- Jun 10, 2025

Indonesia's Coal Exports: A Detailed Review

Because of its extensive reserves and well-positioned export infrastructure, Indonesia continues to be the world's top supplier of thermal coal. Coal continued to be Indonesia's top export in 2024, according to Indonesia Export Data From Import Globals, highlighting its importance to the country's economy. This blog explores Indonesia's coal industry's export patterns, markets, costs, and strategic ramifications between 2020 and 2025.

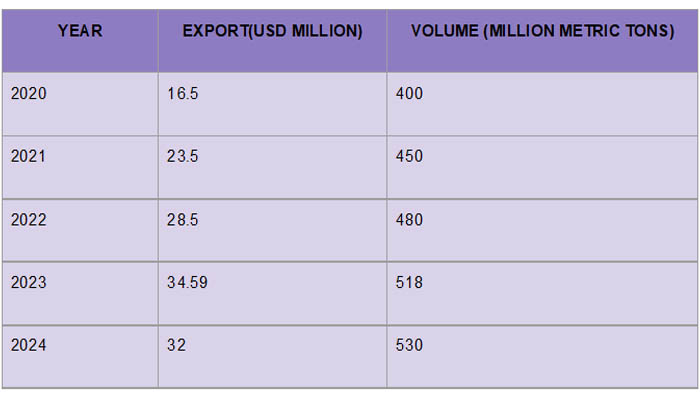

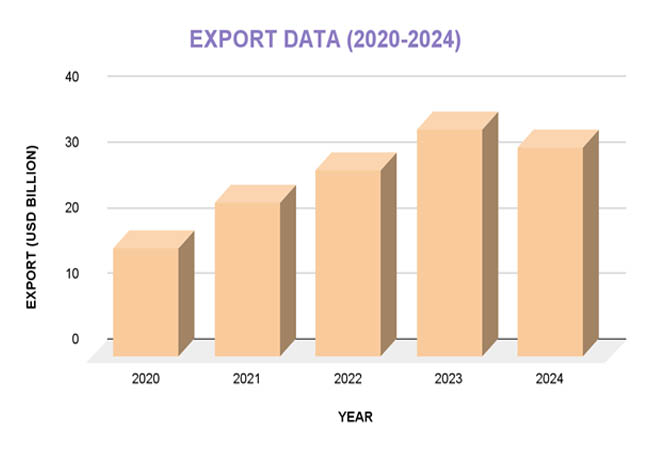

Overview and Data for Exports (2020–2024)

According to Import Globals' Indonesia Import Export Trade Analysis, post-pandemic industrial rebound and worldwide energy shortages, particularly following the disruption of energy markets caused by the Russia-Ukraine war, were the main drivers of the 2021–2023 export value surge. Volumes stayed high even if price corrections in 2024 caused somewhat lower values.

Key Export Locations

The following nations are the main recipients of Indonesia's coal exports. According to Import Globals' Indonesia Import Export Trade Data, these nations are significant users of thermal coal for industrial and electrical production.

China is the biggest buyer, making up more than 40% of all exports. About 215.7 million metric tons of Indonesian coal were imported by China.

With an estimated 108.4 million metric tons received, India is a major importer. A study by Import Globals on Indonesia Export Import Global Trade Data, every year, South Korea imports over 30 million metric tons. Approximately 20 million metric tons are imported annually by the Philippines. Vietnam is an expanding market where imports are rising annually.

Coal's significance to Indonesia

Indonesia's economy depends on coal for some reasons.

Economic Contribution: According to Indonesia Import Export Global Data, Indonesia's economy benefited from coal exports to the tune of almost $34.59 billion.

Employment: More than 200,000 Indonesians work in the mining, transportation, and logistical sectors of the coal business.

Energy Security: Approximately 60% of Indonesia's electricity is generated by coal-fired power plants, guaranteeing a steady supply of energy.

Government Revenue: Through taxes and royalties, the industry makes a substantial contribution to government revenue.

Indonesia's Principal Coal-Producing Regions

The following areas contain the majority of Indonesia's coal reserves:

According to a report by Import Globals on Indonesia Customs Data, East Kalimantan has the biggest coal reserves and accounts for more than 40% of the country's total output.

About 30% of coal production comes from South Kalimantan.

According to Indonesian import data, South Sumatra accounts for about 15% of the country's total output.

With rising investments, Central Kalimantan is becoming a major producer.

Due to the substantial mining infrastructure in these areas, coal extraction and transportation are made more efficient.

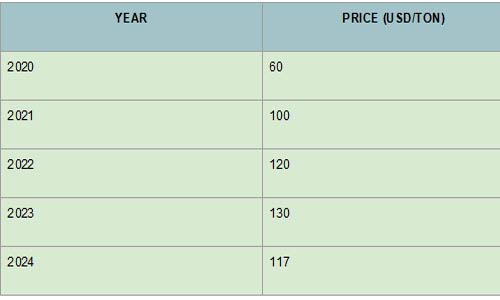

Trends in Prices

Coal prices have fluctuated as a result of global supply and demand dynamics, according to Import Globals' Indonesia Export Data.

Strategic Consequences

According to Import Globals' Indonesia Import Data, Indonesia faces both potential and difficulties in the coal sector:

Prospects:

Revenue Generation: The national economy is supported by consistent coal exports.

Infrastructure Development: In remote areas, coal mining has resulted in better infrastructure.

Regional significance: Indonesia's geopolitical significance is increased by its status as a major coal exporter.

Challenges:

Environmental Issues: The extraction and burning of coal fuels climate change and environmental deterioration.

Price Volatility: Variations in world prices may affect the stability of revenue.

Transition to Renewables: The global move towards renewable energy sources presents long-term difficulties for the coal business, per Indonesia Export Data by Import Globals.

Indonesia is thinking about limiting coal exports in order to preserve domestic supplies and stabilize prices in response to pressures on world prices.

Forecast

The estimate for Coal Exports in 2025 is Cautiously Positive:

Production: Approximately 790 million metric tons are anticipated.

Exports: According to Import Globals' Research on Indonesia Export Import Global Trade Data, it is approximately 540 million metric tons.

Prices: Based on worldwide supply and demand, the Indonesia Export Data has projected that it will average $110 per ton.

With China's demand plateauing, growth in the coal trade is anticipated to be driven by Southeast Asia, especially Vietnam and the Philippines.

Conclusion

Coal continues to be a vital component of Indonesia's export-based economy, contributing significantly to both jobs and national income. Despite obstacles from global energy transitions and environmental concerns, the industry can continue to play a crucial part in Indonesia's economy through prudent management and diversification initiatives.

If you are looking for detailed and up-to-date Indonesia Export Data, You Can Contact Import Globals.

FAQs

Que. Which country is Indonesia's top export destination for coal?

Ans. With more than 40% of all exports, China is the biggest buyer of Indonesian coal.

Que. What is Indonesia's yearly coal production?

Ans. In 2023, Indonesia produced about 775 million metric tons of coal.

Que. How much does Indonesian coal currently cost?

Ans. The average cost of Indonesian coal is approximately $117 per ton as of early 2025.

Que. Which Indonesian regions produce the most coal?

Ans. The main coal-producing regions are Central Kalimantan, South Kalimantan, East Kalimantan, and South Sumatra.

Que. What chances do coal exports from Indonesia have for 2025?

Ans. With prices averaging $110 per ton, it is anticipated that coal exports will amount to around 540 million metric tons in 2025.

Que. Where to obtain detailed Indonesia Export Data?

Ans. Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date Indonesia Export Data.