- Feb 21, 2026

Renewal of Agoa: What It Means for U.S. - Africa Trade in 2026

For more than 20 years, the African Growth and Opportunity Act (AGOA) has been the most important feature of the U.S. trade policy for sub-Saharan Africa. It helps some countries export a lot of things to the U.S. without having to pay tariffs.

Why AGOA is Still Important in 2026

The goal is to boost GDP through exports, create jobs (especially in light industries like textiles), and improve economic ties with the U.S.But from 2025 to 2026, AGOA went from being a "background framework" to a "front-page risk factor."

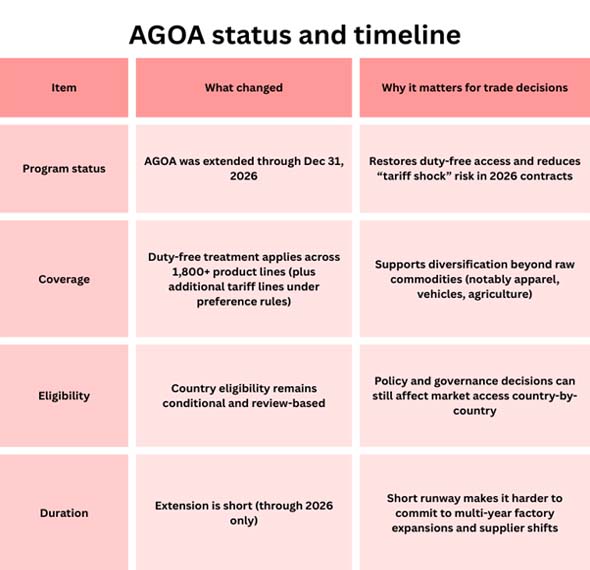

As per USA Import Data by Import Globals, the program stopped on September 30, 2025, and the gap made things unclear right soon. This had an impact on firms that needed to get things done quickly by changing their orders, funding, and production plans. The US passed a brief extension that extends AGOA until December 31, 2026 and resets benefits back to when they were first given. This gave them a break, but not a long-term guarantee.

What Was Renewed and What Wasn't?

The easiest way to think of the 2026 reauthorization is as a "bridge extension." It resumes the preference program and keeps the trade channels open for qualifying exports. However, it does not answer the fundamental question of what U.S.–Africa trade should look like after 2026. As per USA Export Data by Import Globals, the dispute is getting more heated because the U.S. is putting greater emphasis on reciprocity, giving U.S. companies access to markets, and making sure that its strategic interests are more closely aligned.

What the State of U.S.–Africa Commerce Will be in 2026

On a larger scale, the U.S. trade in goods with sub-Saharan Africa is still important but limited. As per Africa Import Data by Import Globals, the U.S. exports things like airplanes, machines, refined petroleum products, and farm inputs. It imports things like energy products, cars, metals, and consumer goods. The deficit changes from year to year and is very much affected by the cycles of commodities prices. The U.S. Census Bureau's goods trade with sub-Saharan Africa (not just AGOA) is shown below. It uses the most current months posted for 2024 and 2025 to illustrate the most recent official pattern across the region.

What AGOA Really Does: The Reality of Use

People often think of AGOA's effects as "big totals." The underlying strategic value of AGOA is that it makes some businesses possible in some natie ons. As per Africa Import Export Trade Data by Import Globals, this is especially true for companies that are up against cheap Asian suppliers and have tight profit margins.

Two essential things stand out: Energy can make up a large part of AGOA totals (as in 2022–2023), yet

The actual "jobs story" in AGOA is non-oil commerce, which includes cars, clothes, and agro-processing.

Who Benefits the Most From the Extension in 2026?

1) Clothing and light manufacturing: help right away, but confidence is low

Apparel exporters benefit more from stable duty-free access than other exporters since U.S. purchasers place orders months in advance. Even a slight delay can cause orders to be sent to other suppliers. As per USA Import Data by Import Globals, the 2026 extension lowers the risk of tariffs in the near future and may assist restart talks about sourcing that have been put on hold, especially for countries where clothing exports support a lot of formal jobs. The limited time frame, meanwhile, until the end of 2026 still makes it hard to expand capacity. To justify additional lines, compliance updates, and hiring more workers, factories and investors need to be able to foresee things for several years. Unless there is real progress toward a longer renewal, 2026 should not be a "boom year" but rather a "stabilization year."

