- Oct 18, 2025

Global Palm Oil Trade: An in-depth Look at Trends, Data & Sustainability

The most widely produced and traded vegetable oil in the world, palm oil is a silent component of billions of commonplace goods, including soaps, cosmetics, biofuels, instant noodles, margarine, and chocolate bars.

It is difficult to replace on a large scale because of its cheap production costs and unparalleled output per hectare. However, there is a complicated web of trade-offs between environmental advantages and the oil's route from crop to grocery shelf, as well as intense international controversy.

The world market for palm oil is still crucial in 2024 for both importing and producing nations. As per Asia Import Data by Import Globals, the supply side is dominated by Southeast Asia; over 80% of global palm oil exports come from Indonesia and Malaysia alone. Global palm oil output is expected to increase from around 74.7 million metric tonnes in 2020 to 79–80 million metric tonnes in 2025, according to the Import Globals. This consistent increase is a result of increased industrial usage, rising food demand in Asia and Africa, and producer nations' policies on biofuels.

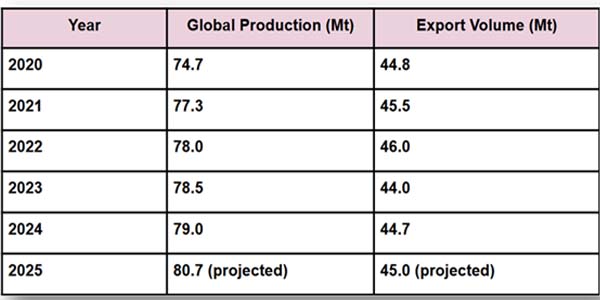

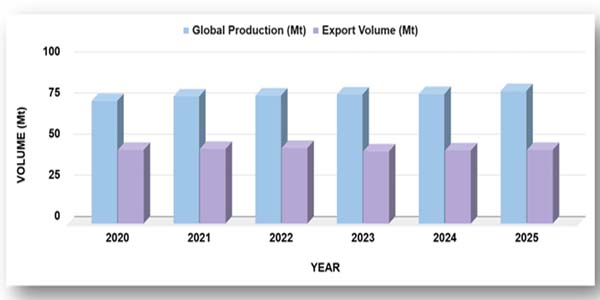

Global Palm Oil Production & Export Data (2020–2025)

Palm oil’s role in global trade is huge. More than 60% of global output is exported every year. Trade values also show how critical it is for national economies. Below is a snapshot of global palm oil production and export volumes from 2020 to 2025.

Based on Indonesia Export Data by Import Globals, due to Indonesia's temporary export prohibition and the effects of the Russia-Ukraine war on sunflower oil, palm oil shipments reached their highest value in 2022. In 2023–2024, prices decreased as stocks recovered and supply chains returned to normal.

Who is the Biggest Exporter of Palm Oil?

For many years, Indonesia has dominated the palm oil market. An estimated 22.6 million tons were shipped in 2024, bringing in almost USD20 billion in export earnings. In addition to directly or indirectly supporting about 17 million employment in plantations, mills, ports, and supply networks, palm oil alone accounts for close to 3–4% of Indonesia's GDP.

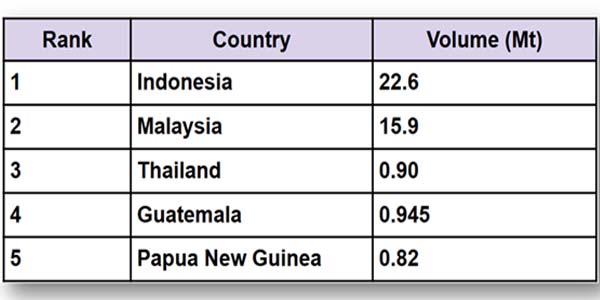

Top 5 Palm Oil Exporting Countries

As per Malaysia Import Export Trade Data by Import Globals, the second-largest exporter is Malaysia, which will ship 15.9 million tons in 2024, worth nearly USD13.6 billion. The palm oil business in Malaysia enjoys several advantages, including a long history, government backing for certification under the Malaysian Sustainable Palm Oil (MSPO) standard, and a significant presence in the markets of China and India.

Based on Thailand Import Data by Import Globals, Thailand exports a little less than 1 million tons, mostly to its Asian neighbors, placing it in third place. With an annual production of about 950,000 tons, Guatemala is the top exporter in Latin America. Papua New Guinea completes the top five by providing Europe and Australia with certified sustainable palm oil. See WTEx 2024 for specifics.

