- Feb 16, 2026

Bangladesh-Japan Economic Partnership Agreement: Preparing for Post-LDC Trade Growth

Bangladesh is approaching a major structural shift: graduating from Least Developed Country (LDC) status on 24 November 2026. That date is more than a milestone on a calendar—it changes the trade terms Bangladesh receives in many markets, including preference schemes that have helped exports stay competitive.

Why this EPA is Important Right Now

Japan has long been one of Bangladesh’s most strategic partners in Asia: a high-income consumer market for apparel, a source of high-quality capital goods, and a major provider of development finance and infrastructure support.

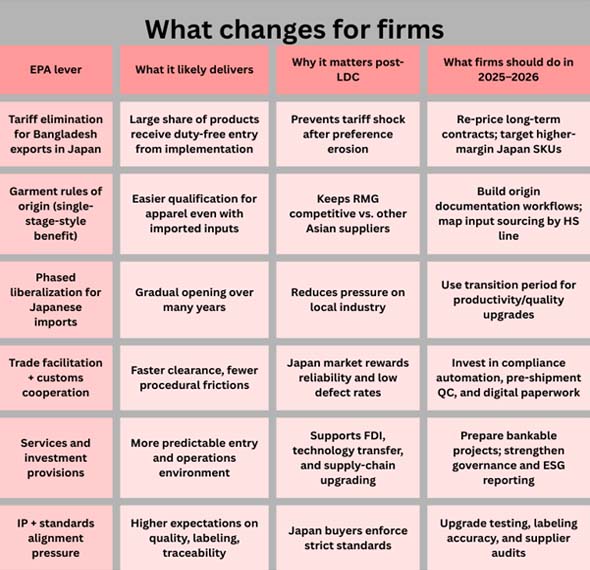

As per Bangladesh Import Data by Import Globals, the Bangladesh–Japan Economic Partnership Agreement (EPA)—referred to in some official communications as the Bangladesh-Japan Economic Partnership Agreement (BJEPA)—is designed to “lock in” market access and investment confidence beyond the post-LDC transition, rather than forcing exporters to face a sudden tariff shock. The timing is also important: 2025–2026 is a period of global trade fragmentation, higher compliance expectations, and more scrutiny of supply chains. In that environment, an EPA is not just about tariff cuts—it’s also about predictable rules of origin, simplified customs, services access, and a platform for investment. Import Globals is a leading data provider of Japan Import Export Trade Data.

From Preference Reliance to Certainty Based on Treaties

Historically, Bangladesh has benefited from Japan’s LDC-focused preferential access under Japan’s GSP/DFQF arrangements. Under DFQF, Japan has provided duty-free access to LDCs on about 97.9% of tariff lines, with a limited number of exclusions. As per Bangladesh Export Data by Import Globals, Bangladesh has also benefited from relaxed rules of origin (including a form of “single transformation” for garments) that made it easier for apparel exporters to qualify. But preference schemes are, by design, unilateral and policy-driven.

They can be revised, narrowed, or phased out as a country’s development status changes. An EPA, by contrast, is a negotiated legal framework—more durable, more predictable, and typically broader (goods, services, investment, facilitation, IP, digital trade, and mobility provisions). For Bangladesh’s export sectors—especially ready-made garments (RMG)—certainty is the key asset. Buyers sign long contracts, plan sourcing years ahead, and increasingly insist on compliance evidence (social, environmental, traceability). A stable trade framework makes Bangladesh easier to “keep” in sourcing strategies.

What We Know About the Epa's Main Package for Access to the Market

As per Bangladesh Custom Data by Import Globals, publicly reported details in late 2025 and early 2026 point to a major immediate tariff benefit for Bangladesh in Japan—especially for apparel—paired with a longer, phased opening for Japanese goods into Bangladesh.

Key Elements Reported Include:

- Duty-free access in Japan for 7,379 Bangladeshi products, described as covering about 97% of Bangladesh’s export basket, effective from the start of implementation.

- Duty-free access in Bangladesh for 1,039 Japanese products, largely phased over as long as 18 years (supporting gradual adjustment for domestic industry).

- Rules of origin support for garments, including single stage transformation features that help apparel qualify even when some upstream inputs are imported.

- As per Bangladesh Trade Data by Import Globals, a significant services package, with Bangladesh opening 97 sub-sectors and Japan opening 120 sub-sectors (as reported), which matters for logistics, IT/ITeS, professional services, and investment facilitation.

- Coverage beyond tariffs: services, investment, trade facilitation, and intellectual property are explicitly referenced in official-style reporting.

The Trade Baseline: What makes Japan Worth the Work

This design signals something practical: the agreement is not only meant to “save” current exports post-LDC, but also to diversify what Bangladesh sells to Japan—moving beyond basic apparel into higher-value manufacturing, leather alternatives, pharmaceuticals, processed foods, light engineering, and services.

