- Jun 30, 2025

Tanzania Import Data Analysis

Tanzania's economy, which is one of the fastest-growing in East Africa, is fueled by mining, tourism, agriculture, and a developing manufacturing sector. The nation, which has a population of over 65 million, has advanced significantly in terms of industrialization, digital transformation, and infrastructure development. Despite global economic shocks, Tanzania has maintained a steady GDP growth rate over the previous ten years, averaging between 4% and 6%, according to Tanzania Import Trade Analysis by Import Globals. The government has aggressively pushed initiatives to draw in foreign investment and diversify trade, and the Tanzanian shilling (TZS) has experienced modest inflationary pressure. Businesses, investors, and politicians must comprehend the import structure and trade dynamics of the nation as it moves closer to achieving its Development Vision 2025 goal of a semi-industrialized economy by 2025. Insights into Tanzania's main import categories, important trading partners, and economic ramifications are explored in this blog, which explores the country's import data from 2020 to 2024.

Tanzania Import Value

Tanzania Import Value

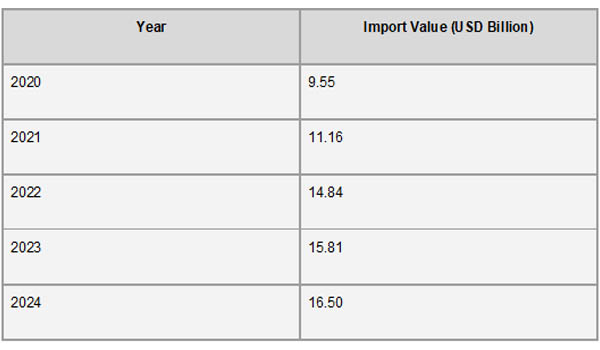

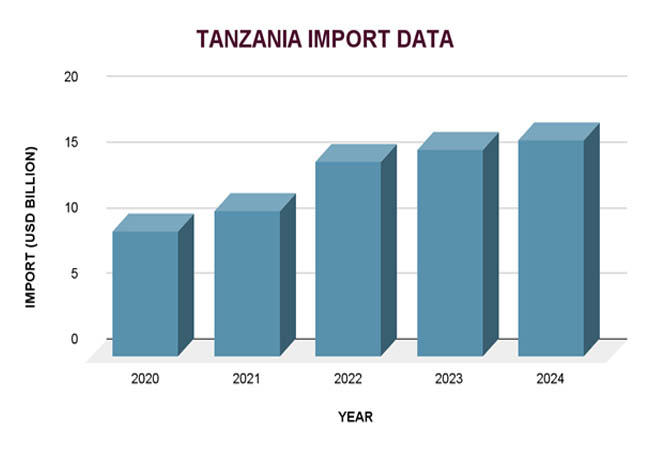

Over the last five years, Tanzania's import value has steadily climbed, which is indicative of the nation's growing economy, rising consumer demand, and heightened industrial activity. According to Tanzania Export Data From Import Globals, the nation imported commodities valued at about USD 9.55 billion in 2020. This amount increased yearly, reaching an anticipated USD 16.50 billion in 2024. Imports of necessities, including refined petroleum, machinery, automobiles, electrical equipment, and food items, are mostly responsible for this growth. The government's drive for industrialization and infrastructure development, which necessitates a broad spectrum of capital goods and inputs made abroad, is reflected in the increase in imports.

Tanzania's urbanization and population growth have also contributed to the rise in import value by increasing demand for energy resources, cars, and building materials. Although robust trade partnerships and regional integration initiatives have helped steady the flow of goods, the Tanzanian shilling's gradual decline against the US dollar has resulted in somewhat higher import costs. Overall, the increasing import trend indicates a rising reliance on foreign commodities to support domestic development and provides insight into important sectors of the nation's economic change, according to Tanzania Import Data From Import Globals.

