- Sep 24, 2025

What the Indonesia–EU Trade Deal (Cepa) Entails and Why It's Important

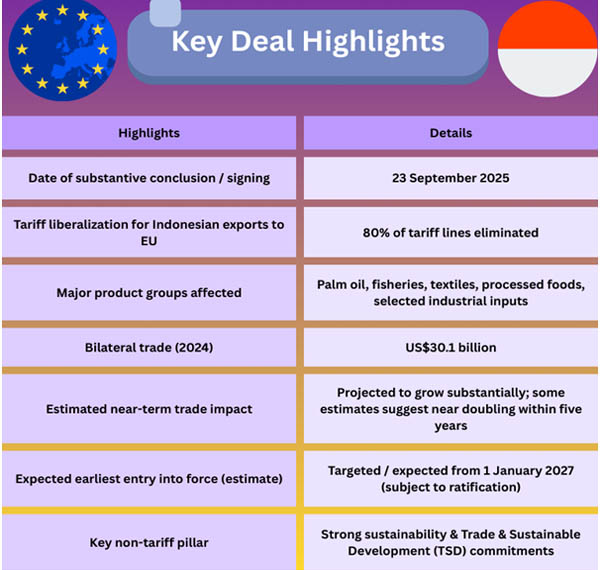

The pact marks a big change in trade between Europe and Southeast Asia after over 10 years of talks. It pledges to lower tariffs on Indonesian exports to the EU, make the sustainability chapter stronger, and give additional protections for investments. As per Europe Import Data by Import Globals, the deal still has to be ratified, so its main promises are important political steps right away, but they won't have any real-world consequences on companies and supply chains for a while.

The essential components of the Agreement are What it States it Will Do

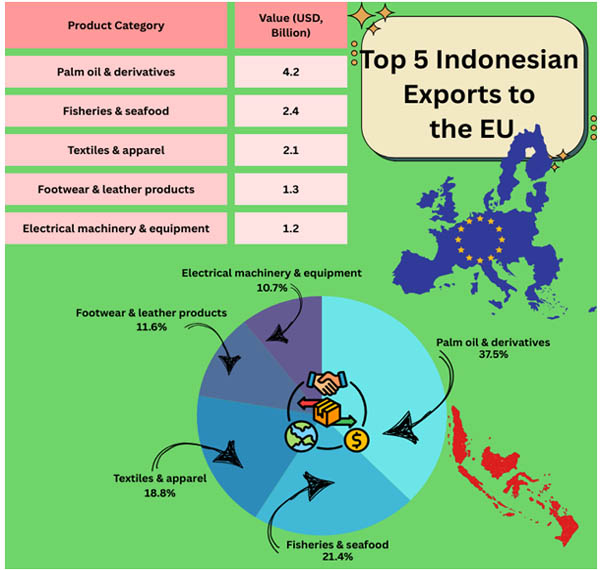

The most intriguing component is that tariffs will be lifted on roughly 80% of Indonesian exports to the EU (by tariff lines). This includes palm oil, seafood, textiles, and certain processed goods. According to Europe Export Data by Import Globals, from the European Commission and Indonesia, the CEPA is a package that combines market access, investment protection, and a big framework for sustainable trade that aims to safeguard the environment, control deforestation, and raise labor standards. Official statements also say that commerce between the EU and Indonesia, which is estimated to be about US$30.1 billion in 2024, will expand a lot. Some estimates say that it will almost double within five years of the deal going into effect.

How the deal will Impact the Flow of Commerce

Removing tariffs on a lot of Indonesian exports will cut costs for Indonesian manufacturers in EU markets and make a wider variety of agricultural and light-manufactured commodities more competitive. As per Indonesia Import Export Trade Data by Import Globals, European businesses will now have easier access to Indonesian markets, particularly for machinery, some processed foods, and services.

According to Import Globals' study on Europe Import Export Global Data, the investment protection chapter will probably also bring more European money into areas related to important minerals, energy, and green technology. The deal can lower prices and shorten supply chains for EU businesses that depend on imports, such as chemicals and textiles that use Indonesian materials. This is better than relying on suppliers that are farther away.

Who wins, who Loses, and What are the Impacts on Distribution?

