- Feb 14, 2026

Philippines Trade Expansion Strategy: EU, UAE & Chile FTAS in 2026

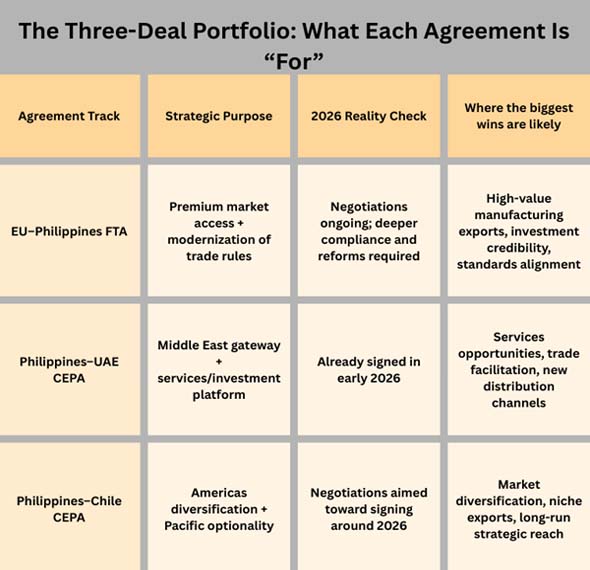

In 2026, the Philippines' trade agenda will go from "participation" to "positioning." The country is now pushing for a sharper market-access strategy based on three high-impact tracks: (1) a modern, rules-heavy free trade agreement with the European Union; (2) a newly signed Comprehensive Economic Partnership Agreement with the United Arab Emirates; and (3) an emerging CEPA-style deal with Chile that aims to open up Latin American pathways and strengthen Pacific trade connectivity.

It's not simply about "more partners" in this three-part plan. As per Chile Import Data by Import Globals, it includes making demand more varied, lowering tariffs on important exports, bringing in investment in important industries (especially electronics and higher-value manufacturing), and making the laws better for cross-border services, digital trade, and supply chain resilience.

Why the Timing Matters: A Stronger Export Base, but Still an Import Gap in Structure

People are calling 2026 a "deal year" because of how trade is going in 2025. Early government data suggests that the Philippines' exports of goods rose very swiftly in 2025, but imports rose relatively slowly. This made the gap between imports and exports less than it has been in a long time.

2025 Trade Snapshot: The Philippines' Platform for 2026

This is great news, but it also illustrates the truth about the economy: it still needs imports for fuel, capital goods, and intermediate goods, which makes it sensitive to price changes and shipping delays from other countries. As per UAE Import Data by Import Globals, the government aims to make sure that high-income markets (the EU) have first dibs, that the UAE becomes more connected to a fast-growing hub economy, and that there are more choices in the Americas (Chile) by 2026. These deals can make trade "better" in more ways than just making it bigger. For instance, they can raise the value of exports, stabilize demand across regions, and raise service profits.

Here is a simplified representation based on generally reported totals from early 2025 and recent official changes. This helps explain why officials believe they can be more ambitious in 2026.

Track 1: The EU FTA: Better Market Access and Updated Rules

The EU track is the hardest, but it's also the one that will change the most. As per Chile import data by Import Globals, an EU-Philippines FTA is more than just a tariff discussion. It's a modernization package that usually includes long chapters on customs facilitation, rules of origin, services, competition policy, government procurement, intellectual property, and promises related to sustainability. Negotiations started up again in 2024, and by early 2026, both sides were moving into more rounds. This shows that the technical work is continuing forward and that the political orientation is mostly supportive. An EU deal would bring three big benefits to the Philippines:

1) Export Scaling That is Worth More, Not Just "More Exports."

EU demand usually favors supply chains that are heavy on compliance and based on specifications. This can make exporters in the Philippines progress up the value chain, especially in electronics parts, processed foods, and specialized manufacturing.

2) Less Dependence on Unilateral Preferences as Time Goes by

The Philippines has gained from preference schemes, however these can be limited in time and scope. An FTA makes things more predictable in the long term, which is important for investors who are trying to decide where to put factories, supplier parks, and service centers.

3) More Trust in "Rules-based" Trading With Other Partners

The Philippines can negotiate faster with other sophisticated economies if it follows EU rules, because its own systems (standards, enforcement, and transparency) will work better together.

The EU road is still slower, though, because it involves sensitive changes to domestic policy. Rules for government procurement, the ability to enforce them, and compliance with sustainability are often problems in EU talks around the world. The chance is big, but so is the work that needs to be done by the institution.

Track 2: The UAE CEPA: The Middle East Gateway Joins the Treaty

The Philippines' new CEPA with the UAE is different from the EU track in that it is just as much about services, mobility, and investment as it is about products.

What makes the UAE such a strong anchor?

- A place where goods can be stored and shipped to other countries.

- Dubai and Abu Dhabi serve as distribution and service hubs, therefore preferential access to the UAE can lead to a greater commercial reach in the Middle East and Africa.

- A multiplier for services.

