- Feb 11, 2026

Malaysia's Biggest Exports in 2025–26 Will Be Electronics, E&e, and Palm Oil

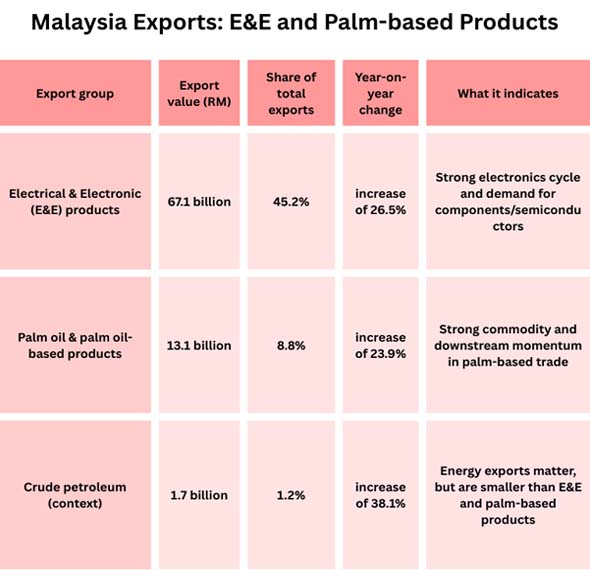

Malaysia enters 2025–26 with an export model powered by two very different—but highly complementary—engines: Electronics & Electrical (E&E) on one side, and palm oil and palm-based products on the other.

Together, they anchor Malaysia’s trade surplus potential, support industrial employment, and influence currency stability. What makes this export mix especially strategic is that each engine responds to a different global cycle: as per Malaysia Import Data by Import Globals, E&E rises and falls with technology and industrial demand, while palm oil is tied to food, oleochemicals, biofuel dynamics, and weather-driven supply conditions.

In 2025–26, Malaysia’s export performance is less about “finding” new pillars and more about strengthening the biggest winners—moving up the value chain in semiconductors and high-value electronics, and expanding the downstream footprint of palm-based exports so earnings become more resilient than raw commodity cycles.

The Export Landscape in 2025–26: Why These Two Sectors Are the Most Important

Malaysia is competitive in exports because it is deeply connected to global supply chains. As per Malaysia Export Data by Import Globals, LE&E has a lot of advantages, like having well-established manufacturing and industrial clusters, being able to make things very accurately, getting a lot of trade ecosystem support in key states, and playing important roles in transnational production networks to boost trade. Palm oil is better since it is a big industry with numerous processing units that make a lot of completed goods, such as oleochemicals, refined goods, and other finished goods.

The difference is evident in 2025–26: to make E&E trade work, it's becoming more and more important to know how much each shipment is worth. As per Malaysia Import Export Trade Data by Import Globals, there are now refined products and higher-margin derivatives like oleochemicals and finished items for both consumers and enterprises.

1) Electronics and E&E: The Main Export Engine for Malaysia

What "E&E" means in Malaysia's Commerce

E&E isn't just one type of product; it's a whole ecosystem that includes semiconductors and electronic parts. Services for creating electronics (such putting them together and testing them) and parts for telecom and computers, as well as industrial electronics and electrical equipment

It's not simply that Malaysia "exports electronics" that makes it a good place to live. As per Malaysia Import Custom Data by Import Globals, it's also a good site to create items since buyers can count on getting the same amount every time, the same quality, and proof of compliance.

Why E&E is doing better in 2025–26

The main reason E&E is doing well is that there is a lot of demand around the world for technology infrastructure and the electronics industry is growing. Malaysia frequently profits from selling more semiconductors and other parts when data centers, servers, consumer electronics, and industrial automation grow.

Even when some categories grew worse, trade performance updates in 2025 kept claiming that E&E was still a source of export growth. As per Malaysia Import Trade Analysis by Import Globals, this shows that the sector's supply chain and order book are still solid.

The new strategy is to go from "volume" to "complexity."

For Malaysia's next phase of E&E expansion, the value of each shipment is very crucial. This means that Malaysia will have a stronger position in higher-value semiconductor segments (like advanced packaging and higher reliability), better speed and predictability (lead times matter as much as price), a wider range of suppliers and more specialization (in materials, precision engineering, and quality systems), and more investment in skilled workers and upgrading of factories. If this trend continues, Malaysia could become a bigger exporter of E&E goods and get a bigger share of the value in each electronics supply chain by 2025–26.

2) Palm Oil: From Making Money on Goods to Strong Exports Downstream

Why palm oil is still so strong?

