- Jan 30, 2026

Aerospace and Defense Exports: France’s High-Value Trade Advantage (2025–26)

France’s trade advantage in 2025–26 is increasingly defined by high-value, high-complexity exports—and no two sectors represent that better than aerospace and defense. These industries don’t compete on low costs; they compete on engineering depth, certification standards, system reliability, and long-term partnerships. The result is an export profile that delivers not just revenue, but also strategic influence, skilled employment, and durable supply-chain strength.

What makes aerospace and defense exports especially powerful is the “lifecycle effect.” A sale is rarely a one-time transaction. It usually triggers years (sometimes decades) of follow-on activity: spares, maintenance, training, upgrades, and support services. For trade performance, that means France benefits from both large platform exports (aircraft, satellites, naval systems) and recurring services exports that compound over time.

Why These Exports Are “High-Value” in Trade Terms

Aerospace and defense exports stand apart from commodity or low-margin manufacturing in four practical ways:

- High unit prices - A single airliner, combat aircraft, radar system, or submarine contract can be worth billions.

- Deep technology content - The export value is embedded in avionics, propulsion, mission systems, software, and complex materials—areas where few countries can compete.

- Long delivery and contract periods - Over the course of a few years, orders become deliveries. This helps in planning production and makes exports less variable.

Help and support

Pipelines that need repairs and improvements make money from exports long after the first sale. In 2025–26, many nations will want this combination: high-value exports that also help the economy by improving skills, research and development, and industrial resilience.

France’s Aerospace Engine: Strong Sales, Strong Exports, Strong Orders

France’s aerospace sector is large enough to materially shape national trade performance. Recent official industry reporting shows that the sector’s export orientation is exceptionally high, and that growth has been supported by both civil and defense demand.

The Key Takeaway: France’s aerospace sector is not only large; it is structurally global, with international sales forming the majority of total revenue.

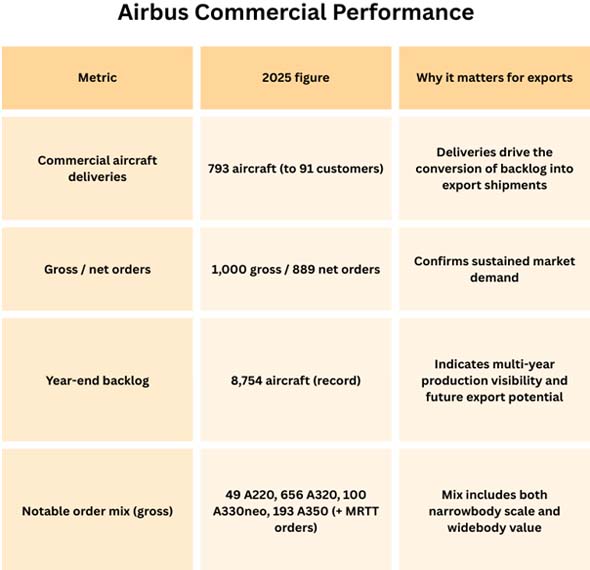

Commercial Aviation: Airbus as a 2025 Performance Signal

A major share of France’s Aerospace Export strength is linked to commercial aircraft and systems. Airbus said that deliveries and backlogs were at record highs in 2025. This means that demand and production pipelines are still robust as we approach into 2026. For the trade advantage in 2025–26, the backlog number is almost as important as the current deliveries.

Defense Exports: High-Value Orders and Strategic Partnerships

Defense exports operate differently from civil aerospace: they are shaped by government-to-government relations, export licensing frameworks, and long-term strategic alignment. But the “high-value” logic is even stronger—contracts can be extremely large, and they frequently include training, sustainment, and modernization.

France’s latest parliamentary reporting on arms exports shows that 2025 was a very strong year for new orders, setting the base for deliveries and export activity through 2025–26 and beyond.

This mix is strategically important: it’s not only “big-ticket platforms,” but also a rising base of support and modernization work that tends to be steadier and longer-lasting.

France’s Global Position: A Top-Tier Arms Exporter

Beyond annual orders, France’s global standing in defense exports reflects sustained competitiveness over multiple years. International arms transfer research has ranked France among the world’s top exporters in the most recently assessed multi-year period.

A Practical Interpretation for 2025–26: France’s defense export system has scale and credibility—important factors when countries choose long-term suppliers for complex, mission-critical capabilities.

The Real Advantage: The Ecosystem and the “Lifetime Export” Model

France’s high-value trade advantage is not just about shipping finished products. It’s about exporting through a complete industrial ecosystem, where value is created at multiple layers:

- Prime manufacturers deliver full platforms (aircraft, helicopters, naval vessels, satellites, missiles, sensors).

- Tier suppliers provide engines, avionics, structures, materials, electronics, software, and specialized components.

- Services networks support export customers with maintenance, upgrades, training, and operational readiness.

This “lifetime export” model is one reason aerospace and defense are so powerful: the export relationship continues long after delivery, often for decades.

2025–26 Themes to Watch: Where France’s Export Advantage Can Expand

1) Order-to-delivery conversion

A strong order year (defense) and record backlog (commercial aircraft) only translate into trade strength if production and supply chains keep up. 2025–26 will heavily reward suppliers that can deliver reliably.

2) Europe as a defense export growth engine

The sharp rise in EU share of defense export orders suggests Europe is becoming a key demand source. That supports France’s ability to deepen industrial cooperation and long-term programs across the region.

3) Services exports as a stabilizer

The growth in sub-€200M contracts (maintenance, training, modernization) indicates that France’s export advantage is increasingly “sticky” and recurring—less dependent on a handful of mega-deals.

4) Dual-use and space competitiveness

France’s aerospace strength extends into space and dual-use capabilities. In a world where communications, surveillance, and resilience matter more, this can expand future export pathways.

Conclusion

In 2025–26, France’s Aerospace and Defense Exports represent a premium trade advantage: high value per shipment, deep technology, and long-term revenue streams. The latest available figures show a sector with strong sales and export orientation in aerospace, record-level aircraft backlog signaling future export throughput, and defense export orders at a very high level—creating a multi-year delivery pipeline. The advantage is not only what France exports today, but how long those export relationships last—and how much industrial capability they sustain at home.

FAQs

Que. Why are exports of aerospace and defense goods called "high-value"?

Ans. Because they have expensive unit prices, complicated technology, certification requirements, and long-term service revenue.

Que. What is the main reason why France's aerospace exports are growing so quickly as we head toward 2026?

Ans. Deliveries of large commercial planes with a record backlog that supports production and export flows for many years.

Que. What do "defense export orders" tell us about the years 2025–26?

Ans. They mean that deliveries will keep coming and exports will keep going on, as defense contracts turn into shipments over a number of years.

Que. Is France's edge only in huge things like planes and submarines?

Ans. No. A bigger share comes from contracts for maintenance, training, modernization, and ongoing support that keep export earnings coming in over time.

Que. Where to get detailed France Export Import Global Trade Data?

Ans. Visit www.importglobals.com.