- Sep 19, 2025

Ukraine’s Barley Export Boom to China in 2025: A Trade Surge in a Shrinking Market

The 2025 increase in barley exports from Ukraine to China is an example of how demand, resilience, and strategic opportunity come together.

Amidst a volatile global grain market and persistent geopolitical difficulties, Ukraine has accomplished a noteworthy milestone in 2025: a sharp increase in barley exports to China. Based on China Import Data by Import Globals, China has confirmed that it will be the leading destination for Ukrainian barley in the 2025 planting season, with an estimated 770,000 metric tons booked for delivery in July and August alone. This increase is a result of China's increasing need for feed grains, changing trade dynamics, and a limited supply of barley worldwide, in addition to Ukraine's robust agricultural industry.

A Robust Export Start: Volumes for July–August 2025

Ukraine shipped almost 140,000 metric tons of barley to China in July 2025, which was one of the highest monthly totals in recent memory. With contracts totaling more than 770,000 tons for the two months, it is anticipated that a further 350,000 to 400,000 tons would be supplied in August. A report by Import Globals on Ukraine Export Data says that given Ukraine's low production and continuous logistical difficulties, this is a noteworthy accomplishment.

Chinese businesses have reportedly purchased up to 700,000 tons of Ukraine's 2025 barley harvest, so guaranteeing a sizeable portion of the country's exportable surplus, according to the agricultural analysis by Import Globals.

Why China? A Vital Market for Barley in Ukraine

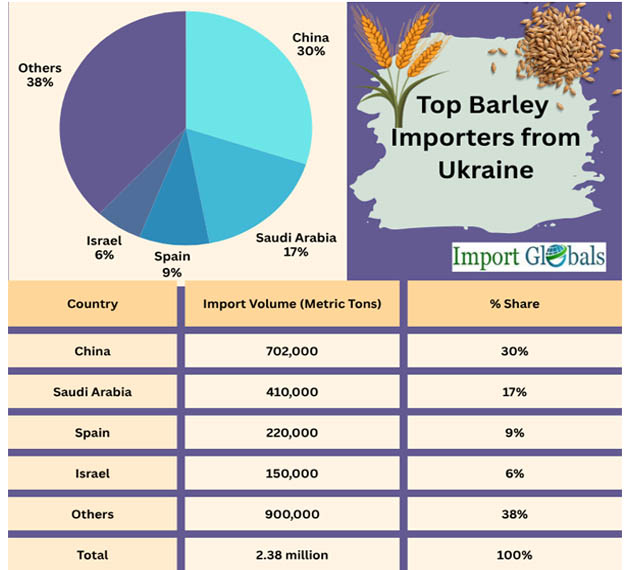

China has been a significant consumer of Ukrainian feed barley for a long time, and in 2025, it reiterated its vital position in Ukraine's export portfolio. As per China Import Export Trade Data by Import Globals, China purchased 702,000 tons of Ukrainian barley during the 2023–2024 marketing year. China returned to the international market in early 2025 with a vigorous purchasing strategy after a temporary halt in procurement in late 2024 because of domestic market safeguards.

Some factors, including weather-related crop failures, lower-than-expected stocks, and rising demand for feed grains in China's growing livestock industry, have contributed to the resumption of the import boom. As per Ukraine Import Custom Data by Import Globals, Ukrainian barley provided the perfect answer because it was both reasonably priced and of excellent quality.

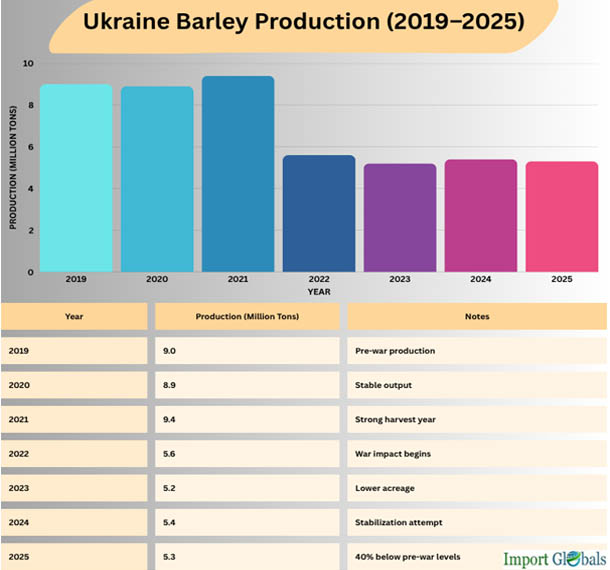

Declining Supply: Ukraine Produces Less Barley

Based on Ukraine Import Trade Analysis by Import Globals, Ukraine is expected to produce approximately 4.5–5.3 million metric tons of barley in 2025–2026, a almost 40% decrease from pre-war levels, despite the export boom. This considerable decrease has been caused by the continuous fighting, damaged infrastructure, and a shrinking amount of arable land. As a result, Ukraine's overall barley export potential is only projected to be 2 million tons, a tiny decrease from 2.32 million tons the year before.

