- Jan 27, 2026

The Role of Oil in Iran's Trade with the World and the U.S. Policy Response

Iran's oil is more than just a product. It's the quickest method for the government to receive hard currency, pay for imports, and build ties between Asia and the Middle East.

Iran has been able to sell more non-oil goods over time, but crude oil, condensate, and petroleum products are still the most important trade flows. This is because they affect Iran's ability to pay its bills, keep its exchange rate stable, and get around restrictions on certain goods through indirect channels.

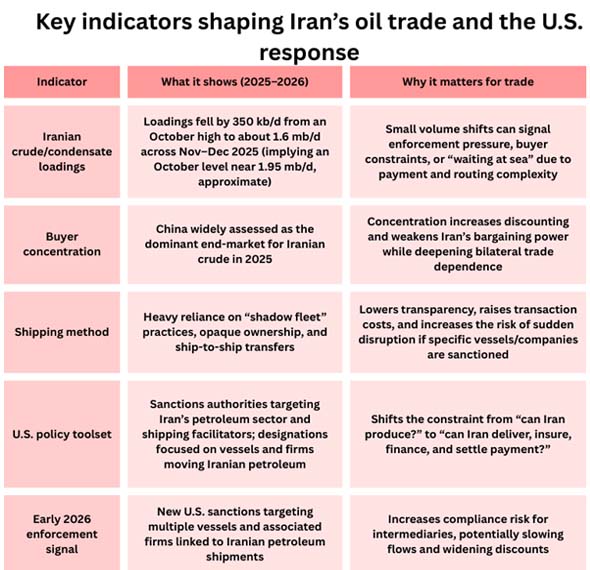

As per Iran Import Data by Import Globals, one reason why oil's role has grown considerably more essential in 2025–2026 is that Iran's oil trade is now more "structure-driven" than "market-driven." Just like worldwide demand, the mix of destinations, modes of transportation, prices, insurance workarounds, and payment pathways are all affected by the level of sanctions pressure and enforcement.

Fewer Doors and Deeper Pipes Will Help Iranian Oil Get to the Rest of the Globe in 2025–2026

Iran's oil exports have been increasingly concentrated throughout this time. There are fewer big end-buyers, but the procedures are more complicated. Asia is the primary player in the world market, and China is thought to be the main consumer of Iranian oil. Smaller volumes can also come through hubs that make it harder to trace where they came from by transshipment, mixing, or relabeling. As per Iran Export Data by Import Globals, this concentration has two effects on trade:

Discount Dependence: The seller can't set prices as high when there aren't many customers. Iran has to sell its oil for less than the market price to make up for the danger of sanctions, lengthier shipping times, and limited access to money.

Logistics Dependence: The trade depends on a "shadow" services ecosystem that includes ship-to-ship transfers, unclear ownership structures, flag changes, and complex business layers that keep cargo moving even when there are problems.

The Chokepoint Factor: Oil Routes and the Strait of Hormuz's High Price

Because of where it is, Iran is an unavoidable reference point for global energy risk. The Strait of Hormuz is a big way for oil to get around the world. It links Gulf producers to markets in Asia. As per Iran oil Exports by Import Globals, if tensions with Iran escalate, oil prices could go up even if the supply isn't affected right away. This premium is significant for Iran's commerce since higher prices can make up for fewer quantities, and more tensions can lead to more enforcement and more sanctions that can also cut volumes.

What the Data Shows: Exports, Loadings, and the Change at the End of 2025 That Affected Early 2026

There was a clear pattern in late 2025: Iranian loadings decreased down from a previous high, and some volumes started to build up in floating storage. As per Iran Customs Data by Import Globals, when there is that kind of buildup, it usually signifies one of three things: the buyer is unsure, there are problems with payment or settlement, or enforcement pressure is slowing down the latter stage of delivery. As we enter 2026, the U.S. measures against the shipping layer have made it evident that Iran's oil trade results depend on more than just price; they also depend on policy. Iran's oil exports are like the air we breathe.