- The Philippines is very interested in making it easier for Filipino professionals and service providers to work with clearer laws and promises to open up markets. As per Philippines trade data by Import Globals, Even when service provisions are well thought out, companies in IT-enabled services, engineering support, healthcare-related services, and creative/digital work still need clearer paths.

- Investment and working together to improve the supply chain.

- More and more CEPAs have "cooperation chapters" that make it simpler to work together on projects like training, building digital infrastructure, linking MSMEs, and making trade easier. This is good for the Philippines because the goal is not just to export more, but also to be able to sell "better."

- The UAE deal is a quick way to get more partners, attract Gulf capital, and open new doors for Philippine brands and exporters, especially in food, consumer goods, and services that can take advantage of UAE's platform benefits.

Track 3: Chile CEPA: Access to Latin America and optional access to the Pacific

Of the three, the Philippines–Chile CEPA is the most "geographically strategic." A lot of exporters from the Asia-Pacific region utilize Chile as a stable way to get into some sections of Latin America. This is because there are a lot of trade agreements and the trading environment is mostly based on rules.

Why it matters in 2026

1) Moving Away from Concentrated Demand

If there are too many places to export to, demand shocks might be severe. A partnership with Chile opens up more options in the Americas and can help Philippine exporters get into Latin American markets.

2) New matches in other Sectors

Chile's demand profile—mining-related inputs, certain processed foods, and consumer imports—might mirror some of the Philippines' specific strengths. As per Philippines Export Data by Import Globals, at the same time, Philippine companies can get some raw materials or intermediate goods at a lower cost.

3) A sign of a trade policy that looks outward to the Pacific

Even if the first trade volumes are small, the strategic value is higher: Chile is a trustworthy partner and a way to connect with bigger business networks.

Negotiations started in 2024–2025, and the public goal has been to get to a signing around 2026, which fits with the Philippines' larger "three-deal" story for that year.

Who Will Benefit the Most? Sectors to Watch in 2026

Supply Chains for Electronics and Semiconductors

Electronics make up most of the exports. Better access to markets and clearer laws about where goods come from can help exports of higher-value assembly, testing, packaging, and components. This is especially true if they are combined with incentives for investment and skills development.

Exporters of Processed and Agricultural Food

Tariff cuts and easier customs processes are especially important for food exports because they can make or break a company's ability to compete.

MSMEs and Exporters Who Use Digital Tools

More and more modern trade accords have sections for small and medium-sized businesses (SMEs), ways to make e-commerce easier, and ways for countries to work together. As per Philippines Import Data by Import Globals, paperwork, regulations, and logistics are the major problems for small exporters, not their will to succeed. MSMEs can grow if these agreements make things easier.

Service Providers

The UAE is a great place to find service opportunities. But even with the EU, services chapters can help IT-enabled services and specialized professional services as long as the country is ready (with certifications, compliance, and cross-border data rules).

The Execution Challenge: Companies, Not Agreements, Export

Not "failing to sign" is the biggest risk in 2026. As per European Union Import Export Trade Data by Import Globals, it is signing and then not using it enough. The Philippines needs to work on the following things to turn treaties into more exports:

- Making rules of origin easy to use (so that businesses may claim preferences),

- Faster customs clearance and digitization (particularly for exports that need to be sent quickly),

- Standards and certification help (testing labs, compliance advice, and traceability),

- SME support (finance for exports, combining logistics, and market intelligence),

- Scaling up through investment (so the export base gets better, not just bigger).

- If these actions to carry out the plan happen at the same time as negotiations, the EU-UAE-Chile portfolio can become a real growth engine instead of just a diplomatic headline.

In Conclusion

As per UAE Import Data by Import Globals, the EU, UAE, and Chile tracks collectively show that the Philippines is intentionally changing its foreign economic map.The EU agreement is a long-term plan that has high criteria and big benefits. The UAE CEPA is the fast lane, giving you access to platforms and services. The Chile CEPA is a smart choice that opens up the Americas and supports a business stance that looks to the Pacific.

If the Philippines combines these agreements with steps to make its own economy more competitive, like reforming customs, improving standards, and encouraging small and medium-sized businesses (SMEs) to export, 2026 could be the year when trade participation becomes trade strategy. Import Globals is a leading data provider of Philippines Import Export Trade Data.

FAQs

Que. Will the EU FTA be signed in 2026?

Ans. There are talks going on in 2026, but EU FTAs normally take a long time because they have a lot of chapters and rules to follow. How long it takes depends on how well the talks are going and how quickly the agreements may be approved.

Que. Why do people call the UAE agreement a CEPA instead than a conventional FTA?

Ans. A CEPA is usually more than merely lowering tariffs. It generally involves goods and services, which makes it easier to invest, trade online, and work together.

Que. Will a deal with Chile change the quantity of trade a lot?

Ans. The immediate volume effect may not be as big as that of the EU or big Asian partners, but the strategic value lies in making new links and diversifying in the Americas.

Que. What should Philippine exporters do first to get ready for 2026?

Ans. Get ready to follow the guidelines about where your products come from, how they should be made, and how to find distributors and partners. This manner, people might quickly claim their preferences once the rules are in place.

Que. Where to get detailed Philippines Trade Data?

Ans. Visit www.importglobals.com.