- Feb 20, 2026

Canada & Indonesia Cepa: Emerging Opportunities in Clean Tech and Agri-Food

As the Canada–Indonesia Comprehensive Economic Partnership Agreement (CEPA) proceeds from negotiation headlines to preparation for real-world implementation, Canada and Indonesia are entering a new era of their business partnership.

For businesses on both sides, the deal is less about "trade liberalization" in the abstract and more about solving two urgent, investable problems: Indonesia's need for cleaner energy and stronger infrastructure, and its need for stable, affordable food supply chains.

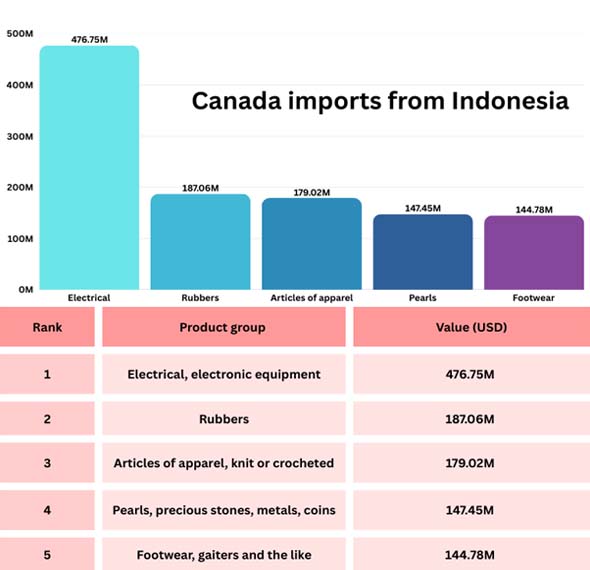

As per Canada Import Data by Import Globals, Canada, on the other hand, wants to diversify its trade with countries in the Indo-Pacific and put its clean and resource capabilities into fast-growing Asian markets. Timing is the most critical thing for 2025–2026. Early movers may set standards, create distribution, and lock in alliances before "CEPA-ready" competition fills the market. The companies that succeed won't just be the ones that export at the lowest cost. They'll be the ones that have local partners, technical credibility, regulatory fluency, and financing arrangements.

Where CEPA Makes a Difference

CEPA aims to make it easier for businesses to enter new markets, lower or get rid of tariffs on a wide range of goods, and make the rules for services, investment, and regulatory transparency clearer. The practical effect is that transaction friction goes down, especially for products that need certification, continuous servicing, spare parts, and long-term performance guarantees. As per Canada Export Data by Import Globals, these are all typical in clean-tech projects and modern agri-food supply chains.

For clean tech, CEPA's most important consequence is not only tariff lines. It's the predictability that helps projects get funding: clearer investment safeguards, more open procedures, and a structure that makes it easier to create cross-border partnerships. For agri-food, CEPA can help Canada become a bigger provider of basics like grains and also help the country move toward higher-value exports like ingredients, processing inputs, and foodservice channels.

Why Indonesia Is a "Demand Engine" for Clean Technology Right Now

Indonesia is a big group of islands with a growing need for power, fast-growing cities, and a complicated system geography. As per Canada Trade Data by Import Globals, this makes it a good place for solutions for distributed energy, storage, grid modernization, and industrial decarbonization. At the same time, there is more demand from investors and policymakers to speed up the use of renewable energy and make the system more flexible.

This is where Canada's clean tech skills come together in a way that is very unusual:

Grid and System Engineering:

- Planning, tools for stability, forecasting, and systems for control.

- Energy Storage and Hybridization: batteries, integrating storage, and managing performance.

- Decarbonizing Industry: services for managing methane, carbon, and electricity use.

- Linking ethical supply chains to battery and electric vehicle ecosystems through critical minerals and processing know-how.

- Project Finance Readiness: Canadian companies frequently have the bankable paperwork, warranties, and compliance standards that big projects need.

- As per Canada Customs Data by Import Globals, Indonesia's renewable energy buildout pipeline, which includes big solar projects, also creates a need for EPC partners, component suppliers, O&M providers, and expert consultants, especially when projects have to meet safety, performance, and reporting standards.

Clean-Tech Opportunity Lanes That Work for CEPA Best

1) Upgrading the grid and finding "flexible" solutions

Because of Indonesia's location, software-defined grid technologies, storage, and hybrid systems are even more useful. As per Indonesia Import Data by Import Globals, Canadian businesses who can offer services like monitoring, forecasting, asset management, and adaptability (not just hardware) are in a good position.

2) Packages for solar, storage, and industrial electricity

More and more, industrial parks and big energy consumers require everything to work right and keep costs down. Packages that include solar, storage, energy management, and finance can do better than selling equipment on its own.

