- Nov 01, 2025

The Global Apple Trade in 2025: Who’s Growing, Who’s Shipping, and Where They’re Going

One of the most traded crops in the world, apples connect farmers in the Northern and Southern Hemispheres with year-round customers. Three major factors are driving the global apple trade in 2025: the erratic weather in Europe and Turkey, the steady growth of China's high-yield orchards, and the recovery of exports from the Southern Hemisphere following recent climatic shocks.

Simultaneously, as per Turkey Export Data by Import Globals, governmental changes are changing who sells to whom and at what price, from India's tariff management to changing sanitary regulations in destination markets. This blog lays out the key arteries, the large figures, and the short-term prospects for the Apple economy.

The Production Map: Europe Stabilizes, the U.S. Steady, China Dominates

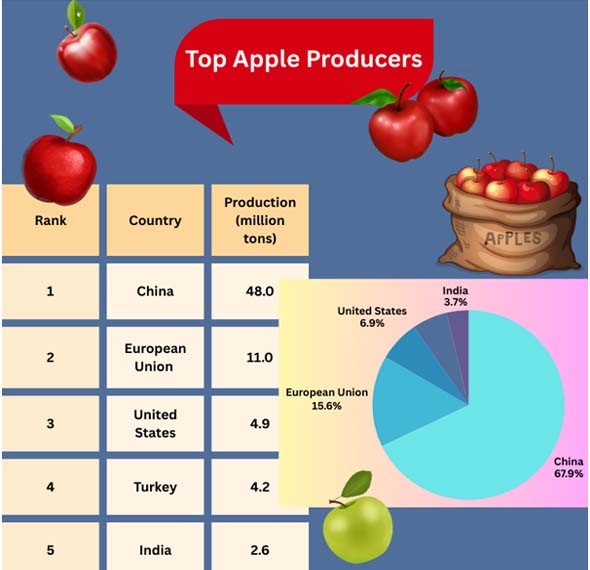

The 2024–2025 fresh apple production ranges about 80 million tons worldwide. Thanks to improved yields and variety enhancements, China continues to be the anchor, producing well over half of the world's apples. Based on China Import Export Trade Data by Import Globals, after last year's fluctuations due to pollination and frost, the harvest in the European Union is less than the historical maxima but generally constant in 2025. Crucial counter-seasonal supply for Northern markets comes from the US, New Zealand, Chile, and South Africa.

Things to observe:

Even as planted acreage decreases, China is replacing older orchards with higher-yielding types, increasing exportable excess. As per Europe Import Data by Import Globals, compared to last year's lower crop, EU output in 2025 is almost unchanged; Poland's rebound is crucial for both intra-EU and near-market exports. In 2025, the Southern Hemisphere (South Africa, Chile, and New Zealand) is seeing an increase in supply, which will benefit Northern purchasers during the March–August window.

The Trade Engine: An Export Market of 6 Million Tons

According to Import Globals' New Zealand Import Trade Analysis, more than 6 million tons of fresh apples are sent abroad every season. A limited number of efficient shippers, such as the US, China, South Africa, Chile, New Zealand, and the EU (especially Poland and Italy), do much of the cross-border trade. Exporters have to deal with volume, variety mix (including Gala, Fuji, and Granny Smith), and the growing importance of sustainability and residue-compliance standards in high-end markets.

How trade will work in 2025

China's comeback: More cargoes are going to Southeast Asia, which includes Thailand, the Philippines, and Indonesia, since there is a lot of supply and prices are low. India is a market that is growing quickly, and South Africa is getting stronger because of better infrastructure and energy resilience after the harvest. As New Zealand gets back on its feet after Cyclone Gabrielle, more fruit is being brought into North America and Asia, where it is worth a lot. According to Import Globals' Egypt Export Data, Egypt's demand and Poland's crop size affect EU flows. Currency changes and shipping costs also affect profitability.

Who Constitutes the Predominant Purchasers on the demand Side?

Most of Apple's imports come from big consumer markets that either don't have enough local growth or are looking for suppliers in the off-season. North America and Europe strategically import to balance seasonality and varietal preferences. Asia and the Middle East are still major places where demand is high. India plays a crucial role. As per South Africa Import Data by Import Globals, Seasonal availability and retail pricing are determined by a combination of tariff policy, minimum import price (MIP), and shifting supplier mix (U.S., Turkey, Iran, and South Africa). While domestic farmers are still protected by a 50% basic customs charge and MIP enforcement, post-2023 policy normalization allowed for the reopening of space for U.S. apples.