2) Exports of Cars and Other Goods: South Africa and Regional Value Chains

Vehicles and parts have been among of the most valuable non-oil AGOA exports. The extension will assist keep shipments going in 2026 and may also help maintain deeper supplier ecosystems (tooling, sub-assemblies, and logistics). But it also makes exporters work harder to prove that AGOA is more than just "preferences." It is also a method to improve standards, make value chains more resilient, and improve traceability.

3) Agriculture and Agro-processing: When Logistics and Standards Are in Sync, the Chances of Success Improve

When exporters can meet U.S. sanitary, phytosanitary, and traceability standards, AGOA's benefits are even greater. As per USA Export Data by Import Globals, duty-free access can be very important for products like processed foods, horticulture, nuts, and specialty crops, as long as exporters can provide the same amount and become certified. Because U.S. importers are becoming more risk-averse, compliance capacity-building and buyer-driven requirements will be more important in 2026.

4) Supply chains for critical minerals and energy transition: strategic benefits, complicated policies

The U.S. aim for strong supply chains in important areas also fits with the 2026 extension. Some African economies are getting ready for processing that adds value instead of just exporting raw materials. But these areas are also the most politically sensitive, where laws of origin, ESG expectations, and geopolitical factors can affect market access as much as tariffs do.

The Key Policy Story in 2026: From "Preferences" to "Terms"

The U.S. is now casting AGOA as something that should provide obvious mutual commercial benefits, such as better access for U.S. companies, less impediments, and more agreement on trade policy priorities. As per Africa Import Data by Import Globals, that doesn't mean AGOA will become an FTA right away, but it does indicate that in 2026 there will probably be more difficult talks about:

- Market access and regulatory hurdles that make it hard for U.S. exporters to conduct business,

- Enforcing governance and eligibility criteria,

- And if the next step should be regional, bilateral, or part of a larger attempt to bring Africa together.

- At the same time, Africa's plan for continental integration (via AfCFTA) is going in the opposite direction: first, develop greater regional markets, and then negotiate from a stronger platform. The most likely "win-win" option after 2026 is one that makes African regional value chains stronger while also making the regulations for U.S. investors and buyers clearer and easier to follow. Import Globals is a leading data provider of USA Import Export Trade Data.

What Businesses Should Do Now (a Guide for 2026)

- Sign contracts for 2026 early if duty-free status has a big effect on prices, but make sure to include clauses for situations that happen after 2026.

- Put money on compliance and traceability, like rules of origin paperwork, labor and environmental expectations, and product standards. This is becoming less of a "nice-to-have" and more of a "market access requirement."

- Diversify inside the U.S. market: instead of relying on one buyer, build portfolios of buyers across retailers, brands, or industries.

- Build regional sourcing when you can. As per USA Import Data by Import Globals, stronger regional inputs can lower the risk of supply problems and make production more stable in case restrictions go stricter later.

Conclusion

The AGOA renewal until December 31, 2026, brings back an important trade link and keeps things running smoothly for exporters and U.S. buyers who need to know how much things will cost when they arrive. But the short time frame also makes 2026 a year of high-stakes negotiations. The direction of policy, judgments about who is eligible, and the future structure of U.S.–Africa trade will all affect whether AGOA becomes a platform for deeper industrial engagement or stays a cliff-edge. After this renewal, the next phase is to build trust: a longer time frame, clearer norms, and a shared strategy that encourages diversification, not just the flow of goods. Import Globals is a leading data provider of Africa Import Export Trade Data.

FAQs

Que. Is AGOA "safe" now that it has been renewed until 2026?

Ans. It lowers the risk for 2026 in the short term, but uncertainty comes back soon if there isn't a longer extension.

Que. In practice, which sectors get the most out of AGOA?

Ans. Non-oil exports like clothes, cars and parts, and some agricultural and food items often create the greatest jobs.

Que. Is it possible for a country to lose its AGOA eligibility even if the program is renewed?

Ans. Yes, eligibility is conditional and can be changed. Countries can be suspended or have their benefits changed.

Que. What should exporters focus on in 2026 to stay ahead of the game?

Ans. Compliance (origin, standards, ESG), reliable delivery, and a variety of buyers—so they're ready if restrictions get stricter after 2026.

Que. Where to get detailed Africa Import Export Trade Data?

Ans. Visit www.importglobals.com.