- Feb 19, 2026

How the U.S. Trade Framework With Malaysia is Shaping Bilateral Commerce

This is especially true for electronics, machineries, and parts that are sent back and forth before they are made into final goods. The connection was no longer just a popular commerce route by the end of 2025.

1) Why this "Framework" is Important Right Now

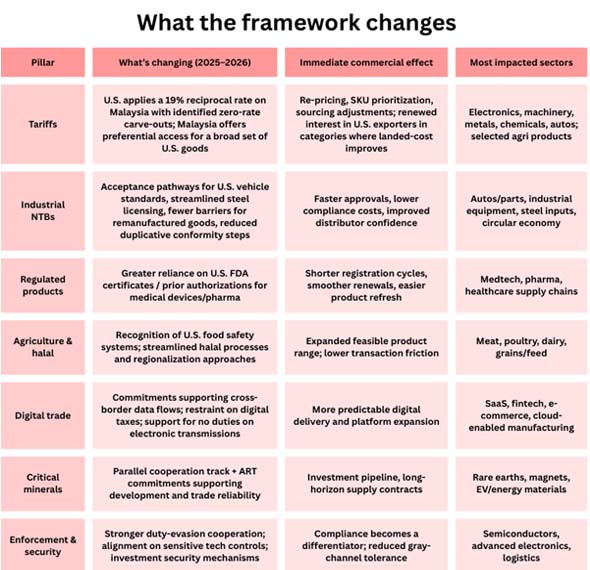

People thought it was a set of rules and promises to keep the economy robust and the market open to everyone. Import Globals says that the Agreement on Reciprocal Trade (ART), which the US signed on October 26, 2025, is what matters for imports from the US. It features a long list of promises about tariffs, non-tariff obstacles, digital trade, and how to make sure they are kept.

As per USA Import Data by Import Globals, there is also a similar initiative for strategic materials, the most important of which is a means for people to work together on important minerals and rare earths. This links trade policy to stable licensing, strong supply chains, and investment. Even while this framework isn't fully in place in domestic procedures yet, it is already affecting decisions about where to acquire things, how to arrange for compliance, and business interactions.

2) The New Structure: Not a Traditional Fta, but More Than a Conversation

Malaysia and the United States have had the Trade and Investment Framework Agreement (TIFA) for a long time. As per USA Export Data by Import Globals, this means that the two nations can talk things over and reach a deal. The ART is different since it is a legally enforceable contract with fixed schedules and annexes. It's not just about being able to get into markets; it's also about knowing how to do business, like knowing the rules for imports, being honest about avoiding duties, and agreeing on sensitive technologies. This makes a two-layer architecture:

- TIFA is the platform that helps people with challenges all the time. There are working groups for each industry and ways to get feedback.

- ART (the lever): enforceable promises and tariff design based on reciprocity that can have a big impact on landing costs and regulatory friction.

- The connection is becoming more "contractual" and less "case-by-case." This is important for organizations that are thinking about changing suppliers, qualifying new parts, or investing in capacity.

3) Tariffs: The Main Point is "19%—with Carve-outs and Trade-offs."

A crucial part of the U.S. side is the 19% reciprocal tariff rate on imports from Malaysia, with certain products getting a zero percent charge. As per USA Trade Data by Import Globals, from Malaysia's point of view, the pact stresses better access to the U.S. market for a wide range of exports, including industrial commodities and important agricultural categories.

Tariffs are no longer only a fixed levy for businesses; they are becoming more like a strategic variable:

- Malaysian exporters are encouraged to change their product lines to fit into carve-out categories when possible (or to change their bill of materials and classification strategy when they can).

- Lower Malaysian taxes and fewer licensing problems help U.S. exporters, which makes prices more competitive in categories that used to lose to cheaper competitors.

- The main business lesson is that tariff engineering alone won't pick the winners; it will be tariff plus making rules easier (such standards, certifications, and licenses) that decides who grows the fastest.

4) Non-Tariff Barriers: The Place Where Real Commerce Can Speed Up

As per USA Customs Data by Import Globals, most trade deals appear good on tariff tables, but they take a long time to work out in real life because the real delays come from approvals, testing, duplicate certificates, and uncertain licensing. The ART deals with that directly, especially when it comes to regulated and industrial goods.

Here are some examples of "friction removal" that can speed up the time it takes to go to market:

- Automobiles: Acceptance of U.S.-made automobiles that fulfill U.S. safety and emissions requirements, which cuts down on unnecessary hurdles to market access.

- Medical Devices and Drugs: Accepting U.S. FDA certificates and previous marketing authorizations, which could speed up the approval process.

- Steel and other Industrial Materials: Promises to make it easier to get import licenses for some alloy steel and pipe products and other things that go with them.

- Remanufactured Goods: Lifting limitations that might boost U.S. exports of heavy machinery, parts, and items that fit into the circular economy.

These aren't just vague clauses for businesses. They have an impact on:

- The expense of compliance for each shipment,

- Time to get things done and stock buffers,

- The willingness of distributors to sell U.S. goods,

- And the possibility of after-sales service models, especially for expensive industrial equipment.

