- Feb 13, 2026

U.S.-Vietnam Reciprocal Trade Framework: New Market Access in 2025

Vietnam is now one of the most important places for making things that Americans want to buy, like electronics, clothes, shoes, and furniture. At the same time, American exporters have been pushing for more access to farm goods, industrial goods, vehicles, and regulated areas like medical devices and drugs in Vietnam.

Why this Framework is Important Right Now

As per USA Import Data by Import Globals, both sides have grown quickly, but the U.S. trade deficit, which is politically sensitive, put Vietnam at the center of Washington's "reciprocal" market-access agenda.

With that in mind, the "Framework for an Agreement on Reciprocal, Fair, and Balanced Trade" between the U.S. and Vietnam (reached in late 2025) is best understood as a market-access-for-stability deal. Vietnam agrees to lower barriers and open up more opportunities for U.S. goods and services, while the U.S. keeps a clear reciprocal tariff structure and a way for some goods to move to a zero-rate category. This blog explains what's really new for exporters and importers, where access to markets is growing, and what 2026 will probably bring as the framework becomes more concrete.

The Trade Baseline: a lot of growth but an even larger imbalance

Trade between two countries has grown quickly, especially in products. Policymakers in the The facts that the U.S. and Vietnam are using are the same:

- As per USA Trade Data by Import Globals, there is a lot of demand, and it is hard to modify supply networks. Vietnam plays a key role in the supply chains for electronics and other commodities that are sold in the U.S.

- The U.S. deficit is big in a structural way. That deficit has become the main "problem statement" for trade talks between the two sides.

- There are still big problems with getting into the market. For U.S. exporters, the biggest problems have always been non-tariff barriers, like getting regulatory permits, licenses, and recognizing standards, not merely border tariffs.

What Does "Reciprocal" Mean in This Context?

As per USA Export Data by Import Globals, the main idea is "balanced trade" through two parallel tracks: Vietnam will give U.S. exports (both industrial and agricultural) better access to its markets and will work to remove certain non-tariff barriers that have historically made it harder for U.S. goods to sell in Vietnam (vehicles, medical devices, pharmaceuticals, IP/digital).

The U.S. has a set reciprocal duty rate on imports from Vietnam, and there is also a way to transfer certain commodities to a 0% reciprocal tariff category based on an annex list.

This is not a typical "single-document FTA" statement that says both sides will get rid of all tariffs. It's not a plan; it's a framework. It's a negotiated structure that is supposed to be put into action through annexes, sectoral agreements, and measures for putting it into action.

Where Exporters Can Find "New Market Access" in 2025

Even if they are just a framework, the market-access signals are clear enough to be useful for planning. There are four groups of people who will probably benefit first.

1) U.S. agriculture: from diplomacy to buying pipelines

As per Vietnam Import Data by Import Globals, U.S. agriculture exports have been a constant point of contention in talks with Vietnam since the country needs a lot of feed grains and other agricultural inputs that can be easily increased.Vietnamese businesses bought a lot from U.S. partners in 2025. This illustrates that farming is a rapid approach to bring the two countries closer together.

For U.S. exporters, the opportunity is not only to sell more, but also to make it easier to plan for import administration and have fewer unofficial obstacles. Vietnamese purchasers want a range of sources and reliable pricing and quality, especially for bulk commodities and animal feed inputs.

2) Recognizing vehicles and standards: getting rid of a "hidden tariff"

Getting individuals to agree on standards, especially for cars made to meet U.S. demands, was one of the most important non-tariff goals that came up in the framework talks. When companies have to rethink their products, undertake more testing, or wait a long time to comply, standards and conformity assessment act like a "hidden tariff."

If Vietnam makes it easier for enterprises to go about, it would have a big effect on business. It could open up new regions that were "technically possible but operationally painful" before.

3) Medical devices and drugs: faster approvals and fewer problems

As per Vietnam Customs Data by Import Globals, when regulated products like pharmaceuticals and gadgets wish to get on the market, they usually have to deal with a lot of red tape. This includes getting a license, meeting dossier criteria, passing local tests, updating reference norms, and waiting a lengthy time for approval. The fundamental purpose of the framework track is to make it easier to get government permission and permits to bring things into the country.

For U.S. companies, even small cuts in approval time can have a big effect on their bottom line (earlier launches, greater participation in hospital tenders, and less working capital stuck in compliance cycles). For Vietnam, the good news is that it can get access to more modern items and competition that can make them better and easier to find.

4) Digital trade, services, and investment: the "next layer" of access

Goods are the main focus of the news, but the framework also points to concluding agreements in areas like digital commerce, services, and investment, which are becoming more and more important for high-value margins. As per Vietnam Export Data by Import Globals, that involves things like being open, being able to plan for cross-border business, and having laws that help commerce on platforms.

