- Sep 12, 2025

Southeast Asia Rising: Vietnam and Indonesia Attract Investment Amid Global Trade Shifts

Vietnam and Indonesia have some of the most active economies in this transition. As per Asia import data by Import Globals, these countries are emerging as top choices for businesses looking to diversify out from China due to a mix of low labor costs, government incentives, infrastructural investment, and expanding industrial bases; this approach is known as "China Plus One."

This blog examines how these nations are dealing with protectionism and trade concerns, providing information on regional investment patterns, industrial development, and sector-specific expansion.

Why Now, Why Southeast Asia?

Since the COVID-19 pandemic, the global trade landscape has undergone tremendous upheaval. Based on USA export data by Import Globals, global corporations have been forced to search for other manufacturing hubs due to ongoing supply chain problems, tariffs, and tensions between the United States and China. Emerging Asian countries benefit from this realignment, especially those with stable political systems, reform-minded administrations, and trade access thanks to agreements like the Regional Comprehensive Economic Partnership (RCEP).

This change in direction is advantageous for Vietnam and Indonesia because

- A youthful, economical workforce

- Changes in pro-business policies

- Large-scale manufacturing foreign direct investment (FDI)

- Growth in logistics and strategic location

- Incentives for high-tech and EV investments

Vietnam’s Economic Advantage: Southeast Asia's Leading Exporter

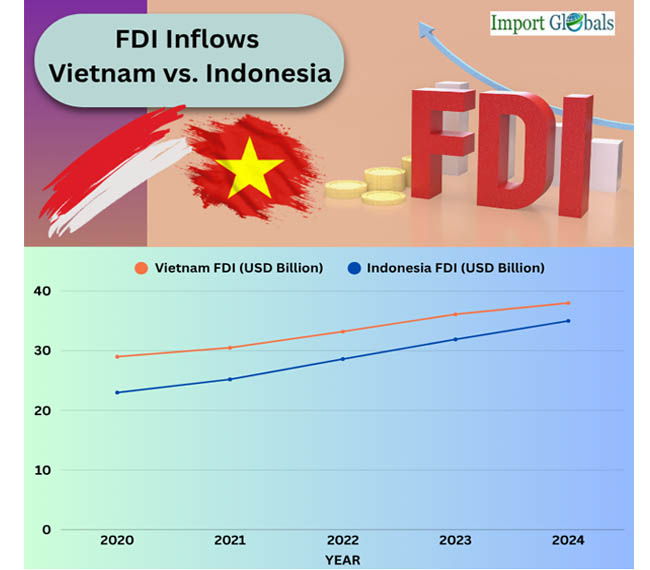

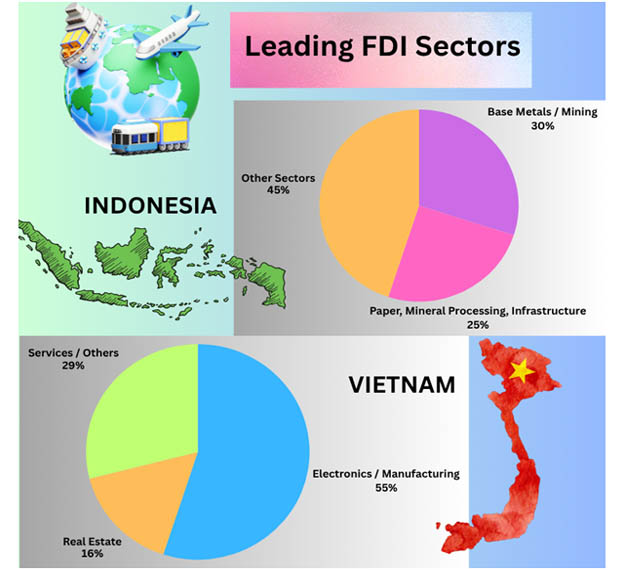

Vietnam has rapidly developed into a major regional manufacturer. It is a preferred location for businesses moving manufacturing out of China due to its extensive integration into global supply chains, especially in the areas of electronics, textiles, and equipment. According to Vietnam Import Data by Import Globals, Vietnam received $36 billion in foreign direct investment in 2023, a significant rise from $29 billion in 2020. Big international companies like Foxconn, Samsung, and Apple have already increased their presence in the nation.

Based on Vietnam Import Export Trade Analysis, in order to provide Vietnam with unmatched access to international markets, the government has also negotiated a number of free trade agreements (FTAs), such as the Regional Comprehensive Economic Partnership (RCEP) and the EU-Vietnam FTA. Its allure is increased by its advantageous location along important shipping lanes and its quickly expanding port facilities.

Highlights:

- From $29 billion in 2020 to a record $38 billion in 2024, FDI inflows increased.

- The production of electronics and semiconductors is being expanded by major investors like as Samsung, Foxconn, and Intel.

- In response to investor demand, industrial park growth has accelerated, rising 17% between 2020 and 2025.

- Vietnamese goods have better access to European markets thanks to the favorable EU-Vietnam Free Trade Agreement (EVFTA).

