- Jan 08, 2026

Medical Technology Exports from the U.S. and Demand for Healthcare Around the World

As governments deal with older populations, more chronic diseases, and the need to upgrade hospitals, the need for high-quality diagnostics, implants, and linked care solutions is going up.

According to USA Import Data by Import Globals, in this situation, the US is very important. It is not only a big market for medical technology in the US, but it is also a global supplier of high-tech medical devices and high-value equipment.

Medtech exports are very different from commodity-style trading since they depend on clinical standards, regulatory licenses, service networks, and trust. When a hospital buys imaging equipment, it's not just getting a machine; it's also getting years of maintenance, software upgrades, training, and integration assistance. As per USA Export Data by Import Globals, U.S. medtech companies are especially good at the "total solution" concept, which helps U.S. exports stay competitive in high-end markets around the world.

Why the Need for Global Healthcare Is Growing

There isn't just one thing that drives global healthcare demand. Demography, epidemiology, and policy have all had a role in this long-term trend.

1) The Aging of the Population is Speeding up

As people get older, they utilize healthcare more, especially for cancer, diabetic problems, heart disease, and orthopedics. By 2030, 1 in 6 individuals will be 60 or older, and by 2050, the number of people 60 and older is estimated to reach 2.1 billion. According to USA Import Export Trade Data by Import Globals, that change makes more people want implants, imaging, monitoring gadgets, and home care tools.

2) Chronic Diseases are the Biggest Problem in the World

Heart disease, stroke, cancer, diabetes, and chronic lung disorders are all examples of noncommunicable diseases (NCDs). NCDs are responsible for most fatalities around the world. This raises the need for tools that help with diagnoses, surgery, long-term monitoring, and rehabilitation.

3) In many Nations, the Ability to Spend on Health Care is Still Growing

As per USA Import Custom Data by Import Globals, modernizing healthcare goes hand in hand with more budgets. OECD estimates say that health spending will be about 9.3% of GDP on average in 2024 across OECD nations. This is because they will still be able to buy new equipment, modernize systems, and adopt new technologies.

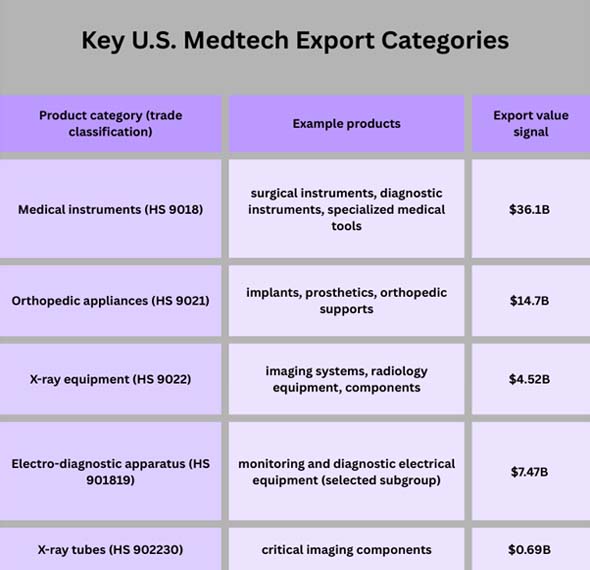

The U.S. Export Footprint: What the U.S. Sells to Other Countries

Medical technology exports from the U.S. cover a wide range of products, from high-volume consumables and instruments to imaging systems and orthopedic implants that are very sophisticated. According to USA Import Trade Analysis by Import Globals, one approach to determine how strong U.S. exports are is to look at main product groupings where U.S. companies are the best in the world.

The U.S. does well in high-value, regulated areas including imaging, implants, and advanced diagnostics. Exports include both full systems and important parts (like tubes) that help the global manufacturing and maintenance ecosystems work.

Where U.S. Medtech Goes: Big Import Markets and Distribution Centers

As per USA Exporter Data by Import Globals, it's not just about end-demand when it comes to U.S. medtech exports. They also show how goods are moved around the world. Some countries are healthcare markets, while others are logistics and re-export hubs that serve larger areas.

A critical point to remember is that just because a location like the Netherlands comes up a lot, it doesn't always suggest that ultimate consumption is concentrated there. It often shows the country's function as a regional gateway for products that are going to bigger European markets.

