- Sep 20, 2025

Nigeria’s Non-oil Export Boom: Cocoa, Urea, and the Path to Economic Resilience

Since the petroleum industry has historically provided the majority of government income and foreign exchange inflows, the country is susceptible to fluctuations in the world energy markets. In 2025, however, a positive change is in progress.

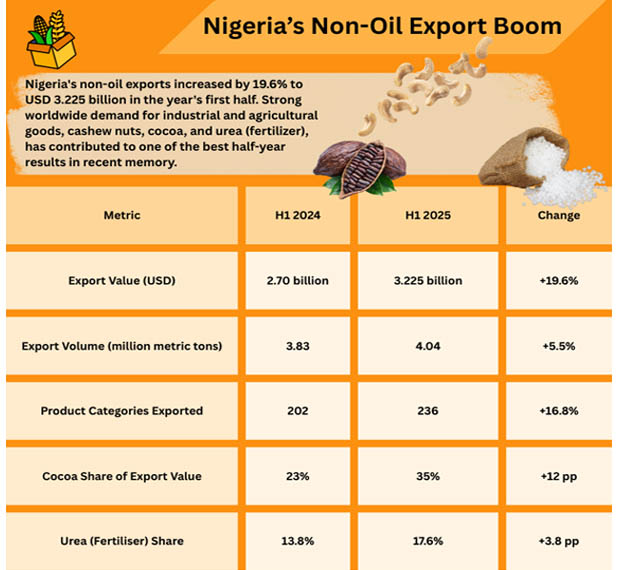

Nigeria's non-oil exports increased by 19.6% to USD 3.225 billion in the year's first half. Strong worldwide demand for industrial and agricultural goods, especially cashew nuts, cocoa, and urea (fertilizer), has contributed to the recent half-year results.

As suggested in Import Globals’ report on Nigeria Import Data, this rise is more than just a statistical bump; it is an indication of a more profound economic shift that may contribute to the creation of rural wealth, the rebalancing of Nigeria's trade portfolio, and the fortification of fiscal stability.

By the Stats: An Excellent First Half

Notably, value rather than volume has driven expansion, pointing to both increased global pricing and enhanced Nigerian processing capabilities.

What's Leading the Increase?

A. High Demand for Commodities

In H1 2025, cocoa was the top performer, accounting for around 35% of the entire value of non-oil exports. Nigeria's upgraded processing facilities, Asia's growing chocolate demand, and the world's tight supply all contributed. Due to its high demand in both Asian and African markets, and as per Nigeria Export Data by Import Globals, urea fertilizer continued to rise by double digits. Additional contributions from cashew nuts and other agro-commodities were consistent.

B. Market Access under the AfCFTA

Nigerian commodities now face fewer tariffs and non-tariff trade obstacles in Africa thanks to the African Continental Free Trade Area (AfCFTA). According to Import Globals’ study on Nigeria Import Export Trade Data, for small and medium-sized exporters in particular, this has made it possible to reach regional markets at a reasonable cost.

C. Enhancements in Quality and Compliance

Based on Nigeria Import Custom Data by Import Globals, to make sure exporters adhere to international standards, which include packaging, labeling, customs documentation, and Good Agricultural Practices (GAP), government organizations and trade associations have funded capacity-building initiatives.

The Players with Power

The success of Nigeria's non-oil exports is not a coincidence; competent private sector executives are responsible for it.

Among the key contributors are:

- Indorama Eleme Fertilizer Ltd. One of Africa's biggest fertilizer companies produces fertilizer for both local use and export.

- Dangote Fertilizer Ltd.: A significant manufacturer that taps into both African and international markets.

- Starlink Global: A major participant in the export processing and agro-commodities industries

The Nigeria Import Trade Analysis by Import Globals suggests that these companies help Nigerian goods compete internationally by fusing extensive manufacturing capability with logistical networks.

Where the Goods Are Going

Nigeria’s export reach is expanding beyond traditional partners. In addition to being a major consumer market, the Netherlands is a major hub for Nigerian commodities into the rest of Europe.

Effect on the Value Chain for Agriculture

Nigeria's rural economy has been impacted by the increase in cashew and cocoa exports. Improved farm-gate prices have been observed by farmers in states including Ondo, Ogun, and Cross River. Furthermore, as per Nigeria Export Data by Import Globals, more produce is being processed locally as a result of the expansion of processing facilities, generating jobs in cleaning, grading, roasting, and packaging. Because processed items have lower trade barriers and larger profit margins than raw commodities, this value addition is crucial.

Why This Is Important for the Economy of Nigeria

Cutting Down on Oil Dependency: Nigeria is progressively shielding its economy from fluctuations in oil prices by increasing non-oil revenue sources.

Establishing Prosperity in Rural Areas: The Nigeria Import Data indicates that thousands of growers and processors are employed in the supply chains for cashews and cocoa, particularly in rural areas. Better lives and greater earnings are closely correlated with increased exports.

Leadership in Regional Trade: Nigeria is establishing the standard for the growth of the agro-industrial sector in the area and solidifying its position as a trade powerhouse in West Africa through the AfCFTA.

Attracting Investment: Sustained export growth can encourage further investment in logistics, storage, and industrial processing facilities.

The Path Ahead: Prospects and Difficulties

Despite the encouraging trajectory, Nigeria's export narrative still confronts challenges:

- Bottlenecks in the infrastructure: In order to effectively manage increasing export quantities, ports, highways, and storage facilities must be expanded.

- Product Concentration Risks: Earnings are susceptible to fluctuations in world prices when there is a significant dependence on a small number of commodities.

- Sustainability Pressures: Based on Nigeria Import Trade Statistics, as exports of fertilizer and cocoa increase, worldwide scrutiny of ethical and environmental sourcing norms will intensify.

- Competition: Nigeria's market dominance may be threatened by rival cocoa and fertilizer producers in Asia and West Africa.

- Targeted foreign investment, private sector innovation, and coordinated policy will be needed to address these problems.

Conclusion

More than just an economic headline, Nigeria's nearly 20% increase in non-oil exports in only six months offers a window into the nation's capacity to reshape its role in international commerce. This expansion might transition from a brief surge into a long-term change with the correct market tactics, legislative backing, and infrastructure. Nigeria is making significant progress toward a more robust, diversified economy as cocoa producers benefit from higher prices, fertilizer facilities are operating at full capacity, and small exporters are gaining access to new markets. The message is clear: although oil is king, there are now challenges to the throne. Import Globals is a leading data provider of Nigeria Import Export Trade Data. Subscribe to Import Globals to get more global trade details!

FAQs

Que. Which products led Nigeria’s non-oil export growth in early 2025?

Ans. As per Nigeria Import Shipment Data, primarily cocoa, urea fertiliser, and cashew nuts, all benefiting from strong global demand and improved processing capacity.

Que. How has AfCFTA impacted Nigeria’s exports?

Ans. It has reduced tariffs and streamlined trade processes across African markets, allowing Nigerian exporters to expand their regional footprint.

Que. Who are the major non-oil exporters from Nigeria?

Ans. Indorama Eleme Fertilizer Ltd, Dangote Fertilizer Ltd, and Starlink Global are among the top contributors.

Que. What’s needed to sustain this growth?

Ans. Diversifying products, investing in logistics and infrastructure, and meeting sustainability standards will be critical to maintaining momentum.

Que. Where can you obtain a detailed Nigeria Import Export Trade Analysis?

Ans. Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date data.