Major Import Product Categories

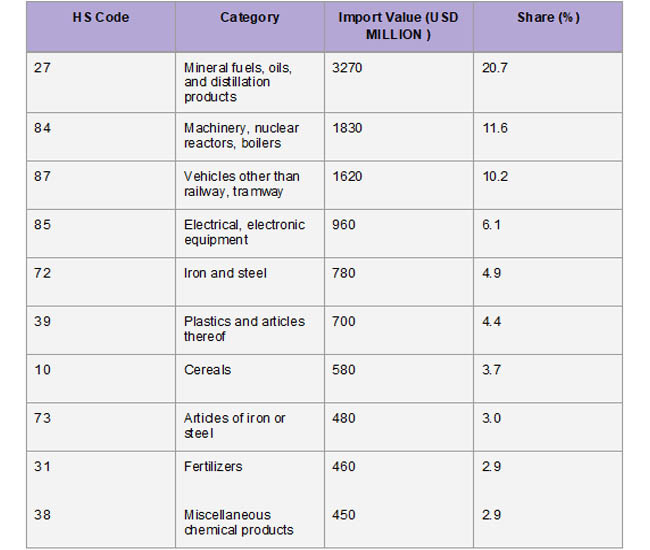

A small number of high-value product categories that are essential to Tanzania's industrial requirements and economic growth dominate the country's import structure. Mineral fuels and petroleum products (HS Code 27) are the largest import category, with approximately USD 3.2 billion in 2023 alone, according to research by Import Globals on Tanzania Import Trade Statistics. These are crucial for supplying energy, industry, and transportation throughout the country. Closely behind are automobiles (HS Code 87) and machinery and mechanical appliances (HS Code 84), which together account for a sizeable amount of the nation's imports. The government's emphasis on industrialization and modernization is reflected in the products' primary uses in public infrastructure projects, mining, building, and agriculture.

Iron and steel (HS Code 72), fertilizers (HS Code 31), and electrical machinery and equipment (HS Code 85) are other noteworthy categories. Cereal imports (HS Code 10) continue to be significant, underscoring disparities in regional agricultural output and issues with food security. Furthermore, the rapidly expanding construction and packaging sectors are supported by imports of plastics (HS Code 39) and iron or steel items (HS Code 73). According to Import Globals' Tanzania Import Shipment Data, these import patterns highlight Tanzania's continuous progress while also highlighting chances for domestic production and import substitution to lessen future reliance on imported commodities.

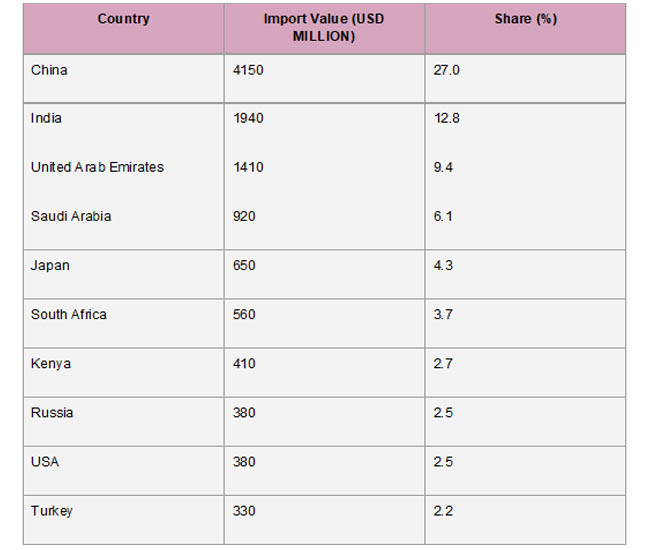

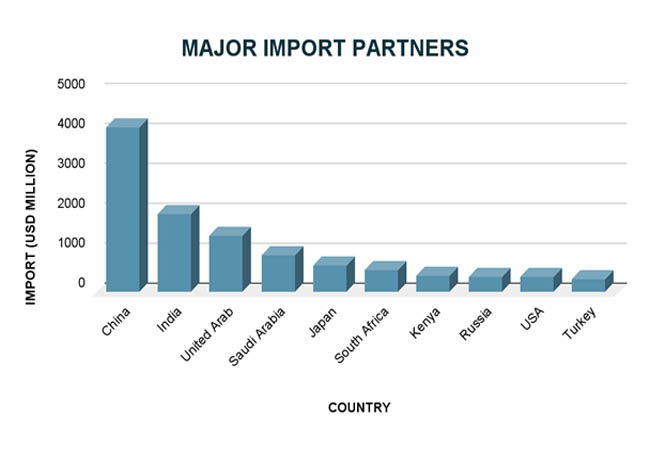

Major Import Partners

Tanzania’s trade relationships are globally diverse, with Asia dominating as the leading source of imports. China is Tanzania's largest import partner, supplying more than USD 4.1 billion worth of commodities in 2023. A research by Import Globals on Tanzania Import Export Trade Analysis states that the main imports from China include textiles, electronics, building materials, and machinery, which reflects China's robust industrial base and low prices. The second-largest partner is India, which imports over USD 1.9 billion worth of goods while exporting a variety of goods such as cars, pharmaceuticals, food items, and petroleum products. For Tanzania's energy needs, Saudi Arabia and the United Arab Emirates (UAE) are important suppliers of refined petroleum and other mineral fuels.

