- Oct 17, 2025

Global Nickel Trade: Supply, Demand, and a Critical Metal's Evolving Geography

Nickel has always been utilized in specialized alloys and stainless steel, but its application in electric vehicle (EV) battery chemistries, particularly nickel-rich cathodes, has elevated it to a strategic level.

With new large suppliers, as per China Import Data by Import Globals, shifting pricing dynamics, and new geopolitical threats influencing the flows of ore, concentrates, and refined metal, the balance of production, refining, and commerce has drastically changed in recent years.

An Overview of the Market and the Importance of Trade

Nickel ores and concentrates (HS 2604), ferronickel, nickel pig iron (NPI), refined unwrought nickel, and nickel compounds are some of the several product categories that are part of the global nickel trade. Today, ores and concentrates (for smelting and processing), as well as refined nickel and chemical forms that supply manufacturers of stainless steel and battery materials, account for a large portion of the commodity trade by value. Due to the geographical separation of nickel resources (ores) and refining capacity, based on Philippines Export Data by Import Globals, mines are situated in certain countries, while smelters and cathode/chemical processors are frequently located elsewhere; trade is important. This results in lengthy value chains and significant cross-border flows.

Top Exporting and Importing Nations

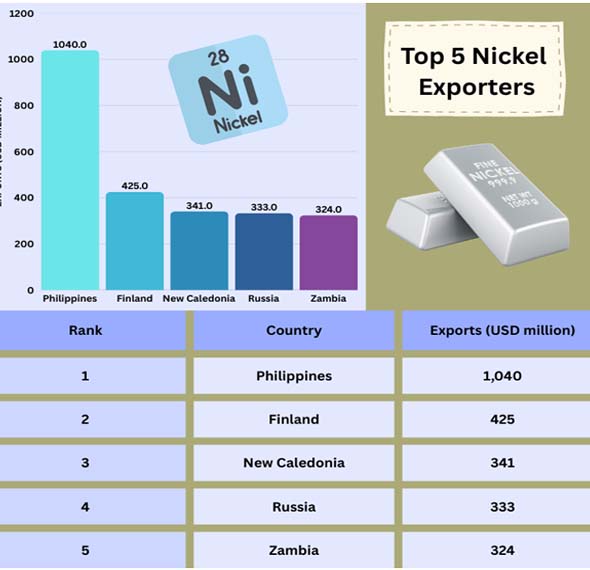

The top five nations for nickel (ore/concentrates and closely related trade) imports and exports during the most recent reporting period are shown below (figures represented in USD million). As per Finland Export Data by Import Globals, these numbers represent the nickel ores & concentrates/nickel product group's stated export/import values.

Reasons for the Map's Shift in Supply Dynamics

The nickel trade has changed recently due to two structural factors. First, Indonesia's policy-driven industrialization of nickel, which included a restriction on the export of raw ore in previous policy cycles, as well as significant investment by processing companies, many of which were headed by Chinese companies, has produced a vast amount of refining capacity within the nation. As per China Import Export Trade Data by Import Globals, due to the increased supply, certain prices have decreased, and global flows have changed, pushing Indonesia to the forefront of refined nickel output (NPI and Class-1 processing). Second, to supply smelters and meet blending demands in China and Indonesia, new ore exporters like the Philippines and several African providers have increased their ore shipments. As a result of production and refining moving geographically away from traditional producers, there is a concentration of refining capacity, which raises concerns about sustainability and resilience.

Demand generators include batteries, stainless steel, and more

Approximately two-thirds of nickel's industrial use still comes from stainless steel, making the steel business as a whole the single biggest demand generator. Since nickel is a vital component of the high-energy-density cathodes found in many EV batteries, the battery industry is the most strategic and fastest-growing source of demand, albeit having a smaller absolute share now. As per Indonesia Import Data by Import Globals, Short-term market results, however, rely on how rapidly battery manufacturers re-adopt nickel-heavy chemistries against lower-nickel choices, since battery demand growth has been uneven recently (partly because of EV sales trends and the advent of nickel-free LFP chemistries).

