- Jan 28, 2026

What the New U.S.- Japan Trade Accord Means for Technology and Auto Sectors

It is a plan based on tariffs, promises of investment, and priorities for economic security. The main point is that there will be a 15% duty on almost all Japanese imports to the U.S., along with different rules for different industries (especially cars and car parts) and a huge investment of up to $550 billion from Japan to help U.S. industry grow.

1) Why This Agreement is Important Right Now

As per Japan Trade Data by Import Globals, these things make the pact especially important for two areas where the U.S. and Japan are very connected: making cars and getting innovative technology.

There are three concerns that businesses need to ask themselves about the deal's real effects in 2025–2026:

- How do new tariff lines affect the prices, sources, and mix of models in cars?

- Does the investment framework speed up the growth of semiconductor, AI/electronics, and upstream inputs production in the U.S.?

- How much "policy certainty" does this bring about, and where does ambiguity still exist?

2) The Deal's Structure in Simple Terms

At a high level, the agreement brings together:

- As per Japan Import Data by Import Globals, a general tariff framework: the U.S. charges a 15% base duty on most goods that come from Japan.

- Sector Tailoring: the framework treats cars and car parts differently, such as lowering the auto-tariff instead of raising the threatening rate in earlier negotiations.

- Signals for Market Access and Procurement: Japan signals that it is open to trade in some areas (mostly around cars and farming in public readouts), while the U.S. focuses on "rebalancing" and production driven by investment.

- A Big Investment Channel: Japan's investment promise comes with ways to make those promises into capital that can be used in strategic industries, like public-finance assistance.

This is just as much an industrial policy and economic security package as it is a trade deal. That's why the electronics and car industries, which have complicated supply networks that are sensitive to geopolitics, are at the core.

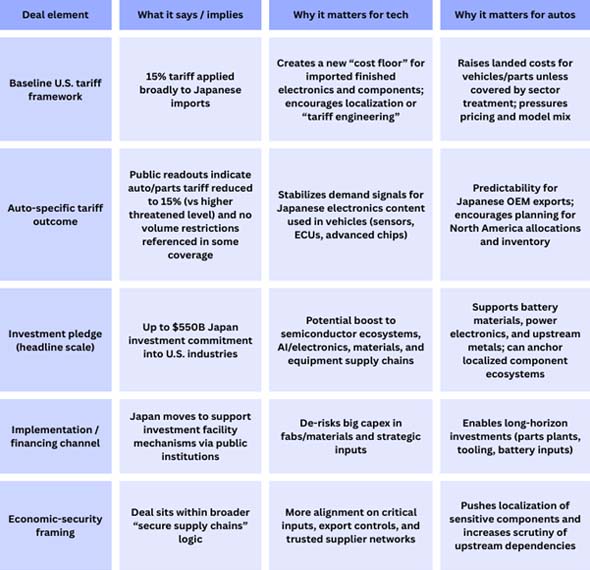

3) A Quick Look at the Main Points

4) What happens to the car industry between 2025 and 2026?

A. Power over prices and "who pays the tariff"

Even though the auto/parts tariff outcome is about 15%, it still matters in a sector where profit margins are thin and incentives may quickly change demand. As per Japan Export Data by Import Globals, most of the time, car companies reply in a number of ways:

- Price changes that only affect trims that are in high demand

- Rebalancing incentives (when subsidies are cut first)

- The model mix is moving toward vehicles with better margins.

- Cost-cutting drives in sourcing parts and logistics

- For Japanese OEMs that sell to the U.S., the most important thing is whether the 15% level stays a consistent planning assumption. If it happens, companies can make choices on purpose: preserve some models as imports and make others more local.

B. No quota-style limits = clear planning

As per USA Import Data by Import Globals, reports that say quotas don't matter because they are often more disruptive than tariffs. A tariff is a cost, while a quota is a rigid limit that can mess up how goods are distributed and how many dealers have them. OEMs can manage supply through economics instead of administrative limits when there are no quotas. This is helpful when demand changes or product cycles change.

C. A new push for the North American footprint

In 2025–2026, anticipate the tariff-plus-investment combination to speed up a trend that has been going on for a while: more production in North America and more regional parts content, especially for vehicles that sell a lot in the U.S. Even if final assembly is heterogeneous, suppliers may still localize things like seats, wire harnesses, electronics modules, and powertrain parts. The "investment channel" also makes it simpler to justify supplier capital expenditures that would be too risky otherwise.

D. Electric vehicles, batteries, and the pipeline for essential materials

Today's cars are like computers on wheels, and EVs make that even more true. As per USA Export Data by Import Globals, a realistic look at 2026 has to follow the supply chain for battery elements including lithium, nickel, cobalt, and graphite.

