- Oct 03, 2025

Oneplus Smartphones: a Rising Star in Global Trade

OnePlus, which is well-known for its slogan "Never Settle," initially gained notoriety with flagship devices like the OnePlus One, which provided premium features at affordable costs.

As per OnePlus Import Data by Import Globals, the business has added other series to its product line throughout the years, including the flagship OnePlus lineup, the mid-range Nord series, and, more recently, foldable gadgets like the OnePlus Open. As an OPPO subsidiary, OnePlus enjoys the advantages of the wider OPPO Group's strong worldwide distribution network and supply chain, but it also has particular difficulties in maintaining market dominance and differentiating its brand.

The Broad Picture: Analysis of the Global Smartphone Trade

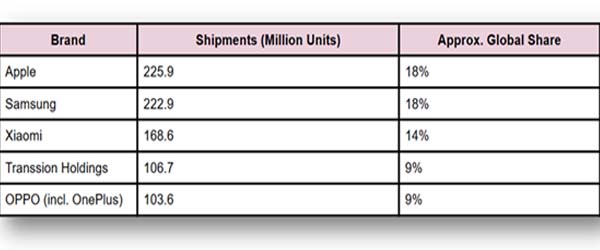

It's crucial to first assess the state of the smartphone market internationally to comprehend OnePlus's success on the global scene. In 2023 and 2024, the worldwide smartphone market showed indications of resurgence, despite initial concerns about market stagnation. Global smartphone shipments reached around 1.22 billion units in 2024, up roughly 7.1% from the year before, according to Canalys and IDC. As per China Export Data by Import Globals, while Chinese companies like Xiaomi, OPPO (which includes OnePlus), Vivo, and Transsion continued to bolster their presence, particularly in Asia, Africa, and Europe, Apple and Samsung maintained their dominance in the top two slots worldwide.

The combined statistic mixes OnePlus and OPPO's core brand, despite the fact that the OPPO Group is still among the top five worldwide smartphone vendors. Therefore, as per OnePlus Import Export Global Data, a detailed examination of geographical statistics and brand-specific shipping estimates is necessary in order to isolate OnePlus's unique contribution.

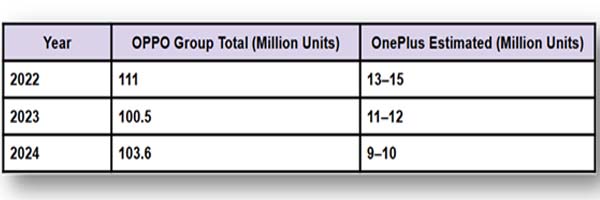

OPPO Group & OnePlus Shipments

India is the Battleground for OnePlus

Outside of China, India has long been the company's largest single market. The youthful, tech-savvy people of India soon grew to associate the brand with high-end Android phones. IDC's most recent data, however, shows that OnePlus's Market Share in India decreased from 6.1% in 2023 to just 3.9% in 2024, indicating a rise in competition from established mid-range rivals like Samsung and Apple as well as up-and-coming sub-brands like Xiaomi and realme.

In 2024, as per India Import Export Trade Data by Import Globals, India shipped close to 151 million smartphones, a little 4% rise over the year before. With a roughly 16.6% market share, Vivo took the lead in this congested sector, while Apple's aggressive entry into India increased its share to 8.2%. In the meantime, fierce competition in the mid-premium market, which was formerly OnePlus's bastion, caused Samsung's share to drop to around 13.2%.

Given that India is one of the biggest smartphone markets in the world in terms of volume, OnePlus's decline there is noteworthy. Its downfall here reflects the larger difficulty the brand has setting itself apart both inside the OPPO group and from other BBK Electronics siblings, such as realme and vivo.

Performance in North America and Europe

As a flagship disruptor, as per USA Import Data by Import Globals, OnePlus made its debut in Western markets, including North America and Europe. An air of exclusivity and excitement was produced by the early "invite-only" sales concept. However, as Chinese companies like Xiaomi and Honor actively expand in Europe while Google, Apple, and Samsung continue to dominate the flagship category, competition has grown fiercer in recent years. OnePlus's market share in the US and Canada is still small in comparison to the two industry titans, Apple and Samsung, which together sell over 80% of smartphones.

