- Feb 18, 2026

EU-Uzbekistan Enhanced Partnership: Expanding Trade & Investment Ties

In 2025–2026, Europe's ties to Uzbekistan went from "promising" to "strategic." The reason is simple: Uzbekistan is becoming a more connected and reform-minded center in Central Asia.

At the same time, the European Union is working to make supply chains more diverse, improve overland connectivity, and find trusted partners for energy-transition inputs and new markets. As per European Union Import Export Trade Data by Import Globals, this better connection isn't just about more trade.

It is about creating the conditions that make trade and investment possible again and again. These include clearer rules, better logistics corridors, bankable infrastructure projects, and stronger links between the private sector and the public sector. For exporters, investors, and logistics companies, the key to success is to be early, disciplined, and based in the area.

What it Means to have A "Enhanced Partnership"

The improved track is based on two pillars that support each other:

A Stronger Political and Economic System

In late 2025, the EU and Uzbekistan signed a new partnership agreement that was meant to improve cooperation in trade, investment, connectivity, and sectoral collaboration. As per European Union Import Data by Import Globals, this is important for businesses because it usually makes the "operating environment" better by making things more open, encouraging regulatory engagement, aligning technological standards, and stopping disputes before they start.

A Project and Financing Pipeline Under Global Gateway

The EU and "Team Europe" institutions are also getting investments for transport corridors, digital connectivity, sustainable energy, and value chains for essential raw materials. This is where exporters and investors acquire traction: through sponsored feasibility studies, tender pipelines, and tools to reduce risk.

In other words, the agreement determines the course, and Global Gateway puts money behind it.

The Trade Truth is That It is Expanding but Yet Not Big Enough

Trade between Uzbekistan and the EU is growing from a small basis, which is what makes it so appealing. When trade is still "small enough," early movers can set standards, build relationships with suppliers, and make localization plans before marketplaces get too saturated. As per Uzbekistan Import Data by Import Globals, this demonstrates that EU exports to Uzbekistan are far bigger than imports, and the total trade in goods has grown quickly since the early 2020s, even though it has been volatile from year to year. The relationship is becoming more and more shaped by imports that are tied to investments (such equipment and technology) and Uzbekistan's desire to export more high-value goods.

What the EU Exports to Uzbekistan and Why It Matters for Investors

In 2024, the EU sent a lot of machinery and transportation equipment to Uzbekistan, followed by chemicals and other manufactured goods. This mix is a classic evidence that an economy is investing in modernization and industrial competence. This is usually a favorable sign for capital goods exporters, engineering services, EPC contractors, and maintenance/service ecosystems.

As per Uzbekistan Export Data by Import Globals, exporters should know that Uzbekistan is buying the tools it needs to modernize, like industrial equipment, systems for transportation, and chemicals. If you export capital goods, you have more than just good products. You also have the ability to install them, offer financing alternatives, have spare parts on hand, and train people.

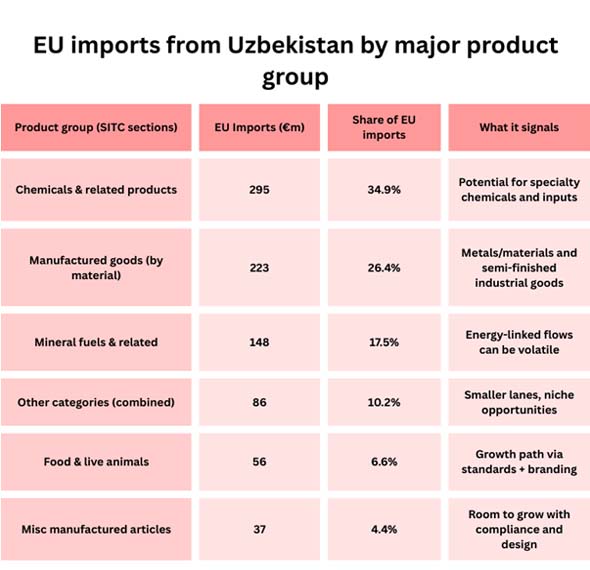

What Uzbekistan Sells to the EU: Where it Can Grow

Uzbekistan's exports to the EU are still smaller and more focused, but the make-up of those exports is changing. The government wants to move up from exporting raw materials to processed agri-food, textiles with compliance credentials, and intermediate industrial goods.

As per European Union Import Export Trade Data by Import Globals, this will be possible with the help of preferential access schemes and reforms. Investors should know that the best thing about Uzbekistan is that it adds value to its products. This includes processing, packaging, certification labs, logistics, and industrial clustering that translates "export potential" into guaranteed access to the EU market.

The GSP+ Factor: The Quiet Speed-Up

Uzbekistan's membership to the EU's GSP+ preference system, which lowers tariffs for countries that promise to be environmentally friendly and follow good governance, has helped the country sell more goods to a wider range of markets. As per European Union Import Data by Import Globals, for businesses, this creates a practical playbook:

- If EU importers want to save money on purchasing some goods, Uzbekistan can be an excellent destination to get them.

