- Dec 22, 2025

Europe's Place in Global Supply Chains for Green Technology

Europe is at a key point in the global green technology economy. When it comes to demand, Europe is one of the greatest markets in the world for renewable energy, electrification, and efficiency solutions.

As per Europe Import Export Trade Data by Import Globals, Europe is still strong in a number of high-value areas, such as wind, industrial equipment, and portions of heat pumps. However, it is facing a lot of competition (and import exposure) in other areas, especially solar PV and several upstream battery and crucial mineral processes.

Europe's role is so vital because it is not "just another buyer." Europe is working hard to change how green-tech supply chains work. It is doing this through industrial policy (to boost local capacity), raw-material policies (to lower concentration risk), and circular-economy laws (to get value back through recycling). The end result is a supply chain function that includes making things, defining standards, managing risks, and making markets.

Why Supply Chains are Important for Green Technology

As per Europe Import Custom Data by Import Globals, green technologies are made up of complicated worldwide networks that include mined materials, processed minerals, precision parts, advanced manufacturing, specialized logistics, and infrastructure that lasts for decades and needs repair and spare parts. Any weak link, like a limited mineral, a missing power electronics part, or a lack of competent installers, can slow down adoption, boost prices, and push back climate targets. Because the global market for important clean technology is likely to grow quickly—reaching hundreds of billions of dollars per year by 2030—controlling supply chains is as much a matter of competition as it is of climate. Europe's policy understands that "deployment without domestic capability" can make things less safe, and "domestic capability without demand" can't grow. So Europe wants both.

Europe's Role in the Supply Chain for Important Green Technologies

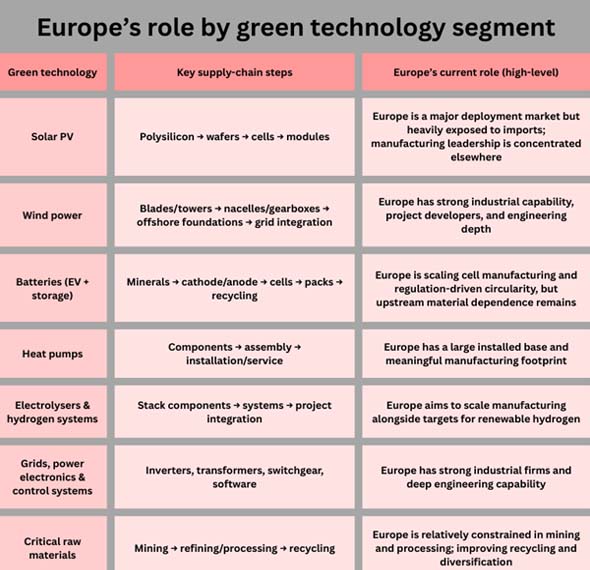

As per Europe Import Trade Analysis by Import Globals, Europe is best characterized as a powerful midstream and downstream actor in several areas, such as systems integration, project development, engineering services, and manufacturing. It has a mixed upstream presence in areas like raw materials, refining, and some phases in mass manufacturing. Europe is competitive on a global scale in some technologies, but in others it is struggling to recover its capability after a protracted shift toward Asia.

Solar PV: As per Europe Exporter Data by Import Globals, Europe is the "demand anchor" for the world, not the Factory

Solar PV shows the biggest structural supply chain problem in Europe. Over the past ten years, a lot of manufacturing capacity in the solar PV value chain has moved to Asia, mainly China. China already has more than 80% of the market for main solar panel production steps, thanks to huge investments and economies of scale.

It's not only about price rivalry for Europe. It also has to do with being exposed to: supply problems, frictions in trade, shipping and logistics problems, and the strategic risk of relying on a very small upstream base.

Europe's answer is based on industrial policy: making the manufacturing base stronger while keeping costs down. As per Europe Importer Data by Import Globals, the hard part is accomplishing this without slowing down installations.

Wind: Europe's Industrial Stronghold, but it can't Grow too Fast

Wind is where Europe's supply chains are still rather strong. Europe has long been good at turbine technology, offshore engineering, maritime logistics, and project development. The main problems are getting permits and getting to the grid.

Supply chain Scaling (big parts, ships, ports), and the Availability of Workers

As per Europe Import Trade Statistics by Import Globals, Wind is more important than just turbines. It pulls in a lot of different industries, like steel fabrication, composites, power electronics, marine construction, high-voltage equipment, and long-term operations and maintenance services.

Batteries: Europe is Growing Quickly, but the Upstream Reality is also moving Quickly

The supply chains for batteries are a classic "strategic-industry" struggle. As per Europe Import Shipment Data by Import Globals, Europe is constructing gigafactories and fighting for circularity through laws, but it is still vulnerable upstream, especially when it comes to minerals and some refining stages. That's why Europe is doing the following at the same time:

increasing the capacity to make cells,

pushing for laws on battery sustainability and traceability,

and stressing the importance of recycling to get lithium, nickel, cobalt, and other elements back.