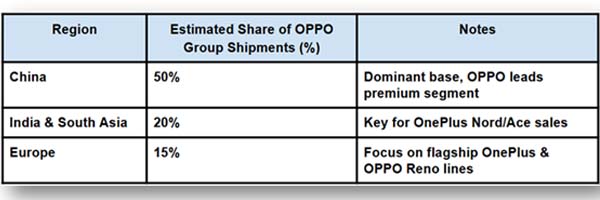

Estimated Regional Split: OPPO Group Incl. OnePlus

Thanks to carrier alliances and devoted user groups, OnePlus maintains visibility despite its very tiny market share. As per OnePlus Export Import Global Trade Data, top-tier features like the Snapdragon 8 Elite CPU and an amazing 6000 mAh battery are included in its most recent flagship, the OnePlus 13, which was released worldwide in January 2025. In an attempt to rival Samsung's Galaxy Z Fold series, the business has ventured into the foldable market with the OnePlus Open.

Asia-Pacific and China: Rivalry but Promise

The market is extremely saturated and quite competitive back home in China. Here, the leading companies include Xiaomi, Huawei, Vivo, and OPPO. According to China Import Trade Analysis by Import Globals, in Q2 2024, OnePlus shipments were included in OPPO's share of the Chinese smartphone market, which was about 16%. Even inside its own business family, OnePlus confronts fierce rivalry, even though particular breakdowns are not made public.

As per Asia Export Data by Import Globals, it's interesting to note that OnePlus has potential in the Asia-Pacific area outside of China, particularly in Southeast Asian nations and developing economies where there is a rising need for mid-range and high-end handsets. Users looking for devices with balanced features without flagship price tags frequently choose devices from the Nord series and Ace line.

Manufacturing Strategy & Supply Chain

The global production and logistics network of its parent company, OPPO, is a huge asset to OnePlus. As per OPPO Import Data by Import Globals, trademark of the brand's "flagship killer" moniker, this synergy enables it to provide premium specifications at reasonable rates while maintaining cost efficiency. But this also implies that OnePlus faces competition from other OPPO brands in terms of internal resources, marketing expenditures, and product emphasis.

This close connection is demonstrated by the choice to combine OnePlus' OxygenOS with OPPO's ColorOS for upcoming software development. It blurs the distinction between what is uniquely OnePlus and what is OPPO, which makes some OnePlus fans wonder if the company can continue to stay autonomous even as it promises quicker upgrades and a more cohesive user experience.

OnePlus International Trade in Numbers

Although BBK and OPPO do not publicly disclose OnePlus's precise standalone shipment numbers, industry analysts such as Import Globals have calculated that, despite OPPO Group's 3% growth to 103.6 million units shipped in 2024, OnePlus's sub-brand saw a shipment decline of more than 20% year over year. As per OnePlus Import Trade Statistics by Import Globals, even while its parent business is still firmly positioned among the top five global suppliers, this sharp difference emphasizes the strain OnePlus faces to make up lost ground.

Future Prospects: Prognosis & Strategic Perspective

According to Import Globals' industry predictions, the worldwide smartphone market may expand between 2025 and 2034 at a compound annual growth rate of around 7-8 percent. As per Global Import Shipment Data, the task for OnePlus is straightforward: maintain, if not surpass, current growth. Expanding the Nord and Ace lines to reach the mid-range market in emerging economies, pushing the boundaries with cutting-edge flagships like the OnePlus 13 and foldables like the Open, and continuing to use OPPO's supply chain for competitive pricing appear to be the three main pillars of the company's strategy. It remains to be seen if this three-pronged approach will be successful. Undoubtedly, OnePlus has to keep developing to preserve its distinct market position and reignite the fervor that made it a global cult favorite among tech aficionados. Import Globals is a leading data provider of OnePlus import export trade data. Subscribe to Import Globals to get more global trade details!

FAQs

Que. What is OnePlus’s global market share today?

Ans. OnePlus’s standalone global share is not published separately, but as part of OPPO, it contributes to the group’s 8–9% global share.

Que. Did OnePlus’s shipments increase in 2024?

Ans. No, according to Omdia, OnePlus shipments fell by over 20%, even though OPPO Group’s total shipments grew.

Que. Which countries are OnePlus’s biggest markets?

Ans. India remains a top market, followed by China, Europe, and North America, where OnePlus sells mainly premium flagships and foldables.

Quw. What is the latest OnePlus flagship device?

Ans. The OnePlus 13, released in January 2025, and the foldable OnePlus Open launched in late 2023 are the latest headline devices.

Que. Where can you obtain detailed OnePlus Import Export Trade Analysis?

Ans. Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date data.