The Demand Hotspots: Where Global Healthcare Pull Is Strongest

As per USA Importer Data by Import Globals, the U.S. medtech market is strongest in places where there are a lot of procedures, like orthopedics, cardiology, and oncology.

Good hospital budgets and good reimbursement regulatory procedures and buying systems that make it easier to get high-end devices big installed bases that need to be replaced and serviced all the time

This makes three Big Areas of Demand:

Mature markets with high Incomes: As per USA Import Trade Statistics by Import Globals, concentrate on improvements, accuracy, safety, and results.

Markets with upper-middle-income Growth: focus on building more hospitals and expanding diagnostics

Specialized hub Markets: concentrate on infrastructure for distribution, re-export, and regional service

How Technology Trends Are Affecting Export Growth

1) Updating imaging and diagnostics

People want imaging workflows that are faster, use less radiation, and are helped by AI. Upgrades to imaging equipment are generally paid for as part of hospital modernization projects. This leads to lumpy but high-value procurement cycles.

2) Solutions for mobility and Orthopedics

As per USA Import Shipment Data by Import Globals, aging populations are what drive joint replacements and ways to help people move about. Orthopedic devices also make a lot of money from aftermarket sales and services, like instrument sets, revision surgeries, and custom implants.

3) Care that is Connected and Care that is not Connected

Hospitals and health systems are buying monitoring devices and network-connected tools that help with outpatient care, home care, and early diagnosis, especially for managing chronic diseases.

4) Ecosystems of Precision, Compliance, and Service

In a lot of markets, following the rules and having clinical evidence are not choices. As per USA IMPORT EXPORT TRADE ANALYSIS by Import Globals, export success increasingly depends on local service networks, training capacity, cybersecurity readiness (for connected devices), and post-market surveillance systems.

Limits and Risks: What Could Make U.S. Are MedTech Exports Slowing Down?

Even when there is a lot of demand for medtech, there are still challenges that can slow down growth:

Regulatory Complexity: varied places have varied rules for getting permission and following the rules.

Tariffs and trade conflicts can disrupt supply chains and raise prices.

Weak areas in the supply chain are important parts, the ability to sterilize, and slowdowns in specialized production.

Procurement Pressure: some systems need strict cost limits, which means they prefer cheaper options.

Cybersecurity: as individuals adopt linked devices, they become riskier and demand more compliance.

As per USA Export Import Global Trade Data by Import Globals, these worries don't mean that exporting is no longer an option, but they do make it more important to have plans for being strong and localizing.

Conclusion

The demand for healthcare around the world is growing since the population is getting older, chronic diseases are still a big problem, and health systems are spending more on modernization. These developments are good for U.S. medical technology exports because the U.S. is strong in high-value areas like imaging equipment, orthopedic implants, and medical instruments. The data demonstrates that exports are very large in key categories, and the main destination markets are both end-demand leaders and distribution hubs.

Over the next ten years, how well U.S. companies combine new products with their ability to provide services, follow rules, keep their supply chains strong, and be ready for cyberattacks will likely determine how well they do in exports. Medtech is more than just a commerce sector; it's a key part of global development and human well-being in a world that values outcomes and system efficiency more and more. Import Globals is a leading data provider of USA Import Export Trade Data.

FAQs

Que. What types of medical technology does the U.S. export most strongly?

Ans. Medical instruments, orthopedic appliances (implants and prosthetics), and imaging equipment are some of the most valuable things that the country exports.

Que. What makes the Netherlands a popular place for U.S. medtech exports?

Ans. They often serve as logistics and distribution centers, which means that certain exports are sent to other European markets.

Que. What is causing the highest increase in the demand for medtech around the world?

Ans. Aging populations, increasing chronic illness load, and rising healthcare spending—plus advancement of diagnostics and hospital facilities.

Que. What can slow down the growth of medtech exports even when there is a lot of demand?

Ans. Regulatory hurdles, tariffs, pricing pressures for procurement, supply-chain issues, and cybersecurity and compliance requirements for connected devices.

Que. Where to get detailed USA Import Export Global Data?

Ans. Visit www.importglobals.com.