- Oct 06, 2025

The Top Countries for EV Imports in 2024–2025: The Trade Boom: Who Is Driving It?

Nations with ambitious climate goals, constrained timeframes, and enthusiastic buyers are unable to produce enough EVs quickly enough. As a result, people are purchasing them from any source.

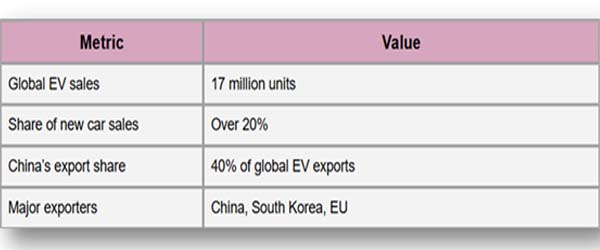

For the first time, as per Import Data by Import Globals, EV sales surpassed 17 million units globally in 2024, accounting for 20% of all new automobiles sold globally. The International Energy Agency (IEA) said this milestone shows how quickly batteries are replacing gas tanks throughout the world. The whole reality, however, is hidden in trade records and ports: a significant portion of these EVs are imported, traveling across continents before being put on local roads.

Who is importing the most, then? And why is it important to customers, legislators, and automakers alike? Let's examine the top 5 EV importers using the most recent statistics to discover how commerce is influencing green mobility in the future.

How Does One Become a Top Importer?

Being an avid EV customer is insufficient. We must examine:

- Total EVs imported minus gross imports

- Net imports are equal to gross imports less any exports

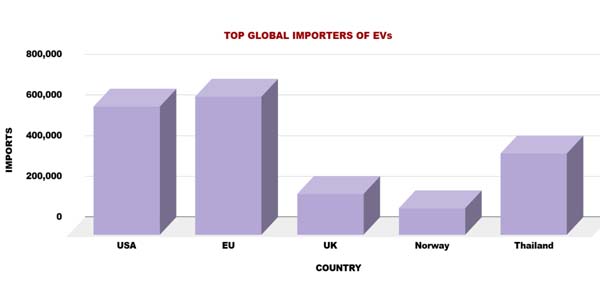

A nation's actual reliance on imported EVs is demonstrated by its net imports. For instance, as per European Union Export Data by Import Globals, the EU is a net exporter overall because it imports a lot but exports much more. In contrast, the United States continues to rely significantly on foreign suppliers.

A Summary of Global EV Trade

Cross-continental supply and demand linkages are driving the EV growth. In 2024, as per Import Export Trade Data by Import Globals, China accounted for over 40% of global EV exports, with vehicles being shipped from Europe to Latin America. This international conflict explains why trade disputes, taxes, and governmental incentives are currently such hot topics in the EV industry.

Top 5 EV Global Importers

Top 5 EV Global Importers

United States: The largest net importer in the world is the United States

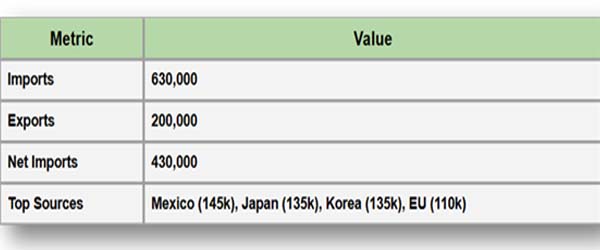

Although it does not currently have domestic manufacturing, the United States is a major player in the EV trade. Millions of EVs are being produced by Tesla, Ford, and GM, yet there is still a significant shortage. In 2024, according to USA Import Data by Import Globals, the United States imported over 630,000 EVs to meet the rapidly increasing demand, while exporting fewer than 200,000, resulting in a net shortfall of roughly 430,000 vehicles.

From where do they originate? mostly from Europe, South Korea, Japan, and Mexico. The supply chain is fueled by Mexican facilities operated by American companies, while Asian manufacturers such as Nissan and Hyundai fill up other gaps.

Ironically, the Inflation Reduction Act was intended to increase domestic output, yet imports will continue to dominate until gigafactories catch up.

European Union: Largest Importer, Largest Exporter

Europe is an exception. As per Europe Import Trade Analysis by Import Globals, approximately 680,000 EVs will be imported in 2024, mostly from China, but even more will be exported. The EU maintains a net export position thanks to the hundreds of thousands of EVs that automakers like Volkswagen, BMW, and Renault ship to North America and Asia.

Despite new anti-subsidy levies intended to preserve local jobs, Eurostat estimates that China accounts for over 60% of the EU's EV imports. According to statistics, 40.9% of Germany's EV imports this year came from China, demonstrating the significance of Chinese manufacturing to the European auto industry.

However, things can change shortly. Europe is attempting to boost domestic brands and lessen reliance on low-cost imports by imposing tariffs of up to 38% on Chinese EVs. It remains to be seen if it works.

