- Feb 12, 2026

India-New Zealand FTA: How Bilateral Trade Could Double by 2030

In a very short amount of time, India and New Zealand have gone from "potential partnership" to "pipeline partnership." The two parties started talking about a Free Trade Agreement (FTA) in March 2025 and finished it in December 2025.

This was one of India's fastest FTAs. As per New Zealand Import Data by Import Globals, the main premise is simple: lower barriers (tariffs, procedures, and constraints on movement), increase certainty (rules and commitments), and open up new flows (services, students, skilled workers, and investment). If the execution meets the goal, doubling commerce between the two countries by 2030 is a reasonable goal. This is not because of one tariff decrease, but because the deal is meant to build on gains in commodities, services, and people-to-people channels.

Where Trade is in 2025–26 and Why the Baseline Already Supports Growth

Trade was already picking up before the FTA had its full commercial effect. India and New Zealand traded roughly US$2.4 billion worth of goods and services in 2024, with India still having a trade surplus. On the goods side, bilateral trade went risen from US$873 million in 2023–24 to US$1.3 billion in 2024–25. This is a big jump that shows how quickly volumes can change when demand, supply, and logistics are all in sync. India's exports of goods to New Zealand reached US$711 million in 2024–25.

As per New Zealand Export Data by Import Globals, India's exports of services to New Zealand also grew 13% in 2024 to US$634 million, with travel, IT, and business services leading the way. New Zealand's view of the situation shows that total two-way commerce is NZ$3.68 billion a year (ending June 2025). During that time, New Zealand's main exports to India were travel services (NZ$948 million), as well as industrial goods, forestry goods (such logs), and horticultural goods (especially apples and kiwifruit). This is important: New Zealand's side of the relationship is already "services-heavy," while India sees obvious chances for products expansion. That kind of compatibility is what well-designed FTAs are meant to make stronger.

What are the Structural Differences in this FTA?

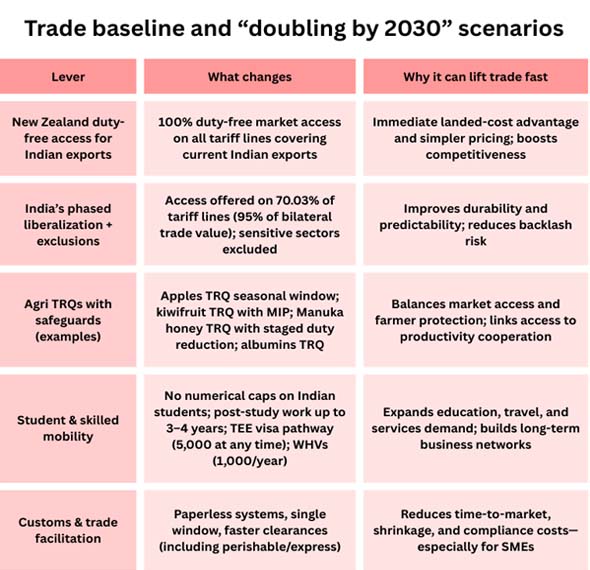

People are calling this accord a "new generation" deal based on four main ideas: tariffs, agricultural productivity, investment, and talent. That mix is important because tariffs alone don't double trade. Trade doubles when (1) market access is combined with (2) predictable rules, (3) smoother border processes, and (4) the movement of people and capability.

1) Almost No Duties on Indian Goods Going Into New Zealand

As per New Zealand Trade Data by Import Globals, New Zealand will give India duty-free access to all of its tariff lines, which will cover all of India's current exports. In practice, this means that Indian exporters in labor-intensive and value-added categories have an instant landed-cost advantage over competitors that don't obtain preferential treatment. Before the FTA, New Zealand's highest tariffs were up to 10% on several Indian exports, including as textiles and clothing, leather, ceramics, carpets, cars, and automotive parts. These are the kinds of "small tariffs" that still affect where retailers and B2B buyers get their goods.

2) India's Controlled Market Access—opening Where It Can and Protecting Where It Must

India's offer is structured so that 70.03% of tariff lines covering 95% of bilateral trade value are open to market access, while 29.97% of tariff lines are not, including some sensitive areas like dairy and certain animal products, select vegetable products, sugar, some fats/oils, arms/ammunition, gems/jewelry, and selected base metals and articles. This is important for the stability of domestic politics: an FTA that safeguards sensitive sectors is much more likely to be carried out consistently, and consistency is what investors and supply chains care about.

3) Agricultural Productivity is Seen as a Way to Make Trade Easier, Not Just a "Farm Chapter."

One unique thing is that New Zealand's access to certain agri-products markets is linked to Agriculture Productivity Action Plans for kiwifruit, apples, and honey. As per India Export Data by Import Globals, These plans include centers of excellence, better planting material, research collaboration, and technical support for managing orchards and post-harvest practices. India uses tariff-rate quotas (TRQs) to control access to its market for certain goods. These TRQs come with protections like the Minimum Import Price (MIP) and monitoring by a Joint Agriculture Productivity Council. This system is meant to balance consumer choice with protection for native farmers.