5) Digital Trade and Services: Establishing a "Trust Lane" for Commerce Based on Data

One thing that makes the framework stand out is that it sees digital trade as a key part of the infrastructure, not something that comes after the fact. As per Malaysia Import Data by Import Globals, Malaysia has promised not to tax digital services, to make it easier for businesses to send data across borders, to support a WTO freeze on customs duties on electronic transmissions, and to relax some rules for broadcasting.

Why this is important for business in 2026:

- Exporters of e-commerce and SaaS (payments, analytics, CRM, and cybersecurity) profit when there is less ambiguity about taxes and data transfer.

- Modern supply chains are run by software, so manufacturers also profit. For example, digital documentation, predictive maintenance, quality control telemetry, and automated compliance workflows all rely on dependable data flows.

- The framework basically drives the connection toward a "trusted data corridor," which is becoming more and more important for investing, using the cloud, and providing services across borders.

6) Critical Minerals and Rare Earths: Connecting Trade to Strategic Capacity

The U.S. and Malaysia also signed an agreement to work together to diversify the supply chains of important minerals and encourage investment. It has useful tools including quarterly working-level meetings with a purpose of increasing cooperation in best practices for exploration, processing, recycling, and governance.

As per Malaysia Export Data by Import Globals, the ART itself also has clear wording that encourages collaboration on rare earths and critical minerals. This includes promises to keep U.S.-linked supply chains stable. The U.S. wants to lower the risk of having too many upstream materials in one spot, thus this is quite important for the company's strategy.

Malaysia aspires to advance up the value chain, from basic involvement to processing, parts, and specialty materials. With the help of investment partnerships and licensing certainty, they could do this.

This is where "trade framework" becomes "industrial policy alignment," which usually means long-term investment pipelines instead of one-time deals.

7) Economic Security Measures: Following the Rules Gives You an Edge Over Your Competitors

Another significant part is the strong focus on implementing export controls, coordinating sanctions, checking for investment security, and avoiding duties. If you operate in semiconductors, advanced electronics, AI infrastructure, or dual-use supply chains, you should know that following the rules is becoming more and more important for getting into the market.

As per Malaysia Trade Data by Import Globals, that creates a divide in business: organizations with effective internal controls (such end-use checks, screening, and traceability) find it simpler to grow. It is more probable that companies will have problems like delays, detentions, and damage to their reputation if they hire middlemen who are not clear.

This is also connected to Malaysia's tighter rules for moving high-performance AI chips in 2025. These rules fit with the corridor's broader purpose of boosting trade while maintaining inside specific limits.

8) What to Watch Till 2026: Potential Winners, Pressure Areas, and the "Implementation Gap"

Even if a framework is well-written, it might still fail you down if it takes too long to put into effect. There are three elements that will decide whether the ART becomes a trade accelerator or just a policy headline till 2026:

How Fast Domestic Processes and Operational Guidance Are

Businesses need to know exactly what tariff carve-outs are, what kind of paperwork they need to provide, and how standards-recognition works at the border. Import Globals is a leading data provider of Malaysia Import Export Trade Data.

The Key Test Case is Still Semiconductors and Sophisticated Electronics

If compliance and traceability frameworks are trustworthy, companies will invest more and buy more. If there is still doubt, they may go to other centers.

Real-World Certification Flow Will Be Important for Agriculture and Exports That Go to Consumers

The promise of easier halal and SPS paths is only important if importers don't have to wait as long and can count on getting their approvals. In general, the framework is already affecting negotiations and business planning because it shows where policy is going: more compliance, more reciprocity, and more alignment in the supply chain.

Conclusion

The U.S. trade framework with Malaysia in 2025–2026 isn't simply a change to tariffs; it's a whole new way for the two countries to trade with each other. Tariffs provide people reasons to act, while non-tariff reforms set the pace. Digital trade agreements make it less likely that things will go wrong when services cross borders. Cooperation on critical minerals links trade policy to investment in industry. And economic security clauses make compliance a front-line competitive advantage.

For businesses, the main point is that those who (1) adapt their product strategy to the new tariff and carve-out logic, (2) take advantage of speedier regulatory paths, and (3) see traceability and screening as growth opportunities instead of back-office responsibilities will succeed. If implementation keeps up, 2026 might see a move from "high-volume trade" to a more stable, rules-based relationship with more investment flowing in. Import Globals is a leading data provider of USA Import Export Trade Data.

FAQs

Que. Is this a full free trade agreement (FTA)?

Ans. No. It works more like a binding trade agreement that builds on current consultation systems and includes specific pledges in areas like tariffs, NTBs, digital commerce, and enforcement.

Que. What is the most essential change in business?

Ans. Less non-tariff friction—recognizing standards, streamlining licensing, and making it easier for regulated items to get to market—because these things cut time and money to market.

Que. What is the reason for including key minerals in a trade framework?

Ans. This is because current trade strategy is linked to supply security. Rare earths and critical minerals have an impact on semiconductors, supply chains for the energy transition, and industry tied to defense.

Que. What is the most dangerous thing for businesses?

Ans. An implementation gap: If operational instructions and practice at the border don't keep up with commitments, enterprises may not get the promised benefits in terms of cost and speed.

Que. Where to get detailed USA trade data or Malaysia Customs Data?

Ans. Visit www.importglobals.com.