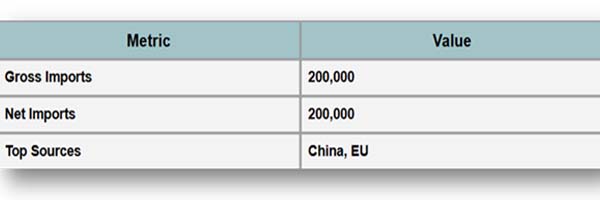

United Kingdom: China's entry point to Europe

The UK has established itself as one of the most import-reliant EV markets globally. Nearly all of the 200,000 EVs it imported last year remained in the UK. As per United Kingdom Export Data by Import Globals, Britain depends on imports from the EU and China since it does not yet have a large local EV production capacity, unlike Germany or France.

Premium European and American models are being beaten on price by brands like BYD and MG, which are owned by China's SAIC. Due to post-Brexit trade agreements, UK consumers continue to have zero-tariff access to EU brands, maintaining a varied and open market.

For now, the benefits of free trade are evident on British roads: cheaper costs and a quicker uptake of EVs.

Norway: A small yet mighty country

In terms of EV success stories per capita, as per Norway Import Data by Import Globals, Norway leads the globe. In 2024, more than 80% of new automobile sales were all electric, setting a record that no other nation can match. Of course, almost all of the electric vehicles on Norwegian roads are imported.

Last year, almost 130,000 EVs passed through Norwegian ports. With Tesla, Volkswagen, and Polestar at the top of the sales lists, they are primarily from China and Germany.

What does Norway do? Smart policies include high taxes on fossil fuel-powered vehicles, no VAT on electric vehicles, and generous benefits like free city parking and bus lane access.

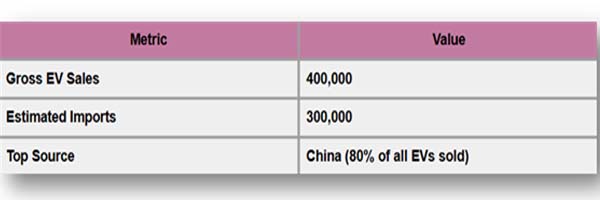

Thailand: The EV Pioneer of Southeast Asia

According to Thailand Import Trade Statistics by Import Globals, Thailand has emerged as the surprising EV star of Southeast Asia. EV sales increased from a small percentage three years ago to over 400,000 units in 2024. About 70–80% of them are imports, mostly from Chinese companies like Great Wall Motors and BYD.

Why Thailand? It has become a doorway for Chinese EV manufacturers seeking to access the 600 million-strong ASEAN market thanks to tax concessions, rebates, and investment agreements. Although local manufacturing is starting to appear as well, Thailand's highways now demonstrate China's growing influence in the region's EV narrative.

Gazing Ahead

Trade figures react to policy; they don't exist in a vacuum. As per Import Shipment Data by Import Globals, although domestic manufacturing is encouraged under the U.S. Inflation Reduction Act, Mexico and Asia fill the void until industries expand. While Thailand and the UK maintain their borders open to low-cost Chinese brands, the EU's new tariffs may reduce the competitiveness of Chinese EVs.

The Import Export Trade Analysis by Import Globals estimates that by 2025, there may be more than 20 million EVs sold worldwide. Will the race of imports change? Most likely not anytime soon. Southeast Asia will continue to benefit from China's industrial boom, Europe will balance protectionism and climate ambitions, and the United States will continue to be the largest net importer.

Conclusion

Remember this the next time you see an EV speeding down the street: It very likely traveled across borders and seas before it was put on the road. As per Export Import Global Trade Data by Import Globals, by connecting Asian manufacturing with Western highways and transforming the car industry more quickly than ever before, imports sustain the global EV boom.

If you are looking for detailed and up-to-date Import Export Global Data, you can contact Import Globals.

FAQs

Que. Which country imports the most EVs in 2024–2025?

Ans. The United States is the largest net importer of EVs, bringing in around 430,000 more EVs than it exports.

Que. Where do most imported EVs come from?

Ans. China is the world’s biggest EV exporter, supplying around 40% of global EV exports, mainly to the EU, UK, US, and Southeast Asia.

Que. Why does the EU import so many EVs if it builds its own?

Ans. The EU has strong local production but also huge demand, so it imports cheaper Chinese EVs while exporting more expensive models abroad.

Que. Which country has the highest EV sales per capita?

Ans. Norway leads the world in per capita EV sales, with over 80% of new cars sold being fully electric, nearly all imported.

Que. Will EV imports keep growing in 2025?

Ans. Yes. Despite tariffs and local production incentives, global EV demand will likely outpace domestic supply in many countries, keeping imports high.

Que. Where can you obtain detailed EV Import Data?

Ans. Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date data.