Indonesian exporters of palm oil, seafood, and clothes, as well as European companies and importers that get their goods from Indonesia, are expected to be among the winners. People in the EU could be able to buy some food and textile items for less money. As per Europe Import Custom Data by Import Globals, EU producers that compete directly with Indonesian commodities that are vulnerable to tariffs (for example, parts of European agriculture and small-scale processors) might be among the losers. The effect on distribution will be different in each member state. Countries with big agro-industrial sectors may ask for protection or transitional measures during ratification.

Concerns about Deforestation, Sustainability, and Safety

Sustainability has been a big political issue for the CEPA. In Europe, palm oil is problematic since it is linked to deforestation and loss of biodiversity. The CEPA is said to have a strong sustainability chapter that aims to make commerce more compatible with environmental and labor norms. But the EU is also having trouble with the timing of its bigger policies. For instance, there is still no agreement on when the EU's laws about importing goods that cause deforestation will be enforced. As per Indonesia Import Trade Analysis by Import Globals, those disputes are important because they will decide whether Indonesian exporters will still have to deal with practical compliance issues even after tariffs go down.

Risks throughout the Ratification Route and Timetable

The CEPA was politically finalized on September 23, 2025, but it still has to be approved by the governments of the countries involved before it can go into effect. The EU side contains measures for consultation and ratification by the European Commission, the European Parliament, and perhaps member states. As per Indonesia Export Data by Import Globals, Indonesia's legislature must also accept the agreement. Official communications say that the earliest possible goal for putting the agreement into effect is around January 1, 2027. However, the actual timetable will depend on how politics work, what member states are worried about (especially when it comes to environmental and agricultural protections), and any rules that need to be written to make the agreement work.

What this means for Geopolitics and Strategy

The CEPA gives the EU a stronger economic position in Southeast Asia, where rivalry for regional power is fierce. As per Europe Import Data by Import Globals, the EU is strengthening its connections with Indonesia, a populous, resource-rich island that is important to supply chains for crucial minerals. This helps the EU diversify its alliances and not rely too much on one supplier. For Indonesia, the deal opens up more options for exports and foreign direct investment. It also gives the government more power to set requirements for sustainability in business across the world. So, in the middle of the decade, the transaction sits at the crossroads of business and politics.

What does this signify for businesses in the near future?

If a business wants to earn money, it should start looking at the CEPA's regulations of origin, supply chain documents, and how well they meet its requirements for sustainability. As per Europe Import Trade Statistics by Import Globals, European companies and importers should look for ways to save costs, but they should also think about how their reputation can suffer if suppliers don't follow environmental rules. Businesses will need guidance from attorneys and customs experts to fill out tariff-preference forms and understand about transitional safeguard measures that might be put in place while the agreement is being ratified.

In Short

The EU–Indonesia CEPA is a big deal for commerce since it has issues with politics, the economy, and how things work. Import Globals' Indonesia Import Data says that it strikes a balance between lowering tariffs and safeguarding investments. If it passes, a lot of businesses will change how they do things. Import Globals is a leading data provider of Europe import export trade data. Sign up for Import Globals to find out more about trade throughout the world!

FAQs

Que. Is the deal already in effect?

Ans. No. As per Europe Import Export Trade Analysis by Import Globals, the CEPA came to a significant completion on September 23, 2025, but it still has to be confirmed and put into effect. The earliest realistic aim proposed is January 1, 2027, but this is still up for approval.

Que. Which items will gain the most from lower tariffs?

Ans. Palm oil, fisheries, textiles, and some processed foods and light industrial lines are some of the primary industries that will benefit from the end of tariffs.

Que. Will the pact make Indonesia cease doing things that lead to deforestation?

Ans. There is a sustainability component in the deal and promises to meet trade-related environmental criteria. However, enforcement and the balance with EU deforestation restrictions are still politically contentious and will be worked out throughout implementation.

Que. How soon will companies see the effects?

Ans. Companies will start to feel the consequences of preparation (supply-chain planning, documentation, certification) right away. The true effects on prices and trade volume will be noticed after ratification and the gradual removal of tariffs, which will probably take many years.

Que. Where can you obtain detailed Europe Export Import Global Trade Data?

Ans. Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date data.