4) The Ability of Workers to Move Around is a Growing Factor for Trade in Services

The deal covers more than just goods. As per India Import Data by Import Globals, There is also a new Temporary Employment Entry visa pathway for Indian experts. This pathway has a limit of 5,000 visas at any given time and 1,000 working holiday visas each year. These rules aren't just "nice to have." They immediately affect education, travel, professional services, and long-term business networks.

5) An Investment Commitment Adds a Second Engine

New Zealand has promised to help India get $20 billion in investment over the next 15 years. If the investment falls short of the promise, there is a rebalancing clause that allows for corrective action. If even a small fraction of this pipeline leads to initiatives in manufacturing, infrastructure, innovation, and digital services, it will stimulate demand for bilateral trade in machinery, parts, professional services, and technological collaborations.

The Math Behind Tripling Trade: A Real Method to Get to 2030

There isn't just one prediction that the number will double by 2030. Instead, there are a number of possible outcomes based on how rapidly preferences are used, how quickly companies sign contracts, and how well border and compliance systems work. A realistic story goes like this: early wins in categories with no tariffs (clothing, engineering goods, pharmaceuticals, processed foods), a steady rise in services (IT, business services, education, tourism), and compounding effects from student and skilled worker mobility and faster customs clearance.

Where the Biggest Triumphs in the Sector Can Happen

1) India Sells a lot of Goods that Need a lot of Labor to Make

When Indian items come into New Zealand with no duties, categories including textiles and clothes, leather and footwear, and other consumer goods can get shelf space and long-term import contracts. This is especially true when procurement teams can lock in tariff certainty.

2) Industrial Supplies, Engineering Items, and Parts

Engineering and industrial goods are good candidates for speeding up trade since they grow through project pipelines (building, infrastructure, renewables, industrial improvements) instead of just consumer demand.

3) Medicines and Health Care

Pharma gains from the removal of some pre-FTA levies (up to 5% for specific lines) and from the building of trust through better regulatory cooperation. As per India Trade Data by Import Globals, the FTA makes it clear that health and traditional medicine services are important, which opens the door for wellness and medical value travel.

4) Education and Travel as "Network Industries"

Rules about student mobility and working after school can significantly boost the flow of students and travelers. Over time, alumni networks also help people find professional services and investment opportunities. This is a potent but often overlooked way to boost commerce.

What Exporters Need to Keep an Eye on in 2026 and Beyond

Rules, Paperwork, and Use: The difference between "FTA signed" and "trade doubled" is how the rules are used. Companies need to accurately claim preference, meet origin and compliance criteria, and set up a process for making documentation that can be used again and again.

SME Enablement: As per New Zealand Import Data by Import Globals, the deal includes organized collaboration for small and medium-sized businesses, programs to help them become ready to export, and connections. If this leads to useful onboarding (such templates, help desks, and predictable clearance), usage rates can go up quickly. India's edge in IT and business services develops as visas, recognized channels, and cross-border contracting become easier and more predictable.

Investment-to-trade conversion: It's important to keep track of how the investment pipeline turns into real projects like renewables, infrastructure, and digital services. Projects lead to repeat orders, which are sales that happen more than once. Import Globals is a leading data provider of India import export trade data.

Conclusion: Doubling by 2030 is possible if the "talent + trade facilitation" engine starts up.

The India–New Zealand FTA is more than just a list of tariffs. It is a business framework that includes access to commodities, protected sensitivities, productivity-linked agricultural cooperation, new customs procedures, and very robust mobility paths. That mix can lead to compounding growth: more students and professionals create more demand for services; greater facilitation makes things easier for small and medium-sized businesses; investment pipelines promote recurring procurement; and tariff certainty makes sourcing decisions "stick." If both sides focus on use and execution from 2026 to 2028, a trade-doubling outcome by 2030 is not just a slogan; it's a real possibility. Import Globals is a leading data provider of New Zealand Import Export Trade Data.

FAQs

Que. Is the FTA between India and New Zealand solely about commodities and taxes?

Ans. No. It also includes areas for collaboration, customs facilitation, and services market access, as well as talent mobility for students and skilled workers.

Que. Which industries could have the biggest growth by 2030?

Ans. Indian exporters of textiles and clothing, engineering items, processed foods, and medicines are in an excellent position. Services like IT, business services, education, and travel can also grow quickly with mobility paths.

Que. How does the deal secure India's important industries?

Ans. India doesn't charge tariffs on almost 30% of its tariff lines, including some sensitive agricultural and industrial categories. Instead, it uses TRQs, MIPs, and safeguards to give some New Zealand agricultural access.

Que. What is the one thing in this FTA that has the highest "trade multiplier"?

Ans. Moving talented people around. Student and skilled paths can help services exports flourish and build long-term business networks that keep commerce increasing even after the first tariff gains are used up.

Que. Where to get detailed New Zealand Export Data?

Ans. Visit www.importglobals.com.