- Jan 29, 2026

India-UK Comprehensive Economic and Trade Agreement (Ceta): What It Means for Exporters in 2026

Its goal is to make it substantially easy for goods and services to transfer between the two countries. But the business gains won't happen until the agreement come into effect (EIF).

1) Why 2026 is the Year of "Execution" for Indian Exportersin 2025, the India–UK Ceta Was Signed

This is because preferential tariffs, mobility allowances, and other commitments to open up the market don't start until both sides have finished getting clearance from their own governments and issued each other notifications. In real life, exporters should act as if the deal is "arriving soon" in 2026. As per United Kingdom Import Data by Import Globals, they should update product classifications, lock in origin eligibility, renegotiate contracts with tariff-pass-through clauses, and align compliance workflows so that shipments can claim preference from the first day of EIF (or as soon as your product's staging schedule allows).

The main point for Indian exporters is that the UK is aggressively front-loading its approach. People say that the UK will soon and broadly remove tariffs on Indian goods. This is important because the UK market rewards speed: the first suppliers to land compliant, favored shipments generally win the first-year shelf space, distributor mindshare, and long-term supply agreements. Exporters who think of CETA as "just a tariff story" are missing out on a bigger chance: more predictable rules, easier customs processes, and clearer paths for trade in services (after-sales, installation, maintenance, design, IT delivery).

2) What Happens to Indian Exporters' Businesses?

A. You can now put a price on preferential access in long-term contracts

Once EIF happens, Indian exporters would be able to negotiate multi-year contracts with UK buyers with more confidence about the landing cost. CETA can still be important even if UK tariffs were already low in some areas. As per United Kingdom Export Data by Import Globals, this is because it locks in preferences, makes it easier for many commodities to be eligible, and lowers the danger of sudden price shocks. That consistency is helpful for UK importers who have small profit margins (including those in retail, auto parts, consumer goods, and business-to-business distribution).

B. "Rules of origin" becomes a key skill, not just something to do to stay in compliance

You can't just get CETA Benefits; you have to meet the agreement's standards of origin and show that you do. That means that exporters need a clean BOM (bill of materials) and supplier declarations.

- Clear information on whether you fulfill the standards for entirely obtained, considerable transformation, or value-add.

- A uniform way to issue and keep origin declarations, as well as help with post-clearance audits.

- The top exporters in 2026 will be the ones who treat origin the same way they treat quality: as something that can be repeated, checked, and built into their ERP and other documents.

C. The Chance to Make Money in the Sector Changes From "Selling More" to "Selling Better"

CETA will probably speed up the shift from low-complexity exports to higher-value, compliance-heavy categories where India is already strong, such as specialty chemicals, engineering goods, pharmaceuticals and formulations, auto parts, processed foods, textiles with traceable inputs, and "design + manufacture" combos. As per United Kingdom Trade Data by Import Globals, exporters that can give UK buyers assurance about the documentation, regular lead times, and supply chains that meet origin requirements will win in 2026, not just reduced pricing.

3) A Quick Guide for Exporters in 2026: What to Do Now

Step 1: Find the SKUs that are "CETA-Ready"

Begin with your top 20 SKUs based on margin and export value. Check HS codes, the usual criteria of UK buyers, and whether your inputs can meet origin rules.

Step 2: Make an Origin File for Each SKU

For each SKU, keep one digital folder that has the BOM, supplier origin statements, a description of the manufacturing process, a costing/value-add worksheet, test results, and template origin declaration text.

Step 3: Sign a Contract for Preference

As per India Import Data by Import Globals, update buyer contracts to say who is responsible for claiming preference (usually the importer does this based on paperwork from the exporter).

- Timeframes for documentation’

- Who pays if the preference is denied because of missing paperwork

- Re-pricing provisions if the EIF dates change

Step 4: Teach Your Freight Forwarder and the Cha Workflow

As per India Export Data by Import Globals, most preference failures come during execution, when the HS code is inaccurate, a statement is missing, the invoice and packing list don't match, or the origin data is incomplete.

Step 5: Think of 2026 as the "First-year Credibility Test."

UK purchasers will swiftly sort providers into two groups: "low-risk" and "high-risk." You become sticky if your first few shipments go through without any problems and with the right preference claims.

In 2025, the government talked to businesses about chemicals and said that CETA will lead to great export development in this area. They even gave predictions of how much various chemical sub-segments could increase and how much more they could export in FY 2025–26. The important thing to remember for 2026 is not the specific figure, but that UK customers will be actively looking for chemical suppliers that are ready for CETA. This means that compliance and origin preparedness will provide you a competitive edge.