This is crucial for strategy because Vietnam is advancing up the value chain (electronics, components, tech assembly), and U.S. companies want to know that their investments are safe and that the rules will be followed, especially when it comes to data, software, and intellectual property.

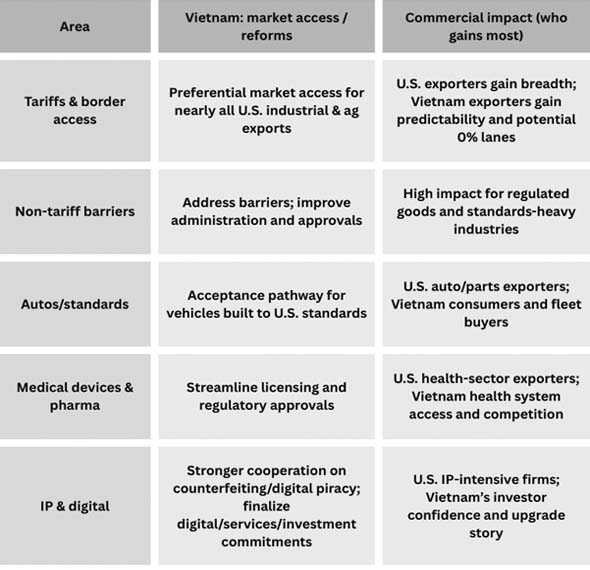

What Each Side is Offering

Here's a useful way to think about the deal structure: Vietnam's concessions are mostly about getting into the market and getting rid of barriers, while the U.S. side is about tariffs and a selective 0% lane.

What to Watch in 2026: The Risk of Implementation vs the Potential for Export Growth

Framework announcements only affect markets when they can be measured. For 2026, teams who deal with trade should keep an eye on four "proof points":

- Annex makes it clear what 0% categories are. Which items from Vietnam can use the 0% reciprocal tariff lane, and what do they need to do to qualify?

- Metrics for processes in regulated fields. Are approvals for medical devices and drugs noticeably faster? Do criteria stay the same?

- Standards recognition in real life. Are vehicle standards accepted enforced by defined rules, or is it up to each case?

- Enforcement of rules of origin and transshipment. Origin rules and enforcement can be a big problem for Vietnam because it is a key part of regional supply chains. This is especially true if tariff differences make it more appealing to reroute goods.

- It's reasonable to predict that agriculture and some industrial sectors will gain fastest (since they are the easiest to scale), while services and digital rules will take longer but are more important for long-term investment positioning.

What This Means for Exporters—things They Can Do

As per USA import data by Import Globals, U.S. exporters should see Vietnam as a market where being ready for regulations is a competitive edge: companies that can swiftly get through licensing, labeling, and compliance will get the first benefits. Agriculture exporters should start building longer-term contracts and logistics linkages immediately.

As per Vietnam import data by Import Globals, Vietnamese exporters should grasp how tariffs function under the reciprocal rate system and do their best to get into any 0% lanes that show up on annex lists. They should also make sure that their origin papers are stronger and that they follow the rules, since "reciprocal" frameworks usually mean extra scrutiny.

Both sides should expect a change from headline diplomacy to real-world verification in 2026. This means keeping track of deadlines, approvals, and writing instructions instead of making statements.

Conclusion

The U.S.-Vietnam Reciprocal Trade Framework is more like a new way to get into the market than a single "tariffs go down everywhere" FTA moment. Vietnam is showing that it wants to give U.S. exporters broad preferential access and remove specific barriers, especially where they have had trouble with procedures for a long time. The U.S., on the other hand, is making a formal reciprocal tariff system while keeping the option to move some goods into a 0% lane through annex-based methods. If the framework is followed, 2026 could be the year when the flow of goods from Vietnam to the U.S. changes from being one-way to two-way. The biggest early wins would be in agriculture, regulated healthcare products, and industrial categories that follow standards. Import Globals is a leading data provider of Vietnam Import Export Trade Data.

FAQs

Que. Is this a full free trade agreement (FTA)?

Ans. No. It is a framework for reaching an agreement that includes promises from different sectors and annexes. These commitments will be put into action through follow-up stages.

Que. Which industries get the most help with market access?

Ans. Agriculture, industrial exports, cars (via acceptance of standards), and regulated products like medical devices and drugs are all important industries.

Que. What is the greatest danger for businesses that are planning around the framework?

Ans. Implementation details, such appendix lists, approval dates, and enforceable guidelines, might take longer than headlines. Keep track of proof points that can be measured.

Que. What should exporters from Vietnam do to get ready?

Ans. To lower the risk of disruption, model tariff exposure, try to get into any 0% product lanes, and make sure that origin and compliance paperwork is stronger.

Que. Where to get detailed USA export data?

Ans. Visit www.importglobals.com.