Due to this restricted supply, a significant amount, nearly 35%–38% of the available exportable stock, is being swallowed by a single nation, which makes the present volume of contracts with China all the more noteworthy.

Growing Costs and Competitive Premiums

Due to Ukraine's limited supply and the abrupt surge in demand from China, prices have significantly increased. Feed barley prices at Odesa port increased from $2–3 to $5–8 per ton in early July 2025, reaching $193–$203 per ton (CPT Odesa).

According to Ukraine Export Data by Import Globals, contracts for China were signed for $240 per ton (CIF), or around $200 to 205 per ton FOB. This demonstrates the premium that Chinese consumers are prepared to pay, as it is far greater than the average costs seen in prior seasons.

According to Import Globals’ analysis, prices may increase to $230–240 per ton FOB by the end of 2025 as a result of Ukrainian exporters prioritizing contracts with China because of these alluring margins, particularly if more importers follow suit.

Shipping Routes and Port Access: Overcoming Logistical Obstacles

Exporting such enormous amounts in a short period is no minor task, particularly for a country functioning under wartime conditions. Based on Ukraine Import Data, Ukraine has depended more on alternative shipping routes, such as the Danube River ports and approved terminals in Romania and Bulgaria, after the Black Sea Grain Initiative was disrupted.

Despite being more expensive and time-consuming, these new logistical systems have shown themselves to be durable. As per China Import Trade Statistics by Import Globals, Ukraine has been able to meet contract deadlines while preserving product quality thanks to the restoration of export certification with China and improved customs procedures at Danube ports.

Strategic Consequences of the Export Boom

The growth in barley trade between China and Ukraine has wider ramifications for both nations:

For Ukraine, it demonstrates that its agricultural sector remains globally relevant, even amid war. Ukraine sustains hard money inflow, boosts its economy, and solidifies its reputation as a dependable grain provider by signing significant contracts with China.

The action guarantees feedstock stability and food security for China. As per Ukraine Import Shipment Data by Import Globals, due to geopolitical issues with other suppliers such as Australia and China's limited domestic barley output, diversification is required. Therefore, Ukraine is essential to this delicate balancing act.

Furthermore, the export boom would reestablish Ukrainian barley as a reliable import for China, which might have an impact on upcoming trade deals and investments in Ukraine's agricultural infrastructure.

Competition: What About Other Providers of Barley?

The worldwide barley supply chain also includes other nations, even though Ukraine is now experiencing a robust export run. Australia, France, Russia, and Argentina are key exporters. However, as per the USA Import Export Trade Analysis, the field has been reduced by several limitations, such as South American logistical bottlenecks, geopolitical sanctions against Russia, and climatic effects in Europe.

Because Chinese buyers act fast to obtain supplies before global prices increase more or availability tightens, Ukraine gains a short-term competitive edge.

Towards the Future: Will the Upswing Continue?

With about 770,000 tons already scheduled for July and August, Ukraine's barley export prospects for the second half of 2025 are still cautiously positive. Even while supply constraints would prevent further significant transactions, robust pricing, reliable port logistics, and ongoing Chinese demand might maintain the momentum.

As per Ukraine Export Import Global Trade Data by Import Globals, Ukraine's long-term standing in the world grain markets will probably depend on its capacity to continue exporting reliably in the face of pressure. Ukraine could continue to forge solid commercial ties with East and Southeast Asia if the existing logistical adjustments hold up and if output levels off or modestly rises in 2026.

Conclusion

Ukraine has effectively tapped into growing Chinese demand and positioned itself as a key participant in the global feed grain industry, although it faces significant domestic problems.

The Ukrainian barley narrative provides a compelling illustration of how adaptability and perseverance can produce outcomes under the most difficult conditions as the globe negotiates issues of food security, climate instability, and trade realignments. Import Globals is a leading data provider of Ukraine import export trade data. Subscribe to Import Globals to get more global trade details!

FAQs

Que. Why did Ukraine’s barley exports to China surge in 2025?

Ans. Due to lower global supply and strong demand from China, Ukraine capitalized on favorable logistics and competitive pricing, boosting shipments dramatically.

Que. How much barley has Ukraine exported to China in 2025 so far?

Ans. By July 2025, Ukraine had exported around 140,000 metric tons, with up to 770,000 tons contracted through August, making China its top market.

Que. What are the main uses of barley in China?

Ans. Barley is primarily used for animal feed and beer production in China, both of which remain strong demand drivers in the 2025 market.

Que. Is this export surge expected to continue?

Ans. Yes, if the demand trend holds and global supplies stay tight, Ukraine may maintain or even expand its market share in the coming months.

Que. Where can you obtain detailed Ukraine Import Export Global Data?

Ans. Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date data.