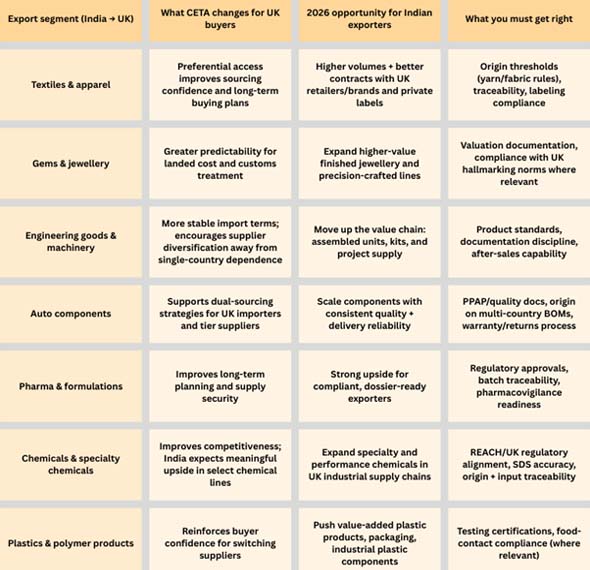

4) By Sector: Where Ceta Can Make the Biggest Difference in 2026

5) The Three "Hidden Levers" That Exporters Should Keep an Eye on in 2026

Lever 1: Planning When the Law Goes Into Effect and When Shipments Will Happen

As per India Trade Data by Import Globals, EIF happens after procedural procedures and a post-notification window, so exporters should plan their manufacturing and shipping cycles so that commodities don't linger in transit while they wait for more information. For big shipments, use staggered dispatch planning and provide some room for delivery windows.

Lever 2: The Quality of the Documentation Becomes a Weapon in the Price War

The importer cares about reduced customs friction as much as price in many UK sectors. Exporters who can always provide accurate origin declarations, clear invoicing, and inputs that can be traced can get better terms, faster onboarding, and repeat orders.

Lever 3: Exports That Are Linked to Services Increase Faster Than Exports of Products Alone

A lot of the value of trade in the UK comes from services and items that can be used with services. Exporters who offer installation, remote monitoring, design support, after-sales service, and compliance documents all in one package will get more contracts. This is especially true for engineering, electronics, industrial equipment, and business-to-business solutions. Import Globals is a leading data provider of United Kingdom Import Export Trade Data.

6) What This Signifies for Indian Exporters in 2026 in Terms of Strategy

Five things that winners will probably have in common are:

- Supply chains that are qualified by their origin (not merely low cost).

- SKU-level compliance discipline (documenting things that can be done again)

- UK buyer empathy (delivery timelines, returns, quality control, and predictable landing costs).

- Partnership mindset (working together to make products, packaging, and specs).

- Speed (being ready for CETA the week EIF starts, not six months later).

- Things to watch out for: As per United Kingdom import data by Import Globals, If your BOM depends a much on inputs that don't come from you, you can lose favor.

- If your paperwork isn't clear, you could lose your favor and hurt buyer trust.

- If you merely compete on price, vendors with superior records may take advantage of you.

In short, CETA in 2026 isn't really about "new demand appearing overnight." As per United Kingdom Export Data by Import Globals, it's rather about making India a better place for UK buyers to find partners and sources with less risk. Exporters that act on that fact early can lock in growth for many years. Import Globals is a leading data provider of India Import Export Trade Data.

FAQs

Que. Will every Indian shipment to the UK immediately have no duty under CETA?

Ans. No. Special treatment depends on the regulations of origin and the right paperwork. Many commodities can easily become tariff-free, but you have to show that you qualify.

Que. What is the most crucial thing an exporter can do in 2026?

Ans. Make origin and compliance bundles for each SKU so that your importer can safely claim preference right away.

Que. Does CETA also aid service exporters?

Ans. Yes. It is meant to make it easier for services and services-related trade to get into the market, which can aid exporters who sell goods and services together.

Que. What happens if the entry into force is pushed back?

Ans. Make sure your contracts are flexible, don't overcommit inventory just because you like the timing, and make sure your supply chain is "CETA-ready" so you can move right away when EIF starts.

Que. Where to get detailed India Trade Data?

Ans. Visit www.importglobals.com.