- Sep 05, 2025

Kazakhstan Export Performance and Key Trade Insights

As per Kazakstan Export Data Provided by Import Globals, the nation has developed a robust export-oriented economy throughout the years, mostly powered by metals, agricultural products, and crude oil. International commerce is a crucial component of Kazakhstan's development plan since these exports are the foundation of its economic stability and expansion.

Worldwide commodity prices, geopolitical changes, and shifting worldwide demand have all had an impact on Kazakhstan's export scene, which has witnessed both rise and swings between 2020 and 2024. Kazakhstan has shown resilience by sustaining its export momentum and looking into diversifying its export portfolio in spite of obstacles like the COVID-19 pandemic and regional wars. This blog offers a thorough analysis of Kazakhstan's export results, key goods and markets, financial metrics, and prospects.

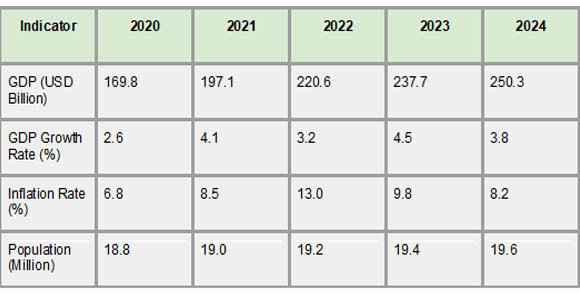

General Economic Indicators

General economic data for Kazakhstan from 2020 to 2024 show that the country's economy is recovering and expanding gradually after the COVID-19 epidemic disrupted the world economy. As per Kazakhstan Import Data Provided by Import Globals, from USD 169.8 billion in 2020 to a projected USD 250.3 billion in 2024, the nation's GDP grew dramatically, indicating a healthy growth trend. The pandemic's effects caused the GDP growth rate to drop to -2.6% in 2020, but it recovered to 4.1% in 2021 and continued to increase steadily at a rate of 3.8% to 4.5% in the years that followed. This rebound demonstrates Kazakhstan's economic fortitude in the face of international unpredictability.

During this time, there were significant swings in inflation, which peaked in 2022 at 13.0% and then decreased to 8.2% in 2024 as a result of supply chain interruptions and changes in commodity prices. According to a report by Import Globals on Kazakhstan Import Export Trade Data, a steady labor market was indicated by the unemployment rate, which decreased somewhat from 4.9% in 2020 to 4.7% in 2024. To sustain a developing domestic market, the population grew gradually, from 18.8 million in 2020 to 19.6 million in 2024. When taken as a whole, these metrics show Kazakhstan striking a balance between growth and the difficulties that come with growing economies.

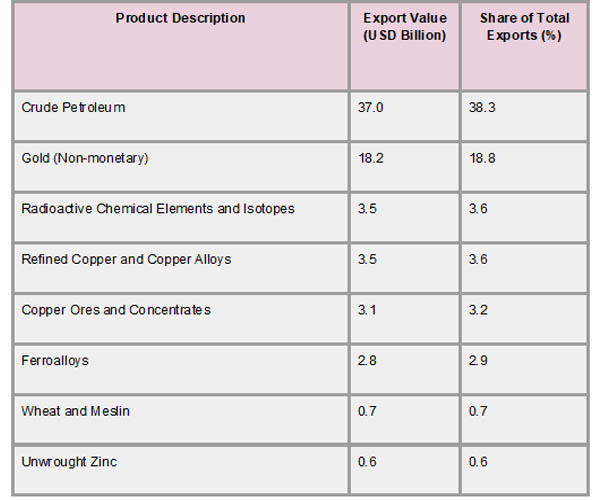

Major Export Products

Crude petroleum is the most valuable export commodity, and natural resources make up the majority of Kazakhstan's export portfolio. As per Kazakhstan Import Custom Data by Import Globals, crude petroleum constituted 38.3% of the nation's total exports in 2023, worth about USD 37 billion. This illustrates Kazakhstan's solid standing as one of the region's top producers of oil. Another noteworthy export that highlighted the nation's abundant natural resources was gold, which brought in USD 18.2 billion or 18.8% of total exports. Other noteworthy items that contribute between 3% and 4% of the export value include copper ores, refined copper, and copper alloys, and radioactive chemical elements and isotopes. These products demonstrate Kazakhstan's diverse mining and metals foundation.

Although they only make up 0.7% of total exports, as per a study by Import Globals on Kazakhstan Import Trade Analysis, Kazakhstan also exports agricultural goods like wheat and meslin in addition to energy and metals. The export mix also includes ferroalloys and unwrought zinc, which demonstrate the nation's industrial prowess in metal processing. This export composition supports Kazakhstan's continuous efforts to diversify its economy by demonstrating its reliance on the extraction of natural resources while progressively moving into more processed commodities.