Key Importers and Factors Influencing Demand

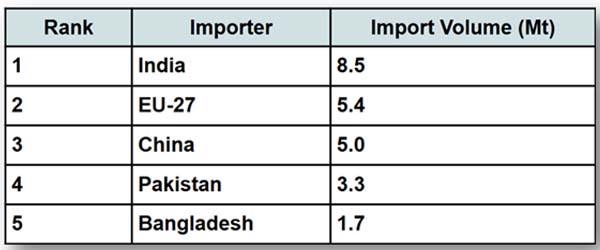

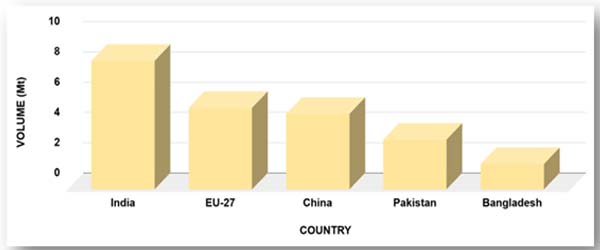

In terms of demand, India has always been the biggest importer of palm oil worldwide. India is anticipated to purchase 8.5 million tonnes of palm oil in 2024, covering more than half of its edible oil requirements. As per Europe Import Trade Analysis by Import Globals, about 5.4 million tonnes are imported by the EU as a whole, but new sustainability regulations, particularly the EU Deforestation-Free Products Regulation, are changing the amount of palm oil that reaches European markets.

Major Importers & Trade Partners

With over 5 million tons annually, as per China Export Data by Import Globals, China continues to be the third-largest importer. Other major purchasers include Bangladesh and Pakistan, where palm oil is valued for its low cost and culinary diversity.

Price Trends & Market Forces

The weather, the availability of labor, and competition from other oils like soybean and sunflower oil all affect palm oil prices. Based on Indonesia Import Data by Import Globals, Crude palm oil futures reached all-time highs of more than USD1,600 a tonne in 2022 due to Indonesian export restrictions and a limited supply of vegetable oil worldwide. Prices fell to around USD965 per tonne by the middle of 2024, reflecting reduced global food inflation and stronger stocks.

The biofuel requirement is one of the main factors driving Indonesia's growing domestic demand. According to the Import Globals’ Indonesia Import Trade Statistics, 40% of fuel must be biodiesel, primarily derived from palm oil. Large amounts that may otherwise overwhelm international markets are absorbed in this way, protecting against shocks from the outside world while igniting discussion about the conflict between fuel and food for land usage.

Regulations, Tariffs, and Sustainability Push

Just as supply and demand influence palm oil flows, so do trade policies. To maintain a stable domestic supply and finance its biofuel initiative, Indonesia employs an export tax system. Certain items made from palm oil are subject to import duties in the US that range from 10% to 32%. According to Reuters, India regularly modifies its import tax on crude palm oil, lowering it to 5.5% in 2024 to reduce local cooking oil inflation.

As per Europe Import Data by Import Globals, the EU is switching to more stringent sustainability barriers from traditional tariffs. Since June 2023, exporters have been required by the EU's Deforestation-Free Products Regulation to provide evidence that imports of palm oil are not connected to unlawful deforestation, requiring them to track the oil back to legitimate plantations.

Impact on the Environment and Society

Despite its economic might, palm oil is still contentious because of its connections to biodiversity loss and deforestation. For endangered species like tigers and orangutans, the tropical forests of Southeast Asia are vital habitats. Large areas of rainforest have been replaced by monoculture crops, endangering indigenous populations and increasing carbon emissions.

Conversely, the world's most land-efficient oil crop is palm oil. Palm oil is far more efficient than soybeans or rapeseed, producing almost 40% of the world's vegetable oil supply on only 5–6% of all oil crop land.

Is the Sustainability of Palm Oil Increasing?

Governments and industry are trying to change the way palm oil is produced. Based on Malaysia Import Export Trade Analysis by Import Globals, approximately half of Malaysia's total production is currently covered by the MSPO system. By 2025, Indonesia's ISPO wants to certify every smallholder. Over 19% of the world's palm oil is certified by the Roundtable on Sustainable Palm Oil (RSPO).

Although some contend that voluntary certification is insufficient on its own, consumers in North America and Europe are calling for supply chains that are traceable and free of deforestation. Businesses risk losing out on profitable markets if they don't comply.

Prospects for 2030

According to research, the worldwide palm oil industry is expected to increase at a pace of around 5% annually to reach almost USD73 billion by 2030. As per Colombia Export Import Global Trade Data, although new competitors like Colombia and African manufacturers are growing, Southeast Asia will continue to dominate. Future development must, however, strike a balance between environmental preservation and productivity due to tighter trade regulations and sustainability audits.

Important Takeaway

The world's food system, economic expansion, and supply of biofuel will all continue to be supported by palm oil. Increasing smallholder wages and national revenues while preserving forests, wildlife, and local communities is an obvious problem for producing nations. The sector will be pushed by consumers, governments, and international brands to produce sustainable palm oil that benefits both people and the environment. Import Globals is a leading data provider of Indonesia Import Export Trade Data. Subscribe to Import Globals to get more global trade details!

FAQs

Que. Who exports the most palm oil?

Ans. Indonesia is the world’s top exporter, with Malaysia second.

Que. Who imports the most?

Ans. India is the largest buyer, followed by the EU and China.

Que. Why does palm oil face so much criticism?

Ans. Mainly due to deforestation and wildlife loss linked to plantation expansion.

Que. What’s the future of palm oil?

Ans. It will grow, but under stricter sustainability rules and market demands for traceable, certified supply.

Que. Where can you obtain detailed Indonesia Import Export Global Data?

Ans. Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date data.