As per Malaysia Exporter Data by Import Globals, palm oil is a key export since it has a lot of global demand for both food and industrial uses, can be produced and processed on a big scale, has established market channels in Asia, Africa, and parts of Europe, and has a strong downstream chain that goes beyond crude palm oil.

In 2024, Malaysia's palm oil export revenues went up a lot because of higher export volumes and improved income across all palm-based segments and industries. This is crucial for 2025–26 since palm oil is not just a commodity export, but it is also a way to export completed goods, oleochemicals, and refined goods.

The "beyond CPO" benefit: why downstream is crucial

Three ways that palm oil exports from Malaysia aid the country are:

- As per Malaysia Importer Data by Import Globals, higher value capture: refined and derivative products sometimes make more money per tonne than raw exports.

- Different markets and industries demand oleochemicals and final commodities.

- Resilience: Products that come after the raw materials can help defend against major price shifts.

- The performance in 2024 shows that downstream categories (oleochemicals and finished goods) are not just extras; they are vital for long-term stability and bring in a lot of money from exports.

- Things to keep an eye on when palm oil is sent abroad from 2025 to 2026

- The weather and production, such as floods, how easy it is to harvest, and how often crops are harvested, all affect how well palm oil does.

As per Malaysia Import Trade Statistics by Import Globals, the costs of different kinds of vegetable oil around the world (soy, sunflower, rapeseed), the rules and regulations for biofuels in the main areas that make and consume biofuels, and the rules and standards for sustainability that can influence market access.

In this scenario, Malaysia's strategic advantage is that its systems are strong enough to retain supply reliability, quality standards, and downstream capacity even when things shift across the world.

How E&E and Palm Oil Work Together in Malaysia's Export Model

Malaysia's two export engines are strong because they spread out cycle risk:

- E&E is an engine that is connected to technology. When demand for tech is high, E&E boosts total exports by a lot, frequently making up a major part of the monthly export value.

- Palm oil is an industrial commodity. It gives you scalability and steady cash flow, especially when export revenue from downstream grows.

- As per Malaysia Import Shipment Data by Import Globals, these two pillars can support each other during high commerce months: E&E makes up most of the value of exports, while palm oil contributes a lot of extra income and helps keep exports steady when tech cycles calm down.

What "Winning" Looks Like in the Growth Strategy for 2025–2026

As per Malaysia Export Import Global Trade Data by Import Globals, Malaysia is projected to have the best export results in 2025–26 if it focuses on five practical drivers:

- Get higher up the E&E value chain

- More advanced parts, better testing and packing, and more specialized knowledge.

- Increase palm exports to other countries

- Raise the percentage of palm-based exports that are refined, specialist, oleochemical, or finished.

- Make things more productive and reliable

- Export champions are winning more and more on delivery predictability, compliance, and quality consistency.

- Make market diversification stronger

- As per Malaysia Import Export Trade Analysis by Import Globals, diversifying your export destinations will make you less vulnerable to shocks in any one market or region.

- Use policy and investment to protect competitiveness.

- Skills development, industrial upgrading, and making commerce easier are just as important as demand cycles.

Conclusion

Electronics and E&E will continue to be Malaysia's biggest exports in 2025–26. They will fuel high-value trade growth. Palm oil and things derived from it will also be essential because they give businesses a lot of chances and ways to make money. We can't keep sending out the same things if we want to go forward. We need to sell more expensive stuff, such newer technology, more inventive manufacturing services, and a higher share of refined and derived palm products.

Exports might do better and be more steady in 2025–26 if Malaysia keeps making both engines stronger and makes logistics more dependable, compliance easier, and resilience stronger. This is true even though the world is still unstable. Import Globals is a leading data provider of Malaysia Import Export Trade Data.

FAQs

Que. What makes E&E Malaysia's biggest export driver?

Ans. Malaysia is a major exporter of electronics and semiconductor parts and goods because it is so intimately involved in global supply chains for these items.

Que. Is palm oil still significant if Malaysia is a big exporter of technology?

Ans. Yes. Palm oil is a big part of exports and revenues, and palm-based exports that come after the raw commodity trade add value to the industry.

Que. What does "downstream palm exports" mean?

Ans. It means refined products, oleochemicals, and finished palm-based products that are worth more than just crude palm oil.

Que. What are the major threats to these export powerhouses in 2025–26?

Ans. There are changes in worldwide demand that affect both E&E and palm oil, as well as shocks in the weather, prices, and regulations that affect both.

Que. Where to get detailed Malaysia Import Export Global Data?

Ans. Visit www.importglobals.com.