Oil money helps pay for fundamental goods that are brought in, such food, medicine, and parts for factories. It also helps with strategic procurement, which can be hard to do when there are penalties. When oil export revenue stops coming in, it has an immediate influence on three things: inflation, the stability of the currency, and the ability of industry to grow (because it's harder to get money for new parts and capital goods). This is why oil is such a large element of Iran's trade in general. Even businesses in Iran that don't export oil nonetheless work in an economy where oil sales have a huge impact on the exchange rate and how money flows.

Why Oil Revenue is Higher Than Trade: It Drives the Ability to Import

The U.S. has been paying more and more attention to the real things that make Iran's oil trade viable, such as shipping, managing vessels, front companies, and networks that help move and sell oil. As per Iran Shipments Data by Import Globals, the goal is not to stop every barrel at the source, but to make it harder to turn oil into money by making it tougher to access to the financial system, pay for items, and move oil.

In early 2026, more evidence suggested that the US was ratcheting up its attacks on ships and firms that were connected to Iranian oil supplies. These attacks were said to be part of a bigger "maximum pressure" plan. It's vital to know this since oil transactions don't only happen between "a buyer and a seller." It's also about the ecosystem that includes shippers, managers, port services, insurers, ship registries, and banks. When those middlemen fear there is a bigger threat, trading slows down, even if people still want to buy.

The U.S. policy reaction in 2025–2026: going after the "delivery system"

Iran's oil trade arrangement in 2025–2026 encourages a "small club" dynamic:

- China is the biggest buyer, and Iran can keep the numbers moving, but it often needs to give up discounts and flexibility to do so.

- Intermediary hubs are areas where cargo can be mixed or sent somewhere else. As per USA Import Data by Import Globals, This keeps things moving, but it also makes things less apparent and more convoluted.

- Higher compliance walls in the West: Companies that do business with Europe and the US don't get into difficulty, but this limits their lawful trade options.

- As a result, Iran's oil trade becomes less connected to the rest of the world and more attached to a narrow network that is willing to take risks. That can keep exports moving, but it also makes them more likely to be targeted by enforcement. Import Globals is a leading data provider of USA Import Export Trade Data.

How This Changes Iran's Connections With Other Oil-producing Countries

1) More Strict Enforcement and Consistent Demand: If enforcement gets tougher and Asian demand stays the same, Iran may keep exporting, but with higher discounts, longer delivery times, and more storage-at-sea activities.

2) Weak Market and Law Enforcement: When prices fall a lot over the world, discounts harm more. Iran would have to either sell more (which is hard when you're under pressure) or give buyers more concessions, which would limit net revenue and the ability to import.

3) Geopolitical Shock Premium: As per Iran import data by Import Globals, prices could go up around the world if tensions rise in critical waterways. Iran might make more money if prices go up, but the same tensions could also make people more compliant, which could hurt revenue.

Conclusion: Oil is still Iran's principal trading good and the place where policy fights take place.

Oil will continue be the most significant thing that Iran trades with the rest of the world in 2025–2026. This is because it is the quickest way to receive foreign money and the most important thing in terms of geopolitics. The U.S. response is shifting from only stopping production to also stopping the distribution and monetization chain, including transportation networks.

Because of this, the trade system is built on more than just supply and demand throughout the world. The warmth of enforcement and the risk appetite of intermediaries also have a large impact on volumes, routes, and income. Analysts need to pay attention to more than just barrels; they also need to pay attention to boats, network, and the areas where oil turns into cash. Import Globals is a leading data provider of Iran Import Export Trade Data.

FAQs

Que. Why does Iran sell less oil to other countries in 2025–2026?

Ans. As per Iran export data by Import Globals, Buyers have more leverage over prices because of sanctions, longer trade supply chains, and fewer options or varieties.

Que. Who buys most of Iran's oil right now?

Ans. Most people think that China is the main place where the goods go, and that smaller amounts come through indirect routes and transshipment.

Que. What is the "shadow fleet," and why does it matter?

Ans. This means that there are ships and networks that carry oil without identifying where it comes from or who owns it. It is important for keeping trade going during sanctions, but it is also open to attack.

Que. Do the U.S. sanctions stop Iran from selling oil?

Ans. They can make exports take longer, cost more, and change their routes, but it's hard to stop them totally when there is demand and trade passes through middlemen.

Que. Where to get detailed Iran trade data?

Ans. Visit www.importglobals.com.