- Refining and processing capacity

- Anode and cathode materials

- Thermal management and power electronics

If the agreement's investment and supply-chain cooperation really make it to these nodes, they can help ease bottlenecks and make sourcing more reliable. But the change won't be smooth. Mining and processing minerals upstream take years, so 2026 is more about project commitments and early capacity than rapid abundance.

5) What Happens to the Tech Industry in 2025–2026?

A. The "tariff floor" changes how companies decide where to get their goods.

As per USA Trade Data by Import Globals, a baseline 15% tariff that is used a lot gives people a reason to: move assembly to the U.S. (or to lower-tariff routes if they are available) change the way bills of materials (BOM) are made to lower tariff vulnerability. Think about where the final setup, packaging, and testing take place again.

For tech companies, these choices affect where they get parts, how they make contracts, and where they contribute the most value at the end.

B. Semiconductors and Electronics Are at the Heart of Strategy

As per Japan Trade Data by Import Globals, the deal's focus on investment is most important when the U.S. needs capacity and Japan has world-class skills in areas like innovative materials, equipment ecosystems, specialty chemicals, and vital components. If capital is used wisely, 2025–2026 might see: stronger supplier ecosystems surrounding U.S. fabs.

-more backup sources for important inputs

-extra capacity in specialty manufacturing

-The short-term consequence is usually less risk and shorter lead times, not lower prices right away.

C. Ai and Advanced Computing: A Chance to Make Money and a Lot of Work to Do to Follow the Rules

As technology becomes more security-sensitive, "trusted supply chain" alignment can make it easier for businesses in different countries to work together, but it can also make it harder to follow the rules. Companies could expect: extra paperwork and proof of ownership requirements.

-more careful checking of upstream sources

-more focus on export controls and end-use issues

-In practice, this gives companies with good governance and clear supply chains an advantage.

6) People Who Win, Lose, and Have Second-order Repercussions Possible Winners

- As per Japan Import Data by Import Globals, Japanese OEMs and top-tier suppliers that can mix exporting with localizing in North America.

- U.S. industrial initiatives that potentially get funding and skills from Japan.

- Semiconductor and electronics ecosystems that benefit from better materials and equipment durability.

Risks and Pressure Points

- People who want to buy entry-level cars are sensitive to price changes if prices go up faster than incomes.

- Smaller suppliers that can't pay for modifications to localization or compliance.

- There is a lack of clarity about how consistently the framework is used and understood across products.

- Watch for trade diversion as a second-order consequence. As per Japan Export Data by Import Globals, if supply chains that are linked to Japan become "preferred" for important areas, other suppliers may lose market share even if they are cheaper.

7) What to watch until 2026

- If you only want to keep an eye on a few things, keep an eye on how quickly the investment promise transforms into funded projects (announcements are not the same as deployed funds).

- Real-world consequences can change when it comes to tariffs on cars, parts, and important tech categories.

- Supply-chain problems with important minerals and high-purity materials (the hard portions of scaling).

- As per USA Trade Data by Import Globals, new plant announcements, supplier localization, and revised sourcing footprints are all examples of "truth signals" of influence in the business world.

8) Conclusion: A Strategic Deal With Real-world Effects

The easiest way to think of this deal between the U.S. and Japan is as a strategic bargain: on one side, there are tariffs and market access signals, and on the other side, there are big investments and supply chain alignment. For cars, the key news is that export planning is more predictable and there are stronger reasons to localize. The major news in tech is that tariffs are forcing supply chains to be re-optimized. At the same time, there is a push for investment and security that can make semiconductor and advanced manufacturing ecosystems stronger.

Companies who don't only see this as a headline but as a way of doing business will do the best in 2025–2026. They will change their pricing, sourcing, compliance, and capex plans as needed. Import Globals is a leading data provider of Japan Import Export Trade Data.

FAQs

Que. Does this agreement get rid of tariffs between the U.S. and Japan?

Ans. No. Instead of getting rid of all tariffs, the framework is based on a baseline tariff structure (15% on most Japanese imports) and treatment that is specific to each sector.

Que. What will happen to the car business immediately away?

Ans. Plans and prices that are clear. OEMs can more flexibly choose prices, distribution, and what to localize in North America when there are no volume constraints and a defined tariff level.

Que. What does the acquisition signify for the supply chains of AI and semiconductors?

Ans. Primarily by investing and making supply chain security more in line, which makes materials, equipment ecosystems, and strategic inputs stronger while rising compliance standards.

Que. Is the $550 billion investment going to happen for sure?

Ans. Not right away. The effect in the actual world depends on how the projects are carried out, how they are supported, and if they transition from promises to paid, finished investments.

Que. Where to get detailed USA Trade Data?

Ans. Visit www.importglobals.com.