3) Technologies for managing carbon and the environment

Because Indonesia has a lot of factories, there is a need for instruments to monitor emissions, reduce methane, clean up the environment, and make sure rules are followed. In these areas, Canada has established vendors and trustworthy service providers, including "measurement-first" solutions that make it easier to get finance and meet compliance requirements.

4) Critical minerals cooperation

It connects upstream-to-manufacturing Indonesia's role in battery minerals and Canada's strengths in mining, processing, and responsible supply chain practices create opportunities for joint ventures, processing collaboration, and services exports, especially when customers want traceability and ESG compliance.

Agriculture and Food: From Basic Needs to Value-Added Growth

Canada and Indonesia already have a significant trade relationship when it comes to agri-food, especially when it comes to key crops utilized in food processing. As per Indonesia Export Data by Import Globals, CEPA can strengthen this base and expand into higher-value categories as Indonesia’s middle class grows and modern retail and foodservice channels scale.

What is most Likely to Expand the Fastest

- Grains and basic inputs (continuing volume strength, more competition as barriers collapse).

- Food processing supplies, like specialist flours, protein additives, and feed inputs.

- Products that are tied to cold chains and packaging (where quality and shelf life are key).

- Foodservice channels, such as restaurants, quick-service restaurants, motels, and institutional buyers who want a steady supply.

What to Watch in 2026: Signs of Early Movers

It's important to know that Indonesia's foodservice growth outlook is good. When foodservice grows, it needs more reliable, standardized inputs, which is exactly what Canadian exporters can provide.

Even with CEPA, Indonesia is still a market where success depends on being disciplined in business. As per Canada Import Data by Import Globals, some common causes of friction are certification procedures, the power of importers and distributors, local content standards in some categories, and the difficulty of public-sector procurement.

A useful way to reduce risk in 2025–2026:

- Pick "service-backed" offers (such maintenance, monitoring, and warranties) instead of one-time delivery.

- Documentation, safety, traceability, and reporting are all parts of compliance.

- Work with local partners including EPCs, distributors, and project developers that are already familiar with licensing.

- As per Canada Export Data by Import Globals, finance is strategy: buyers of clean tech typically need structured finance, and delivering a solution is better than selling a part.

- Pilot quickly, then grow: a single credible pilot with measured results is typically the strongest sales tool.

The Problems with Real-World Execution (and How to Avoid Them)

As CEPA gets closer to going into effect, keep an eye out for three signs that show where short-term deals will be made:

- Public and utility procurement pipelines (for things like grid, storage, solar, and system upgrades).

- Budgets for industrial decarbonization (energy efficiency, monitoring, and switching fuels).

- Food security moves (planning for imports, reserve policy, and how to buy staples).

- If you want to develop a pipeline for 2026, the best time to make relationships, get certifications, and submit pilot projects is before the market completely adjusts to the CEPA possibility. Import Globals is a leading data provider of Canada Import Export Trade Data.

Conclusion

The Canada–Indonesia CEPA makes it possible to move at two speeds. The fast lane is trade growth in the foreseeable future, notably in basic agri-foods and technologies that make things easier. The compounding lane involves clean-tech platforms including grid modernization, storage integration, industrial decarbonization, and carbon management services that expand through long-term contracts and recurrent installations. Companies who see CEPA as more than simply a tariff headline and use it as a go-to-market method will succeed.

They should create local partnerships, make offerings that are ready for financing, and start with pilots that show results. The cooperation has the potential to become one of the most useful growth stories for both countries in the Indo-Pacific region between 2025 and 2026, when energy transformation and food resilience are important. Import Globals is a leading data provider of Indonesia Import Export Trade Data.

FAQs

Que. Is CEPA mostly about tariffs, or does it also aid services and investments?

Ans. It's more than just tariffs. Clean-tech initiatives often depend on clear rules, investment arrangements, and service contracts, all of which CEPA is meant to strengthen.

Que. Which parts of clean technology are the most appealing right now?

Ans. Tools for modernizing the grid, solar-plus-storage bundles, solutions for improving industrial efficiency, and services for measuring and meeting emissions standards tend to be adopted more quickly.

Que. Which kind of agri-food get the most out of better access to markets?

Ans. Core products are still staple grains and processing inputs, but as consumer demand develops, value-added ingredients and supply chains tied to food service can grow swiftly.

Que. What is the largest risk of failing to carry out the plan for new businesses?

Ans. Not taking into account the reality of doing business in the area, such as certification, distribution, procurement, and the quality of partnerships. A local partner strategy and a pilot-first approach lower this risk.

Que. Where to get detailed Canada Customs Data or Indonesia Export Data?

Ans. Visit www.importglobals.com.