Outside of Asia, major donors include the United States, South Africa, Kenya, Japan, and Russia. While Kenya, Tanzania's neighbor and a member of the East African Community (EAC), is a major player in regional commerce with agricultural and industrial goods, Japan primarily exports automobiles and machinery. South Africa and Turkey also maintain robust export flows to Tanzania, particularly in metals, machinery, and chemicals. These varied collaborations show Tanzania's deliberate attempt to preserve a robust and balanced import portfolio while promoting diplomatic and commercial relations across continents, according to Tanzania Export Import Global Trade Data by Import Globals.

Strategic Consequences

Import diversification: It is necessary to reduce supply chain risks, as seen by Tanzania's reliance on a small number of import categories, such as machinery and mineral fuels. Trade Partnerships: Improving economic resilience and lowering reliance on established partners may be achieved by fortifying trade ties with emerging markets. Infrastructure Development: According to Import Globals' Tanzania Export Data, infrastructure investment is essential for enabling more efficient import procedures and lowering logistics and transportation expenses.

Tanzania's growing reliance on imports, especially for machinery, automobiles, and fuel, presents both opportunities and risks. In addition to promoting industrial expansion, modernization, and infrastructural development, these imports expose the economy to outside shocks, including exchange rate volatility and worldwide price swings. Strategic imbalances in trade talks may result from Tanzania's strong reliance on a small number of nations, such as China and India, for essential products, according to the Tanzania Import Export Global Data. Furthermore, the ongoing trade deficit puts pressure on Tanzania's foreign exchange reserves and strengthens the value of the local currency. But this import trend also offers the government a chance to promote import substitution by funding domestic manufacturing, agro-processing, and energy generation—actions that might boost economic resilience, generate employment, and lessen reliance on imported commodities in the long run.

Predicted Trend

According to Import Globals' Tanzania Import Export Trade Data, industrialization, urbanization, and rising consumer demand are expected to fuel the import value's continued upward trajectory at an estimated growth rate of 5–6% per year. Tanzania’s import trend is expected to continue its upward trajectory over the next five years, driven by ongoing industrialization, infrastructure expansion, and population growth. As the country moves toward its Development Vision 2025 goals, demand for capital goods, construction materials, machinery, and refined fuels will remain high. The government’s focus on large-scale projects, such as roads, ports, energy, and railways, will further increase the need for imported equipment and technology. However, gradual improvements in domestic manufacturing and regional trade integration through the African Continental Free Trade Area (AfCFTA) may help moderate the growth rate of imports in the long term, especially in sectors where local production can substitute for foreign goods.

In conclusion

Tanzania's 2020–2024 import statistics show a developing economy with rising demand for a wide range of goods. Although Tanzania has made progress in growing its import base, strategic diversification and infrastructure development are urgently needed to guarantee sustainable economic growth and resilience against changes in international trade, per a study by Import Globals on Tanzania Import Custom Data.

Tanzania is undergoing significant modernization, infrastructure expansion, and industrial growth, which is reflected in its import landscape. The country's reliance on outside sources for gasoline, machinery, and necessities is shown by the rising import value, which also shows economic vitality and rising demand. The key to striking a balance between growth and sustainability will be regional cooperation, investment in local sectors, and strategic diversification of trade partners. Long-term economic resilience and self-reliance will depend on focused policy reforms and careful import control as Tanzania moves closer to being a semi-industrialized economy by 2025.

If you are looking for detailed and up-to-date Tanzania Import Data, you can contact Import Globals.

FAQs

Que. What are the most popular imports into Tanzania?

Ans. Among the top import categories are iron and steel, machinery, cars, electrical equipment, and mineral fuels.

Que. Which nations are the main import partners of Tanzania?

Ans. Japan, Saudi Arabia, the United Arab Emirates, China, and India are important import suppliers.

Que. How has the import value of Tanzania evolved?

Ans. From $9.55 billion in 2020 to an expected $16.50 billion in 2024, imports have risen considerably.

Que. What aspects of the economy affect Tanzania's import patterns?

Ans. Import trends are strongly influenced by GDP growth, inflation rates, currency rates, and industry demand.

Que. Where to obtain detailed Tanzania Import Data?

Ans. Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date Tanzania Import Data.