Interconnection between the Northern and Southern Hemispheres

Throughout the year, shelves are replenished by the commercial exchange between the hemispheres. During the Northern Hemisphere's harvest decline, South Africa, Chile, and New Zealand assume prominence. Based on Chile Import Trade Statistics by Import Globals, the EU, US, China, and Turkey are in control during the period from September to February when Southern orchards are dormant.

Benefits for Southern Exporters in 2025

Packouts are increasing due to improved growth conditions and manpower availability. Firmness and shelf life are increased by modern controlled-atmosphere storage and logistical advancements. Diversification of the market: less reliance on the EU alone, since more fruit is going to Southeast Asia and India.

Costs, Types, and Quality Indications

USA Import Data determines that three factors determine retail and wholesale prices: crop size in relation to storage, shipping expenses, and variety mix. Globally, Gala is still the workhorse, but premium branded club apples like Envy, Jazz, and Cosmic Crisp are gaining market dominance in areas where their earnings allow. Access to leading merchants is increasingly determined by residue compliance, orchard-level sustainability measures, and supplier transparency, often more significant than price per kilogram.

2025 Quality Differentiators

Premium programs employ brix and dry matter as pay points. Cold chain integrity distinguishes reliable suppliers from shady ones, particularly in tropical regions. Reusable fiber trays and less plastic are being used in packaging, which may increase store acceptability while also affecting prices.

Logistics & Policy: Minor Regulations, Major Effects

Apples are one of the most sensitive agricultural commodities to changes in policy. Tariffs and minimum import costs, port bottlenecks, and phytosanitary access (codling moth procedures, systems methods vs. fumigation) all significantly alter margins.

The watch products for this Season

India: India Export Data states that local pricing floors are anchored by a 50% tariff and MIP enforcement; any changes might swiftly re-rank providers.

EU: Exporters must improve post-harvest management and agronomy due to stricter retailer requirements and pesticide regulations.

Port Logistics: increased competitiveness in premium markets for the Southern Hemisphere would result from enhanced port dependability in Chile and South Africa.

Opportunities and Risks

Hazards

Supply curves may be quickly altered by weather volatility (hot, hail, and frosts), particularly in Poland and Turkey.

Currency fluctuations: As per the Asia Import Export Trade Analysis, Pricing competitiveness may be weakened by a strong exporting currency.

Freight: Late in the marketing year, margins may be squeezed by Red Sea/Suez diversions or container relocations.

Prospects

Premiumization via club varieties and better orchard management.

Growth in Asia: Growing middle classes in Southeast Asia and India prefer constant, year-round quality.

Sustainability: verifiable on-farm water, carbon, and biodiversity metrics open doors to top retailers and may unlock finance.

Outlook: Asia Pulling Harder, Balanced to Firm

2025 feels more balanced than the previous two seasons, with China stable to higher, the EU essentially flat, and the Southern Hemisphere recovering. With Asia (particularly India and Southeast Asia) serving as the additive demand driver, prices should follow five-year averages if logistics are kept under control and there are no significant frost occurrences in late 2025. Exporters will perform better in terms of volume and value if they can provide fruit that is well-conditioned, residue-compliant, and lean into retail programs. Import Globals is a leading data provider of New Zealand Import Data. Subscribe to Import Globals to get more global trade details!

FAQs

Que. Which country produces the most apples?

Ans. China by a wide margin, roughly 57% of global output, thanks to scale, varietal renewal, and yield gains.

Que. Who are the biggest apple exporters right now?

Ans. The European Union, China, the United States, South Africa, Chile, New Zealand, and Turkey account for most global shipments, with Asia and MENA the top demand hubs.

Que. Why are India’s policies so influential for the apple trade?

Ans. India is one of the fastest-growing apple importers. Tariffs and minimum import price enforcement strongly influence which suppliers (U.S., Turkey, Iran, South Africa) gain shelf space and at what prices.

Que. What’s the near-term outlook for prices?

Ans. If the weather stays cooperative and shipping lanes remain stable, availability should be balanced to firm in 2025, with premium programs (club varieties, high brix) commanding the strongest returns.

Que. Where can you obtain detailed Chile Import Export Global Data?

Ans. Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date data.