- For Uzbek exporters, scaling up means being ready to follow rules about traceability, labor and environmental norms, and having strong documentation.

- For investors, compliance infrastructure itself becomes something they can invest in, like testing labs, certification services, digital traceability, ESG audits, wastewater treatment, and safer chemicals handling.

- In many new industrial centers, the "real moat" isn't cheap labor; it's being able to be audited and follow the rules on a large scale.

Why Corridors Are More Important Than Tariffs When It Comes to Investing in Connectivity

In Central Asia, trade is generally limited more by location, border problems, and shipping costs than by tariffs. As per Uzbekistan Import Data by Import Globals, this is why the EU's effort for better connectivity is so important to the stronger partnership:

- Transport Corridors: making highways, logistics nodes, and cross-border flow management better makes things more reliable and cuts down on lead times.

- Digital Connectivity: exporters can better handle paperwork, payments, and customer service with stronger networks and digital public infrastructure.

- Clean Energy and Efficiency: the cost and reliability of energy, as well as meeting buyers' expectations for sustainability, are becoming more and more important for businesses to stay competitive.

- This is Where Eu-backed Funding is Quite Important: it may turn "corridor ambition" into real projects that can be bid on and signed.

Critical Raw Materials and Industrial Cooperation: The Strategic Layer

Europe's focus on supply resilience from 2025 to 2026 has made Central Asia more important from a strategic point of view. As per Uzbekistan Export Data by Import Globals, Uzbekistan's potential role goes beyond extraction. The higher-value opportunity is in processing, refining, and developing a responsible supply chain that meets the environmental and ethical standards that European purchasers are increasingly looking for.

This gives businesses a number of options:

- Exports of mining, processing, safety, and environmental control equipment

- Engineering and EPC services

- Digital tools for tracking and following the rules

- Joint partnerships in midstream processing where you can get bankable offtake

- The best projects will be the ones that meet EU standards while still being cost-effective in the local market and having long-term commitments from buyers.

A Useful Guide for Businesses on What to Do in 2026

1) Don't think of Uzbekistan as a one-time sale; think of it as a "platform market."

As per European Union Import Export Trade Data by Import Globals, If you send machinery, chemicals, pharmaceutical inputs, or engineering services to other countries, you should arrange for a distributor and service partner organization.

- Parts and warranty service,

- Training and documentation that is specific to a location.

2) Create an export model that puts compliance first

If you are buying something from Uzbekistan or investing there, you should expect EU purchasers to want: traceability,

- Certification,

- ESG papers,

- Trustworthy audit trails.

3) Follow the money: make a map of the Global Gateway pipeline.

Often, the quickest way to grow is through sponsored projects like enhancements to transportation and logistics. Import Globals is a leading data provider of European Union import export trade data.

- Programs for digital connectivity,

- Enhancements to industry that are tied to sustainability.

- As per Uzbekistan Import Data by Import Globals, get ready for the tender early by getting your qualification dossiers, consortium partners, and local legal skills in order.

4) Make mixed offers that include a product, financing, and service

In many markets for modernization, the seller who can package: equipment,

- Care,

- Training,

- And a reliable way to get money (vendor finance, partner banks, or IFI-linked organizations).

5) For investors, "enabling infrastructure" should be at the top of their list

Investments with high leverage include:

- Logistics and cold chain,

- Testing and certification labs,

- Clean utilities in industrial parks,

- Treating wastewater and using resources more efficiently,

- Internet platforms for compliance and tracking.

These make it possible for more than one export sector

Conclusion: A Relationship Going From Possible to Real

As per Uzbekistan Export Data by Import Globals, the EU–Uzbekistan enhanced relationship is turning into a real economic corridor. New policies and finance pledges are making projects that can be invested in and commerce easier. In the short term, companies that focus on the basics—realistic logistics, strict compliance, good service, and strong partnerships—will do well. In the long run, companies that focus on connectivity, clean industry, and responsible supply chains will do well. Import Globals is a leading data provider of Uzbekistan Import Export Trade Data.

FAQs

Que. Is trade between the EU and Uzbekistan already big enough to make a difference?

Ans. Yes, since it is developing from a base that can be managed. This is perfect for new businesses to build distribution, alliances, and brand trust before the competition gets tougher.

Que. What sectors will be the best for EU exporters in 2026?

Ans. Sectors that make capital goods and are linked to modernization include machinery, transport equipment, industrial systems, chemicals, and the services that keep them running.

Que. What is the main non-tariff hurdle to trade growth?

Ans. Logistics and compliance readiness—documentation, standards, auditability, and reliable corridor performance are just as important as tariffs.

Que. What are the finest places to invest besides extraction?

Ans. Processing/value addition, compliance infrastructure (labs, traceability), logistical nodes, and clean utilities that help industry that is focused on exports.

Que. Where to get detailed European Union import data or Uzbekistan export data?

Ans. Visit www.importglobals.com.