Indonesia's Accelerating: The Infrastructure and EV Magnet

The largest economy in Southeast Asia, Indonesia, has a distinct but complementary economic narrative. It is drawing investment in infrastructure, digital transformation, and electric vehicles (EVs) by utilizing its vast customer base and wealth of natural resources. Based on Indonesia Import Data by Import Globals, the largest economy in Southeast Asia, Indonesia, has experienced a boom in investment due to its aggressive infrastructural and industrial programs. FDI increased to nearly $35 billion in 2023 from $23 billion in 2020. Much of this investment is focused on the electric vehicle (EV) industry since the government wants to use Indonesia's enormous nickel deposits to establish the country as a global center for battery manufacturing.

With significant port, highway, and industrial park developments now in progress, infrastructure continues to be a top priority. As per Indonesia Import Trade Statistics by Import Globals, these advancements are in line with Indonesia's "Making Indonesia 4.0" plan, which places a strong priority on sustainable manufacturing and high-tech businesses.

Highlights

- Between 2020 and 2024, FDI increased from $23 billion to $35 billion.

- China and South Korea's investments in the battery ecosystem and nickel mining are supporting the growth of EV manufacturing.

- To draw in investors, government initiatives like the Job Creation Law and Omnibus Law streamline labor and land regulations.

- With the help of Hyundai, LG Energy, and CATL, Indonesia hopes to become an EV powerhouse in Asia.

Special Economic Zones and Industrial Parks: Areas of Rapid Development

To draw in foreign investment, both nations have actively created industrial parks and special economic zones (SEZs). Since 2020, as per Vietnam Import Trade Analysis by Import Globals, Vietnam's need for industrial land has grown by more than 17%, while Indonesia has experienced a 20% growth. For businesses wishing to relocate swiftly and affordably, these zones provide ready-built infrastructure, simplified rules, and tax benefits.

Realigning Trade: Tensions in International Trade and the Emergence of the China+1 Strategy

The U.S.-China tariff war, COVID-19, and, as per USA Export Data by Import Globals, most recently, the rise of protectionist policies among major countries have all caused disruptions to global commerce in recent years. Multinational corporations have been forced by these events to reconsider their excessive reliance on Chinese manufacturing. Many responded by implementing the "China +1" strategy, which aims to keep a manufacturing base in China while establishing alternative businesses abroad.

Leading the way in this approach are Vietnam and Indonesia. Vietnam has a long history of exporting textiles and electronics, a trained labor population, and is geographically close to China. In the meantime, as per Indonesia Export Import Global Trade Data, Indonesia has a sizable domestic market, a wealth of natural resources, and rising significance in industries like infrastructure and electric vehicles (EVs).

The "China Plus One" policy is one of the major developments influencing Southeast Asia's ascent. In order to lower risk and expenses, multinational corporations use this strategy, which involves maintaining some manufacturing in China while shifting a portion abroad, particularly to nations like Vietnam, Indonesia, and India. This change is motivated by risk diversification, access to new geographical markets, and cost concerns. As per Indonesia Import Data by Import Globals, Vietnam and Indonesia are essential to the future of international commerce because they provide stability as well as advantageous access to important trade routes.

For instance:

- Apple has moved some of the production of its iPads and AirPods to Vietnam.

- Southeast Asia is now where Panasonic and Sony have extended their production outside of China.

- Indonesia is being used by automakers to assemble EV batteries and vehicles.

- Regional trade maps are changing as a result of this trend, with ASEAN economies emerging as vital centers for global manufacturing and supply chains becoming more multipolar.

Conclusion

As per Southeast Asia Import Export Trade Data, Vietnam and Indonesia are anticipated to benefit even more as more businesses shift their operations to reduce geopolitical and tariff-related concerns in:

- High-value production (semiconductors, electronics)

- Green industries (solar components, batteries, and EVs)

- Intelligent logistics and infrastructure

It is anticipated that Vietnam and Indonesia will continue to gain from continuous supply chain diversification in the future. With strategic investments in digitization, sustainability, and trade infrastructure, together with the Indo-Pacific's geopolitical alignment, both nations are positioned as essential participants in the global economy.

Analysts predict that, if policy stability and infrastructural expansion continue, Vietnam and Indonesia may be able to compete with South Korea and Mexico by 2030 in terms of export volumes and industrial capacity. Import Globals is a leading data provider of Indonesia import export trade data. Subscribe to Import Globals to get more global trade details!

FAQs

Que. Why are companies moving from China to Southeast Asia?

Ans. Rising labor costs, tariffs, and geopolitical tensions with the U.S. are pushing firms to diversify production to countries like Vietnam and Indonesia.

Que. What sectors are booming in Vietnam and Indonesia?

Ans. Vietnam leads in electronics and apparel; Indonesia is growing in EVs, mining, and infrastructure.

Que. Are these trends short-term?

Ans. No. The realignment is part of a long-term supply chain diversification strategy that’s expected to continue through 2030 and beyond.

Que. Is Southeast Asia replacing China in manufacturing?

Ans. Not entirely; China remains dominant, but Southeast Asia is increasingly becoming a complementary hub in global supply chains.

Que. Where can you obtain detailed Vietnam Import Shipment Data?

Ans. Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date data.