Japan is not only large—it is specific. It demands product consistency, documentation discipline, and on-time delivery. Those requirements can be a barrier for first-time entrants, but they also create stickiness once supplier credibility is established.

As per Japan Import Data by Import Globals, trade data points for 2024 show that two-way goods trade is meaningful and relatively balanced in value terms:

- Japan’s imports from Bangladesh (2024): about US$1.53 billion.

- Japan’s exports to Bangladesh (2024): about US$1.51 billion.

- Apparel remains the anchor of Bangladesh’s exports to Japan, but the opportunity lies in expanding share in a high-quality market while building a reputation that spills over into other OECD destinations.

Getting Ready for Growth after the LDC: A Practical Plan

1) Treat Rules of Origin as a Core Capability, Not Paperwork

In Japan, “qualifying” is everything. As per Japan Export Data by Import Globals, firms should build internal origin competence: product-wise bill-of-materials mapping, supplier declarations, and auditable traceability. For apparel, even a favorable single-transformation-style pathway still requires documentary discipline.

A good strategy is to create a dedicated “origin and compliance desk” that works with merchandising, sourcing, and finance—so the commercial team does not sell what compliance cannot certify.

2) Upgrade Quality Systems to Japan Expectations

Japanese buyers penalize variability. Bangladesh exporters targeting Japan should level up:

- In-line and final QC, defect analytics, and root-cause prevention.

- Packaging and labeling accuracy (Japanese language requirements where needed).

- Fabric performance testing and chemical compliance where relevant.

- This is less about one-time certifications and more about repeatable factory routines.

3) Use the EPA to Diversify Beyond Basic Apparel

As per Japan Custom Data by Import Globals, the EPA’s biggest long-term value may be in diversification: more engineered textiles, functional wear, footwear substitutes, jute-based composites, bicycles/light engineering, consumer goods, and IT services. Japan’s market rewards specialization and quality branding.

Bangladesh can also use Japanese partnerships for process upgrading—lean manufacturing, automation, energy efficiency, and higher-value design work.

4) Align Investment Pitches With Japanese Decision Logic

Japanese investors often value stability, governance clarity, and long-term partnership models. EPA-backed certainty can improve investor confidence, but Bangladesh still needs:

- Credible dispute-handling and predictable regulations

- Faster land/utility provisioning for industrial projects

- Better logistics reliability (ports, inland transport, customs predictability)

- In 2025, Japan also announced major financial assistance for Bangladesh, reinforcing the broader economic partnership environment and signaling continued strategic interest.

More Than Just Trade: The Multiplier for Infrastructure and Connectivity

As per Japan Trade Data by Import Globals, trade agreements deliver faster when they ride on connectivity. Bangladesh-Japan cooperation has strong infrastructure depth (ports, transport corridors, urban transit, and industrial capacity building). As logistics improves—especially at ports and trade-facilitation interfaces—the cost and time to serve Japan falls.

For exporters, this matters in a simple way: lower lead times and fewer clearance uncertainties let suppliers accept tighter delivery windows, which is often the difference between winning and losing Japan orders.

How to be successful in 2026–2028

If implemented well, the EPA could produce three visible outcomes after LDC graduation:

- Retention of competitiveness in Japan for core export lines (especially apparel) even after broader preference dynamics change.

- Rising Japanese investment in export-oriented manufacturing and logistics ecosystems, not only consumption-market consumer goods.

- As per Bangladesh import data by Import Globals, export diversification: more non-apparel goods and more services participation, with Bangladesh building “Japan-grade” credibility that helps in other demanding markets.

- The agreement is a platform. The actual growth will be decided by execution—compliance systems, product strategy, logistics performance, and investor-ready project pipelines. Import Globals is a leading data provider of Bangladesh Import Export Trade Data.

FAQs

Que. When is Bangladesh’s LDC graduation scheduled?

Ans. Bangladesh is scheduled to graduate from LDC status on 24 November 2026.

Que. What is the headline benefit of the Bangladesh–Japan EPA for exporters?

Ans. Reported terms include duty-free access in Japan for 7,379 Bangladeshi products, covering most of Bangladesh’s export basket, with garments benefiting from day one.

Que. Does the EPA only cover goods trade?

Ans. No. Reported coverage includes trade in services, investment, trade facilitation, and intellectual property, making it a broad economic framework.

Que. What should exporters do immediately to prepare?

Ans. Build strong rules-of-origin documentation, upgrade quality systems to Japan buyer standards, and develop diversified product offerings beyond basic apparel.

Que. Where to get detailed Bangladesh export data and Japan trade data?

Ans. Visit www.importglobals.com.