As per Europe Import Export Trade Analysis by Import Globals, Europe also thinks that battery consumption would skyrocket through 2030 because of electric vehicles and grid storage. This means that batteries are both a business opportunity and a strategic area of dependence.

Heat Pumps: Europe's short-term industrial edge, but demand can Change Quickly

Heat pumps are a key part of Europe's plan to make buildings less carbon-intensive. Europe has a lot of factories, and industry reports show that most of the heat pumps sold in Europe are also made there (and this percentage is expected to grow over time). As per Europe Export Import Global Trade Data by Import Globals, sales have also been all over the place lately because of policy uncertainty, high financing charges, and worries about whether consumers can afford things.

For supply chains, heat pumps are as much About: installation, service networks, availability of parts, just like they are for manufacturing. Europe's biggest chance is to quickly increase both production and the number of competent workers needed for installation.

Electrolyzers and Hydrogen: Europe's "Scale-Up Decade"

Hydrogen is being marketed as a key instrument for reducing carbon emissions in industries that are hard to decarbonize, such as steel, chemicals, shipping fuels, and some heavy transport. Europe has made it clear that it wants to create and import a lot of renewable hydrogen by 2030. This puts the electrolyser supply chain in the spotlight: stacks, catalysts, membranes, power electronics, and system integration. Europe's advantage in this area is often in high-quality engineering and putting together industrial systems. As per Europe Import Export Global Data by Import Globals, the hardest element is the speed: going from prototypes to making things on a large scale and delivering projects on time and on budget.

Raw materials: the battleground of the supply chain that Europe wants to Fix

Lithium for batteries, rare earths for magnets, copper for grids, silicon for solar, and more are all important raw ingredients that come before almost every green technology. Europe's approach is becoming more and more based on benchmarks, with goals set to increase domestic capacity and lower dependency on any one third-country supplier.

Rules and standards: Europe as a "rule-maker" in green supply chains

Europe's impact is not limited to production volumes. It also affects how global supply chains work through rules and regulations, especially when it comes to things like:

product sustainability criteria,

reporting and traceability,

responsibilities for recycling and recovery,

and rules for getting into the market.

This "market power" is important because suppliers all over the world typically change their products to meet EU standards in order to sell them in Europe. This means that Europe's standards are exported around the world.

What Europe Needs to do to make its Influence Stronger

- The next step for Europe depends on how well it does on five practical fronts:

- Make more Products without Slowing down Rollout

- Local production is important, but we still need to install things quickly to reach our climate goals.

Get the materials and processing you need up front. As per Europe Import Data by Import Globals, goals assist, but projects still need to get approved, funded, and built.

- Increase the Skills of your Workers

- Installers, welders, electricians, grid engineers, and technicians become problems in the supply chain.

- Make demand Signals more Stable

- Changes in incentives and policies might stop investment in heat pumps, electric vehicles, and clean manufacturing.

- Compete on Price while staying Strong

- Europe needs to close the cost disparities in important technologies without becoming too reliant on them.

Final Thoughts

Europe has many roles in global green technology supply chains. It is a major deployment engine, a strong manufacturer in several fields (particularly wind and industrial systems), and a global standards-setter through regulation and industrial policy. But Europe's strategic shortcomings, especially when it comes to making solar PV and procuring the raw materials it needs, are real and need to be remedied over time. If Europe can quickly boost its clean-tech manufacturing, diversify its upstream inputs, and set up circular recovery, it will stay one of the most important parts of the green transition supply chain in the globe. Import Globals is a leading data provider of Europe Import Export Trade Data.

FAQs

Que. Does Europe make a lot of environmentally friendly technologies?

Ans. Yes, in some sectors, like wind and some portions of heat pumps and industrial systems. But it is still vulnerable to imports in other areas, like solar PV upstream manufacturing.

Que. What makes crucial raw materials so important for Europe's green transition?

Ans. They are inputs that go into batteries, grids, wind turbines, and solar PV. If the supply isn't stable, deployment slows down and costs go up.

Que. What is Europe doing to lessen its reliance on supply chains?

Ans. It is advocating for net-zero technology to be made in the country and defining standards for the mining, processing, recycling, and supply diversification of important raw materials.

Que. What other ways does Europe affect global supply chains besides making things?

Ans. Suppliers often have to follow rules and standards (including sustainability, traceability, and recycling) in order to sell their goods in Europe.

Que. Where to get detailed Europe Export Data?

Ans. Visit www.importglobals.com.