that involves cost, speed to market, and strategic risk; they are not just an economic choice. As per Vietnam Import Export Trade Analysis, while local manufacturing might improve supply resilience and lessen geopolitical vulnerability, it can also increase production costs and take longer to scale new capacity. These cost increases may result in increased consumer pricing or reduced manufacturer margins for consumer gadgets with narrow profit margins. Governments and businesses may be willing to pay more for strategically important goods, such as sophisticated semiconductors, certain battery chemistries, and telecom backbone equipment, to ensure supply.

The function of Industry and Policy Coordination

The role of government policy is significant. Incentives for home production and U.S. financing for chip fabrication are intended to gradually lessen strategic reliance. USA Import Trade Statistics by Import Globals indicates that Trade policy measures like tariffs, export restrictions, and investment screening can also change sourcing choices, although they may cause temporary disruptions if they aren't used in conjunction with incentives to establish other supply sources. To move supply chains at the scale needed, industry-led cooperation is frequently required (e.g., pooled supplier financing, cooperative investments in regional fabs).

Conclusion

The United States’ dependence on Asian electronics supply chains is the product of efficiency, scale, and decades of industrial development in Asia. That same concentration creates vulnerability to interruptions and geopolitical pressure. Policy and private-sector responses, from onshoring and friend-shoring to better supply-chain mapping and investments in domestic capability, are addressing the problem, but the shift will be gradual. For now, American consumers and firms still rely heavily on Asian partners to deliver the devices and components that power modern life. Import Globals is a leading data provider of USA import export trade data. Subscribe to Import Globals to get more details on global trade!

FAQs

Que. What is the value of U.S. electronics imports in 2023?

Ans. The U.S. imported approximately $480 billion worth of electronics in 2023, making it one of the largest import categories.

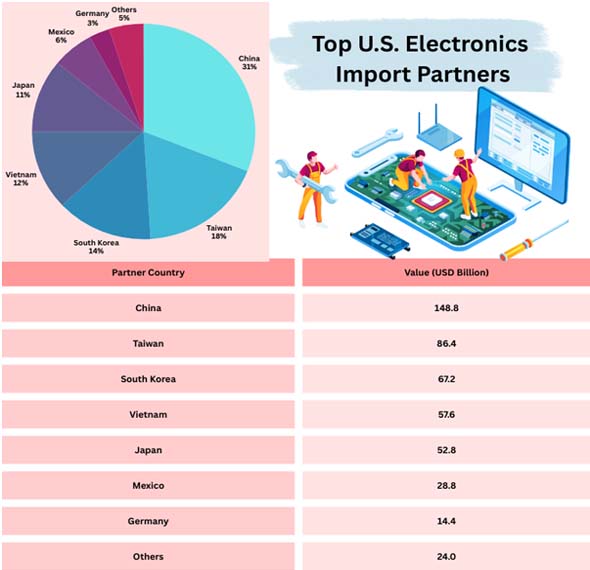

Que. Which country is the largest supplier of electronics to the U.S.?

Ans. USA Export Import Global Trade Data indicates that China is the largest supplier, accounting for about 31% of U.S. electronics imports.

Que. Why does the U.S. depend heavily on Asia for electronics?

Ans. Asia offers cost efficiency, large-scale manufacturing, advanced specialization in semiconductors, and integrated supply ecosystems that the U.S. currently lacks.

Que. How is the U.S. reducing its dependence on Asian electronics imports?

Ans. Through domestic manufacturing initiatives like the CHIPS Act, supply chain diversification to countries like Vietnam and Mexico, and partnerships with allies like Japan and South Korea.

Que. Where can you obtain detailed USA Import Data?

Ans. Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date data.