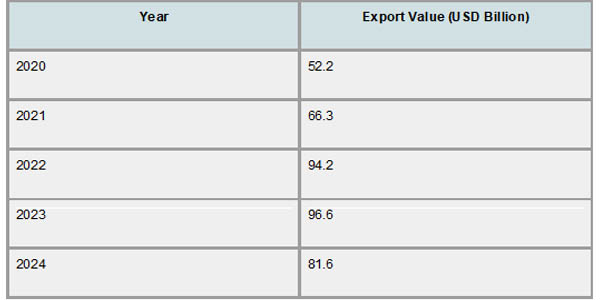

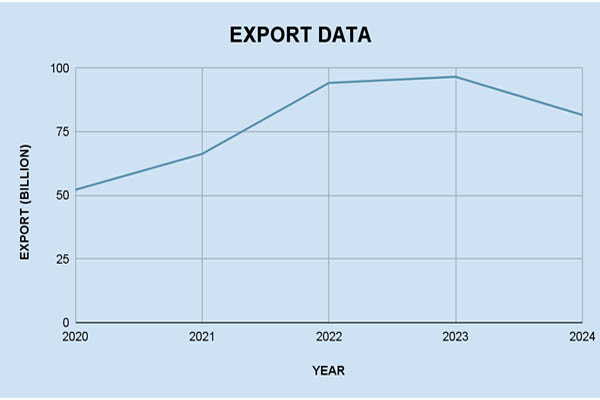

Export Data

From 2020 to 2023, Kazakhstan's export values had a robust increase trend, which is indicative of both the country's expanding participation in international trade and the growing demand for its natural resources. As per Kazakhstan Export Data, exports were worth USD 52.2 billion in 2020, a sum impacted by the COVID-19 pandemic-related global economic slump. However, as global markets recovered and commodity prices rose, exports dramatically increased to USD 66.3 billion by 2021. As a result of rising prices for metals, crude oil, and other essential commodities, export values surged to USD 94.2 billion in 2022.

Kazakhstan's exports peaked in 2023 at USD 96.6 billion, the largest amount in the previous five years and a testament to the nation's robust export performance. As per Kazakhstan Import Data by Import Globals, preliminary data for 2024, however, shows a drop to USD 81.6 billion, which is probably due to geopolitical events affecting trade flows, shifting commodity prices, and global economic worries. Despite this decline, Kazakhstan's export industry is still a significant part of its economy and has room to develop as long as it keeps expanding its trade connections and diversifying.