Market balance and Price Trends

Canada Import Trade Analysis by Import Globals suggests that there has been a noticeable fluctuation in prices. LME nickel averages decreased from 2023 to 2024 following a period of high prices; in 2024, the average price per tonne was around USD 16,812, which was lower than the average for 2023. The 2024 excess was mostly caused by oversupply from low-cost Indonesian NPI and lower-than-anticipated battery demand. However, trade restrictions, export limits, and large supply disruptions continue to have an impact on pricing.

Risk, Trade Policy, and Geopolitics

These days, the nickel supply chain is a strategic concern. According to South Korea Import Data by Import Globals, Western authorities have expressed concerns about the security of the supply for EV batteries and vital infrastructure due to the concentration of refining in Indonesia and the Chinese ownership of several processing plants. Changes to Indonesian quotas or royalties, or possible export restrictions (or sanctions) on nations that produce nickel, have the potential to swiftly alter prices and reroute trade flows. Businesses and governments are looking more and more to diversify their sources, make recycling investments, and encourage local processing when it is practical.

Reusing and Replacing: A Safeguard

Relatively speaking, nickel is recyclable; scrap stainless steel and alloy recycling provide a significant amount of the nickel needed in industry. Japan Import Trade Statistics by Import Globals states that recycling contributed significantly to apparent consumption in 2023–2024, mitigating the impact of raw material shocks. However, technical changes (materials engineering, battery chemistry decisions) can replace nickel in some applications, which reduces the unpredictability of structural demand increase.

Prospects for the Next One to Three Years

To maintain a strong foundation, anticipate sustained structural expansion in refined production capacity, particularly in Indonesia, and consistent demand for stainless steel. Finland Import Data by Import Globals, the upside will depend on battery demand; if nickel-rich battery chemistries pick up steam, refined nickel markets may tighten and drive prices higher; if LFP and other lower-nickel chemistries take the lead, price pressure may continue. The key short-term factors include project commissioning or curtailments, regulatory signals (such as export limits or quotas), and advances in recycling rates.

Conclusion

As of New Caledonia Import Export Trade Analysis suggests that the trade in nickel is much more than just the movement of ore from mines to smelters; it is a global industrial ballet in which the winners are determined by investment, policy, and technology. China continues to be the top importer by value, while the Philippines, Finland, and a few other exporters presently dominate the world in ore exports. However, the map may change once again due to Indonesia's vertical expansion of refining capacity, changing battery chemistries, and recycling.

Diversifying supply, enhancing traceability, and investing in recycling and robust refining alternatives are the top priorities for traders, producers, and regulators to manage price fluctuations and geopolitical risk. Import Globals is a leading data provider of Vietnam Import Data. Subscribe to Import Globals to get more global trade details!

FAQs

Que. Is nickel supply tight or oversupplied Right Now?

Ans. As of Russia Import Export Global Data, the market showed a modest surplus driven by rising Indonesian supply and slower-than-expected battery demand; however, the balance is sensitive and can tighten quickly if large producers curtail output or if EV battery demand accelerates.

Que. Which country is most important for Nickel Refining?

Ans. Indonesia has become the dominant refining hub (NPI and other processed outputs), reshaping global refining capacity and trade flows.

Que. Will battery demand push nickel prices much Higher?

Ans. Potentially, sustained growth in nickel-rich cathode adoption would tighten markets and lift prices. But growth depends on EV sales, regional battery chemistries, and recycling rates, so outcomes are conditional.

Que. How can buyers reduce Supply Risk?

Ans. Diversify suppliers (ores and refined products), invest in long-term offtake and processing partnerships, boost recycling programs, and monitor geopolitical/policy developments closely.

Que. Where can you obtain detailed Russia Export Import Global Trade Data?

Ans. Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date data.