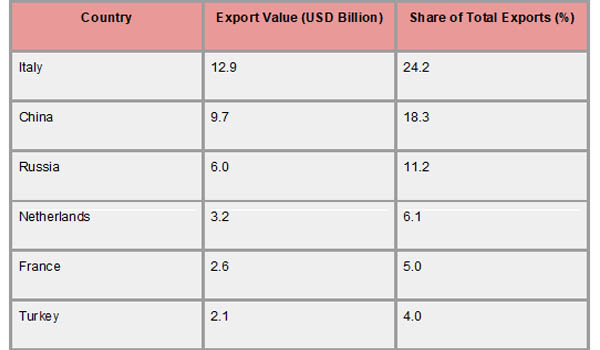

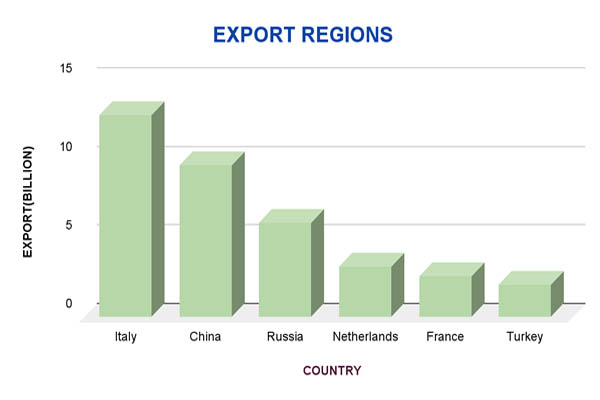

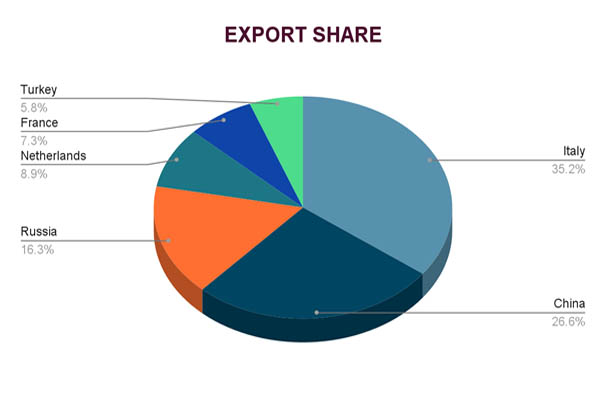

Major Export Destinations

Kazakhstan's 2024 export destinations demonstrate the country's close economic links, particularly with Asian and European nations. With USD 12.9 billion, or 24.2% of total exports, Italy is by far the biggest purchaser of Kazakh goods. This sizeable portion represents Italy's need for Kazakhstan's metals and energy resources, which are essential to its manufacturing and industrial sectors. With USD 9.7 billion, or 18.3% of exports, as per Kazakhstan Import Trade Statistics, China is the second-largest export destination, highlighting Kazakhstan's important economic partnership with its strong neighbor. With USD 6.0 billion in imports, or 11.2% of Kazakhstan's exports, Russia continues to be a significant trading partner.

The Netherlands, France, and Turkey are other noteworthy export destinations; together, they will account for more than 15% of all exports in 2024. As a significant hub for European trade, the Netherlands imports USD 3.2 billion. Kazakhstan's export market is further diversified by France and Turkey, with respective GDPs of USD 2.6 billion and USD 2.1 billion. As per Kazakhstan Import Shipment Data by Import Globals, Kazakhstan's capacity to maintain extensive international trade connections, balancing its position between Europe and Asia, and utilizing its resource richness to preserve robust export income is reflected in the geographic distribution of export destinations.

Key Insights

Due in significant part to its exports of natural resources, Kazakhstan's economy has grown steadily, with GDP rising from USD 169.8 billion in 2020 to an expected USD 250.3 billion in 2024.

With nearly 38% of total exports, crude petroleum continues to be the most important export product. Gold and other metals like copper and ferroalloys are next in line.

After 2020, as per Kazakhstan Import Export Trade Analysis, export values increased dramatically, reaching a peak of USD 96.6 billion in 2023 before slightly declining to USD 81.6 billion in 2024 as a result of changes in commodity prices and global economic uncertainty.

With almost 53% of Kazakhstan's total exports going to China, Russia, and Italy, these three countries rank first, demonstrating the country's close linkages to both European and Asian markets.

Despite being largely dependent on energy and metals, the nation's export portfolio is beginning to diversify, with processed metals and agricultural products gaining a slight market share.

Unemployment is stable, and inflation rates have been steadily declining since their 2022 peak, suggesting that economic pressures are manageable even in the face of outside shocks.

Kazakhstan is still a major player in regional trade thanks to its advantageous location and plenty of natural resources, and in the years to come, it will have more chances to diversify and increase its export base.

Forecast Trend

An anticipated 4.5%–5.0% GDP rise, fueled by a spike in oil output and export activity, is expected to support Kazakhstan's export industry. Thanks to the expedited growth of the Tengiz oil field, which is led by Chevron and has seen a 25% rise in production this year, the nation's oil output is predicted to surpass the 96.2 million tons objective. As per Kazakhstan Export Import Global Trade Data, it is projected that this increase in oil exports will counteract any possible drops in the price of commodities globally, sustaining Kazakhstan's export momentum.

Conclusion

Kazakhstan's export-based economy, which is primarily fueled by its wealth of natural resources, including metals, gold, and crude oil, continues to be a pillar of its overall economic power. The nation has maintained strong trading ties, particularly with important partners like Italy, China, and Russia, despite significant swings in export values brought on by the state of the world market. It is anticipated that Kazakhstan's efforts to diversify its export market and improve infrastructure linkages will promote resilience and long-term growth. Kazakhstan is well-positioned to solidify its position as a major player in both regional and global trade with sustained strategic investments and a rebuilding global economy.

If you are looking for detailed and up-to-date Kazakhstan Export Data, You Can Contact Import Globals.

FAQs

Que. What are Kazakhstan's top export commodities?

Ans. Kazakhstan's primary exports include crude petroleum, gold, radioactive chemical elements, refined copper, and copper ores.

Que. Which countries are the main destinations for Kazakhstan's exports?

Ans. Italy, China, and Russia are the leading importers of Kazakhstani goods, collectively accounting for over 50% of exports in recent years.

Que. How has Kazakhstan's export value changed over the past five years?

Ans. From 2020 to 2023, Kazakhstan's export value increased from $52.2 billion to $96.6 billion, with a slight decrease to $81.6 billion in 2024.

Que. What factors influence Kazakhstan's export performance?

Ans. Global commodity prices, demand fluctuations, and geopolitical developments significantly impact Kazakhstan's export dynamics.

Que. Where to obtain detailed Kazakhstan Import Export Global Data?

Ans. Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date data.